Marko Geber/DigitalVision via Getty Images

Thesis

Fiverr (NYSE:FVRR) was one of the highest high-fliers in the 2020/2021 growth stock frenzy. The stock flew too close to the sun peaking at 67 times sales and burned its wings. Now that the stock has experienced a brutal 90% drawdown the company is in bargain territory as a market leader in an ever-growing industry. I have been holding Fiverr since August 2021, a 48% drawdown from high. Since then the stock fell another 80%, but the fundamentals are still the same. I consider Fiverr a strong buy here and will average down myself.

This analysis will mainly evolve around my valuation model for Fiverr and why I believe the stock to be undervalued. If you want to read my previous Fiverr article from this April where I go over the fundamentals of the company and its moat, you can find it here.

Fiverr enjoys strong tailwinds

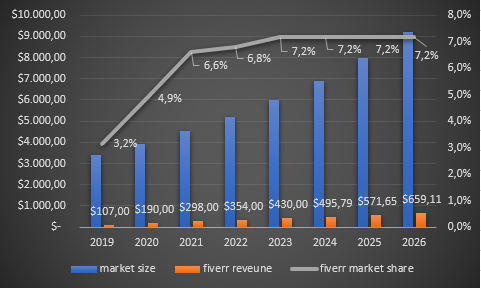

According to GlobalNewsWire, the market size of online freelancing platforms is expected to grow from $3.39 billion in 2019 to $9.19 billion by 2026, a 15.3% CAGR. A fast-growing industry is a strong tailwind for a growth company and Fiverr’s case is no exception. In the graphic below you can see my conservative projection of Fiverr’s revenue. For the 2022 full year and 2023 revenue numbers, I used Seeking Alphas Consensus Revenue estimates and for the 2024-2026 numbers I projected the 15.3% CAGR from GlobalNewsWire into the future. I used the same CAGR for the total market size growth. This model doesn’t assume incremental market share gains for Fiverr as they did in every of the last 4 years.

Fiverr revenue projection (Authors model)

Revenue is great, what about profits?

The downfall of many growth stocks over the last year has been the lack of earnings or at least the lack of earnings in sight. In the past and short term Fiverr is no different.

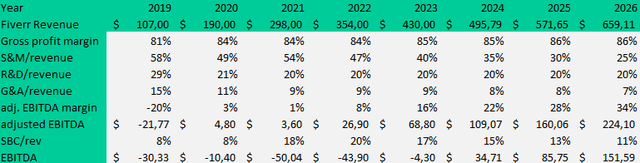

Below you can see the adjusted EBITDA margin and the unadjusted EBITDA margin. The large difference between adjusted and non-adjusted EBITDA is stock-based compensation, one of the big negatives for Fiverr. As is the case for many growth companies, money is reinvested into the business and no earnings are retained. We can observe that margins saw a nice trend from 2019 to 2021, but a decline in 2022. Fiverr did profit nicely from Covid, having a massive pull forward in demand for its services. In 2020 the company experienced hyper-growth rates of close to 100%! The company did a great job in capturing this demand and gaining market share. Fighting against hard 2021 comps and continuing to invest aggressively into the business, profitability dived, but there is reason to believe why this will change in the future.

|

Year |

2019 | 2020 | 2021 |

2022(guided) |

|---|---|---|---|---|

| Adjusted EBITDA margin | -16.8% | 4.8% | 7.7% | 2.9-4.6% |

| EBITDA margin | -29% | -4% | -13% | -16% |

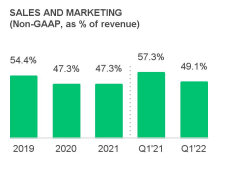

Aggressive marketing as a lever

As you can see on the left, Fiverr spends a lot of money on marketing. In the last years, S&M has been between 54% and 47%. This large and aggressive marketing spend is part of the reason why they have been able to grow market share consistently and profit from booming demand from Covid. Now that the world is returning to its old ways, at least partially, growth looks bumpy for Fiverr. User growth isn’t booming anymore, but this has a reason. To quote CFO Ofer Katz from the May 23th Company Conference Presentation:

So over time, when we look into active buyer, we need to bear in mind that we’re not only after quantity but also after quality.

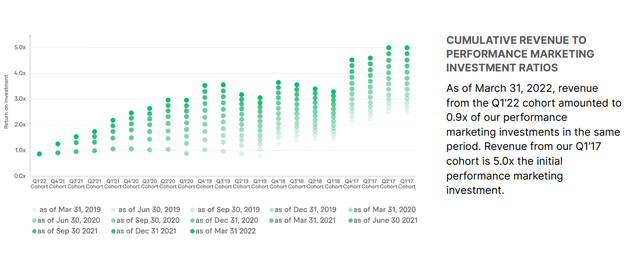

Currently, Fiverr is looking to keep the high-value buyers but seems one-time Covid users falling off. Over the long term, we can see that Fiverr’s marketing spend yielded a great Return on Investment. A customer acquired in Q1 2017 generated 5 times the customer acquisition cost in revenues. As long as they have this track record of high marketing yields, they should continue spending. Once this slows down they have a huge lever to pull and decrease spending.

Fiverr marketing cohorts (Fiverr Q1)

Modeling Fiverr’s profitability

I modeled Fiverr’s EBITDA up until 2026 under the assumption that marketing spending will slow down from 47% of revenue to 25% of revenues in 2026. The other costs are also expected to decrease as a percentage of revenue as the company becomes more efficient and scales. I expect R&D spending to stay around 20%. The company still invests a lot of money into the development of its platform, via its own research but also acquisitions, which is critical to ensure that they are the leader in the space. I expect G&A to gradually decline as the company becomes more efficient. Gross margins are already at a very high level, but I see them driving higher margins over time with increasing efficiency. Stock based-compensation is one of the big red flags for Fiverr in my opinion. Growth stocks love to save cash by paying employees in stock options. During the explosive growth over the last years, these options paid off well for employees and the SBC costs exploded. With a return to normalized growth, I expect these costs to normalize as well. Overall I expect Fiverr to post $151 million in EBITDA in 2026. With a current enterprise value of $1.2 billion, this would be roughly an 8 EV/EBITDA multiple, under the conservative assumption that Fiverr grows in line with the market and doesn’t capture any more market share.

Fiverr EBITDA model until 2026 (Authors model)

In line with Analyst expectations

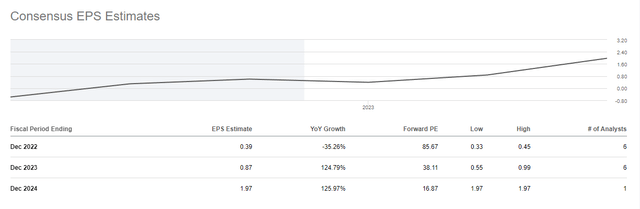

I intentionally tried to keep my model relatively conservative. If we take a look at analyst expectations, we can see that they expect 2023 PE to be around 38. One analyst estimated the 2014 forward PE at 16.87, which is much below my model, but since it is only a single analyst’s opinion we have to take it with a grain of salt.

Fiverr Analyst EPS estimates (Seeking Alpha Fiverr earnings)

Conclusion

I consider Fiverr a strong buy here for long-term investors that believe in the continuous increase of market share for the online gig economy versus offline freelancing. I believe that Fiverr will remain the leader in this industry and is currently heavily undervalued based on my conservative model.

This article was mainly around the valuation and profitability of Fiverr. If you want to know my opinion on Fiverr’s business and moat, check out my previous article.

Be the first to comment