Justin Sullivan

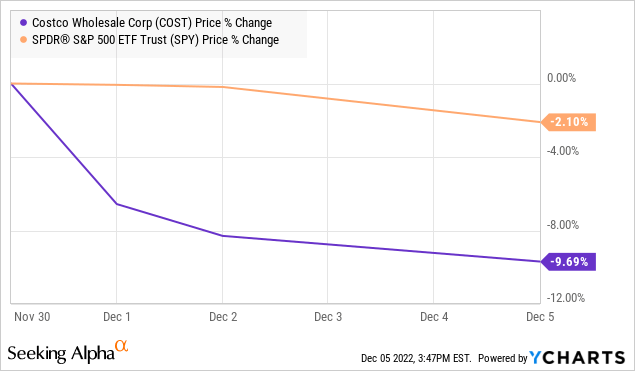

Costco Wholesale Corporation (NASDAQ:COST) has been under pressure amid a string of poor headlines heading into its upcoming quarterly report. The stock is down nearly 10% just in the past week against some Wall Street downgrades and disappointing pre-announced comparable sales data for November.

The setup here follows what was an otherwise resilient 2022 highlighted by strong earnings despite the challenging macro backdrop. The concern now is that consumer spending headwinds are finally taking their toll on operating momentum. We’re watching some shifts at the margin including lower gasoline prices that have likely hit its fuel business with a peripheral impact on the core retail operation.

There’s a lot to like about COST which deserves its blue-chip status supported by solid long-term fundamentals. On the other hand, risks over the near term appear tilted to the downside with some caution warranted ahead of earnings. We expect the volatility in shares to continue.

COST Earnings Preview

Costco is set to report its fiscal 2023 Q1 earnings on December 8th for the twelve weeks ending November 20th. Notably, this quarter does not capture the holiday shopping season that traditionally kicks off following Thanksgiving, which gets captured in fiscal Q2.

The current market consensus is for EPS of $3.16, which represents a 6.6% increase from the period last year. The market is also looking for revenue to reach $54.7 billion, up 8.6% year-over-year.

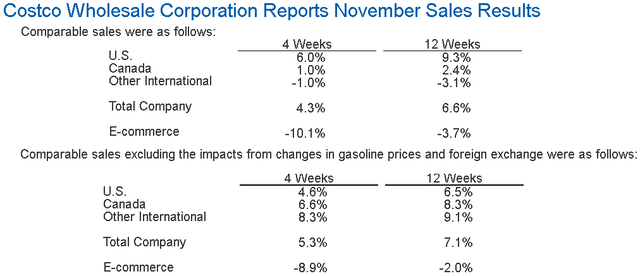

The top line figure becomes a problem considering the recent monthly retail update, reporting net sales of $53.4 billion over the quarter, up 8.1% year-over-year. Typically, there is a spread between these effectively preliminary results and the financial report that includes membership fees and also considers accounting foreign exchange adjustments. Nevertheless, a miss to the top line for this quarter is on the table depending on any last-minute changes to the consensus.

A key theme that will likely be discussed during the conference call is a declining trend in e-commerce sales, down -3.7% y/y in the quarter, or -2.0% excluding FX impacts, on a comparable basis. This was also down from a positive 7.1% gain in the prior quarter ending in August.

The e-commerce side typically accounts for a larger proportion of higher-margin discretionary items compared to food which is often the staple at warehouse locations. The dynamic is also a poor indicator of earnings as it relates to the operating margin. The apparent slowdown compared to the stronger first half of the calendar year 2022 could be connected to consumers pulling back on purchases precisely because of the economic environment including higher interest rates.

Keep in mind that Costco is global, with approximately 22% of sales from its Canadian and international operations. The business outside the U.S. also accounts for nearly one-third of total operating income. Here we can bring up the impact of the stronger dollar that will be both reflected directly in the financials, and also indirectly through the impact of consumer incomes in various regions getting squeezed through local economic factors.

China for example has been a growth driver for the company in recent years, but the recent Covid lockdowns and weak economic indicators explain the slowdown on the international side.

The other theme to watch will come down to the contribution from the company’s 668 gas stations, which represent approximately 14% of total sales. It’s understood that the fuel business offered at a discount to members compared to local market prices is meant to encourage shopping at the warehouses, but comes at the expense of being a lower-margin segment.

The challenge here is that as fuel prices have trended lower over the last several months, the impact is that the urgency by members seen at the start of 2022 to visit the locations when gasoline prices hit a record high near $5.00 a gallon is now missing. The impact here is already captured in the weaker comparable sales trend but may also slow new membership signups if that incentive for gasoline savings is missing.

As it relates to the bottom-line earnings figure this quarter, there are a few moving parts with some conflicting data. Favorably, the company likely benefited from declining inflation compared to the highs in the first half of the year, with a positive impact on its costs related to logistics to be reflected in the operating margin. There is a sense that easing supply chain disruptions may have provided some room for EPS to outperform expectations. This, of course, is positive, but the forward outlook will be weighed more heavily.

COST Stock Price Forecast

The recent bearish trading action in the stock with shares falling from near $540 at the end of November to the current price below $490 implies low expectations heading into the Q1 report. It’s hard to bet aggressively on more downside if the market is already pricing in some of those headwinds. A deteriorating economic environment defined by higher unemployment into 2023 could naturally drag demand and would hit the top-line result over the next few quarters.

In terms of positives, there is a case to be made that signs inflation is trending lower as a global theme into 2023 could prop up consumer spending through an improved sentiment which is important for the retail business. Costco could even capture some market share at the margin with shoppers attracted to its deals facing tighter income budgets. Still, we don’t see shares breaking out significantly higher without clear evidence of a re-acceleration in the business with an eye on comparable sales over the next few months. This may take a few quarters to play out.

According to consensus, the market is looking for revenue growth to average around 7% over the next three years while earnings. The forecast is for earnings to run higher in the 12% range over the period based on an expectation of higher margins.

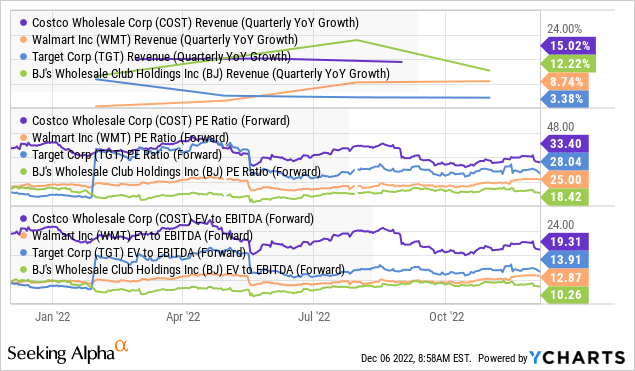

We mentioned Costco’s lofty valuation, trading at a forward P/E of 33x or 19x EV to forward EBITDA multiple. The spread to sector names like Walmart Inc. (WMT), Target Corporation (TGT), and BJ’s Wholesale Club Holdings, Inc. (BJ) reflects in part what has been a higher growth trajectory. Revenues climbed 15% year-over-year in the last quarter compared to 12% for BJ, WMT at 9%, and 3% with TGT.

Even with the expected moderating top-line through 2023, our take is that as long these names are facing similar macro trends, Costco should continue to trade at a premium to this group. This dynamic is consistent with its stronger long-term outlook with a leadership in various regions particularly through the members-only warehouse model. Still, the question becomes how much downside there is to the sector against consumer spending headwinds and revisions to earnings estimates.

Final Thoughts

Putting it all together, this is a tricky report that will set the tone for Costco Wholesale Corporation into 2023. We rate COST shares as a hold, implying more of a neutral view on the stock price without a good reason to expect a spike higher, but also viewing the downside as relatively limited.

In the near term, COST should find some support around the $455 level which was the low in shares from October. Tactically, the opportunity to pick up the stock on a move under $400 would turn us more bullish. The baseline here is for Costco Wholesale Corporation to continue trading in a relatively tight range between $400 and $500 for the foreseeable future.

![COST metrics]](https://static.seekingalpha.com/uploads/2022/12/6/49782598-16703358988367774.png)

Be the first to comment