tumsasedgars/iStock via Getty Images

Investment Thesis

The recent global economic downturn has affected all industries. Private equity investments have seen the most significant declines in the current market conditions, which has led to a disproportionate decrease in the price for Forge Global Holdings (NYSE:FRGE). The lack of liquidity experienced by the market is because buyers of private companies with a value of over $1 billion, also known as Unicorns, are holding on to their investments. In contrast, sellers are demanding a discount relative to the fair value price of companies. Once the price equilibrium is established and liquidity returns to this market, the investors can expect sizeable returns by investing in FRGE.

Background

Forge Global Holdings has an exciting new concept that enables retail investors to invest in private companies. Alternatively, it allows individuals and institutions to sell their shares to interested buyers. Shares of popular private companies like Stripe, SpaceX, and Plaid are available for both buying and selling on the Forge platform.

Traditionally, investors who invest in a start-up enterprise would have to wait for the company to become public to enable the sale of shares of a company. Alternatively, the individuals would have to seek, convince, and sell shares privately to other individuals or institutions. As an intermediary and an exchange platform, FRGE is democratizing the overall process by enabling individuals to buy and sell their shares in private companies using a secure online platform while also helping provide liquidity for the overall private equity market.

Company Fundamentals

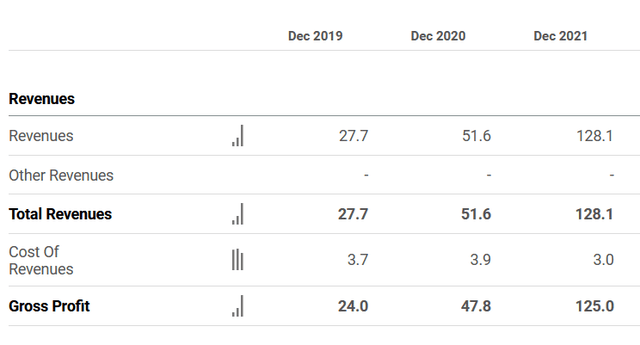

The overall revenue of FRGE has increased over four times, going from $27.7 million to $116.0 million in December 2021. The company’s revenue is comprised mainly of a company placement fee, which is around 73% of the revenue generated by the company. The remaining revenue is based on settling transactions between buyers and sellers, also referred to as a net take rate of 3.5%.

The gross profit has increased over five times, going from $24 million in 2019 to $125 million in 2021.

FRGE Revenue Growth Profile (Source: SeekingAlpha)

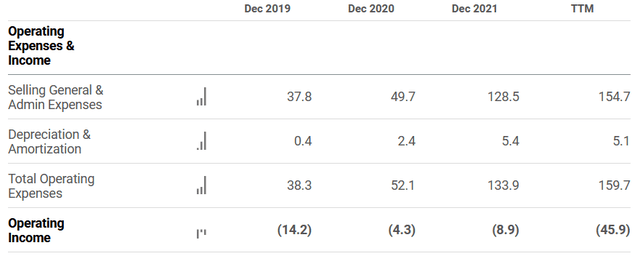

Since the company is in the early stages of acquiring new users, most of the gross profit is reinvested in growing the platform through SG&A activities, as shown below. As a result, the company operated at a net loss of $45.9 million on a trailing twelve-month basis.

FRGE Business Reinvestment Through SG&A Activity (Source: SeekingAlpha)

Headwinds

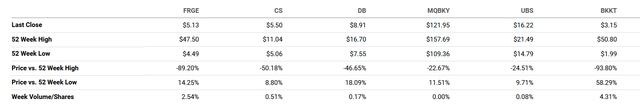

The company is susceptible to the global macro-economic slow-down, like other companies within the same sector, all of which have been operating at or near their 52-week lows.

Company Comparison (Source: SeekingAlpha)

However, FRGE is more prone to market declines because of the nature of its business. Due to the low liquidity of the private equity markets, it is much harder to match buyers and sellers because buyers expect discounts on shares; they want to purchase commensurate with the overall public market declines. On the other hand, the sellers have a lot of conviction in the companies they own and are willing to wait out the near-term market volatility for a more substantial pay-off in the future: Either through the overall market recovery or when the private company decides to IPO.

Company Growth Catalysts

In the financial markets, it is often said, “Buy the rumor, sell the news.” The most active trading activity on the Forge platform is those companies rumored to IPO. Forge benefits when transactions in private companies are settled, and new companies are listed on the forum. Additionally, capital flows from venture capital firms looking to invest in private companies also increase activity on the platform, which translates into more significant revenues for the company. As the economy recovers, it is anticipated that both VC and private equity investment activity will increase. Additionally, as more new companies looking to raise capital are listed on the platform, the revenues generated from listing new companies will be a steady income stream for FRGE.

Investment Risks

The market cap for FRGE is below $1 billion, which makes it a small cap investment. Investors should know that small-cap companies tend to be volatile in price action. Additionally, matching buyers and sellers in private equity is longer than in public markets. Therefore, FRGE has risks in terms of lead time for returning to normal in terms of its revenue and the size of the company.

Conclusion

Private equity investments are often only reserved for high-net-worth individuals, and FRGE democratizes the process by enabling buyers of shares in private companies to find sellers. With the recent macro headwinds, FRGE has experienced a lack of liquidity and consequent declines in its revenue. As the economy recovers, we can anticipate the venture capital, new company listings, and buying and selling activity to resume back to normal levels. Investors with a high tolerance for risk and a long investment time horizon should consider investing in FRGE.

Be the first to comment