Rodrigo Paiva/Getty Images News

The election of a seasoned politician Luiz Inácio Lula da Silva better known as Lula for a President of Brazil a couple of months ago made the market panic and pushed the share price of the Brazilian oil major Petrobras (NYSE:PBR)(NYSE:PBR.A) to unimaginably low levels. There are some valid new concerns about the company’s ability to create shareholder value in the near term since the potential dividend cut along with the increase in capital expenditures could make the investment in the company less attractive than before. However, there’s a case to be made that thanks to the latest geopolitical developments the company would nevertheless be able to benefit from the relatively high oil prices, which would outweigh all the major risks that could materialize under a new Brazilian administration, and is the main reason why I’ve recently opened a long position in the company.

Domestic Policy Meets Geopolitics

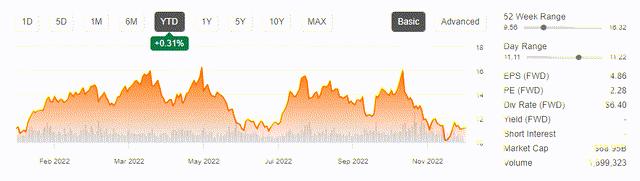

Since the Brazilian government has a majority ownership in Petrobras, the election of a left-leaning candidate Lula for another term as the President of Brazil made the markets panic due to the possibility that the company’s ability to create shareholder value in the near term would be diminished due to the potential interference of a new administration into the business’s affairs. Since the end of the second round of presidential elections in which Lula came out as a winner in late October, Petrobras’s stock has greatly depreciated from its 52-week highs to its 52-week lows and only recently found a support level around $11 per common share.

Petrobras’s Share Price Performance (Seeking Alpha)

Such a rapid decline that we’ve witnessed in recent weeks could be considered nothing more than an overreaction as it’s safe to assume that the political fears are overblown simply due to the fact that Lula would still face fierce opposition in the Brazilian parliament, which would prevent Brazil from becoming another Venezuela. At the same time, in the last week and a half, we’ve received two major bullish signs, which indicate that major risks that are associated with Petrobras are unlikely to materialize anytime soon.

First of all, in late November, a member of Lula’s transition team publicly stated that there won’t be an interventionist stance on Petrobras, which eased some of the market’s concerns. Then yesterday, news came out that the company’s current CEO Caio Mário Paes de Andrade will step out from his role, which would also ensure a peaceful transition of power and decrease the level of uncertainty that currently surrounds the business.

Both of those are positive developments, which are more than likely to help Petrobras to ease domestic concerns and at the same time help the company to focus on continuing to generate record returns thanks to the tight oil market. Let’s not forget that the European embargo along with a price cap on Russian oil has been implemented only a couple of days ago and there’s already an indication that the Russian seaborne exports have already halved at the beginning of this week as a result of this. Add to this the fact that the American strategic petroleum reserve is depleting, while OPEC+ has recently decided to take away ~1% of daily global oil supplies out of the markets and we could safely arrive at a conclusion that relatively high oil prices are here to stay for a while. The U.S. Energy Information Administration believes that to be the case as well by stating the following in its latest energy report:

Despite the recent drop in crude oil prices, we still expect that falling global inventories of oil in early 2023 will push Brent prices back above $90/b by the beginning of the second quarter of 2023 (2Q23). Although we expect some downward oil price pressure could emerge in the second half of 2023 (2H23) based on our forecast of rising oil inventories, that pressure will likely be balanced by the ongoing possibility of supply disruptions or production growth that is slower than our forecast. We forecast the Brent crude oil spot price will average $92/b for all of 2023.

Add to this the fact that the European embargo on Russian petroleum products is going to be implemented on February 5, and it becomes obvious that supply disruptions are here to stay, which would more than likely keep the oil prices at the current relatively high levels and help Petrobras fully benefit from all of those developments.

However, even though the company has already greatly benefited from the ongoing energy crisis, its stock currently shows a less than 1% YTD return mostly due to the overreaction to the recent presidential elections. This creates an opportunity, as the geopolitical developments described above have all the chances to help Petrobras continue to generate record returns for a considerable amount of time, which is why the street believes that its common shares represent ~30% upside from the current levels and have the opportunity to appreciate once domestic risks ease.

Petrobras’s Consensus Price Target (Seeking Alpha)

All Eyes On Dividends

There are several valid concerns that despite all the positive developments could nevertheless prevent Petrobras’s stock from reaching the consensus price target. At this stage, it’s more than likely that Petrobras’s dividends are about to be drastically cut. While the Q3 dividends would be paid in full, the decision about the distribution of dividends for Q4 profits would be made under new leadership, which would be appointed by the Lula administration.

As a left-leaning President, Lula has already hinted at the need to reevaluate Petrobras’s domestic pricing policy along with its divestment strategy. The new administration is interested in expanding the company’s refining capacity along with the need to invest more resources into alternative energy sources. As a result of this, it’s safe to assume that Petrobras’s current dividend policy would be reevaluated as well, which is one of the main reasons why some of the major advisory firms recently began to downgrade the company.

However, the good news is that dividends nevertheless won’t be fully cut. First of all, the Brazilian government is the biggest beneficiary of the distribution of those dividends. Therefore, cutting them entirely would make no sense for the new administration.

Secondly, Petrobras’s bylaws clearly state that the company should be paying at least 25% of its adjusted net profits in the form of dividends to its shareholders.

Therefore, it appears that the downside at the current levels is already priced in after the latest depreciation, while the geopolitical developments could potentially outweigh the domestic risks described above and undermine the domestic concerns.

The Bottom Line

Lula just like Bolsonaro is a seasoned populist politician, who despite his aggressive rhetoric understands the importance of making sure that the country’s biggest oil major continues to generate great returns that are later distributed to the government in the form of taxes and dividends as well. While there’s a valid concern that we could see a potential dividend cut along with the increase in capital expenditures both for political and economic reasons, Brazil itself is highly unlikely to experience a Venezuelan-style decline due to fierce opposition to Lula’s rule in the Brazilian Parliament.

Therefore, after the latest decline, Petrobras seems like an attractive stock to own at the current levels, which is why recently I’ve opened a long position in it. The goal right now is to see how Lula’s administration would rule the country in the first few months, after which a decision would be made whether to increase a stake in the company or continue to hold an initial stake only until a new opportunity presents itself.

Be the first to comment