Teamjackson/iStock via Getty Images

The American company Tesla, Inc. (NASDAQ:TSLA) and Chinese company BYD Company Limited (OTCPK:BYDDF) are the two largest electric vehicle manufacturers in the world.

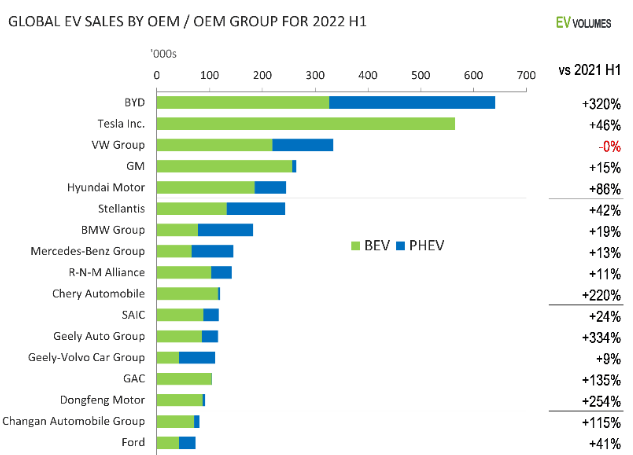

Based upon the sales of BEV (Battery Electric Vehicle) and PHEV (Plug-in Hybrid Electric Vehicle) vehicles combined, BYD produced the most and Tesla was second.

If you only include BEVs then the position is reversed with TSLA leading and BYD coming in 2nd place.

EV Volumes

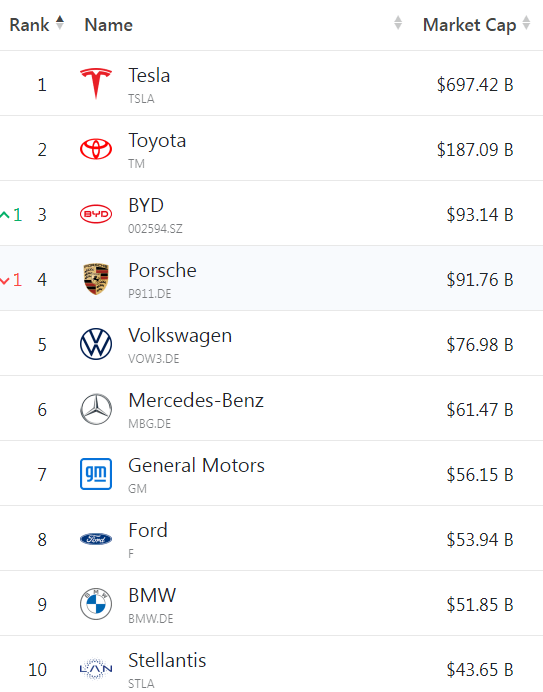

The markets realize these exceptional production results by valuing these two stalwarts at number one and number three respectively in MV (Market Value).

But note that Tesla’s huge MV of almost $700 billion is greater than the next 8 companies combined.

companiesmarketcap.com

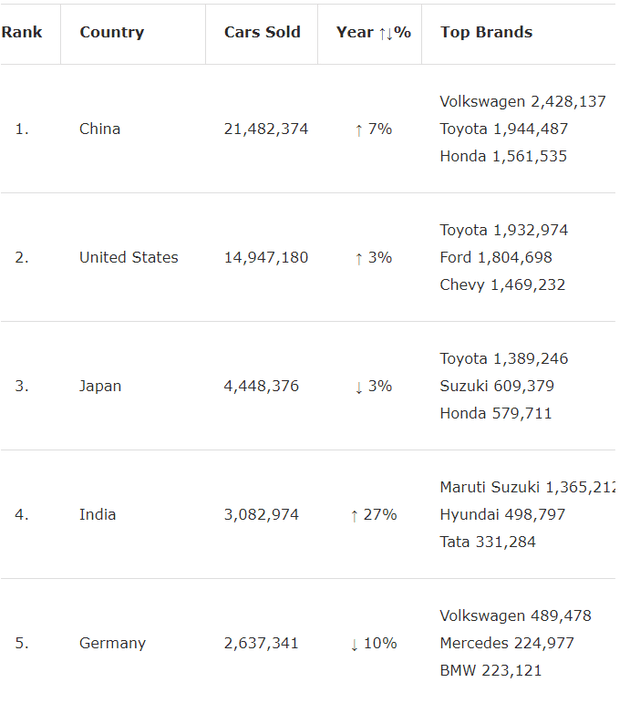

Both have large unit sales in China, the world’s largest car market.

Here are the Top 5 for 2021.

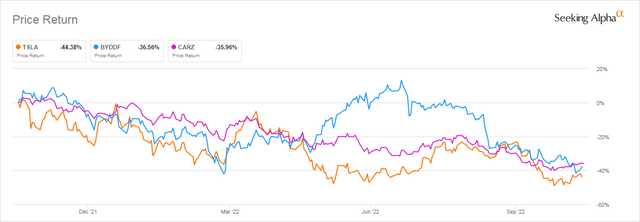

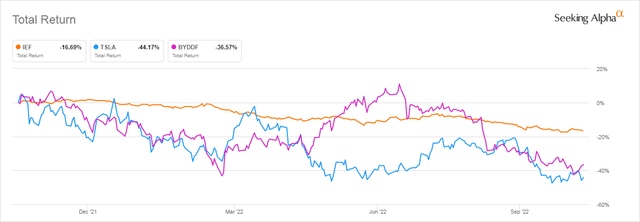

In the last year, BYD has done somewhat better than Tesla, but they are not far apart, with BYD down 36% and Tesla down 44%. Compared to the car EV market in general represented by the ETF CARZ, all three are down substantially.

CARZ is defined thusly:

CARZ tracks the S-Network Electric & Future Vehicle Ecosystem Index, which targets companies operating in the electric and future vehicle ecosystem. Source: Investopedia.

In this article, I will look at both companies to determine which one is the best investment choice.

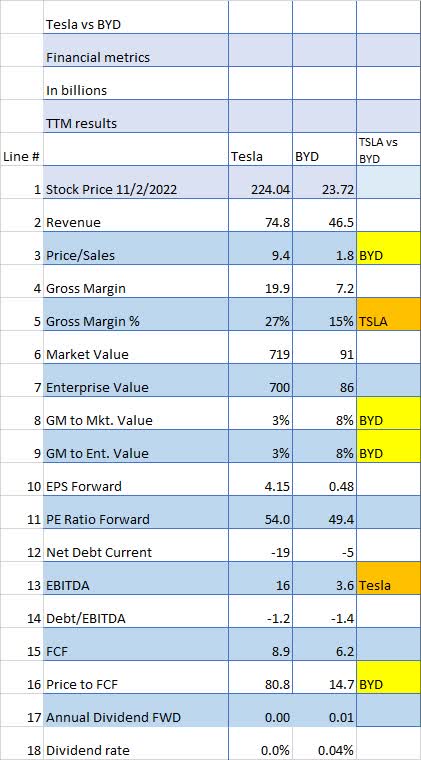

Financial metrics

It is obvious from the financial metrics table below that Tesla is a much bigger company by revenue but is extremely overpriced relative to some key financial metrics outlined below.

Let’s start with the Price to Sales ratio (Line 3) where Tesla’s 9.4x is more than 5 times BYD’s ratio of 1.8x. That is typically a huge value discrepancy.

Seeking Alpha and author

But on a GM (Gross Margin) basis (Line 4) Tesla is much more profitable with 27% margins compared to BYD’s 15%. The GM advantage disappears however, when we compare GM to market value (Line 8) and enterprise value (Line 9) where BYD’s margin based on the value of the two companies is 8% compared to Tesla’s 3%.

This is indicative of either Tesla being overpriced or BYD being underpriced relative to each other.

Tesla’s EBITDA (Line 13) reflects Tesla’s higher margins, with EBITDA being more than 4 times BYD’s EBITDA even though Tesla’s revenue is only 1.8 times BYD’s.

And finally, on a Price to FCF (Free Cash Flow) basis (Line 16), Tesla again appears to be overpriced relative to BYD.

Other interesting items include a similar PE Ratio (Line 11) and a negative Debt/EBITDA ratio (Line 14) that indicates both companies are flush with cash and have in effect no long-term debt on their balance sheet.

The annual dividend (Line 17) comes down to zero for Tesla and a minimal 1 penny for BYD.

Overall, based on Financial metrics, Tesla looks overvalued relative to BYD, but that is also true of virtually every car company in the world.

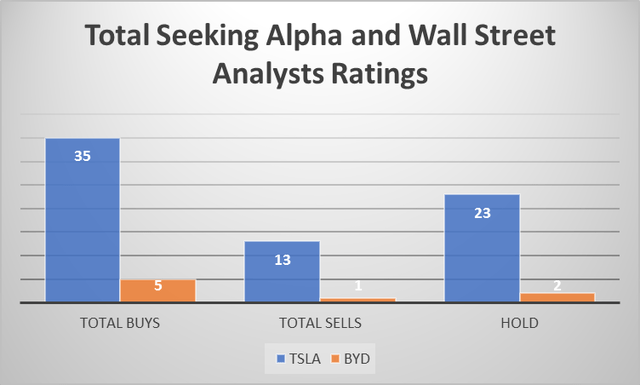

Analysts’ ratings are slightly better for BYD than Tesla

If we look at Seeking Alpha plus Wall Street analysts combined, we can see that BYD is more highly recommended than Tesla with 5 Buys and only 1 Sell versus TSLA’s 35 Buys and 13 Sells. However, note that BYD has many fewer recommendations in total.

In addition, TSLA’s 23 Holds show some indecision on the part of analysts compared to BYD’s 2 Holds.

The small number of ratings for BYD could also reflect a lack of interest in Chinese stocks in general and may be responsible for some of the difference in price vs value comps shown in the financial metrics section above.

The quants don’t appear to think either one is a Buy at this point, with Tesla rated as a slightly higher Hold than BYD. No great enthusiasm for either company from Quants either.

Seeking Alpha and author

There is good news and there is bad news

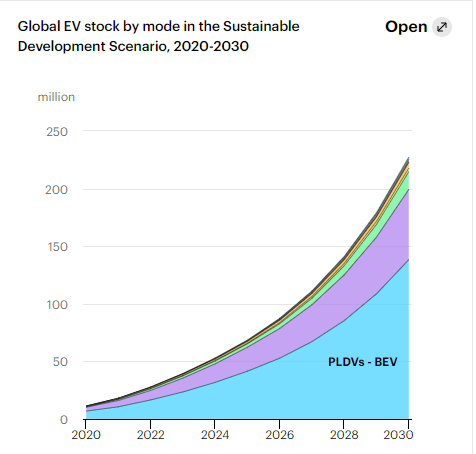

As everyone knows, the predictions for future EV sales are off of the charts. Here is IEA’s (International Energy Agency) chart for volumes out to 2030.

That’s about a 10x increase over the next 8 years or so.

IEA

This may be why Elon Musk has predicted a 50% growth rate for the next few years.

The bad news is everywhere around the world right now, including the war in Ukraine, chip-sourcing problems, and battery-building limitations going forward.

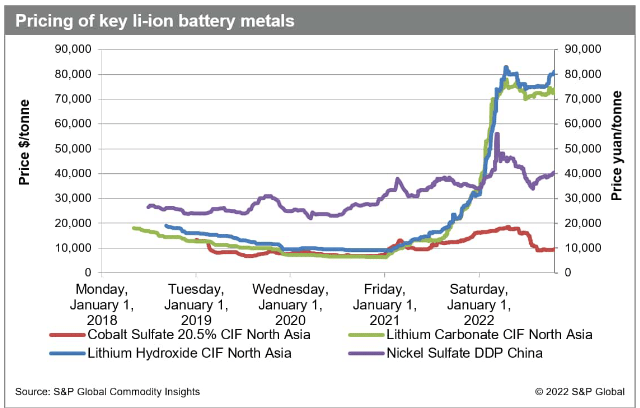

As S&P Global put it, prices for all minerals going into batteries are increasing in cost, including lithium, cobalt, nickel, and copper.

S&P Global

This has resulted in increased prices as shown by Tesla’s latest $2,500 to $6,000 increase in the price of all Tesla models. Inflation isn’t over yet either.

Higher interest rates are also having a negative effect on both TSLA and BYD with both down more than 35% over the last year compared to Treasury 7-10 year bond which is down only 17%.

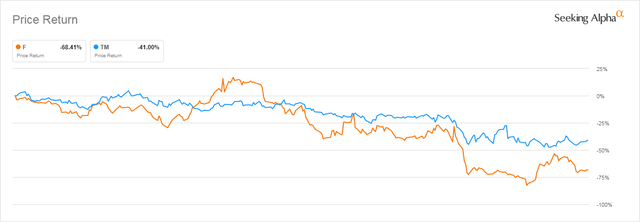

Car sales don’t do well during recessions either as shown by the following chart. Note that Ford (F) and Toyota’s (TM) price performance was dismal during the last recession, dropping by more than 40% from December 2007 to June 2009.

And finally, there is the China lockdown phenomenon, which seems to be ongoing with no end in sight. Since China is one of the biggest markets for both companies, the effects are extensive.

Conclusion

Based upon all of the above discussion, I think it is correct to say that neither company’s near-term outlook looks overly promising. If there is one word to describe their 2022 prospects, it is lackluster.

Another big issue is what I call the “China put” meaning no investor can be sure what the CCP (Chinese Communist Party) might do to any business in China, foreign or domestic. If you want to see an example, check this chart out comparing Alibaba (BABA) to Amazon (AMZN) over the last 3 years. Amazon has not done well with a breakeven price performance, but Alibaba is down over 63%.

I don’t know exactly what if anything the Chinese government had to do with the BABA decline, but it is certainly enough to give any investor pause.

At this point in time, I see no reason to invest in either company unless you have a very long timeline extending out at least 5 years. I am currently holding Tesla shares in a long-term account.

Both Tesla and BYD are “Sells” until such time as the above problems are resolved or at least ameliorated.

Be the first to comment