Justin Sullivan/Getty Images News

(Note: This article was in the newsletter on June 5, 2022 and has been updated as needed.)

Warner Bros. Discovery, Inc. (NASDAQ:WBD) stock has lagged the market recently. That, of course, has brought out a lot of comments by trend followers that the current trend will continue. It might because you never know the future. Furthermore, during the last conference call, management made a comment about a noisy fiscal 2022. That should have surprised no one when it comes to a merger of this size. Those traders hoping for an instant stock pop were disappointed. Long-term investors should realize that the stock price initial drop is a buying opportunity.

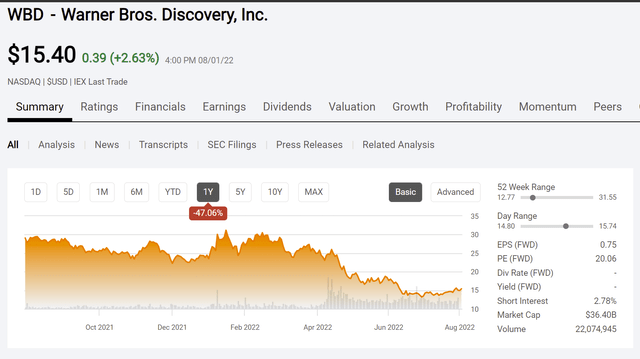

Warner Brothers Common Stock Price History And Key Valuation Measures (Seeking Alpha Website August 1, 2022)

The long-term story is still intact. It is just that the market got carried away with stories of lots of cash flow tomorrow and then realized that tomorrow got pushed back.

It is not uncommon for the market to fret about cash flow and earnings as the time for the benefits to show up approaches. The idea that management would have an instant solution that shows benefits from day one is at best speculative. The stock price shown above is far more common.

As usual, the exuberance about the benefits of the coming merger got way out of hand in 2021. Now what is happening is the income investors are getting out of a stock that will not pay a dividend while those who purchased at considerably higher prices are “throwing in the towel.” It takes some time for a new equilibrium to be established between buyers and sellers.

Management has pointed out a lot of superior assets gained in the merger. But they also pointed out that the acquired division had little to no free cash flow. This, unfortunately, points out just how poor the previous management of the division had been. Properly managed companies in this industry generate a fair amount of cash flow.

Management also noted in the conference call that Discovery was generating that free cash flow. Now management intends to scale that free cash flow to the amount it should be for the combined company. Usually that means getting rid of a lot of initiatives that management pointed out do not meet a return threshold.

The market was concerned about a lack of precise disclosure. But management really has not seen the assets other than any examination before the purchase. Management stated that they need to review things a lot better before they give guidance. That is a rare realistic approach that the market will hate initially. But that approach also begins to build a reliability so important to higher share prices down the road from the “trust factor.”

One of the keys to superior management has to be a frank discussion of the good and the bad. The conference call provided just that along with a warning that a housecleaning involving a merger of this size would take a fair amount of fiscal year 2022. Managements that state the problems upfront to the public shareholders are far more likely to resolve those issues even if they make a few mistakes along the way.

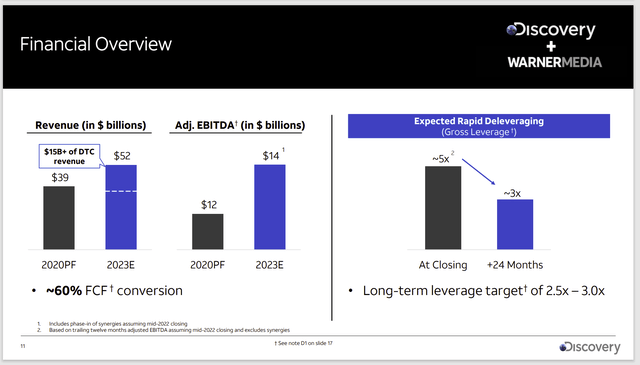

Discovery Financial Guidance Of What Is Now Warner Brothers Discovery (The Former Discovery Presentation Of The Merger That Became Warner Brothers Discovery.)

Management clearly had worries about the acquisition cash flow. The difference in relative cash flow margins shown above is striking. The old Discovery clearly had excellent cash flow margins. That gives investors some idea of the long-term margins that management will strive for with the combined company. That informal goal should also provide years of earnings growth as the combined company heads to those kinds of cash flows.

As management stated in the conference call, the leverage will be higher than expected. But that leverage will not approach the worst-case scenario shown above. A combination of debt repayments from free cash flow and growth of EBITDA should enable the target leverage goal to be met.

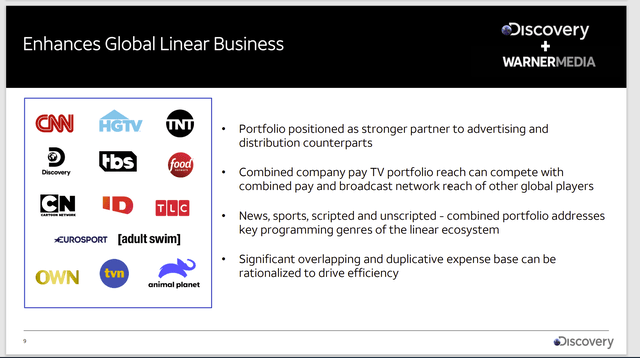

Discovery Before The Merger Description Of Post Merger Assets. (Discovery Merger Presentation Before What Is Now Warner Brothers Discovery.)

The cutting out of projects that have no hope in the eyes of management will be the easy part even if management happens to make an occasional mistake. The longer-term project will be the establishment of financial ratios that were apparent in Discovery before the recent merger.

There are a lot of possibilities here and one can certainly argue which one will dominate. For me, the DC Universe probably has the most profit opportunities given what Disney (DIS) has done with its comic book movies. This company now owns the Batman and Superman franchise along with a lot of other previously unexplored characters. Those two alone probably have the potential for far more income than was the case under AT&T (T). Management pretty much stated that during the conference call and I have to agree.

Secondly, the CNN news business has to be managed for cash flows. The news business has changed in ways I never dreamed of since I was young. Now news outlets tend to search for an audience, with some outlets going out of their way to bend the presentation to the preference of those audiences to in effect “guarantee” a profit.

This management appears to be taking great pains to bring reliable news to what they hope is a far larger audience that wants actual news with a little less opinion. The way it was stated in the news conference kept management from offending all kinds of special interests. Bringing that about in a sufficient cash flow (and earnings) future is going to be an interesting undertaking. There could be a lot of fragments that need to be served by the news outlet that would be profitable to exploit.

After that are a lot of significant possibilities that may end up exceeding those two. Mr. Market has clearly been fretting about a lack of specifics because he does not like uncertainty. Therefore, a recent memo to employees got a lot of attention.

One of the things promised to investors and the market was a company breakdown of finances by reporting areas that make sense to the new company. This company, like Disney, is going to benefit a lot from the streaming service in ways that do not show up as streaming profits. Furthermore, this company does not directly compete with Disney in a whole lot of areas except for some overlaps like the DC Universe.

The two companies do compete for the spare time of people. But the entertainment promised by each is largely different. That is a clear advantage for both as the streaming competition heats up. The winners of the competition will be those that find a profitable streaming niche where the competition is lower than the “general market.”

Both Amazon (AMZN) and Apple (AAPL) do not have the related divisions that benefit to the extent that Disney and Warner Brothers Discovery do. Therefore, both Amazon and Apple are potential casualties of this competition in the long run.

The most efficient operations are likely to be the long-term winners. Both Disney and Warner Brothers Discovery have far more potential benefits in other divisions to offset the reported losses in the streaming division. That means that neither has to report a profit in streaming to improve overall company profitability. It also means that Warner Brothers Discovery can look forward to a lot of earnings growth regardless of the outcome of the streaming wars because streaming is likely to prove to be a long-term plus for the company every year the company participates instreaming.

Be the first to comment