jetcityimage

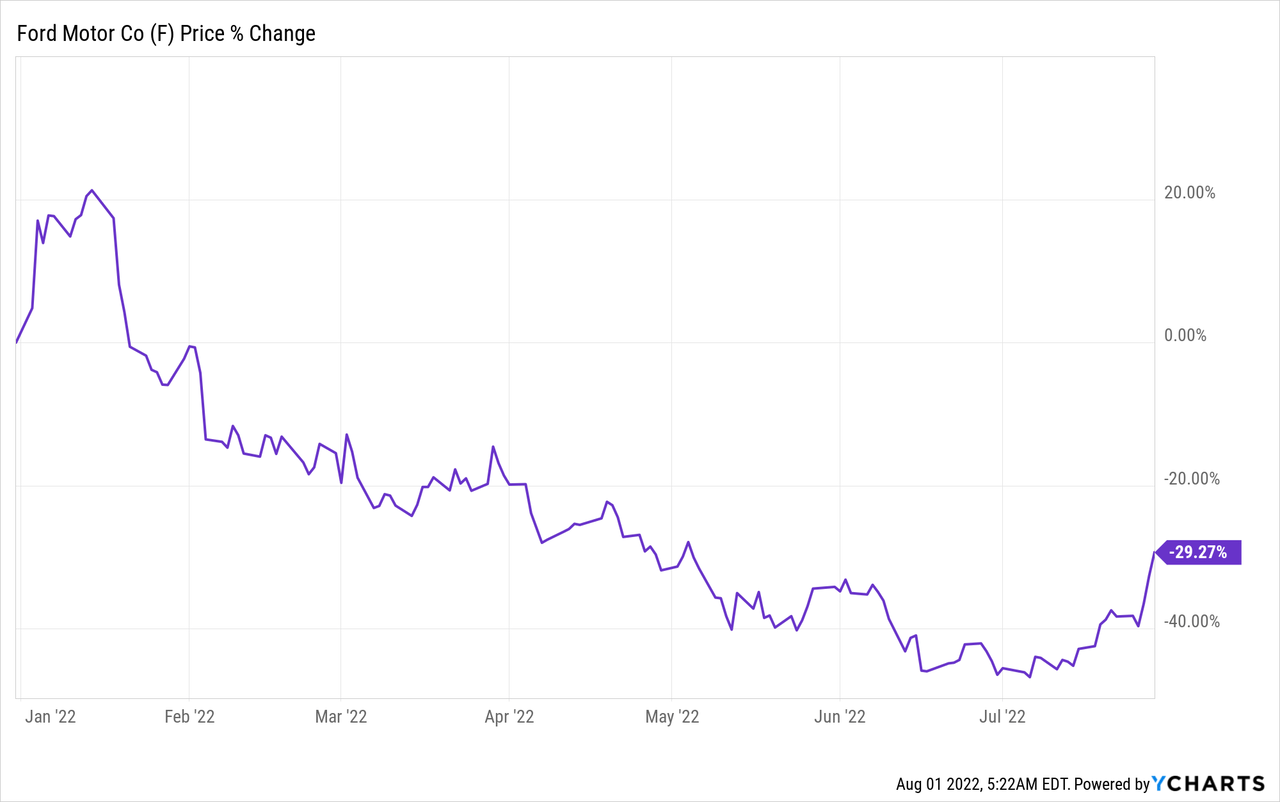

Ford (NYSE:F) took a $2.4B impairment on its investment in EV start-up Rivian Automotive (RIVN) in the second-quarter. Besides that, Ford crushed earnings estimates and the car brand confirmed its outlook for FY 2022 regarding adjusted EBIT and free cash flow which has given the stock new upside momentum last week. Recession fears are overblown and Ford’s earnings prospects in the electric vehicle market continue to be undervalued. For those reasons, I believe that Ford’s shares have strong revaluation potential!

Ford crushed estimates

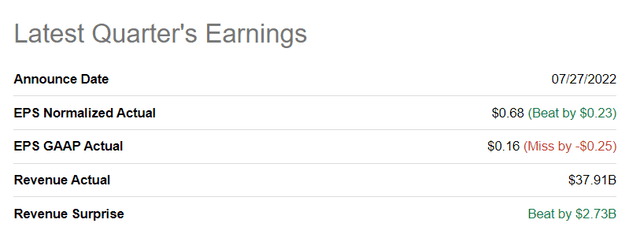

Ford delivered an earnings card that was much better than expected. Ford reported EPS of $0.68, sailing past the average EPS prediction of $0.45. Revenues of $37.91B were also much better than expected due to a continual recovery in the wholesale market.

Seeking Alpha: Ford Q2’22 Results

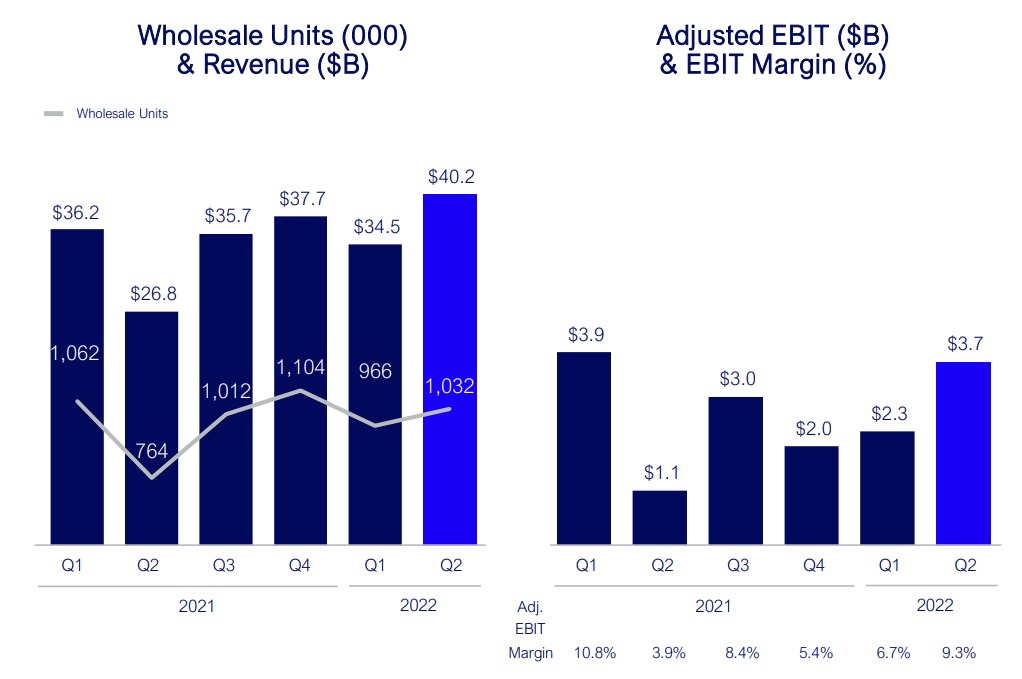

Ford’s second-quarter results were great chiefly because of recovering wholesale volumes and improved pricing driven by strong customer demand. Ford’s wholesale business took a hit from supply-chain disruptions in Q2’21 but the market has continually recovered throughout the last year. More favorable market conditions in the second-quarter made a 50% rebound in wholesale volumes possible for Ford in Q2’22.

Ford’s Q2’22 EBIT was $3.7B, showing 236% year over year growth, due to less severe supply chain problems. Ford’s second-quarter EBIT was the highest since the start of the pandemic in 2020.

Ford: Wholesale Volumes, EBIT Q2’22

Rivian equity valuation loss

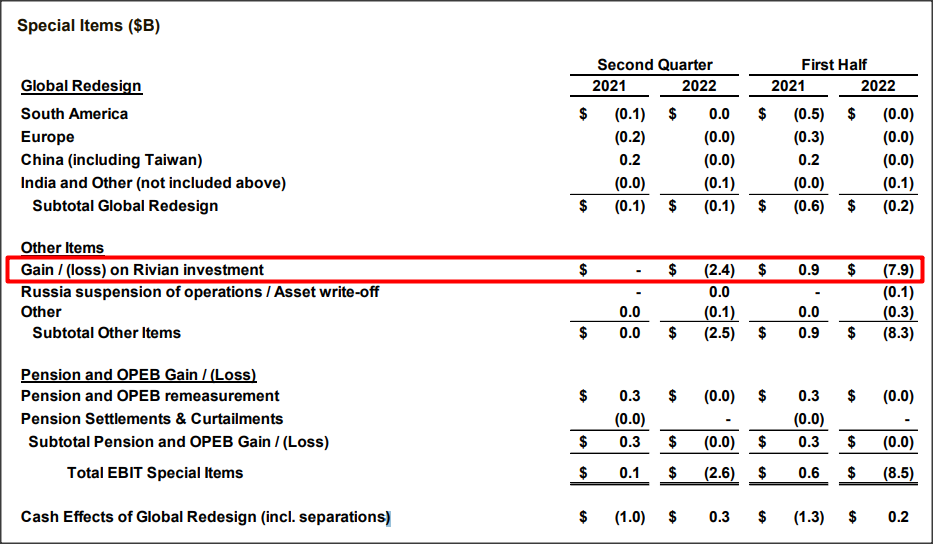

Ford owned 101.9M Rivian common shares at the beginning of Q2’22 and sold 25.2M during the second-quarter, leaving it with a block of shares that are worth approximately $2.6B. During the second-quarter, Rivian’s share price declined 49%… which resulted in a $2.4 billion mark-to-market loss on Ford’s equity holding in the electric vehicle manufacturer.

In the first-quarter, Ford suffered a $5.4B mark-to-market loss on its investment in Rivian bringing the total recognized loss for the car brand to $7.9B in FY 2022. Amazon (AMZN), which also heavily invested in the electric vehicle maker before last year’s IPO, suffered a massive $11.5B loss on its equity investment in FY 2022.

Ford: Rivian Q2’22 Special Item

FY 2022 outlook unchanged

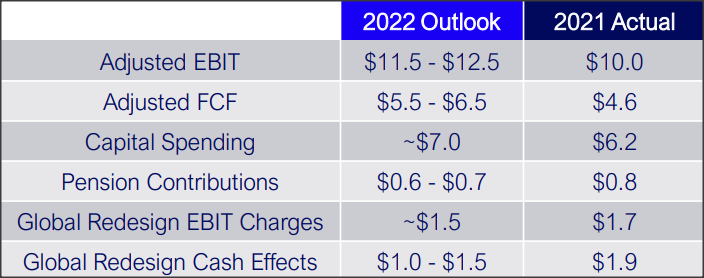

Before earnings I was a bit fearful that Ford would change its adjusted EBIT and free cash flow guidance, in part because inflation and supply chain problems have evolved into key issues for the auto industry. Because of inflation, many EV companies have also started to raise their prices which typically cools off demand and could have resulted in lower free cash flow and profit expectations.

Ford, however, confirmed its FY 2022 guidance and continues to see $11.5-12.5B in adjusted EBIT and $5.5-6.5B in free cash flow. Ford also continues to project commodity price headwinds of $4B despite prices of basic commodities recently falling due to fears of a recession.

Ford: FY 2022 Outlook

Ford is raising its dividend

Ford confronted persistent recession fears head on by not only confirming its outlook but also by increasing its dividend 50% to 15 cents a share. Ford suspended its dividend in the early days of the COVID-19 pandemic in 2020 and reinstated it in Q4’21 at 10 cents a share. The 50% dividend increase that Ford just announced has two important implications for shareholders:

- The dividend yield has increased from 3.1% before earnings to 4.1% after earnings (considering that Ford’s shares revalued 11% since Q2’22 earnings were submitted)

- The higher dividend proves management’s confidence in its product portfolio, revenue prospects and financial strength despite recession concerns.

The dividend is now back to where it was before the pandemic.

Ford remains cheap

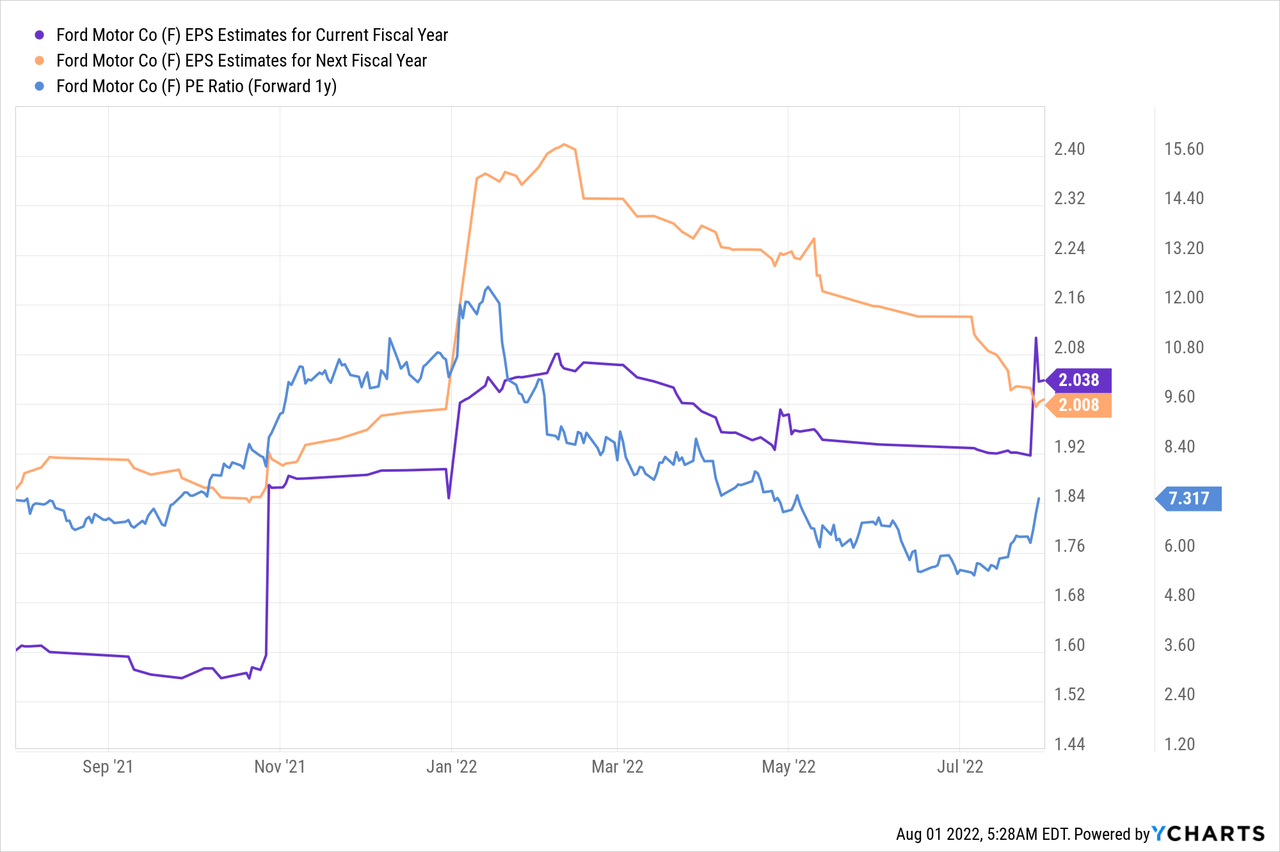

Ford’s prospects in the electric vehicle market are undervalued and the car brand’s EPS estimates may also be set for a reevaluation after Ford discounted recession fears. Current predictions call for $2.01 in FY 2023 EPS implying a P-E ratio of 7.3 X. I like Ford a lot for its EV transition and believe the company could ultimately grow into a $160B market valuation.

Risks with Ford

In response to growth concerns, commodity prices have fallen lately which takes pressure off of Ford’s profit forecast. However, inflation in July likely remained high, despite a drop-off in prices for basic materials such as copper. The supply chain also continues to pose a significant risk to Ford. New COVID-19 lockdowns in China and other places could delay the timely sourcing of computer parts and result in deteriorating earnings prospects for Ford. What would change my mind about Ford is if the car brand would lower its full-year EBIT and FCF outlook in the third-quarter due to decelerating economic growth prospects and growing margin pressures.

Final thoughts

Shares of Ford have surged 11% since Q2’22 earnings were reported. This increase in pricing resulted from Ford confronting recession fears — which have weighed on the car brand’s valuation lately — by confirming its FY 2022 EBIT and FCF outlook, and raising its dividend by 50%. The dividend increase was unexpected and a nice surprise for shareholders. Since companies usually only raise dividends when they have confidence in their financial performance, the market may have to reevaluate Ford. Despite the increase in pricing, I believe shares of Ford continue to have a very favorable risk profile!

Be the first to comment