JannHuizenga/iStock Unreleased via Getty Images

My casino management career was born with the early days of proliferation of legal states beyond Nevada from the early 80s through the 2000s. During that time, I watched the rise of relatively small, tech innovative slot machine makers ride a wave that ultimately brought them into the ranks of dominant sector giants. Before the tech explosion in the early era, slot sales were dominated by Chicago-based Bally Manufacturing, which literally owned the market. But as gaming expanded, new contenders entered the fray and went mano y mano with Bally. Companies like the original IGT which pioneered video slots, Williams an arcade games maker, Aristocrat Leisure of Australia and Scientific games which evolved from a scratch off lottery supplier.

Now, the field is a multi-billion dollar diverse sector of huge international manufacturers of slots and table games, online wagering technology and social gaming marketers. Lost in the shuffle, as it were, is that niche operator we highlighted back in 2020: PlayAGS (NYSE:AGS). Its buy story was straightforward: It had created a firm niche of sales to tribal casinos that was real and growing. And it also had toe-dipped and was increasing its installed base in Latin America, specifically Mexico.

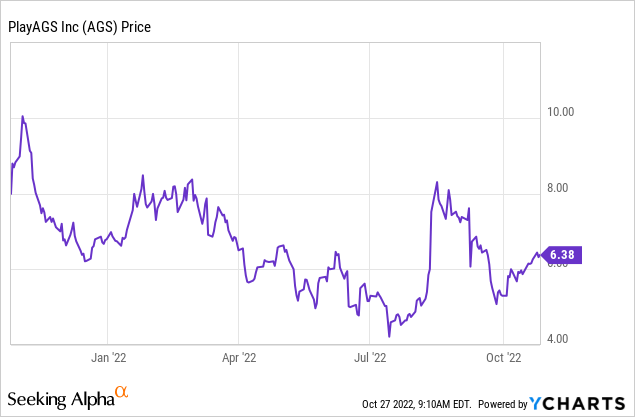

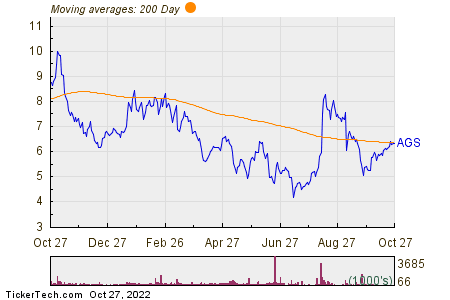

So what has happened since my first look at this nimble little company is that it has managed to thrive in its niche and live through the pandemic. It now sits at a price we find attractive relative to the giants in the field. It had spiked 17% last month on the heels of a $10 a share takeover bid from Inspired Entertainment (INSE). PlayAGS rejected the offer and the stock dipped. At writing, it traded at $6.45 a share.

Above: On the dip now, the timing is right for an entry point.

Our thesis going forward: We don’t think the INSE bid is the last one the company will see. While it’s not in play as such, the fundamentals going forward suggest to us that it remains a tasty possible target for a large acquirer looking for a path to enhance its access to the lucrative tribal market for slots and table games that PlayAGS enjoys.

Makers in the slot business historically found their way from outlier mini-market share marketers to mainstream suppliers usually found their mojo with breakthrough games. This was clearly the case with IGT and their video blackjack and poker machines, Aristocrat with their introduction of the wide-body cabinets that dominate today. Add domestic legalizations and international growth and you had the formula for small operators to enter the billion-dollar stage after lots of tech design and feature breakthroughs.

That’s not the case here. This company’s product lines, which I have reviewed, provide diversity, innovation and good tech research showing up on both their slots and games products. They have three main streams of revenue: Slots, table games and interactive. The product line as I saw it at the most recent gaming show in Vegas included 37 new games, card shufflers and an interesting blackjack side bet product we think has good potential ahead.

The company has a surprising game library for a maker of its size in the Class II and Class III machines plus an entry into the revived Historical Horse Racing games. FYH: The horse racing slots are nothing new. They date way back into the Vegas days. It’s merely a slot machine that instead of displaying fruit symbols, runs film loops of horse races set deep into history and players bet on the winners. Dramatic improvements from the old, gritty film loops to the best of what tech can do today have breathed new life into the games.

Given the sector’s assemblage of giants both in games development and financial heft, it’s somewhat remarkable in this age that a small operator can not only compete, but grow with savvy marketing. That PlayAGS has done by intense concentration on keeping products fresh and diverse, tightly focused on increasing both its sales and installed base of progressives in the tribal gaming area. That segment doubled in units over 3Q22 to 838, up 40%.

While tribal casinos dot every type of market in most legal states, they generally are located in more isolated pieces of geography than do commercial casinos. Because of that, tribal casinos have fared well during the pandemic due to their locales and this has helped propel PlayAGS results.

PlayAGS

Data Highlights

52- week range: $4.21–$10.45

Market cap: $234m

Forward P/E: 11.34

Balance sheet (mrq)

Cash: $47m

Total debt: $571m.

Current ratio: 2.2

Analyst forward Earning estimates

2022: – ($0.03) Pandemic a factor.

2023E: $0.19 forward momentum from growth in all three revenue streams ahead.

Revenue:

2022E: $301m

2023E: $315m

TTM

Operating cash flow: $77.3m

Levered sash flow: $42m

EBITDA: $108M

The rationale for a buy case

Generally buying a stock on the basis of its being cheap but offering nothing else is a losing game. That’s understood. But the attractive entry point we see here at $6.50 a share for a company that has managed to sustain its business and grow during a difficult run of macro headwinds is a real story. Clearly what you’re buying here is not so much a David and Goliath story, but one of resiliency in the face of multiple challenges in a sector where only giants can reasonably be expected to tread. The sheer cost of recruiting top tech game development talent, financing long duration research into innovation is monumental. Add to that the massive investment the giants in the field have made in establishing a network of branch sales and tech support offices globally brings an ever-mounting level of debt for them to remain competitive.

So here we have a mini-cap company, operating in a high-cost field, under the continuing gun of the pandemic, beset by the price of poker as it were, being raised by the big guns in the business an PlayAGS remains viable.

So what does that tell us is the payoff play here?

In our view, this is either a merger or takeover stock. The $10 offer put on the table by INSE won’t be the last one. We think management was wise to turn down the deal.

Alpha Spread’s calculation of relative value of the stock is at $22.13 a share indicating an undervaluation of 72%. That may be something of a stretch to agree with among many investors but our own calculation based on what we see as the forward revenue profile of the company post-pandemic in 2023, is not that far off at $17.65. No matter which case you buy, or even if you don’t buy either, the fact is that this company has a base of resilience, tech savvy and solid grasp on a niche market that makes it worth much more than it is trading at now.

At its current price, given the overall outlook of the US regional gaming business alone, we believe it’s way undervalued. And this is a situation that clearly will lend itself to covetous eyes sooner rather than later. A $10 a share offer didn’t make it. But we believe anything at or above $12 begins to get interesting to holders. The alternative to an eventual deal is for PlayAGS to continue going at it alone—it has proven it can. But at some point, the air of a deal becomes rarefied when you have a market really hungry for stocks with substantial upsides in a chaotic macro environment.

Be the first to comment