Justin Sullivan

Our previous analysis of Ford (NYSE:F) emphasized the yield curve and its influence on cyclical stocks. Even though we were wrong in the short run, we firmly believe that Ford’s stock is in danger of losing value in the coming quarters. In addition, we’ve noticed a great deal of enthusiasm surrounding Ford’s dividend yield; however, over-optimistic behavior could thwart investors’ decision-making.

We assign a sell rating to Ford stock; here’s why.

Dividend Yield

Starting off with the latest talking point, Ford’s dividend yield. I bet many of you are thinking: “I won’t be able to secure a yield like this on Ford stock ever again”.

In isolation, you’re correct. Ford’s dividend yield of 3.02% isn’t only appealing because of its reinstatement and yield size but also because of its growth potential.

According to the stock’s trailing metrics, the company’s cash from operations stands at $12.40 billion, and its coverage ratio is at a solid 4.24x, which communicates an abundance of security.

Furthermore, Ford’s cash dividend payout ratio of 20.16% is astonishingly low. In fact, it’s at a 41.66% sector discount, suggesting the company holds enough capacity to increase its future shareholders’ compensation.

| Dividend Yield | 3.02% |

| Payout Ratio | 16.39% |

| Coverage Ratio | 4.24x |

| Cash From Operations | $12.40 billion |

Source: Seeking Alpha

However, there’s a flip side to all of this. Dividend payouts rarely follow a linear trajectory. In fact, they tend to revert to mean abruptly.

A Good-looking Car Isn’t Enough

Based on readers’ comments on our previous Ford articles, I’m fully aware that many of Ford’s investors believe that a good-looking vehicle equates to a good stock investment.

I’m also aware that Ford’s SUVs are running hot, with U.S. sales growing by 47.7% in August. Additionally, you could say that a broad-based August U.S. vehicle sales increase of 27.3% is more than decent. However, this probably won’t last for very long as the current bearish economic climate will eventually catch up to all automotive companies (including Ford).

A firm such as Ford possesses customer loyalty, but customers will only stay loyal to a firm’s products for as long as they can afford them. Meaning that there will come a time when everyone will be window-shopping.

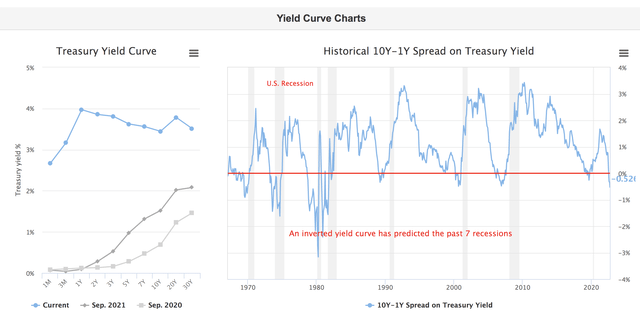

I want to emphasize the yield curve. The yield curve is inverted, signaling a pending recession. Seminal financial literature suggests that a culmination of rising interest rates and a contractionary macroeconomic environment usually causes automotive sales to recede. Therefore, systemic risk points toward a possible impending downtrend in Ford’s broad-based vehicle sales.

Valuation & Pricing

Based on relative valuation metrics, Ford is overvalued as its projected earnings-per-share is significantly softer than its trailing earnings-per-share. This is conveyed by the large discrepancy between the stock’s current price-to-earnings and its forward price-to-earnings.

What’s the fundamental reason for Ford’s forward price-earnings premium?

The fundamental reason why Ford’s forward price-to-earnings is at a premium is because of the exact features I mentioned in the previous section, which is the array of cyclical/macroeconomic headwinds the global economy has in store.

Additionally, there’s a strong case that Ford’s stock might be overvalued relative to its book value. I say this because parsimoniously, a price-to-book ratio that exceeds 1.00 usually suggests a stock’s trading at a premium unless its forward ROE (return on equity) settles above its current level.

| Price-Earnings | 5.14x |

| Price-Earnings (FWD) | 22.25x |

| Price-Book | 1.36x |

Source: Seeking Alpha

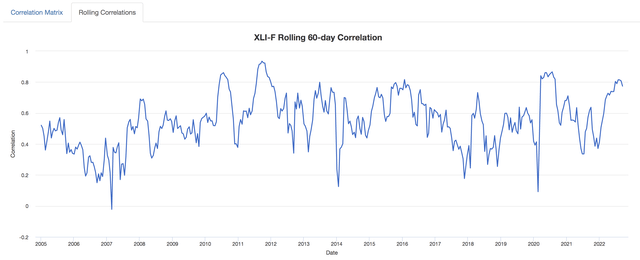

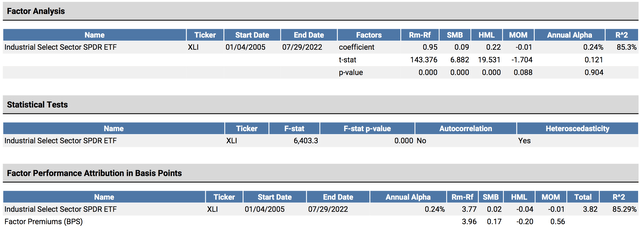

Another factor worth considering is that Ford’s lagging from an asset pricing perspective. I simulated a Fama & French four-factor model to explain the historical returns of the Industrial Select Sector SPDR ETF (NYSE:XLI), which holds a 0.58 correlation with Ford’s stock.

My rationale for the simulation stems from my willingness to discover a way to describe cyclical stock performance to our readers; however, the Fama & French four-factor model only functions on portfolio/ETF regressions and not individual stock regressions. Therefore, I ran the regression on the Industrial Select Sector SPDR ETF.

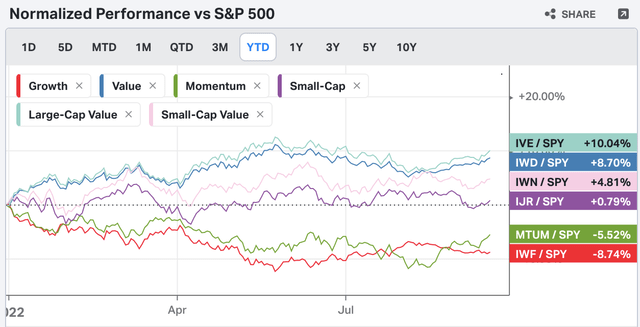

The regression’s results convey that since 2005, industrial stocks have underperformed whenever large-cap stocks outperform (the market) and when value stocks outperform. Also, industrial stocks tend to underperform when momentum stocks outperform other stocks.

Based on the current year-to-date performance of various stock segments, value stocks and large-cap stocks have outperformed the rest of the market, which is to be expected in a risk-off environment. Unless there’s a fundamental shift in the economy, industrial stocks (including Ford) will likely continue to underperform the broader stock market.

Concluding Thoughts

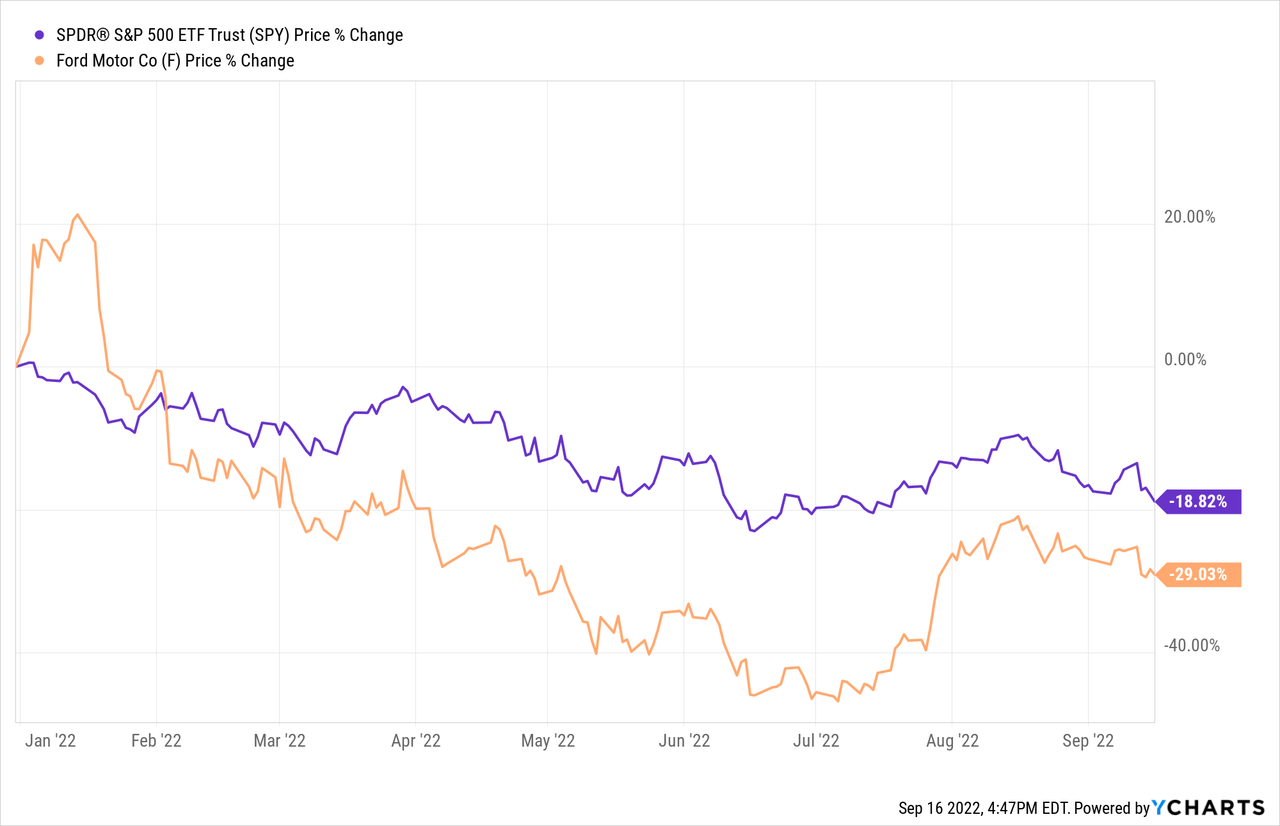

The reinstatement of its dividend has caused many investors to rush toward Ford stock. However, we see this as a temporary benefit and believe Ford will continue to underperform the broader stock universe (as it has since the turn of the year).

Even though Ford’s been able to stay afloat in a topsy-turvy economy, we believe its “best-in-class” status is irrelevant in the coming quarters as cyclical stocks are set for a systemic downturn.

Lastly, key valuation and asset pricing metrics indicate that Ford’s stock is overvalued and overpriced, leading us to assign a strong sell rating to the stock.

If you’re interested in more advanced analysis, be sure to keep an eye out for our marketplace program, “The Factor Investing Hub,” which launches soon. FIH is an AI-driven “smart beta/factor investing” portfolio management concept with the goal of balancing long-term portfolios relative to “factors.”

Be the first to comment