shapecharge/E+ via Getty Images

Information and innovation are now at the forefront of capital market growth. It is no wonder that financial data and solution providers are enjoying an upsurge in their business. Over the past decade, FactSet Research Systems Inc. (NYSE:FDS) has sped up its growth. Its acquisitions expanded its capacity as more clients flocked into the capital market. Thankfully, it appears fruitful as revenue and margin expansion remain solid. It maintains stable cash levels and stable financial leverage. As such, it can sustain its expansion, borrowings, and dividends. Yet, the stock price seems divorced from its impressive fundamentals.

Company Performance

FactSet provides financial data and analytics, and software solutions for its clients globally. For over four decades, it has been flexible through market changes and digital transformation. From its offices across regions, it works to create value for its stakeholders. Today, it remains a valuable platform for asset managers and other investment professionals.

Primarily, its revenues come from client subscriptions. It allows them to access financial data and analytics, aggregate market data, and other software solutions. In its financial segment, raw materials are in the form of financial reports, which the analyst reorganizes using an app. Accounts are reclassified according to FDS accounting principles. Even so, it is still in line with whatever GAAP the financial report uses. Financial data appears as simplified financial statements with financial ratios and workflow insights. Even better, they may access insights into the global market and industry trends. The app also allows the clients to watch their portfolio performance and execute trades. As such, FDS offers a seamless user experience in analyzing data and risk management. It combines its technology offerings and data solutions with its client services.

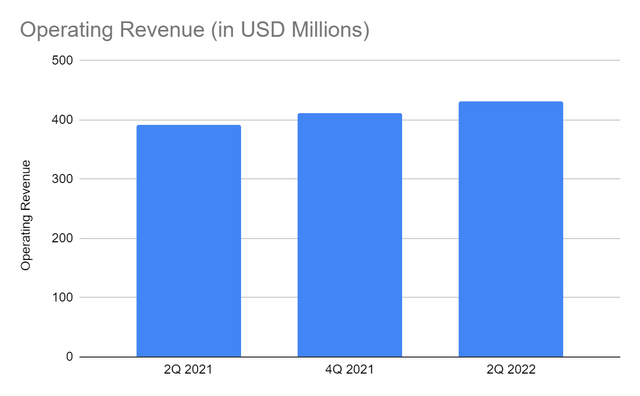

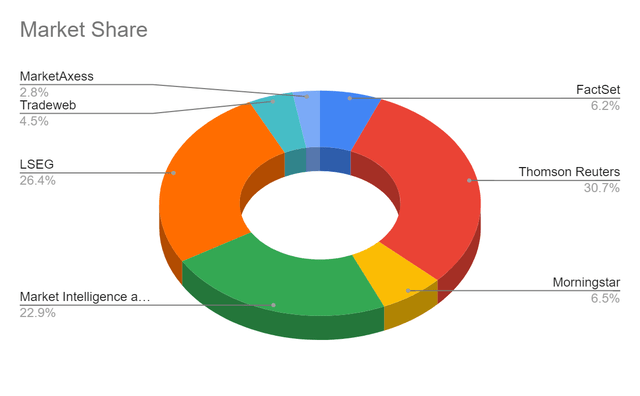

Its operating revenue of $431 million is a 10% year-over-year growth from $392 million in 2Q 2021. Thanks to the increased demand for research and advisory and analytics solutions. It is also driven by its prudent acquisitions, investments, and divestitures. Although its peers have similar offerings, opportunities remain high. Information and technology remain at the forefront of the evolving market. Also, differentiated content is what sets each company apart from others. Relative to its closest peers, it holds a market share of 6.2% vs. 6.1%. Also, its revenue growth is higher than the peer average of 8.8%. I included S&P Global (SPGI) since it holds Capital IQ, a direct competitor. Likewise, the London Stock Exchange Group (LSEG) has Refinitiv.

Operating Revenue (MarketWatch)

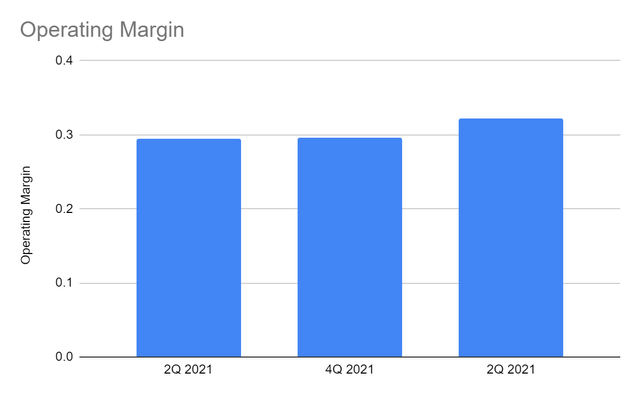

But what makes it durable is its strong customer base. It has 90% client retention and a 5% increase in user count. Of course, sustained growth is not driven by market demand for content alone. In fact, it is one of the companies that capitalize on prudent M&As and investments. These appear fruitful, allowing FDS to enhance digital capabilities and data management strategy. Even better, they help speed up its top-line growth while enhancing its productivity. It shows that FDS maintains efficient asset management as it expands its capacity. Costs and expenses increase but remain relatively lower than the operating revenue. So, the operating margin without extraordinary expenses is even higher at 32%.

Operating Margin (MarketWatch)

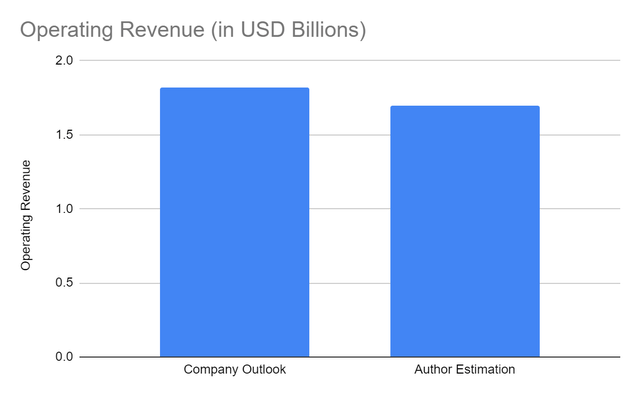

This year, FactSet estimates its operating revenue to amount to $1.8-1.83 billion. Meanwhile, their estimation of operating margin, including extraordinary expenses is 26%. I also have an optimistic view, but my estimation is lower at $1.72 billion. It is in line with the average revenue growth in recent years and the quarterly values. It may be a conservative estimation, given the potential impact of inflationary pressures.

Operating Revenue (2Q 2022 Report and Author Estimation)

Why FactSet Research Systems Inc. May Sustain Its Success

The capital market is expanding but is faced with macroeconomic pressures. Inflation raises the costs of operations, but its impact may extend further. It may affect the market as it erodes the value of earnings. As such, it may be tough to gauge the value of the companies, especially those part of market indexes. It also applies to FDS, given that it is part of the S&P 500.

Fortunately, FactSet Research Systems Inc. continues to demonstrate robust performance. Its steady revenue growth and margin expansion remain evident. Even better, it is now more capable of catering to more clients and improving its processes with its recent M&As. It continues to expand its private market offering and enhances workflow solutions through targeted investments. The broad scope of its data and analytics allows it to offer more accurate insights and solutions. It may even optimize its untapped potential in other regions. Note that over 50% of its revenues are from the US. The US alone comprises $121.9 trillion, which is more than half of the global equity market capitalization. $39 trillion are from the Asia-Pacific region while $45 trillion is the combined value in other regions.

For more efficient trading and market settlement, FDS now owns CUSIP Global Services (CGS). In turn, the company offers $1 billion in senior notes. As such, FactSet will play a more crucial role in the capital market. It may entice more demand since CUSIP works as a provider of a unique common language or code for financial instruments across exchanges. FactSet may streamline its products and workflow capabilities using it.

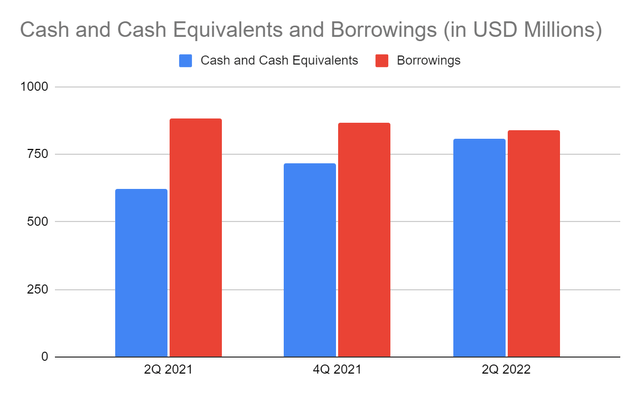

Aside from its expanding capacity, FactSet shows its sustainability through its solid balance sheet. It has impressive liquidity, given its stable cash levels and financial leverage. Its cash and cash equivalents of $808 million are 30% higher than in 2Q 2022. Meanwhile, borrowings are lower at $838 million vs. $884 million. But, it will have a substantial increase, given the issuance of its senior notes to acquire CUSIP. Even so, this move may pay off in no time. Note that the entity covers $170 million of revenues in S&P Global. It is also a staple in the financial market, making it an edge for FactSet. Also, FactSet continues to generate positive cash inflows, which increase its cash levels. Currently, cash covers 34% of the total assets, so it is still very liquid. Also, Net Debt/EBITDA is low at 1.34x. If we add the senior notes, the ratio will be 2.96x. But, it is still lower than the maximum range of 4x. It means that the company has enough income to cover its borrowings.

Cash and Cash Equivalents and Borrowings (MarketWatch)

FactSet may also have to watch out for its Goodwill since it is already 33% of the total assets. But, it is typical for S&P 500 companies to have a percentage of 30-40% since they acquire more assets and companies. Also, it is still lower than the maximum percentage of 40%, so FactSet is not overspending yet. Its deep value and growth remain enticing, which may generate more income.

Stock Price Assessment

The stock price of FactSet has been in a steep decrease since the latter part of the previous year. At $354.36, it has already been cut by 26% from its starting price. Yet, it does not appear to be cheap. These metrics show that the stock price is not fairly valued yet. The same goes for its close peers, making FDS the second most fairly valued stock on the list.

|

P/E Ratio |

P/B Ratio |

EV/EBITDA |

|

|

FactSet |

32.13 |

10.88 |

23.56 |

|

Thomson Reuters |

29.23 |

4.29 |

31.17 |

|

Morningstar |

53.87 |

7.24 |

26.70 |

|

Tradeweb |

58.02 |

2.99 |

|

|

MarketAxess |

41.49 |

9.76 |

25.97 |

With regards to its dividend payments, the company remains consistent and generous. The amount goes up by 11% on average. Also, it is part of Dividend Contenders since it has been paying and raising dividends for over 20 years. But, the dividend yield is only 1%, which is way lower than the average of the S&P 500. To assess the price better, we may refer to the DCF Model and the Dividend Discount Model.

DCF Model

FCFF $426,150,000

Cash and Cash Equivalents $808,000,000

Borrowings $838,000,000

Perpetual Growth Rate 4.8%

WACC 9.2%

Common Shares Outstanding 37,884,000

Stock Price $354.36

Derived Value $288.88

Dividend Discount Model

Stock Price $354.36

Average Dividend Growth 0.1111541418

Estimated Dividends Per Share $3.42

Cost of Capital Equity 0.1238053439

Derived Value $300.3843446 or $300.38

The derived value in both models affirms the potential overvaluation. The stock price may still be expensive even after the continued downtrend. As such, there is a potential price decrease of 16-20%.

Bottomline

FactSet Research Systems Inc. is a very robust, viable, and liquid company. It expands while keeping its fundamentals solid and intact. But even if it is a strong buy for me, the price does not appear cheap today. Also, it is not an enticing dividend stock, given the low dividend yield. The recommendation is that FactSet Research Systems Inc. is a hold.

Be the first to comment