alvarez

American Shipping Company ASA (OTCQX:ASCJF) is a core holding in the HDS+ portfolio.

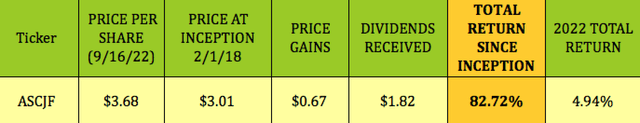

We added it on 2/1/18, a bit more than 4.5 years ago. Since then, American Shipping Company has delivered a total return from inception of 82.72%, averaging well over 19% per year. Better yet for us income investors, 73% of its return came from its $1.82/share in dividends.

So far in 2022, ASCJF has had a total return of 9.61%, outdistancing the S&P 500’s -17.7% loss by a very wide margin.

Profile:

American Shipping Company owns a fleet of nine modern handy size product tankers, one modern handy size shuttle tanker and an international subsea construction vessel. The Company is listed on the Oslo Stock Exchange under the symbol “AMSC.”

Established in 2005, American Shipping Company is a ship finance company focused on the intercoastal U.S. Jones Act shipping market. It owns 10 modern handy size product tankers and one modern handy size shuttle tanker on long term bareboat charters with Overseas Shipholding Group (OSG), a U.S.-based company. Aker ASA is the largest shareholder with ~19% of the shares.

NOTE: We’ll refer to American Shipping as AMSC or ASCJF in this article.

Jones Act:

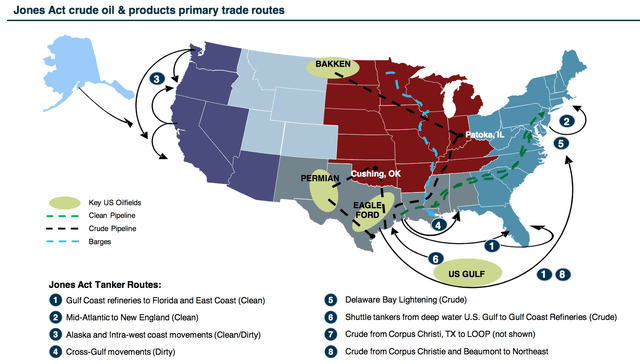

The Jones Act is a U.S. law that was passed in the 1920’s. It stipulates that “waterborne transportation of merchandise between two points in the United States must take place aboard a vessel that is U.S.-built, U.S.-owned, U.S.-flagged, and U.S.-crewed.”

The Jones Act is an essential feature of U.S. national security policy, as it provides required capacity to support national security needs and avoid complete dependence on ships controlled by foreign nations. Since the U.S. maritime position in international trades has declined significantly in the last three decades, the Jones Act is the primary maritime market for U.S. shipyards and operators.

The Gulf of Mexico is a major shipping lane for Jones Act vessels. Since Florida has no pipeline connection nor any refineries, all clean products (gasoline, diesel, and jet fuel) consumed are supplied by sea via Jones Act vessels.

Over the past 10 years, this trade has grown with a CAGR of about 3.5%.There’s also demand for Gulf product in the Northeast, but that’s dependent upon pricing vs. international alternatives such as Brent Crude.

The pandemic reduced demand, with lower refinery utilization, but the International Energy Agency (“IEA”) now sees clean fuel volumes almost fully recovered.

Fleet:

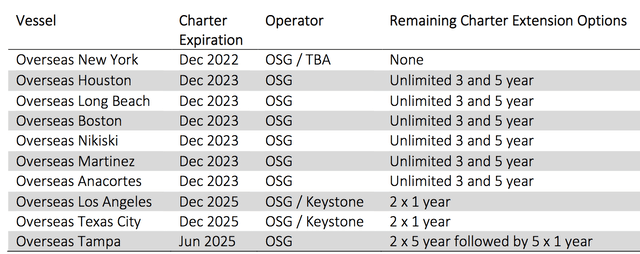

AMSC charters its vessels on long term bareboat charters that provide stable, predictable cash flow. On June 10th, AMSC announced 2 new multi-year Jones Act bareboat charters with Keystone Shipping Co., commencing upon redelivery of the current charters in December 2022.

In May 2022, AMSC reached an agreement to acquire the offshore construction vessel Normand Maximus, and to enter into a long-term bareboat charter commencing in Q4 2022 to a subsidiary of Solstad Offshore ASA, which will be accretive to earnings. This bareboat contract is 5 years firm, with 2 x 5-year extension options.

The fleet had a Backlog of Jones Act secured bareboat revenue of USD $175.7M, with an average weighted tenor of 1.9 years, as of 6/30/22.

AMSC operates under the Jones Act. on fairly long term contracts, which were renewed in December 2019. Its main charterer is OSG. The end users of these vessels are blue chip companies: Royal Dutch Shell, BP, Chevron, Philips 66, and Marathon.

AMSC also has a profit-sharing agreement with OSG, which could drop to its bottom line. In addition, it has a Deferred Principal Obligation, DPO, via which OSG repays principal and interest, up to $7M/vessel, over a period of 18 years. However, if the vessel’s charter is terminated, the balance becomes due immediately. This gives AMSC good leverage with OSG in rechartering negotiations.

AMSC continues to enjoy downside protection with “come hell or high water” bareboat contracts (meaning that the charterer pays for the crew and vessel operating expenses), with 1 product tanker secured until December 2022, 6 product tankers secured until December 2023, 1 shuttle tanker secured until June 2025, and 2 vessels secured until December 2025:

Earnings:

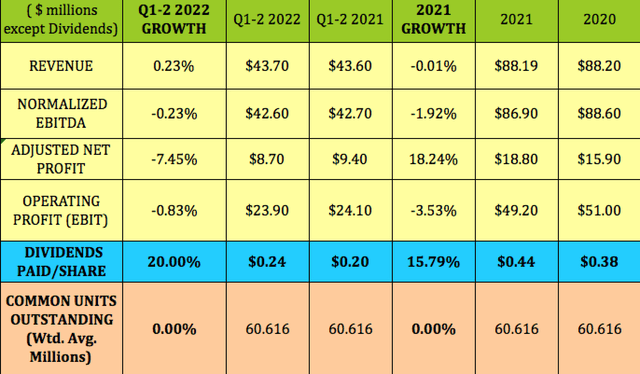

AMSC isn’t an earnings growth engine, but is more of a steady earner, with consistent Revenue, EBITDA, and EBIT, which support its quarterly distributions. Adjusted Net Profit can sometimes be lumpy, due to expense timing issues.

AMSC’s share count, which had been steady at ~60.6M since at least 2017, may face an 18% dilution, if a private placement for 11.24M shares is approved at an October shareholder meeting.

Dividends:

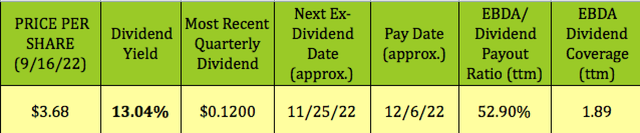

At its 9/15/22 $3.86 price/share, AMSC has a very attractive 12.44% dividend yield.

AMSC generally goes ex-dividend in a Feb-March/May/Aug./Nov. schedule, and pays in a March/June/Sept./Dec. schedule. It should go ex-dividend next on ~11/25/22, with a ~12/6/22 pay date.

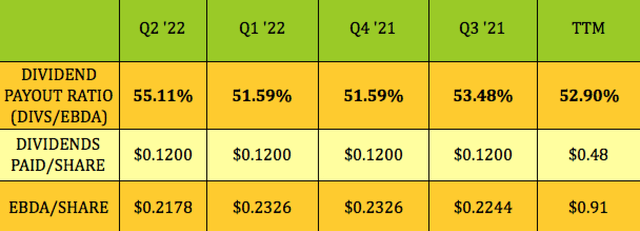

On an EBDA basis, Earnings Before Depreciation & Amortization, AMSC’s Dividend Payout ratio has been very steady, running between 51.59% and 55.11% quarterly. The trailing average payout ratio is 52.90%, which equals a dividend coverage ratio of 1.89X.

Taxes:

AMSC had ~USD $467.8 million of federal net operating losses in carry forward in its U.S. subsidiaries as of 12/31/21, of which ~ USD 151.7M are subject to certain IRS limitations. It also had ~USD $62.9M of net operating losses in carry forward in Norway as of 12/31/21.

Profitability & Leverage:

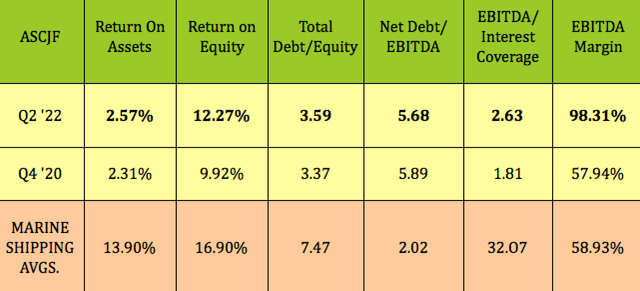

AMSC has had a good rise in ROE in 2022, with it rising above pre-pandemic levels. ROA also rose modestly. Net Debt/EBITDA improved a bit, while Debt/Equity is a bit higher. However, EBITDA/Interest coverage is currently much stronger, at 2.63X, vs. 1.81X in Q4 ’20.

AMSC’s Debt/Equity leverage is much lower than broad industry averages, while its Net Debt/EBITDA leverage is higher than average.

Debt:

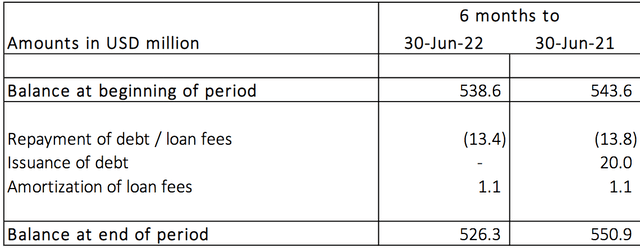

Management paid down $13.4M in debt in the 1st half of 2022, bringing the debt balance down by 4.5% vs. 6/30/21. AMSC was in compliance with all of its debt covenants as of June 30, 2022. All of AMSC’s debt matures in 2025.

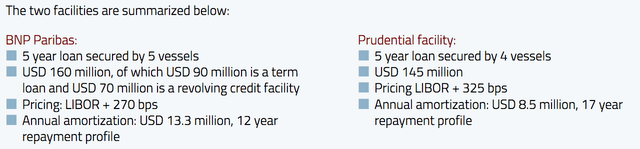

AMSC has 2 credit facilities: A 5-year $160M term loan/credit facility with BNP Paribas, secured by 5 vessels; and a 5-year $145M loan with Prudential:

Valuations:

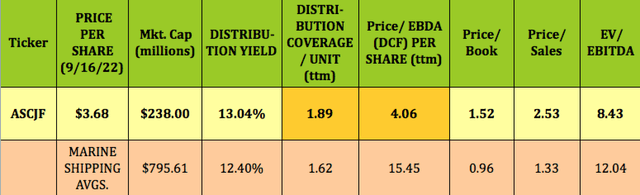

While its P/Book and P/Sales are higher than the broad Marine Shipping industry’s average values, where ASCJF looks very undervalued is in its Price/EBDA per share of 4.06X, which is much lower than the industry average of 15.45X.

ASCJF is also cheaper on an EV/EBITDA basis, at 8.43X, vs. the 12.04X industry average. Additionally, its Distribution Coverage of 1.89X is above the industry’s 1.62X average.

Outlook:

“Whilst demand for clean transportation is back to pre-pandemic levels, it is the emerging renewable diesel trade that drives demand and time charter rates. AMSC presently has 5 vessels in this trade – this may increase to 7 vessels in the near term.

The renewables trade consists of transportation of bio-fuels from the U.S. Gulf to the U.S. West Coast and is required for states on the U.S. West Coast to reach certain carbon emissions targets. The round trip from U.S. Gulf to U.S. West Coast is over 30 days and accordingly the longest in the Jones Act, which means additional ton miles for the fleet.

The (vessel) supply side of the market remains stable, with limited U.S. yard capacity and rising newbuilding costs, making it “unlikely for newbuilds to enter the market for years to come.” (AMSC site) (emphasis added).

Parting Thoughts:

American Shipping Company ASA is a classic hidden dividend stock – scant media coverage, (the most recent article on Seeking Alpha was by us in Q3 ’19), no Wall St. analyst coverage, and its earnings presentations/calls aren’t listed on SA, either.

The upcoming potential share dilution in early October may provide cheaper entry prices for new investors. On the earnings side, the new vessel acquisition in Q4 ’22 should counter some of the dilution’s effect on per share earnings and cash flow/share in Q4 ’22. We rate ASCJF a long term BUY, but wait until after the dilution.

If you’re interested in other high yield vehicles, we cover them every Friday and Sunday in our articles.

Be the first to comment