sankai

This article has been written in collaboration with David Carter of Wood Capital Investments.

Introduction

I maintain a strong buy rating on Netlist, Inc. (OTCQB:NLST). The company has a rapidly growing underlying business paired with being embroiled in what may be the largest patent infringement case in history. The massive payout potential of the lawsuit has created an asymmetric opportunity and a tremendous risk-to-reward ratio. Over the past two years, I have published seven previous articles on Netlist and its story, with the most recent linked here.

Who is Netlist?

Netlist, founded in 2000 and headquartered in Irvine, California, is a leading provider of high-performance modular memory subsystems to the world’s premier OEMs. The company specializes in hybrid memory, combining DRAM and NAND flash raw materials to create memory solutions. Their patented memory technologies provide superior performance and high density at a cost-efficient price, with use spanning a broad variety of markets and functions – a market that only expands as technology use grows.

Netlist has a history of being a disruptive trailblazer. For example, they were the first to develop the load-reduced DIMM, HyperCloud®, based on Netlist’s distributed buffer architecture. This architecture was later adopted by the industry for DDR4 LRDIMM. Netlist was also the first to bring NAND flash to the memory channel with their NVvault® NVDIMM. These innovative products were built on Netlist’s early pioneering work in areas such as embedding passives into printed circuit boards to free up board real estate; doubling densities via quad-rank double data rate (DDR) technology; and other off-chip technology advances that result in improved performance and lower costs compared to conventional memory.

Netlist continues this tradition by introducing HybriDIMM, the industry’s first Storage Class Memory product built on commodity DRAM and flash. HybriDIMM is the first SCM product to operate in current Intel® x86 servers without BIOS and hardware changes and the first unified DRAM-NAND solution that scales memory to terabyte storage capacities and accelerates storage to nanosecond memory speeds. HybriDIMM will be a key piece in the business after the lawsuits have finished.

Because of Netlist’s commitment to innovation, the company has a broad portfolio of patents, many of which are seminal, in the areas of hybrid memory, storage class memory, rank multiplication, and load reduction, among others. Netlist’s strategy is to combine its unique board-level intellectual property with a thorough understanding of semiconductor building blocks and system-level applications to deliver performance, cost, and time-to-market advantages to OEMs. This strategy is made capable because of a state-of-the-art, wholly owned, ISO- and OSHAS-certified manufacturing and testing facilities in Suzhou, China. Netlist, like every other computer chip company, has some risk from its exposure to China and the Taiwanese conflict.

Per Netlist’s last SEC filing, they had $43 million in cash and $36 million in current liabilities. In the last quarter, they lost $9.6 million, with the cost of the litigation being a significant drag on the bottom line. Legal fees were just under $6 million this quarter, and because the company is suing many of the big players in the industry, only a tiny part of the market is available for them to sell to. Once the lawsuits eventually finish, the company will be in a much stronger financial place regardless of the result simply by not having its expense, having new licensing revenues, and being able to sell to new massive buyers.

Lawsuit background

The Netlist Legal story is complicated and lengthy. It started when Alphabet/Google (GOOG, GOOGL) was presented with Netlist technology in the mid-2000s under an NDA. Google test-drove the product, and they liked it a lot. What they did not like and fought against was the cost Netlist wanted (per Google’s argument). Netlist alleges that Google decided to steal the product by making it themselves or coercing other manufacturers to create copycat versions of the technology to bypass any royalties to Netlist.

In 2009, Netlist officially brought forth a lawsuit. The judge in the 2009 case ordered a random cross-section of servers to be examined, which showed that Google was using technology described in the 912 patent. In that time (the mid-2000s to now), Google went from being one of several competing search engine/email providers (AOL, Yahoo, Ask Jeeves, Bing, etc.) to having a practical monopoly on the entire market due to the broader storage and retrieval capabilities. This led Netlist to assume that their intellectual property is one of the direct reasons why. Google’s new priority was to invalidate Netlist’s patents, since they did not argue for innocence (already caught red-handed with the technology described in the 912 patent specifically).

Netlist has 130+ patents, and with all ongoing litigation, only roughly a dozen patents are in question across the Micron Technology, Inc. (MU), Samsung (OTCPK:SSNLF, OTCPK:SSNNF), and Google litigation. The biggest of these is the 912 patent, which we will get to below.

PTAB

The Patent Trial and Appeal Board (PTAB) was created in 2012 and is supposed to represent an objective third-party resource to review patent validity and make the legal landscape much cleaner to navigate for district courts handling disputes. In reality, it seems to be an entity fueled by big tech to invalidate patents to get out of paying appropriate royalties for fair use. Many of the players responsible for the PTAB’s inception come from the same legal counsel that has previously represented big tech companies. The PTAB is paid case by case, so they seem unfairly incentivized to take on cases. These inter-partes reviews (IPRs) take a year on average. When a big tech company is accused of stealing a smaller company’s intellectual property, it will use the PTAB to request a stay on the case pending the review. It is easy and understandable to believe that district judges, paid a salary no matter how many cases they see, will accept the stay simply because it cleans their docket for the moment. Then, post-review, the district judge will often adopt the PTAB’s decision as their own. Big tech has deep pockets and allegedly is happy to pay for such service, as it is often much cheaper in the long run than paying fair royalties.

The PTAB grants reviews on over 70% of all requests and boasts an 84% invalidation rate on all patents formally reviewed. In our estimates, it is arguably closer to a 50% rate due to patents that are partially through an IPR when a company chooses to settle outside of court. Those partial IPRs are not completed. Also, the PTAB allows multiple companies to request and have practically identical IPRs granted when reviewing similar patents – most of the time only enabling more time to be wasted at the detriment of the patent holder. The PTAB maintains guidelines for abuse from multiple parties of interest, but it seems they are often willing to turn a blind eye and work around it for the more prominent companies. In several instances, these little companies go out of business during this time-wasting strategy, allowing big tech firms to absorb their patents, whether invalidated or not, for pennies on the dollar.

Netlist is a rare example of a company that has only improved over time despite the odds and has more cash on hand, better sales, stronger hiring numbers, and increased R&D. They have proven that they can survive to see court cases to completion.

The ‘912 Patent

A description of the ‘912 patent is found here.

The ‘912 patent refers to the use of rank multiplication in an LRDIMM (Load-Reduced DIMM) memory module. Such DIMMs can have four ranks or blocks of memory, and the patent describes IP to present the LRDIMM logically as only having two ranks, thus getting over system memory controller limits on the maximum rank count.

According to Agni Research:

“Netlist asserts that the ‘912 patent enabled Google to build servers with high capacity and rapid memory that allowed said servers to store an entire Oracle database in memory which allowed lightning-fast search results. The ‘912 patent played a large part in Google’s dominance in search.”

Spanning a decade (which is unprecedented), Netlist and Google have fought over the ‘912 patent. It went through several reviews, appeals, etc., until it was validated at the federal circuit court level in 2020 unanimously as not only valid but also SEMINAL. The status of seminal indicates that it is a patented product that gives users a tremendous advantage, thus explaining why Google went from one of many to the monopoly of the industry making a lot of money since. This is unwavering.

Google withdrew its right to appeal further to the U.S. Supreme Court, as this historic rule 36 style verdict (where the federal circuit affirmed lower court’s rulings without any input or amendment) has never been overturned at the Supreme Court level. Google then tried to invalidate all 78 claims of the ‘912 patent for past infringement (accepting the claims and ‘912 validity from the time it was recognized in court and post-any “amendments” done by Netlist to update/rewrite the claims as they are relevant today). So, 2021 to the present and future royalties, Google acknowledges and will pay for. They are simply playing damage control on how much money this will cost them – and a guilty verdict on past infringement spanning over a decade can be worth billions.

The next battle was with “claim 16 intervening rights,” as it was the only claim out of 78 to survive back to inception/infringement from the 2021 update of the ‘912 patent, which is worth a substantial amount. As momentum built toward the claim 16 hearing in November 2021, the night before the hearing Judge Armstrong in the Northern District of California stayed the case for no obvious reason for three months. Three months later, she did a second consecutive stay. At that time, she was offloading several cases and not hearing any, so it was likely for personal reasons unrelated to the case itself.

This delay was unacceptable to the company, so they switched judges successfully to Judge Seeborg. Seeborg went through with the claim 16 intervening rights hearing and ruled in favor of Netlist that Google is on the hook for 4-rank DDR4 DIMMs (a product used by Google between 2014-2020).

Google successfully limited its exposure by avoiding 8-rank and 16-rank DDR4 DIMMs. A settlement would likely not come close to the cost of all infringed products multiplied over the years. Still, this claim 16 DDR4 rank 4 victory alone could manifest in the largest patent infringement in U.S. history (the current record is $2.54 Billion).

Google Is Not The Only One In Trouble

In related cases within the same timeframe, Netlist sued SK Hynix (000660), Inphi Corporation (IPHI), Micron, and Samsung (amongst others such as SanDisk (WDC)). Samsung, in particular, had a contract with Netlist from 2015-2020-ish, but early on, there was compelling evidence that Samsung was in breach of the contract and not fulfilling its obligations to Netlist. So Netlist unilaterally withdrew their contract, and Samsung fought it in a breach of contract suit, ultimately losing as they were proven to be in breach in December 2021. It was tricky because Netlist was only allowed to give limited info to a jury at that trial, and the jury saw the contract was breached and should be voided but awarded no damages.

The jury deliberated quickly on a Friday evening, and some believed the verdict was a miscarriage of justice as you cannot have a breach without clear damages and whether such damages were proven was perhaps debatable. The judge returned and granted Netlist nominal damages so the breach would be legal and binding in February 2022. Samsung is currently appealing, and Netlist looks forward to bringing closure to this appeal process with confidence.

To throw another variable in the mix, SK Hynix, in spring 2021, got to the Markman Claim Construction trial (despite requesting stays for ongoing IPRs), where they were forced to decide between the discovery of their records or settling outside of court. An overwhelming majority of these cases settle outside of court for such reasons. When companies run out of time-wasting ammo, they don’t want their dirty laundry seen in the litigation public domain (because it’s either a losing battle or possibly because it could further incriminate them with a plethora of other less-than-ethical business practices).

Predictably, four weeks after the Markman hearing, SK Hynix settled. This resulted in a $40 million in damages and a $640 million product sharing agreement so Netlist could access SK Hynix manufacturing at a discount to sell and pursue other smaller markets. This has already proven to be worth more than the initial agreement and has been very advantageous for both Netlist and SK Hynix.

At that time, Google was on the verge of either showing its cards or settling. Samsung had no solid contract to stand on, SK Hynix had already settled, and Inphi’s trial was withdrawn without prejudice. Perhaps Inphi agreed to share incriminating information about Google/others on behalf of Netlist, who knows. Their infringement was limited in scope and has since been bought out by Marvell Technology (MRVL). It begs the question that maybe they wanted to avoid carrying over legal issues to the new firm. This is yet to be determined, but it was done without prejudice, meaning Netlist can always reinstate the lawsuit if they wish.

Additionally, Netlist’s verbiage has changed on motions filed from “on belief” to “on information and belief” – it leads us to speculate that Inphi could be providing information. The Micron trial was also gaining momentum for several patents and was recently added to those that infringe on the ‘912 as well. Half the patents are in the West District of Texas (where there is a current stay on the case), and the other half is being tried in the East District of Texas with judges who are not as prone to stay – more on that to come.

The six months of stagnation from the end of 2021 to the beginning of 2022 hurt Netlist’s momentum, but morale was still high. Then Samsung blindsided Netlist with a Delaware suit where they requested a ‘912 IPR (a new trial proceeding to review ‘912’s patentability) with the PTAB – something already reviewed five times that went to the highest court in the land and was deemed seminal, meaning transformative to the industry. This new suit was very puzzling, because why would Samsung request this ‘912 review considering that Netlist wasn’t even suing Samsung over that patent then? Moreover, since the patent is already valid, it cannot be overturned, but Judge Seeborg’s ruling against Google on claim 16 potentially can. The Google case was stayed for 90 days until there could be clarification as to what was happening.

Recent Events

The PTAB in October 2022 disappointingly granted an IPR because the claim 16 definition of “rank” multiplication differs ever so slightly from a definition of rank used in one of Netlist’s older patents. A simple wording technicality. Same technology and method, just some use more material. By definition, the core requirement of rank is to have at least two or more memory devices to wire them to achieve high memory capacity with lower DIMMs…but never only 1 DIMM because that doesn’t help to achieve low-cost, high memory capacity – which is the entire aim of the patent ‘912. Samsung argues the definition should mean “one or more,” whereas Netlist argues “two or more,” as the use of rank implies that there is a row (or more than one).

From WordDisk, “a memory rank is a set of DRAM chips connected to the same chip select, which are therefore accessed simultaneously.” From this definition, a set can never imply a single unit. A single-rank DIMM has one SET of memory chips accessed while writing or reading from memory. A dual-rank DIMM is similar to having two single-rank DIMMs on the same module, with only one rank accessible at the time. A quad-rank DIMM is, effectively, two dual-rank DIMMs on the same module. Samsung is trying to imply that Netlist is only entitled to single-chip servers potentially, instead of stacked servers which is what Google primarily uses.

It is disappointing how it appears that Samsung and Google are parties of interest. This has wrongfully been overlooked by PTAB. To reinforce PTAB’s blind eye to this sort of thing, in 2019, in an unrelated case against SEVEN Networks, LLC, Google was able to “convince” the PTAB that its parent company Alphabet Inc., which oversees and controls Google, was not a real party of interest.

On 11/3/22, Irell and Manella attorney Philip Warrick requested that the PTAB convene a Precedential Opinion Panel in accordance with Standard Operating Procedure two (revision 10) to rehear the panel decision, assess the basis of Google’s real-party-of-interest (RPI) status as well as the “second bite at the apple” standard prohibiting consecutive wasteful IPRs on the same patent, and reverse the panel’s institution decision. The facts presented are clear that the PTAB committed an injustice in allowing the IPR on the merits of the claim alone and the fact that Samsung admitted in the declaratory judgment action complaint to requesting the IPR to indemnify Google upon Google’s request. Clear party of interest? PTAB failed to have Samsung defend that Google is not a party of interest – as it was not Netlist’s burden of proof in a typical procedure. Mr. Warrick presented 6 case study references in his request to show evidence that PTAB acted unorthodoxly in the recent ruling and antagonistically compared to established precedent.

It is essential to know that Google and Samsung allegedly have worked together often in the past decade to muddy IP litigations, double dip on time-wasting opportunities, and even fund each other’s lawsuit defenses. A strong starting point for this was when Google came to Samsung’s aid in a patent battle against Apple (AAPL) in 2012-2014 before formally announcing a global patent agreement. Arguably, there is no limit to the deceptive practices they are comfortable using, including evading word limits with incorrect annotations (Case No. IRP2022-00615 Patent Owner Preliminary Response argument page two from Netlist legal team), manipulatively using the PTAB while being clear parties of interest together (as pointed out by P. Warrick and currently awaiting PTAB response on decision reversal), not to mention their lobbying power and political endorsements. If simple retail investors can infer this from publicly available information, then presumably so should the ethical honorable legal representatives working to see justice prevail.

In an IPWatchdog hosted webinar sponsored by the Innovation Alliance on “Fixing the PTAB,” released in Oct 2022, Intellectual Property professional and former IBM executive, Honorable Kathleen O’Malley, stated that IPRs need to have a basis in fairness and currently, “it is a problem.” Needless to say, reform is needed. With this news, Google and Netlist agreed to stay the Google case until the Samsung case wraps up, as this is the final straw Google has to stand on. The consolation prize to all this is that Samsung was dragged into the Eastern District of Texas with judge Gilstrap.

Judge Gilstrap apparently has seen over 25% of the nation’s patent litigation cases. He does not slow down for unnecessary time wasters and has a history of denying PTAB IPR-based requests for a stay. Samsung and Micron are caught up in Gilstrap’s web, unable to escape despite their many requests to stay or transfer to another district. Judge Gilstrap is adamant that the similar patents across Micron and Samsung be tried together for efficiency even though a few of Micron’s patents are tied in the Western District of Texas and currently “stayed.”

As of today, Gilstrap is moving forward with the trials, and Samsung just had their Markman Trial with Magistrate Payne (a pretrial hearing in the U.S. District Court during which a judge examines evidence from all parties on the appropriate meanings of relevant keywords used in a patent claim) on November 4th, 2022 for a basket of patents not involving the ‘912. On November 17th, a case management conference is scheduled to set up a Markman Trial date for the ‘912 and other associated patents with Gilstrap.

If Gilstrap can push through and get one or both Samsung and Micron to be compelled into discovery, the chances are strong that they will offer a settlement instead of showing their dirty laundry just as SK Hynix did. The hope is Gilstrap will not be entertaining any more stays despite ongoing IPRs on some patents. Gilstrap is the authority, not the PTAB, so ultimately, nothing they do matters if Gilstrap is adamant about keeping the case moving.

Judge Gilstrap often utilizes Magistrate Payne’s expertise in the same Texas ED to oversee a majority of Markman claim construction hearings. Judge Payne has construed a significantly high number of patent claim terms (over 8,200 terms as of 2022) – the highest claim construction record of all time compared to other judges in past polls or rankings. Moreover, regarding actual Markman trials conducted, Judge Payne ranks among the top five federal judges, magistrates, or districts who have conducted the most hearings. Gilstrap is also in that rank.

Payne and Gilstrap have already had cases against Netlist’s infringers (Google, Samsung, etc.) before, and they are not friendly to them. For example, back in 2014, in SimpleAir, Inc. v. Microsoft Corp., et al., 2:13-cv-416-JRG, an east Texas jury entered a damages verdict against Google for $85 million for patent infringement. Most defendants, including Microsoft (MSFT), chose to settle this lawsuit. Google, however, proceeded to trial. On Jan 18th of that year, the East Texas jury entered a verdict against Google, finding that it infringed on the ‘914 and ‘433 patents deemed valid. At first, the jury struggled to determine damages, of which Google moved for a new trial on all issues. The Honorable Judge Gilstrap denied Google’s motion and set dates for jury selection and trial on just the issue of damages on March 17th. By the 19th, the jury entered its official verdict for $85 million.

In two recent cases involving Samsung (Uniloc 2017 LLC v. Samsung Elecs. America, Inc in 2020 and Staton Techiya, LLC v. Samsung Elecs. Co 2022), Judge Payne repeatedly denied Samsung’s request for a stay due to ongoing appeals or third-party IPRs, respectively.

On 11/4, the Markman Claim Construction hearing took place over the 054, 506, 339, 918, 060, and 160 patents. Payne asked several questions to Samsung throughout the trial every time Samsung presented arguments, and he appeared to be mildly arguing with them. The only patent that Payne seemed to question for clarification on the Netlist side was the 339 patent (which has significant implications in the Germany litigation as well). Netlist’s attorney answered very matter-of-fact. Samsung’s attorney was very long-winded.

For perspective, it is commonly assumed that the more the judge needs to ask questions, the worse it is assumed to be for that party. Claim construction needs to be simple and concise. Not a complicated word salad consisting of several paragraphs. It appears Samsung tried hard to finagle things to its advantage, and it seems Payne was not entertaining it. We look to hearing shortly about Payne’s final decisions on claims and moving forward from there. Additionally, at the end of October 2022, we finally saw compliance from Renasas Electronics, Inc to honor their subpoena in the Samsung discovery.

In the meantime, all court jury trials have been proposed and go as follows:

-

May 2023 – Samsung Texas Jury Trial over non-912 patents

-

May 2023 – Germany Jury trial (Samsung, Google, and Micron)

-

January 2024 – Micron Texas Jury trial

-

February 2025 – Samsung/Google Delaware Jury Trial.

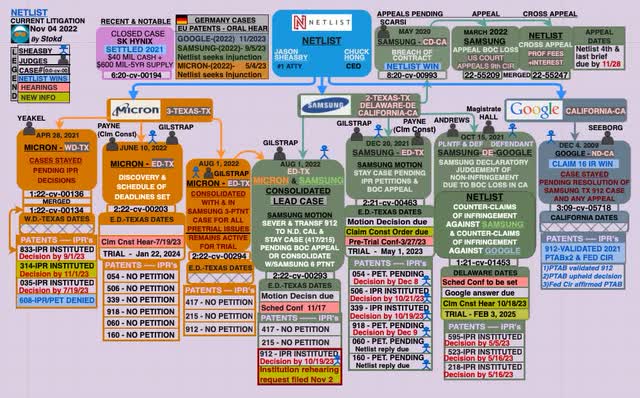

A useful graphic to look at for this complex litigation:

Often these disputes settle outside of court before a jury trial. A headwind facing the company and investors is that Netlist does not have the resources to continue paying legal fees and support a weak market demand (as seen in q3 2022 results and hinted that would continue for one or two more quarters) if nothing were to be resolved until the latest 2025 trial date without having to dilute shares or dip into their line of credit available. That is something to be aware of, but not frightened by. There should be many opportunities for settlement before that time. It is possible to assume a strong stock price recovery within 7-8 months from now, with the hopes of the Samsung Texas case going to a jury trial or settling outside of court before the trial date in May 2023.

One possible conclusion is that the first company to settle will lose the least. All other companies will likely fold shortly afterward. Once Samsung folds, for instance, Google likely will too. In my opinion, it is not a question of guilt or innocence at this point, but of who won and how much the winner will be compensated. Since they have been fighting so hard for so long, many believe the damages and future licensing could be substantial across all companies.

Future Stock Price Speculation

To emphasize a similar legal battle against Google, we must understand the Vringo case of 2012-2014. Vringo owned two patents on AdWords and AdSense (software that increases search engine optimization for advertisements on search engines). The judge ruled in favor of Vringo, and it went to a jury trial. The jury awarded damages ($30 million) and a percentage of royalties moving forward. This was re-examined by the USPTO (now PTAB’s job), and both patents survived their IPRs intact but not seminal. It was then taken through the first round of appeals on the merits of the whole case. USPTO agreed with the district judge and jury’s ruling and even doubled the original royalty percentage.

Then in the Federal Circuit Court of Appeals, 2 out of 3 judges showed reasonable doubt as to the patent validity (basically ruling prior art renders the patents “obvious” and, therefore, useless), causing everything to fall apart and winnings to be reversed. The company still exists but went private and rebranded. After everything was won and verified many times, it was a significant rug pull.

The ‘912 patent has survived where Vringo’s patents failed at the Federal Court of Appeals. However, this tactic is something to be cautious of on all other patents not already seminally verified by the Court of Appeals if there is no settlement outside of court.

Even if this isn’t the biggest settlement in history, it will still be substantial and produce large revenue from future licensing. With settlements in place, Netlist presumably should be deep in the black and placed back on the NASDAQ instead of staying OTC as soon as they reinstate a Board of Directors. Plus, Netlist has an ace in the hole with future HybriDIMM technology, which the CEO, Chuck Hong, apparently claims is worth billions of dollars annually and is already patent-protected. Hong explains the future technology as being quick with large storage capacity. Netlist has all the makings to be the industry leader in memory storage technology. Cloud-based storage/retrieval is only growing in prevalence as technology improves, and the implications are vast.

As stated previously, 90%+ of these cases settle before jury trial and before discovery into the infringer’s records. So that’s the rough timeline to anticipate based on the jury trials listed above.

For perspective, in 1999, Qualcomm (QCOM) sued/won against Ericsson and Motorola in a seminal patent victory, and within 12 months post-settlement, the stock went from $3-$90 (settling longer term around the $60 range). This was during the dot com bubble when the rest of the market crashed. We anticipate similar results with Netlist, given enough timeline post settlements, but it is important to disclose that the main similarity in the comparison is that it was a “seminal” case victory in a time of market turbulence – there are many discrepancies when comparing the cases otherwise (one of which is the fact that QCOM was on the NASDAQ and NLST is currently “over the counter” aka a penny stock). Netlist’s CEO chose to de-list the company from the stock exchange to prevent a harmful reverse split, and shareholders praised Hong for his decision. Hong maintains that post settlements, a new Board of Directors will be appointed, and they will apply to be re-listed to the NASDAQ. The new listing would allow many institutions and new investors the opportunity to buy the company providing a large tailwind. Additionally, it will allow the company to be included in many indexes, such as the Russell 3000, which could also provide a tailwind.

After this, and assuming with all likelihood that there will be recognition from the settlements and positive consecutive earnings cycles, we argue Netlist’s technology has all the revolutionary markings of companies like Nvidia (NVDA), who grew exponentially from 2016 to 2021 after institutional investors saw promise in their emerging technologies.

Netlist is a true David and Goliath story where big tech has fought harder than ever not to have to pay for Netlist tech. Why fight so hard if it’s worthless? Why settle with other companies often and not Netlist? Most litigation + appeals take two to four years. This has lasted three times as long and counting, but there are no time limits on litigation.

Google has already accepted the terms of the ‘912 patent and their infringement from 2021 to the present. Netlist is not a patent troll; they have an underlying business that is flourishing despite the lawsuits. Therefore, the long-term risk is more so to the time and patience of retail investors. On OTC, there’s also the element of broker/dealer price discretion and ongoing manipulation from market makers and retail traders. Investors face increased volatility and decreased liquidity in the short term, with soft future quarters predicted across the entire sector.

We see this as a powder keg waiting to explode, and these Netlist prices are very enticing. If there’s a worst-case scenario event and things drag out as long as possible, the underlying company in a bad economic environment is still worth $0.80 – $1.20.

The stock hit $10 on the SK Hynix settlement, and the exuberance of the noose closing in on Google + others next. Progress has been made on all cases since that time, only reinforcing Netlist’s merits on all fronts. The SK Hynix settlement was anticipated to be the weakest of all ongoing cases. The stays to the case for specific periods made the stock ripe for manipulation and impatience, which is why the stock price has walked down most of the year (9 months of the last 12-month period have been in a stay). In the meantime, many bullish traders took the chance to trade the stock around the catalyst dates, adding to short-term volatility. Long positions will probably continue to be added without much trading the closer we get to finalized court decisions.

In conclusion, we have a $10 to $30 soft initial price target for Netlist in the coming months post-settlements based on expecting a windfall of cash, ongoing licensing revenue, and continued organic sales growth.

Be the first to comment