guvendemir/E+ via Getty Images

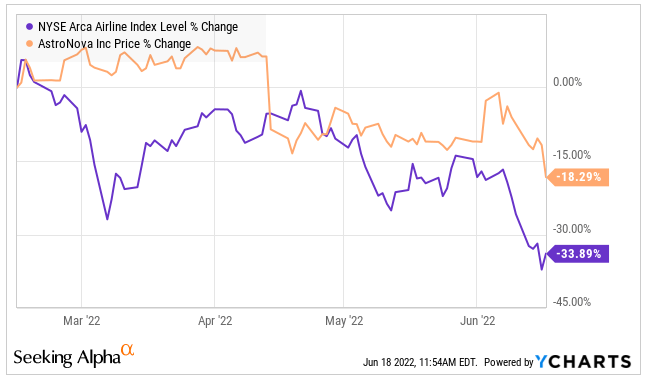

In my previous article, I recommended not buying AstroNova (NASDAQ:ALOT) shares as there would be a better entry point, I recommended building a position under $12 per share. The stock is down 18% since that article and trading at $11.48 per share, so should we build a position in ALOT?

Ycharts

Since February, the expectation of inflation and the Fed reaction has changed, ALOT’s cost of capital has increased 50bps from 6.8% to 7.3%. In this article, I will evaluate if ALOT shares seem attractive at the current stock price taking into account the latest earnings results and the new cost of capital.

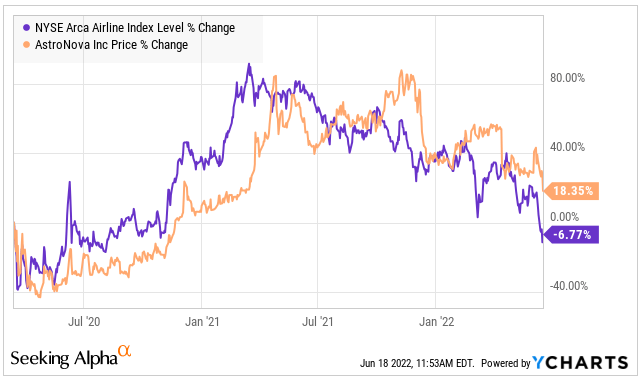

ALOT is outperforming the index since the start of the pandemic

In early 2021, ALOT shares were underperforming the index, however, since then the index has dropped more aggressively than ALOT. The reason for the drop has been a combination of the supply chain, inflation and the increase in interest rates.

Ycharts

I believe that ALOT’s stock price did not drop as much as the index for two reasons. First, the index was already pricing a faster recovery than ALOT. Secondly, ALOT has some products that are de-coupled from the airline industry. Fiscal 2022 marked the ninth consecutive year of revenue growth in the Product Identification segment. This segment does not rely on the airline industry and offers direct-to-package printing solutions.

2022 Earning results

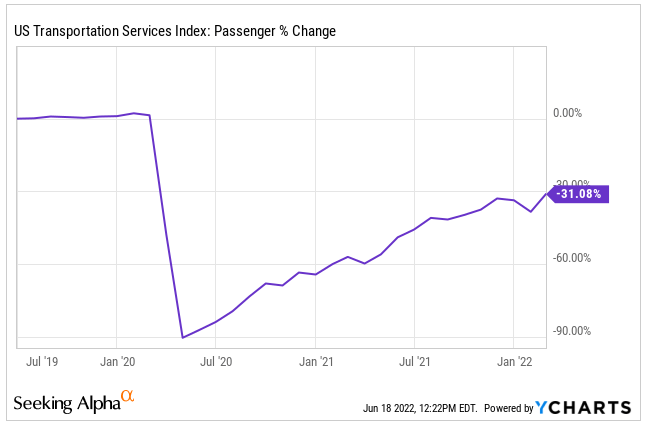

Revenues increased 1% to 117.5M USD. While the Product Identification segment increased a mere 0.8%, the Test & Measurement segment increased 3.1% in the year. Both segments were impacted by the shortage of parts that caused 2M USD in revenues pushed from Q4 to Q1. The increase in air travellers drove the growth in the Test & Measurement segment. Air travellers are still 31% below pre-pandemic levels but as the economy opens up and restrictions are eliminated, we should return to the pre-pandemic level of air passengers by 2023/2024. IATA expects a full recovery of global air traffic by 2024 and North America to recover by 2023.

Ycharts

The recovery in the Product Identification segment has been slower as the company is still facing challenges to meet with customers at trade shows and on-site in their facilities. However, trade shows have restarted and I expect a recovery of this segment in the following quarters.

Higher revenues in Q1 but margins still impacted by the macro situation

There was an uptick in Q1 driven by the continued recovery in air traffic. Revenues increased 6.6% to 31M USD in the quarter. The Test & Measurement segment increased 55.3% to 9.3M USD while the Product Identification segment decreased 6.0% to 21.7M USD. Management expects Product Identification revenues to increase in the coming quarters supported by the release of a new entry-point printer.

Similar to the previous quarters, ALOT continued to experience margin pressures due to higher material costs, labor cost increases and supply chain disruptions. As a result, gross margin decreased by 250bps from 37.4% to 34.6%. ALOT has been increasing prices on many of its products which should help recover a portion of this lost margin.

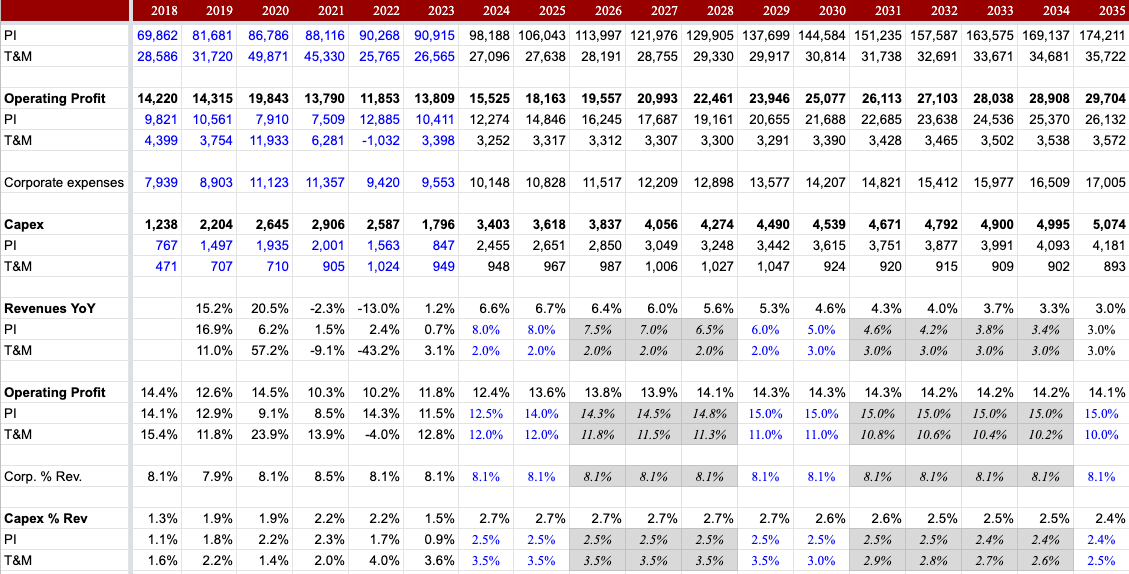

Valuation

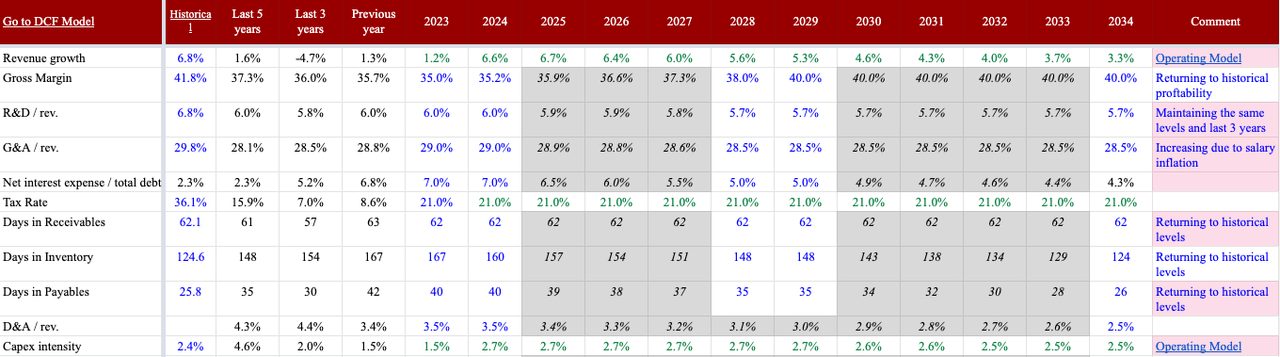

Operationally, my forecast does not change materially from my previous estimates. The only material change was a faster improvement in margins of the Test & Measurement segment.

Author estimates

Author estimates

However, the cost of capital increased 50bps from 6.8% to 7.3% which is the main driver of the valuation dropping from $17 to $14.20 per share.

This results in an almost symmetric risk/reward profile offering a 23% upside to the $14.20 fair price and a 26% downside to my $8.50 pessimistic scenario valuation. I would be a buyer of the stock below $10.50 per share as at that level the stock would offer a 35% upside or a 19% downside.

Be the first to comment