josefkubes

3M Is Joining Bad Company

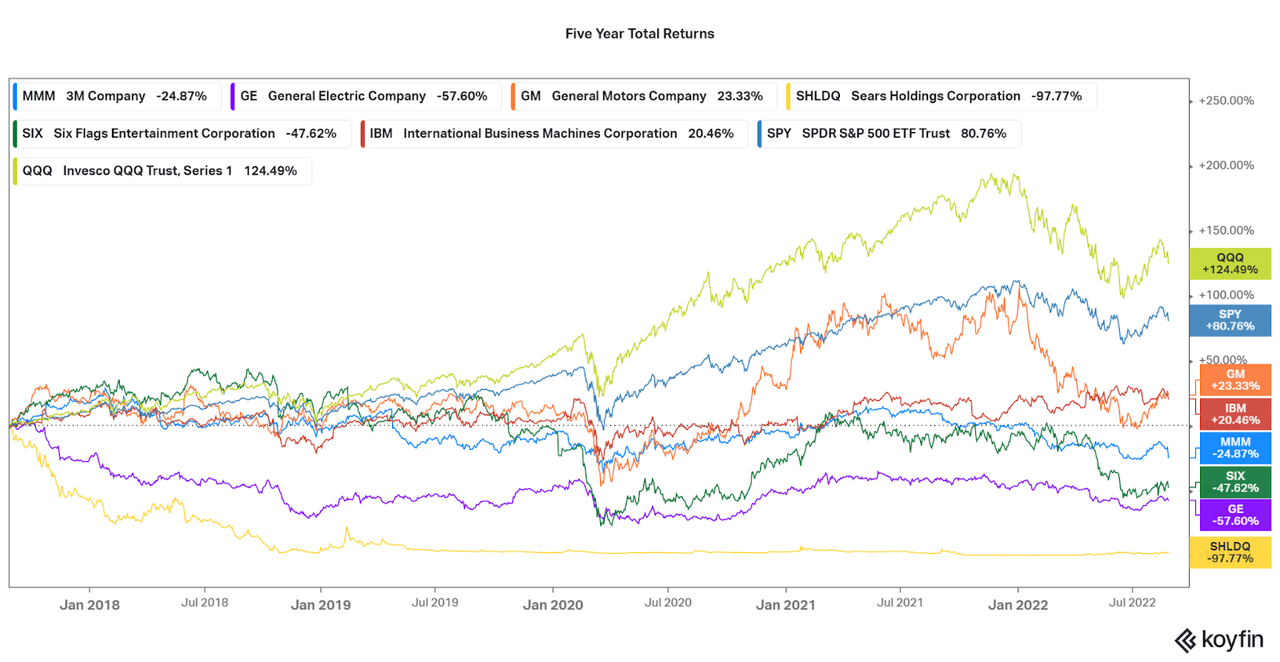

Unfortunately, certain once powerful companies tend to struggle at the end of their lives. The years of death throes from companies like 3M (NYSE:MMM), General Electric (GE), Sears (OTC:SHLDQ), General Motors (GM), Six Flags (SIX), IBM (IBM), and more, are hurtful for those who cling on to hope. The fact that all six of the listed companies can still be traded on the market is a major red flag, especially considering that some have gone through bankruptcies in the past.

Worrying signs! 3M is also not in the same situation as Apple (AAPL), which was on the verge of bankruptcy in the 90s, just to have Microsoft (MSFT) swoop in and save them. Rather, issues with competition, age, litigation, and more are leading these former stalwarts to show their age and underperform the market significantly.

The five-year total return of each company can be summarized by one word: stagnation. Regardless of the “moat,” market share, technological advantage, or what have you, all of these aging names are underperforming the broader market. 3M has held on for the longest, and I am writing now in the hopes of persuading the last few stubborn investors searching for the last ray of light. Time waits for no one, and it is important to pass the baton at some point.

Koyfin

Notice a nice pattern in the above chart? There are different stages to the weakness and suffering investors must face. While Sears is essentially dust on the wind at a $20 million market cap, others such as GM and IBM are hanging on to a thread of life, and market caps above $50 billion. 3M has already begun the long slide, but pockets of strength seem to be fewer and farther between.

Investors may ask: from here on out, what will 3M’s story look like? As QQQ’s total return shows, it will not even be close to equal with what younger, growth oriented companies will return. Underperformance compared to S&P 500 also indicates a lack of growth in line with the market. In fact, the data suggests there can be no more arguments about “high yield” or “safety.” It is time to get rid of 3M before they end up like Sears or GE.

3M’s Qualitative Issues

What came first, the chicken or the egg? While qualitative factors are not the only factors that influence future performance, they certainly paint a picture of the headwinds a company must face. For 3M, the pack of wolves is circling. I see very little in terms of ground breaking R&D that will save the company from the coming risks.

Primarily, risk is coming in the form of litigation from certain mistakes, mistrust, negligence, and ignorance from the past. On one side is the staggering amount of lawsuits regarding defective ear plugs sold to the military beginning in the 90s from a company they acquired. Was this bad due diligence? Was it negligence and a feeling of invulnerability?

The judicial system certainly is siding with those who have suffered from using the allegedly faulty equipment. I also see many investors blame the lawyers and people suing the company, but surely your anger will do little to reduce the significant financial damages 3M is set to face. Your anger should instead be focused on yourself for holding the asset through this period of weakness.

U.S. Bankruptcy Judge Jeffrey J. Graham ruled against a temporary stay of suits accusing the company and a bankrupt subsidiary, Aearo Technologies, of selling allegedly defective combat earplugs that didn’t prevent hearing loss, Bloomberg News reported.

In terms of public image, the litigation is certainly not helpful, regardless of your opinion on the results. Therefore, the valuation is certainly hindered and prospective customers may think twice. Especially hurtful is the fact that 3M is failing to admit fault, dragging lawsuits out over years, and trying to deflect blame on the now bankrupt subsidiary. Then, investors also have to consider the cost of these lawsuits as they are certainly wasteful and are reaching a staggering cost. Good thing 3M sells billions of necessary products right? Well, competition is rife and the quantitative factors I will discuss below are not a strong argument for 3M’s necessity.

There is another area of litigation that has yet to boil over, and that is in regards to forever chemicals. In fact, the US EPA is set to list the chemicals as hazardous, opening the doors to litigation, remediation, and more. 3M is already facing heat in Europe for their direct role in the production and distribution of these chemicals, and the worst has yet to come. Also, back in 2021 3M settled lawsuits with various concerned groups for almost $100 million. Considering that 3M continues to manufacture and sell products containing the chemicals, I find this may be a mistake that will come back to haunt them. Per the SA article:

If the rule is finalized, it will trigger increased reporting standards for releases of the two chemicals into the environment and give the EPA more tools under the federal Superfund law to require cleanup, EPA Administrator Michael Regan said.

As the new EPA rules come out, the doors will swing open for additional lawsuits. Beyond litigation, remediation services that may be forced will also be extremely costly. Again, regardless of your own personal opinion on whether the lawsuits or remediation is justified, 3M will bear the costs associated with all these risks. Is it fair? Perhaps not, but it is still a headwind the company will face and there is no need to invest into that fate.

E.I. du Pont de Nemours was named as a defendant in more than 6,100 PFAS lawsuits since 2005, the Bloomberg Law analysis found. But no company’s degree of legal jeopardy may be rising faster than 3M’s. It was named in an average of more than three PFAS-related lawsuits a day last year, according to the analysis. The company’s most recent annual report dedicated more than 15 pages to its legal exposure from PFAS.

Total PFAS liabilities could reach $30 billion in a “worst-case scenario” for the company, according to some estimates.

“It’s looking like 3M is going to bear the most liability, if there is any,” Bloomberg Intelligence analyst Holly Froum said. It becomes more apparent as the court splits defendants into the different roles they had in manufacturing PFAS-containing products, she said.

“Some of them only made surfactant and some were the finished product manufacturers. 3M did everything.”

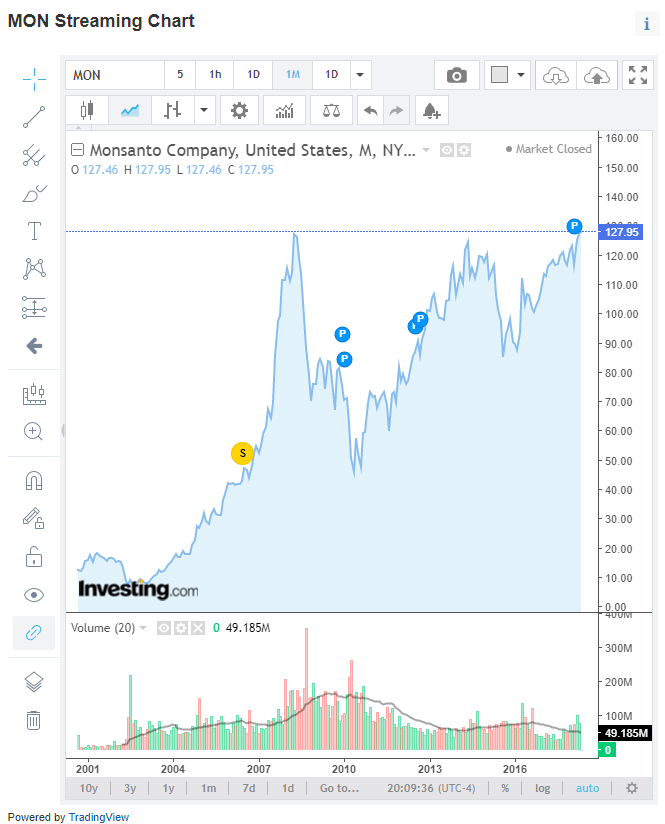

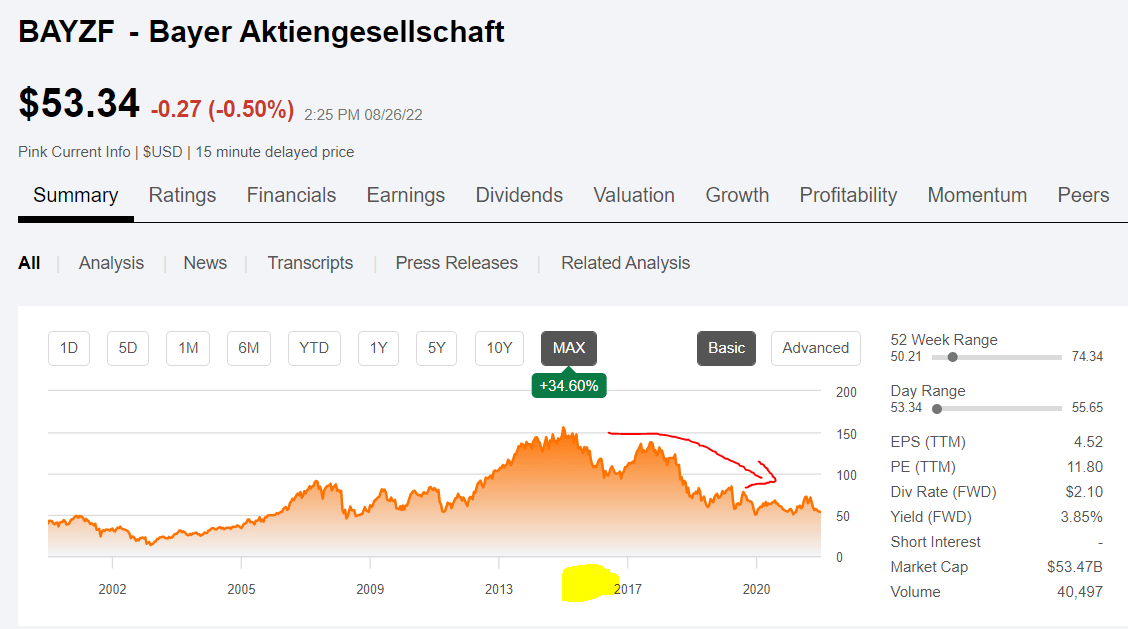

Worry not current 3M investors. There is one case in the past that may actually allow for upsides. It is our dear friend Monsanto. Monsanto was on a tear in the 2000s when they were public (see chart below). They even got acquired by Bayer with little noise and now we all forget the problems with Agent Orange, DDT, Round-up, polystyrene, GMOs, and more, even components for nuclear weapons! Well, it’s not quite true as Bayer has been suffering ever since their $63 billion acquisition in 2016, according to Fierce Pharma.

What does one of the worst corporate deals in modern history look like? In Bayer’s Monsanto takeover, it means the value of an entire company has gone poof.

Bayer acquired Monsanto for $63 billion in 2018 after a tough buyout battle and intense antitrust scrutiny. The German conglomerate’s market cap in Frankfurt today is close to that dollar amount-and that’s after rumors of an $8 billion Roundup settlement drove up its shares by more than 15% in early August.

Trading View and Investing.com Seeking Alpha

Quantitative Issues

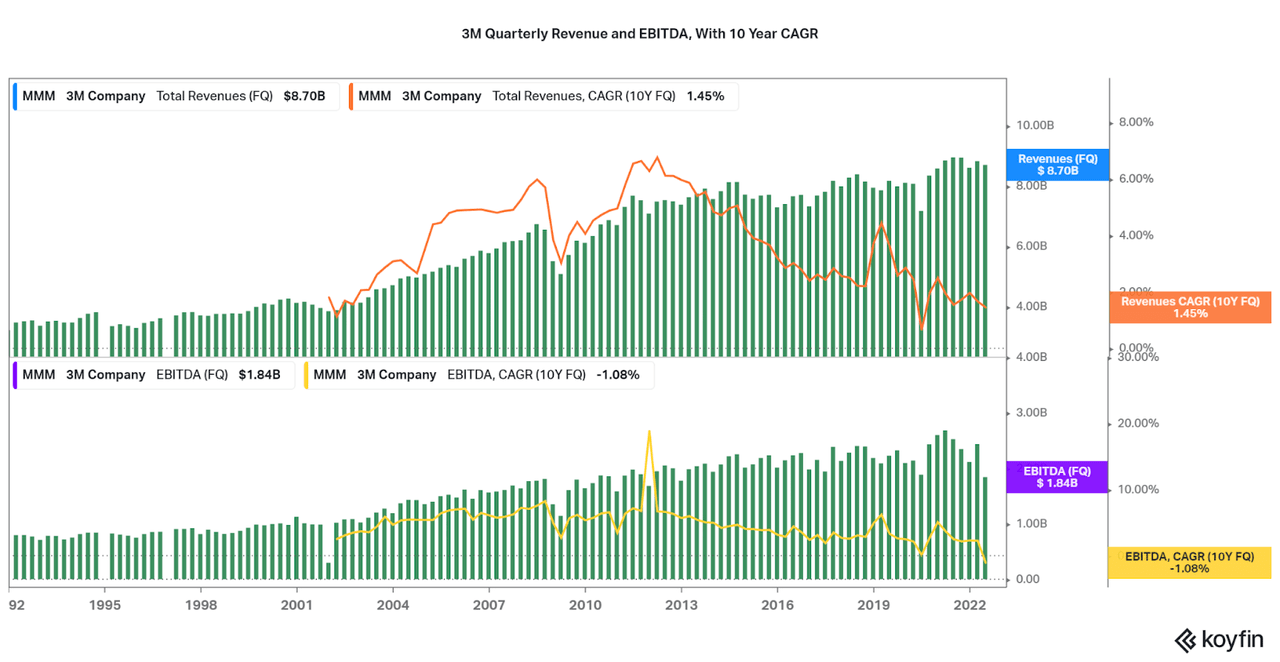

To understand the risks of these old companies like 3M, we just have to look at the financials. While stagnation is fairly normal for large companies, especially industrials, there are worrying growth patterns emerging. First and foremost, topline revenue growth per year is falling, since a peak in 2013. Now, 3M’s 10 year CAGR revenue rate is only 1.45%. While this is higher than most of the peers I discussed in the introduction of this article, the downward slope continues even in 2021 when fiscal stimulus should have revitalized some growth segments. Instead, 3M continued the downward trend, albeit with a small rebound after the pandemic.

At the same time, earnings also have been stagnant for essentially 15 years, when looking at EBITDA. The same downward sloping growth pattern is also present, and unfortunately 3M is seeing negative EBITDA growth on a 10 year annualized rate for the most recent quarter, -1.1%. No company of 3M’s capabilities should have the same EBITDA as 2012. It is a sign of the times, and we do not even have to dive into all the competitive reasons for the weak growth and profitability. Sure, one can point to 3M’s continued high profitability as a strong point, but those strong margins are slowly crumbling. The chart below summarized both points, and I see no positive signs from either revenue or EBITDA growth.

Koyfin

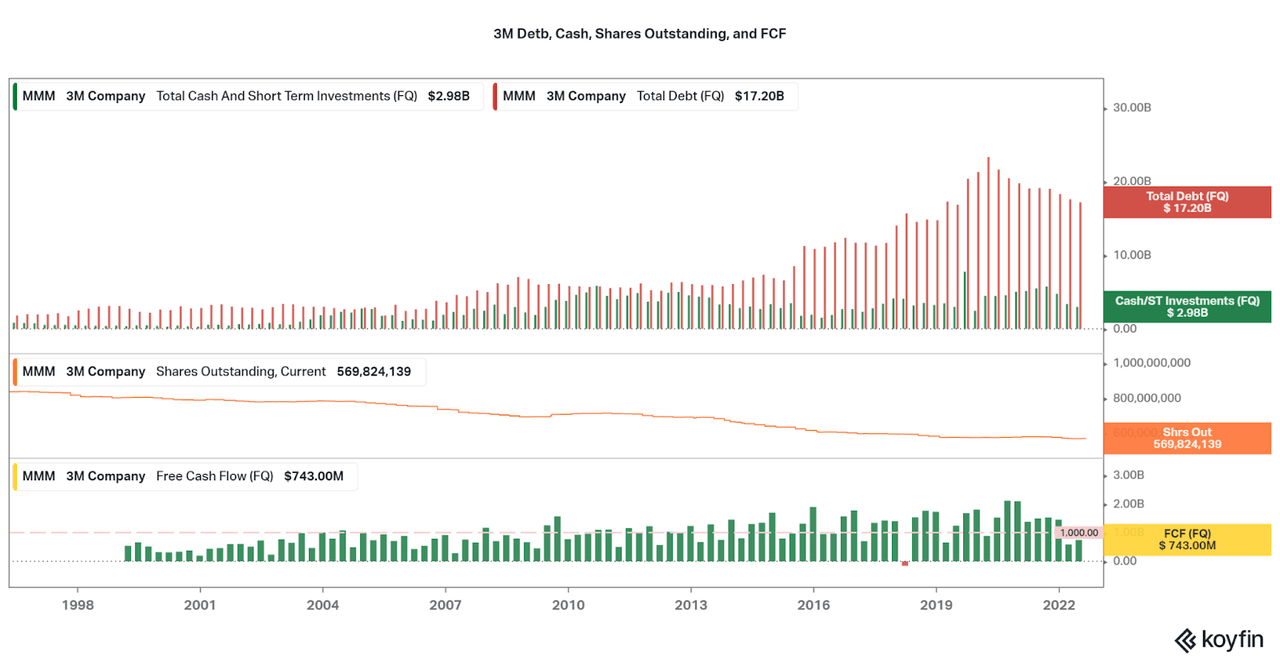

To carry the burden of lacking growth of profits, the once incredibly strong balance sheet of 3M is weakening. First and foremost, debt is increasing while cash is essentially flat. Meanwhile, free cash flow has been quite weak and unable to sustain significant improvements to the balance sheet. However, I will have to point out that the low-compared-to-market-cap debt is being reduced since a peak in early 2020 and dilution is not being used to fund cash flows. Current investors who are not persuaded by my thesis to sell can hold on to the plateaued, but still positive, free cash flow per year and enjoy the stagnation.

Koyfin

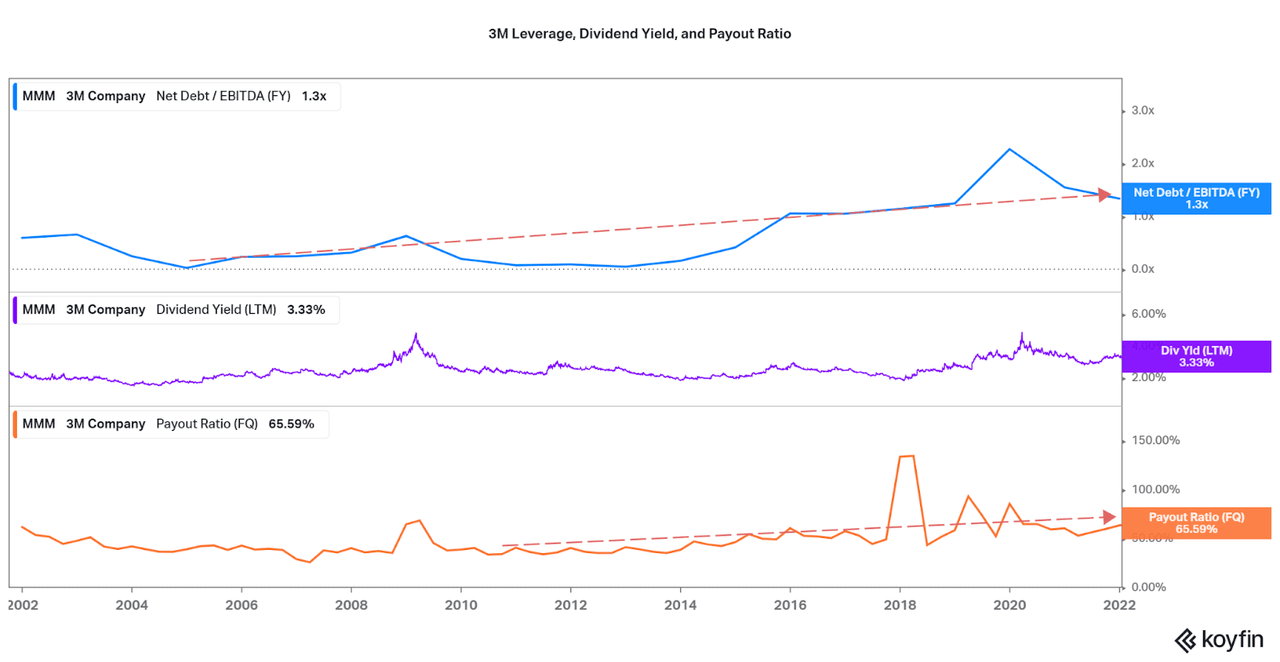

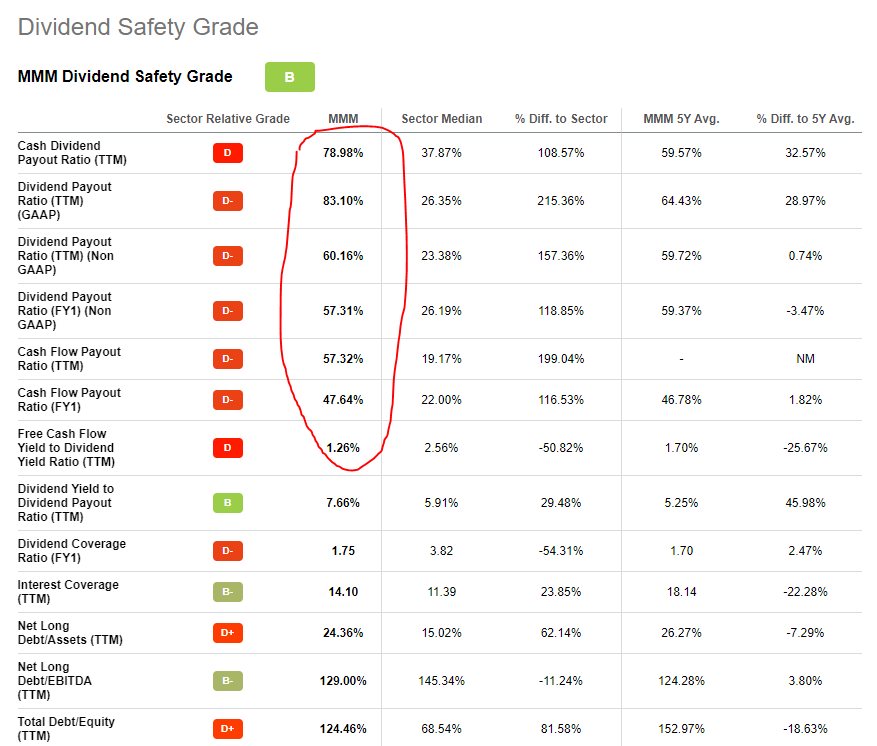

While the balance sheet may be hanging on by a thread, we can point to balance sheet weakness in other financial indicators. First, management holds on to their status as a dividend king, having an increasing dividend for 63 years straight, the current yield is hard to support. The current 3.33% yield (LTM) is higher than the historical average, and this has pushed up the payout ratio above 65%.

Perhaps to fund this unnecessary dividend, management though a little more leverage was necessary. We can see that leverage is slowly increasing for at least a decade, and only debt reduction will aid in reducing leverage (no earnings growth remember?). While above average cash on hand and profit margins artificially boost 3M’s Quant Dividend Safety score, I find that the high payout ratio and rising debt to be significant worry points, when considered alongside the falling growth.

Koyfin Seeking Alpha

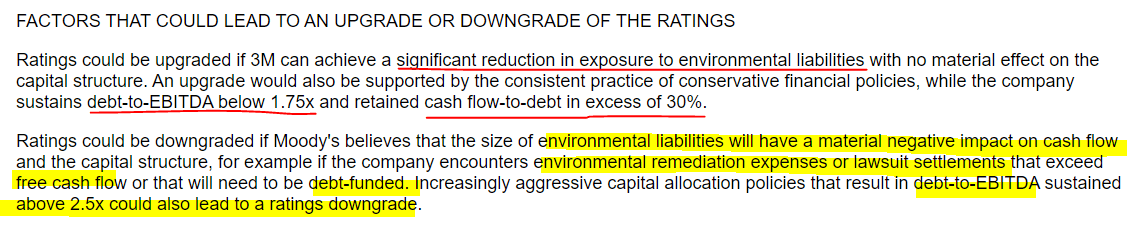

It seems that many institutions and investors are holding on to the hope that 3M sees some form of resurgence. The most recent non-paywalled update to 3M’s credit rating was back in February 2022 by Moody’s, and S & P Global has indicated downgrades in 2021 and 2022. Taking a look at the more positive commentary by Moody’s we see that the ratings agency factors the low amount of leverage and stable free cash flow generation. In fact, they believe 3M can be upgraded if environmental liabilities have “no material effect on the capital structure.” No mention of the falling growth and weakening profits.

I believe the points that may lead to a downgrade are far more likely to occur. Lawsuits over forever chemicals and earplugs are increasing in both quantity and scope, and there is no end in sight. There will continue to be impacts due to these costs. We can also see that the leverage trend is increasing, and the most recent quarter’s free cash flow is a bad sign for things to come. I do not believe 3M will continue to pay off debt, unless they cut the dividend or do not invest in growth (already occurring).

Moody’s

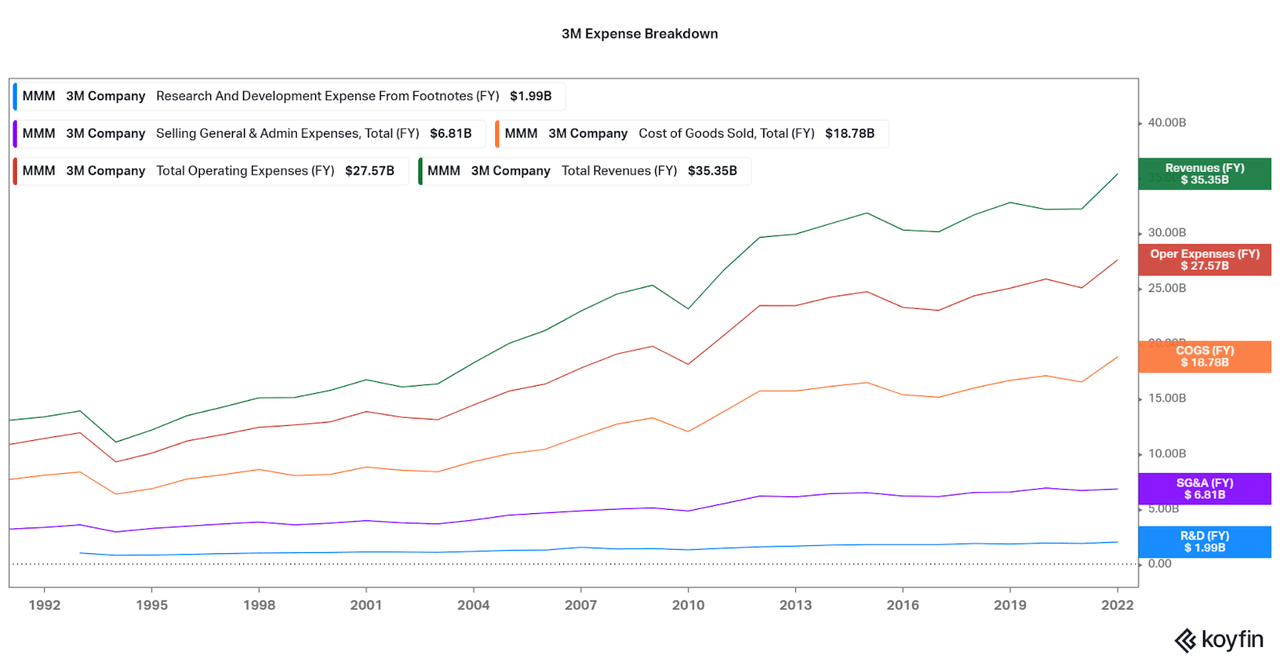

How do I know that 3M is not investing in growth? Just look at the expense breakdown chart below. While the trend in yearly revenues is moving slowly upwards, where is the equal increase in R&D or SG&A? These are both signs that the company is not investing in growth, whether through marketing or product innovation. I am sure bulls will point to the increased profitability instead, but lagging growth down the road will be worse in my opinion. Regardless, red flags are popping up wherever you look.

Koyfin

Moving Forward

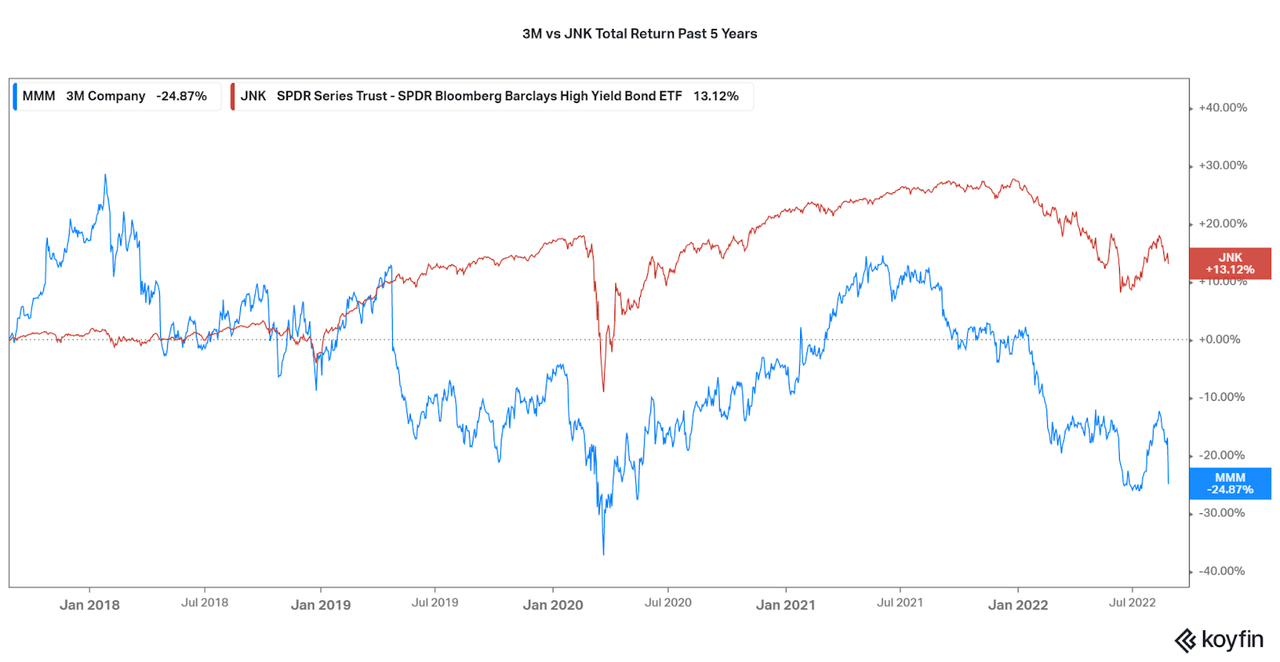

So, as financial performance suffers, will we be looking at another Sears story? Or General Motors during the financial crisis? Perhaps, but 3M is certainly not that weak yet and sells plenty of necessary products. However, I prefer to not invest into a downward trend and I believe that 3M will continue to underperform. The first bad sign is that 3M has underperformed junk bonds, as per the SPDR High Yield Bond ETF (JNK), over the past five years. That shows that 3M loses its value as a stable asset, capital appreciator, and as a dividend payer. Considering there are plenty of other fish in the sea to meet these goals, I do not think 3M is worth taking a shot.

Koyfin

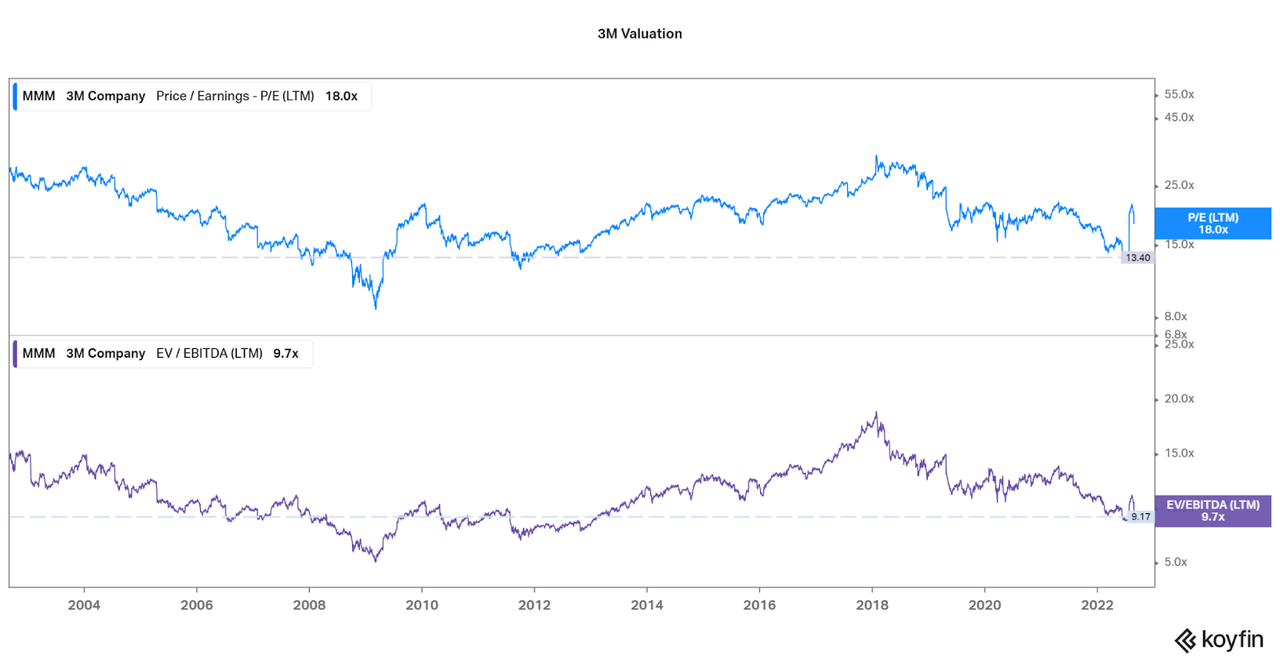

At the same time, 3M has been beaten down in share price over the past five years and the shares are reaching historically now valuations. While I find these are high due to the poor performance here in 2022 compared to 2008-2013 when the financial performance was much better. If growth continues to trend downward, then the share price will also be under more pressure to fall. As seen last Friday, August 26th, investors are beginning to sell as they realize the risk from litigation that 3M is set to face. If anything, wait for the worst to blow over, the shares to be dumped by institutional and retail investors, and then re-consider the shares at that point.

Koyfin

Conclusion

I have been looking into conglomerates lately for my research, and there are many approaches to reaching large sizes. In terms of Toshiba (OTCPK:TOSBF, TOSYY), a decade of operational mistakes and an overreliance on weak revenue segments has caused the company to finally consider selling off significant assets or going private. GE also seems to be taking this path, although they also are making investors suffer along the way and I find it is not worth the risk. Not to mention the mess occurring over at AT&T (T). 3M seems to be following this pattern with their announcement to sell off their strong healthcare segment. Unfortunately, I feel this is the wrong approach, and I believe that the opposite should be done.

Instead of getting rid of high quality assets, or splitting into distinct companies, I believe that 3M should just sell lagging assets. This would be similar to the approach taken by Ashland (ASH), which has sold off dozens of underperforming assets (such as Valvoline (VVV)) and focused on what was working. Even as revenues are far below peaks in the early 2010s, Ashland has been able to rise to all-time high share prices in this weak market.

I believe that their approach worked and can be replicated to some degree of success. If 3M looks to begin a similar process, I may reconsider my bearish view. Until then, I find little reward and plenty of risk and would recommend investors look elsewhere. Want to see a list of better replacements? Let me know in the comments.

Thanks for reading.

Be the first to comment