carloscastilla/iStock via Getty Images

Thesis

Eaton Vance Tax-Advantaged Global Dividend Opportunities Fund (NYSE:ETO) is a global multi asset fund from the Eaton Vance family. The vehicle is overweight equities which account for over 82% of the portfolio. With a small exposure to U.S. investment grade and high yield bonds the fund enhances its yield via this bucketing. The fund invests primarily in global dividend-paying common and preferred stocks and seeks to distribute a high level of dividend income. The current dividend yield is 7.7%, achieved with a modest leverage of 20%.

The fund has consistently outperformed a global equities ETF, namely the Vanguard Total World Stock Index Fund ETF (VT), with a fairly low standard deviation of only 21 versus 16.7 for the global index. ETO tends to juice up its dividend yield via a small allocation to U.S. fixed income and runs a fairly low conservative leverage ratio of 20%. The fund was down more than -30% earlier in the year but has now rebounded strongly. A large portion of the rebound is comprised from a premium to NAV. The fund traded at a discount to NAV during the June market sell-off, but has now reverted to a high premium of 11.6% to net asset value. We do not think this is warranted and we think we are going to see a mean-reversion here during the next down leg of this bear market.

We do not think we have bottomed out in this bear market and we are waiting for peak inflation or a cessation for the war in Ukraine to feel more constructive on equities. Long term ETO is undoubtedly a winner as it has proven though its historic performance but today’s price point is not a good entry point. We would not buy a CEF trading at a decade long premium to NAV during what we believe is a bear market rally. We like ETO, its performance and analytics, but we would think a retail investor is best suited to wait for the next leg down in this market for a much better valuation point.

Analytics

AUM: $0.455 billion.

Sharpe Ratio: 0.47 (5Y).

St Deviation: 21 (5Y).

Yield: 7.73%.

Expense Ratio: 1.29%.

Premium/Discount to NAV: +11.64%.

Z-Stat: 3.55.

Leverage Ratio: 20%.

Holdings

The fund’s portfolio is global, but with a high North America allocation:

Geographic Mix (Fund Fact Sheet)

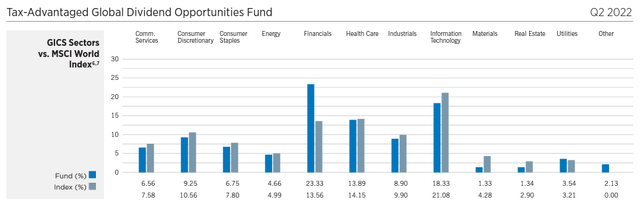

The fund is currently overweight financials versus a global stock index:

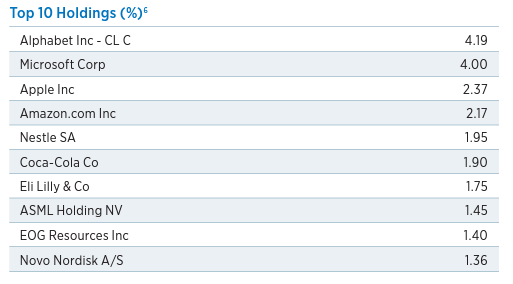

The fund’s top holdings are large, well-known international mega-caps:

Top Holdings (Fund Fact Sheet)

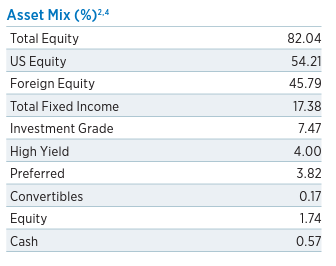

The fund also has a small allocation to fixed income:

Asset Mix (Fund Fact Sheet)

We can see that as of the Q2 2022 fact sheet, approximately 17.38% of the fund was allocated to fixed income instruments. On the fixed income side Investment Grade paper made up the bulk of the exposure, followed by a small allocation to high yield. This CEF does not really fall in the multi-asset category for us, and we feel the small allocation to fixed income pursued here is mainly geared towards enhancing the fund’s total returns.

Performance

The fund is down only -10.7% year to date when compared to a world index:

YTD Performance (Seeking Alpha)

On a five year time-frame the fund has outperformed significantly:

5-year Performance (Seeking Alpha)

We can see that ETO is up +71% during this period while VT is up only 46%. A ten year chart reveals the same significant outperformance:

10-year Performance (Seeking Alpha)

What is interesting to note is that ETO has consistently posted better results than a world index fund. If we look at the above graph we can notice that the orange line that highlights ETO’s total return is consistently above the VT total return. ETO is not a “one-trick pony” but employs a systematic strategy that has been consistent in generating alpha. If the fund only had short periods of outperformance with a mean reversion then we would not have been so sanguine regarding their alpha generation capabilities.

Premium/Discount to NAV

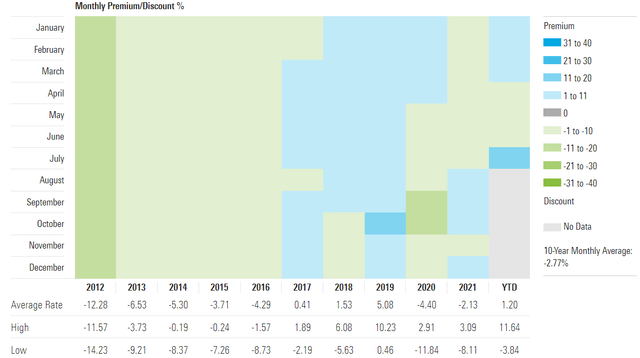

The fund has alternated between premiums and discounts to NAV historically:

Premium / Discount to NAV (Morningstar)

We can see from the above graph, courtesy of Morningstar, that the fund had consistently traded at a discount to net asset value up to 2017. We see an alternation between premiums and discounts from that point on.

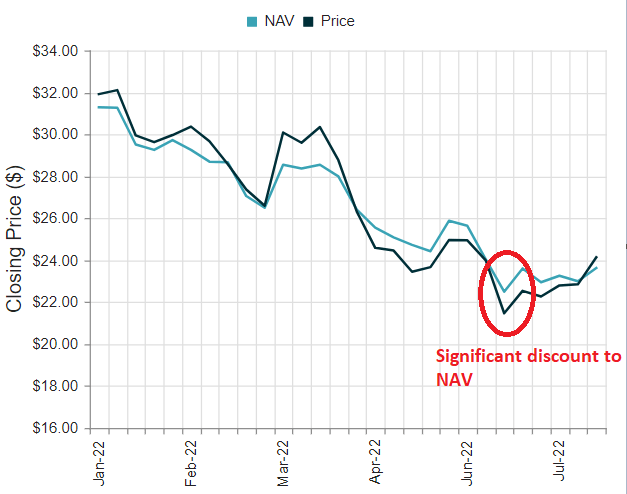

Like a number of other CEFs the vehicle was trading at a substantial discount to NAV during the June market sell-off:

Recent Premium to NAV Performance (CefConnect)

It is now trading at a decade long high premium! Do you think that is warranted? Do you think that it is normal and it will last? We think not. Just like a spring that was coiled very tightly the fund has sprung to an unsustainable level from a premium standpoint currently. We are not debating the merits of the fund here – the vehicle has very robust long term performance, but from a CEF structure standpoint, which allows for premiums to NAV to exist, the current level is unwarranted.

Do expect another reversion to discount to NAV during the next market sell-off. We believe we are in a bear market which has not bottomed out yet and trading the premium/discount to NAV for CEFs is a good strategy during the current macro set-up.

Conclusion

ETO is a globally focused closed end fund that focuses on dividend paying stocks. The fund has a small fixed income bucket that contains U.S. investment grade and high yield bonds and is utilized to juice up the dividend yield. The fund has performed admirably on 5- and 10-year lookback periods, outperforming VT handsomely. We like ETO long term but feel it is currently overpriced with a historic premium to net asset value. We saw a very strong rebound in this fund after the June market sell-off which has moved its market price to a premium to NAV from a discount. From a macro standpoint we believe we are in a bear market and we are witnessing just an adjustment to oversold conditions in June. We expect another leg down which would provide a much better entry point for ETO.

Be the first to comment