salarko/iStock Editorial via Getty Images

Back in May of this year, I added Uniswap (UNI-USD) to the BlockChain Reaction portfolio. Shortly after that, I provided a public article detailing some of the key trends and metrics that I felt justified a UNI long position. Given the recent collapse of FTX (FTT-USD) and the market response to that centralized exchange blowup, I think it’s important to provide an update to my view on UNI.

Centralized Vs. Decentralized

As I’ve detailed in previous articles for both Seeking Alpha and BlockChain Reaction, it’s important to remember that FTX is a failure of a centralized business. It is not a failure of any decentralized network or decentralized exchange. The FTX collapse is theoretically a great catalyst for platforms like Uniswap and various other decentralized exchanges, or DEXes. Since FTX paused withdrawals, we’ve seen a widespread movement through crypto to remove assets from centralized custodians:

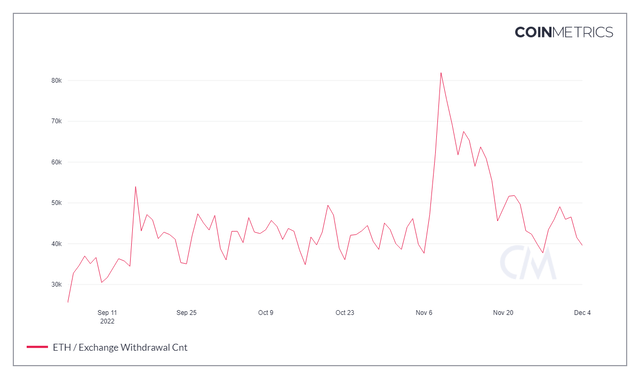

ETH Exchange Transactions (CoinMetrics)

Ethereum (ETH-USD), the network where Uniswap was built, had a large spike from a little under 38k exchange withdrawal transactions on Monday November 6th up to 82k exchange transactions on the 8th when market participants became nervous about third party risk. November 8th was the largest single day for Ethereum exchange withdrawals since June 14th – two days after Celsius halted withdrawals.

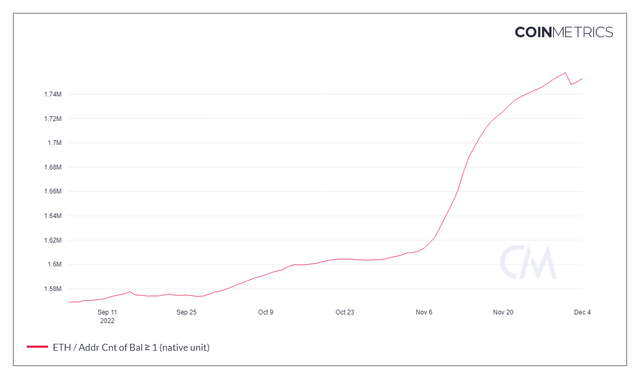

1 ETH Min Wallet Addresses (CoinMetrics)

We can see the move to self-custody following FTX reflected in some of the on-chain wallet address metrics as well. Wallet addresses with at least 1 ETH spiked from 1.61 million the day before FTX to 1.76 million at the start of December. Crypto holders have rightly become more uneasy about leaving assets on exchanges. DEXes like Uniswap should thrive in a larger movement toward self-custody.

Uniswap Usage

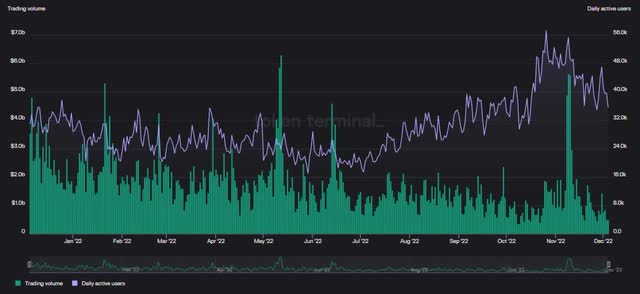

As can probably be expected, with more ETH moving off exchanges and into self-custody wallets, DEX platforms like Uniswap have seen spikes in application usage compared to previous averages in 2022.

Uniswap Daily Active Users (TokenTerminal)

The sustained move to a new high in Uniswap daily active users for 2022 actually started before the FTX collapse. Interestingly, the bigger increase in Uniswap DAUs happened in late October rather than early November. That said, even after a little dip since the October spike, Uniswap daily active users are still higher than the pre-October move and much higher than the activity in the summer months. What has fallen though is the trading volume.

After a massive spike from $1.5 billion in trading volume on Monday November 7th, Uniswap trading volume combined for over $16 billion over the next three days. Volume has generally been steadily declining since that initial surge last month.

Uniswap’s Tokenomics Problem

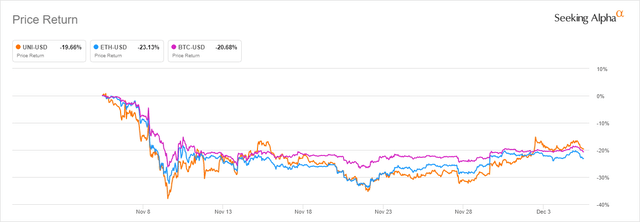

Even after the enormous surge in trading volume a month ago, the UNI token price didn’t really reflect the increased usage of the protocol:

1 Month Performance (Seeking Alpha)

UNI behaved very similarly to top crypto assets Ethereum and Bitcoin (BTC-USD). The token suffered a large drawdown and has failed to regain pre-FTX price levels despite a fundamental setup that should favor the protocol for the token. The question is why? The last few weeks have exposed what I now believe to be a serious flaw in Uniswap’s tokenomics; UNI is not a utility token. It isn’t required by users to facilitate swaps. Holders of UNI don’t get reduction on fees. The only conceivable purpose for holding UNI for any fundamental purpose is if you want to vote on governance proposals. None of this is new. But now we’re seeing that governance may not really be as strong of a reason for holding as initially thought.

Do UNI Holders Really Have Control?

Governance over a protocol is a fine reason to hold a token if you want to be able to vote on the protocol’s future direction. I don’t personally think it’s a great reason to hold a token by itself. But I can get past that if the governance story is strong enough. For Uniswap, I now question if the idea of platform governance is a good enough reason to hold UNI specifically.

Uniswap recently announced the platform is collecting quite a bit of user information. While it is not collecting names, physical addresses, or IP addresses, it does collect device-level information to better personalize the platform for users:

We and our third-party services providers may access and collect information from localStorage, mobile deviceID, cookies, web beacons, and other similar technologies to provide and personalize the Services and features of the Services for you across sessions.

Many in the DeFi space were very upset about this because it seemingly flies in the face of “web3” for a crypto application to be doing what is very much viewed as “web2” behavior. At present, governance is the only fundamental reason to have exposure to UNI. And this type of data collection was never voted on by the token holders. Until token holders are rewarded with platform fee distributions or given some sort of in-app benefit for holding, “governance” over the platform may no longer be a valid reason to hold the token in my view.

The Airdrop

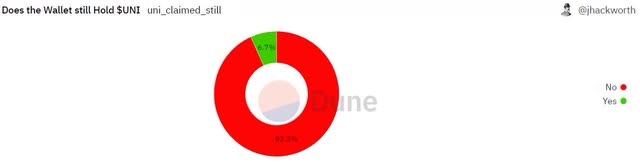

Uniswap tokens were originally airdropped to roughly 300,000 early users of the Uniswap platform. It’s been a little over two years since that airdrop and incredibly, only 6.7% of the wallets that claimed airdropped UNI tokens are still holding those UNI balances:

Dune Analytics/Jhackworth

Almost 220k wallets actually claimed the token of the 300k or so that were eligible for the drop. Of those 220k wallets that claimed, less than 15k airdropped wallet addresses still hold the UNI. That means that more than 205k of the original protocol users didn’t feel the token was worth keeping and several thousand more never even claimed the token airdrop to begin with.

Summary

Another potential headwind facing Uniswap is what liquidity providers do in response to a “fee switch” vote. Later this month, DAO members will likely decide to turn on a 10% fee that will impact liquidity providers in the Uniswap platform. This could conceivably push LPs away from Uniswap and into alternative DEX platforms. But to this point that remains to be seen. Uniswap will be testing the theories should the voters approve the switch.

The current environment should theoretically favor decentralized exchange adoption. Uniswap is among the top DEXes in the entire crypto market but has seen an exodus of token holders following a token airdrop two years ago. There are still hundreds of thousands of UNI token holders at this time but the only fundamental reason for holding the token is platform governance. Given the recent finding that important platform decisions like data collection aren’t actually being voted on, there is a centralization of power concern pertaining to Uniswap that I think raises some alarm.

Until there is utility for the token within in the protocol either through fee reduction or revenue payout, I can’t see much of a purpose in holding UNI other than as a digital collectible or to simply speculate on a higher token price. I sold UNI from my crypto investment portfolio in November and broke even from the May purchase. There may come a time when UNI has a fundamental justification as a token investment, but I don’t think we’re there yet.

Be the first to comment