Makhbubakhon Ismatova

Energy Transfer (NYSE:ET) has prioritized debt reduction over the past two years and has made greater progress towards cleaning up its balance sheet, reducing net debt by billions of dollars and bringing the leverage ratio to within its long-term target range.

While management had indicated as recently as its Q3 earnings call that it would use retained cash flow and existing liquidity to continue paying down debt as it matures in the coming years, ET seemed to contradict that statement when it recently raised ~$2.5 billion in new long-term debt with the stated purpose of using it to repay outstanding indebtedness.

In this article, we look at what this could mean for ET in 2023.

Management’s Prior Pledge To Pay Down Debt

On its Q3 earnings call, ET management stated that it is planning to prioritize paying down debt over buying back units in the near term, citing its desire to use free cash flow to pay down debt as it matures in 2023:

When it comes to unit buybacks, we’re going to continue to look at paying down that debt. We really want to get that leverage target in that 4 to 4.5 range. And we’d be quite happy to get it to the — closer to the 4 range. And we’re going to have some opportunities next year with all the free cash flow that we’re seeing and some of the debt maturities, we’re going to continue to look at that. So we would put that up there higher than unit buyback to get to the lower leverage.

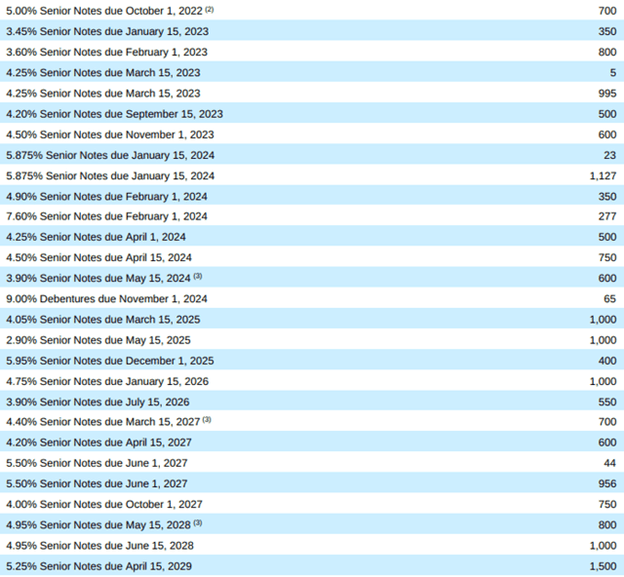

According to the 2021 10-K, ET has $3.25 billion in debt maturing in 2023:

Upcoming Debt Maturities (ET 2021 10-K)

Between its ~$2.5 billion in current liquidity and expected ~$2 billion in free cash flow net of distributions in 2023, ET should be able to easily pay off its maturities as they come due next year as well as in the years that follow.

Explaining The Recent Debt Raise

So, why is it raising nearly $2.5 billion in debt while interest rates are at elevated levels? Does it not still plan to pay off debt as it matures using retained cash flow and existing liquidity?

We believe it does. However, this debt raise still makes sense to us for a few reasons:

1. First, to pay off next year’s maturing debt entirely from excess cash flow and current liquidity would require it to put some extra debt on its credit facility. While it is impossible to know exactly what the interest rates will be like next year, ET would be taking on some interest rate risk by taking that approach and would also be limiting its financial flexibility to take advantage of attractive opportunities to grow the business via additional organic investments or acquisitions. By raising this debt now on terms that are not too bad given the current environment ($1.0 billion of 5.550% senior notes due 2028 and $1.5 billion of 5.750% senior notes due 2033), ET eliminates that interest rate risk and also improves its financial flexibility. Even with the debt raise, it can still reduce outstanding debt by $0.75 billion in 2023 by using retained cash flow as a supplement to this debt raise. Furthermore, if it uses the cash proceeds from this debt raise to pay down debt and retains its cash flow generated next year with the intent of using it to pay down additional debt maturities in 2024 and beyond, it will still be reducing net debt by the same amount.

2. Another reason why this makes sense to us is because several of its 2024 debt maturities have very high interest rates on them (~$1.5 billion of debt maturing with coupon rates ranging between 5.875% and 9%). ET just raised $2.5 billion of debt at a 5.67% weighted average interest rate and with maturities spanning 2028 – 2033. As a result, it increased its capacity to pay off this much higher cost and shorter term debt with debt on meaningfully cheaper and longer maturity terms, so this debt raise makes sense for that reason as well.

A Cause For Caution

While we can understand the rationale for this debt raise and believe that management can continue to keep its previous commitment to using retained cash flow to reduce net indebtedness as debt maturities come up, we are also not blind to the ongoing risk that ET might be reverting to its old ways.

In the past, ET leveraged up its balance sheet by taking on substantial debt to finance aggressive and expensive acquisitions and growth projects, only to leave investors holding the bag when they failed to deliver the projected returns. While ET founder Kelcy Warren is no longer CEO, he is still the Executive Chairman of the board and very much at-large.

For example, back on the Q2 earnings call management had this to say about their approach to capital allocation once the leverage target is achieved:

I think it’s very important to note with all the projects we’re talking about right now that are very good, high-returning projects. We’re going to continue to look at that… and we’ll have a good, healthy discussion internally here with our Executive Chairman as well with our Board as we continue to focus on that… [We] expect our strong coverage and balance sheet strength to allow us to further prioritize growth within our capital allocation strategy… We also continue to evaluate opportunities in the petrochemical space, which would include developing a project along the Gulf Coast as well as potential M&A opportunities… Kelcy gave us the directive that we need to step in to petchem, we certainly are doing that… from an M&A perspective, anything that’s for sale, we’ll take a look at pretty much like anything in the industry.

As a result, if ET continues to raise debt like this, it could very well be a signal that another major spending spree is in the works, so investors need to keep an eye out for that.

Investor Takeaway

Overall, we are not overly concerned about the recent ET debt issuance and believe it makes perfect sense within ET’s recent pivot towards aggressive deleveraging and positions them well to continue reducing net indebtedness as debt matures in the coming years. It also jives well with what they said on the Q3 earnings call:

we’re clearly looking at paying down as much as we can. There is still a little bit to go as far as getting what our free cash flow is going to be. But in fairness, we do have a very good capacity left on our revolver from our credit facility. So we’ve got options as to how to navigate that, and we’re going to be careful. I don’t really want to get out in front of it and try to preannounce. But you nailed it when you said looking at trying to pay down as much as we can of [2023 debt maturities] if not moving some of it to the revolver only because when you look out over the remainder of the year and you see what the free cash flow continues throughout the year, we have a lot of financial flexibility right now is the way I’d like to leave that, and we’re going to play the best options we can of reaching all the targets that we want we’re going after.

That said, we are also mindful of ET’s past history of aggressive leveraged spending, and that the person primarily responsible for that approach is still in a position of significant influence. As a result, while we rate ET a Buy and view it as one of our top midstream and energy sector picks right now, we are also keeping a cautious eye open moving forward.

Be the first to comment