Justin Sullivan

If you still believe Founder and CEO Mark Zuckerberg of Meta Platforms, Inc./Facebook (NASDAQ:META) is a technology wunderkind creating riches for all his shareholders, think again. It appears he has wrapped his large ego into a metaverse pretzel, all but guaranteed to lose massive amounts of capital for years to come. Popular and media friendly COO Sheryl Sandberg saw the writing on the wall this year (and huge financial downside risk approaching), deciding to resign in early summer. It reminded me of the out-of-the-blue resignation by wildly successful Walt Disney (DIS) CEO Bob Iger right before the pandemic hit in early 2020. Surprise exits by top managers of name-brand companies often foretell something is amiss with operations.

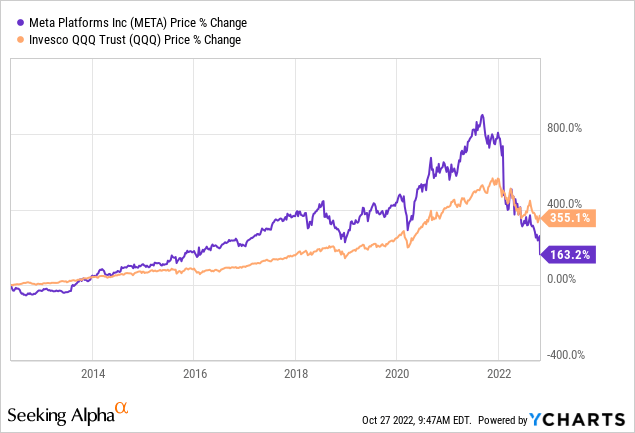

After the metaverse fiasco (spending $12+ billion more than revenue generation on a trailing 12-month basis), it is becoming increasingly clear Zuckerberg is no better a futurist thinker than the average technology CEO. In fact, Wall Street is saying Zuckerberg may be a far worse-than-typical manager of a mega-cap company. Don’t take my word for it. Look at the long-term price trend in Meta’s stock price since the May 18th, 2012 IPO at $38 per share. This morning’s $99 price (on October 27th, 2022) has actually generated a very SUBPAR long-term return vs. the peer Invesco NASDAQ 100 ETF (QQQ) drawn below.

YCharts – Meta Platforms vs. NASDAQ 100 QQQ Price Performance, Since May 18th, 2012 IPO

Whether reviewing price change or total returns including dividends (Meta pays zero cash dividends), the company’s stock has only returned HALF of the gain of the high-tech mega-cap sector over the last decade! The compounded total return for Meta, had you bought on the first day of trading, works out to +10% annually. That’s not genius. That sucks versus an equivalent-period total return about the same as the S&P 500 index.

How To Fix Meta Platforms

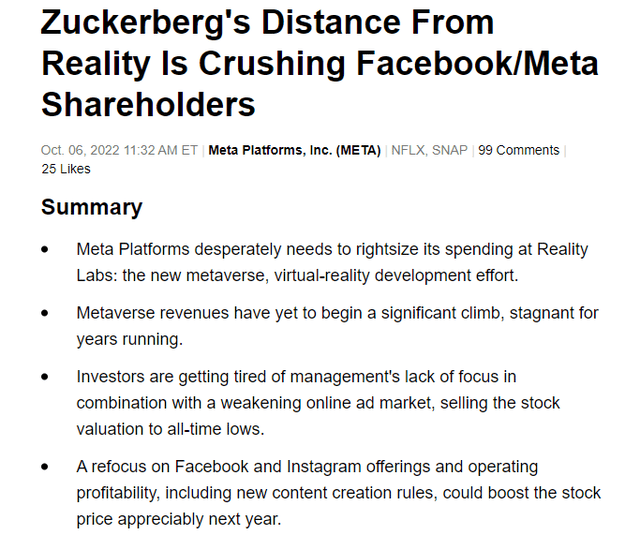

I wrote an article just a few weeks ago here at $139 a share explaining what Meta needed to do to right the sinking ship (stock price). Instead of slashing costs at Meta overall, and Reality Labs specifically, Zuckerberg yesterday announced he is upping the ante, all but guaranteeing subpar Meta shareholder returns over the next 3-5 years. Who wants a piece of that? I don’t.

Seeking Alpha – Paul Franke, Meta Platforms Article, October 6th, 2022

Believe it or not, if the metaverse experiment was completely shuttered (eliminating massive capital losses) and Zuckerberg himself resigned, I would be very bullish on the remaining assets and future of social media darlings Facebook, Instagram, and Reels on top of the secure instant messaging WhatsApp. All of the units outside of the metaverse dream vision are actually worth something and continue to grow, albeit at normalized business rates.

The bad news for shareholders today, and a clear way to fix Meta’s financial mess, is highlighted below in the Q3 earnings release. The sad part is it’s obvious to everyone except the king-like decision maker at Meta Platforms, Mark Zuckerberg, who controls a majority 55% of voting stock in the corporation.

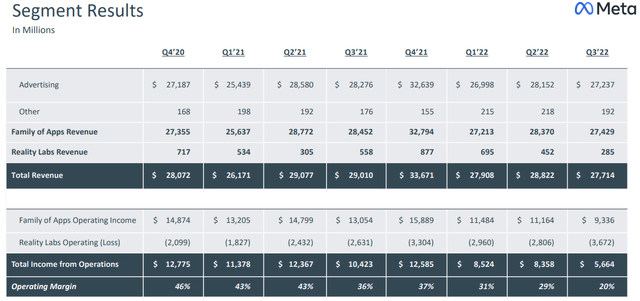

Basically, revenues have flatlined since late 2020 and GAAP earnings slid backwards quickly with the ad recession (which management cannot do anything about), while Reality Labs spending has exploded despite lacking any material revenue stream (which management has total control over). The net effect has been an implosion in operating margin from 46% of sales two years ago to 20% at the end of September 2022.

Meta Platforms Q3 2022 – Segment Revenue/Cost Breakdown, Q4 2020 to Q3 2022

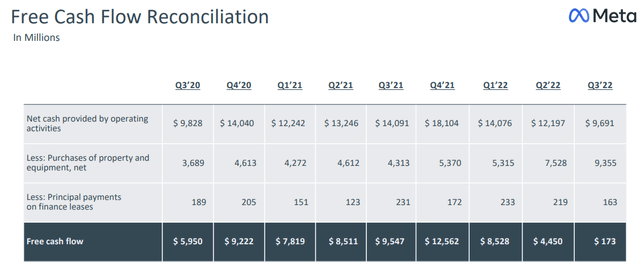

Even worse, free cash flow (“FCF”) has all but disappeared in Q3 numbers! If this result continues for four quarters, it will be the worst free cash showing since the company went public in 2012.

Meta Platforms Q3 2022 – Free Cash Flow Table, Q3 2020 to Q3 2022

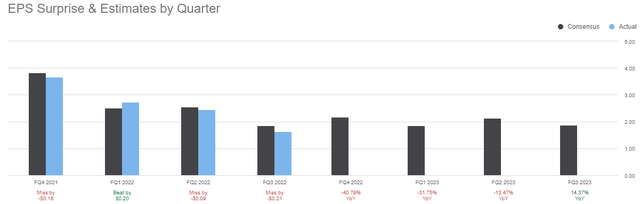

And, the outlook for 2023 is not any brighter. GAAP EPS results are falling fast in 2022 and not projected to rise next year by Wall Street analysts. I am forecasting 2023 GAAP EPS of $6 to $8, depending on the health of the ad market during stagflation and assuming Reality Labs spending stays flat (which Zuckerberg is warning will increase). At $99 a share, the GAAP P/E range of 13x to 16x is low, but not yet ultra-cheap given all the moving parts at risk over the next 12 months.

Seeking Alpha – Meta Platforms, EPS Quarterly Estimates Table, Q4 2020 to Q3 2023

Final Thoughts

Continuing to fund the Reality Labs metaverse creation at the same or higher rates in 2023 is not genius. It’s borderline madness, at least from a financial perspective for shareholders.

My bottom-line conclusion is Meta has substantial underlying value in its social media properties. If the metaverse pipedream was eliminated, I would be wildly bullish on the financial setup and low valuation currently. However, the -20% stock dive today is a direct result of the decision to stay the course on Reality Labs losses, even as an advertising recession takes hold in a negative fashion for immediate operating results. Ad sales have flattened and are beginning to move in reverse in the second half of 2022. Instead of a growth company hitting on all cylinders, Meta today appears to have intentionally broken the engine necessary to create shareholder worth.

In essence, Reality Labs losses are pushing the value of the whole company well under the water level of a lake, something like when a fish pulls a bobber on your line into the deep. Once Reality Labs losses are slashed, the bobber will shoot straight back up and jump out of the water. For a visualization, that’s exactly what could happen to Meta’s stock price, if Zuckerberg gets some financial common sense knocked into him.

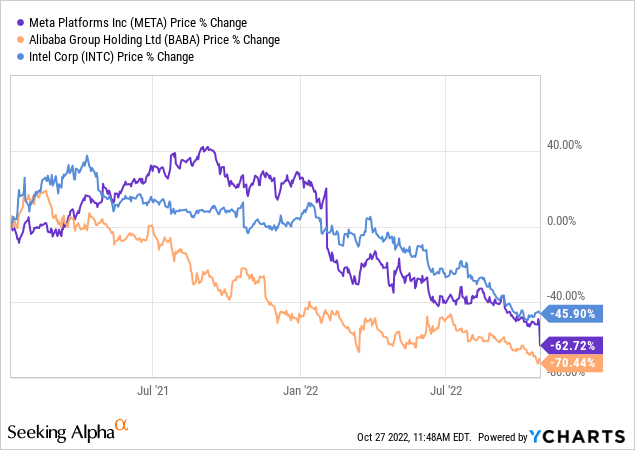

Peaking early in the company’s public-trading history, valuations on slowing growth rates for the whole business have been in regular decline since 2014-15. To a degree, Meta/Facebook has proven akin to a “value trap” for investors, similar to Alibaba (BABA) or Intel (INTC) during 2021-22. For investors and analysts, it looks like ratios of fundamental operating results cannot get any cheaper. Then they do.

YCharts – Meta Platforms, Alibaba, Intel – Tech Value Traps, Since January 2021

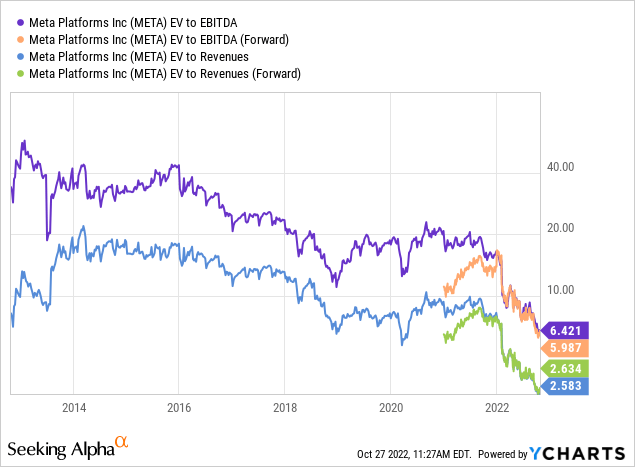

Enterprise value (equity market cap plus $10 billion in total debt minus $42 billion in cash/short-term investments) as a function of EBITDA or Revenues is absolutely reaching for bargain levels. However, stocks can stay in a bargain position for months or even years, if a catalyst for earnings and cash flow expansion fails to arrive on schedule.

YCharts – Meta Platforms EV Ratios, Since 2013 (Pre-Q3 Announcement)

For sure, pessimism on Meta’s future is becoming mainstream in the press and from beaten-up investors. The ingredients for a long-term price bottom and positive turn are there, but it’s almost entirely up to Zuckerberg to restore some confidence in the ship’s captain. Otherwise, the mutiny of shareholders selling will continue unabated.

I have a Hold rating for knucklehead shareholders loving the pain of investment losses, while praying for a turnaround any day now. For me to buy a stake (or upgrade my rating), we need to see an even greater price loss to make up for the low odds of Zuckerberg cutting spending markedly on the metaverse thing. Declining GAAP earnings on flat sales are not the recipe for a quick reversal or long-term share growth. Perhaps an $80-$90 price before the end of the year, or a change of heart from management through a major restructuring of costs, including slashed Reality Labs spending in half or more, could encourage me to be a Meta bull.

What’s the risk/reward setup owning Meta today? In my opinion, worst-case scenario valuations on a weak global economy next year, with even higher levels of metaverse investment could drop price below $80 over the short run (less than 6 months). Upside is limited to $150 over the next 12 months, assuming a stronger ad market environment and slight downshift in Reality Labs spending dollars. The Meta Platforms Q3 numbers were a total disaster, and the possibility of similar prints in Q4 2022 and Q1 2023 are worrisome.

Thanks for reading. Please consider this article a first step in your due diligence process. Consulting with a registered and experienced investment advisor is recommended before making any trade.

Be the first to comment