Michael Vi/iStock Editorial via Getty Images

Tencent (OTCPK:TCEHY) shareholders have suffered multiple headwinds in the past 12 months and the stock price is down more than 50% from ATH in February 2021. While I do not want to ignore the macro-economic and regulatory challenges that the company is facing, I suggest investors focus on fundamentals.

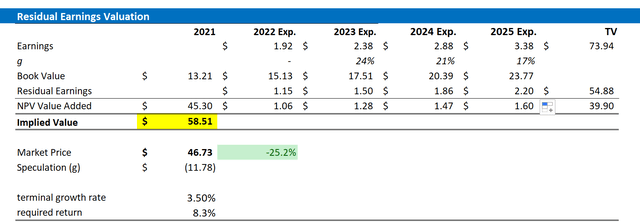

In this article, I use the Residual Earnings framework to value Tencent—and I anchor my calculations on EPS analyst consensus estimates, a WACC of 8.3%, and terminal value growth equal to expected nominal GDP growth. My analysis calculates a fair per share value of $58.51, thus implying considerable upside of >25%.

About Tencent

Tencent is a leading software technology and internet company based in China. Founded in 1998 by Ma Huateng, who still leads the company as CEO, Tencent has grown to be the biggest company in China based on market capitalization. The company is active in multiple business segments including games, internet payment services, artificial intelligence solutions, social networking services, online advertising, and mobile value-added services. In theory Tencent operates as a holding company with equity stakes in multiple subsidiaries. For reference, here is an indicative list of Tencent’s stakes: Link to Excel Spread.

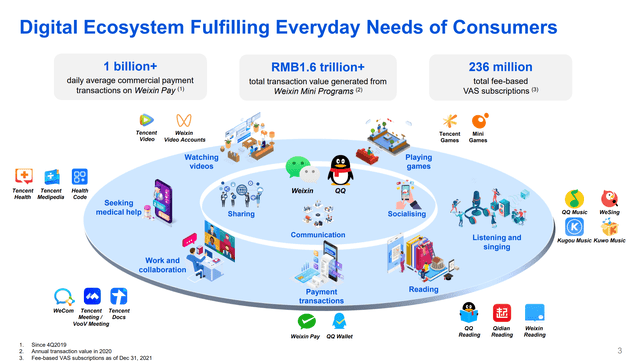

Notably Tencent is the world’s leading game developer; Tencent’s Weixin/WeChat is China’s leading communication provider with a MAU of 1,268 million; Tencent’s payment arm Weixin Pay is China’s leading mobile payment provider with more than 1 billion commercial transactions daily; Tencent Cloud is the second largest cloud provider in China.

Tencent Investor Presentation, 2022

Financial Overview

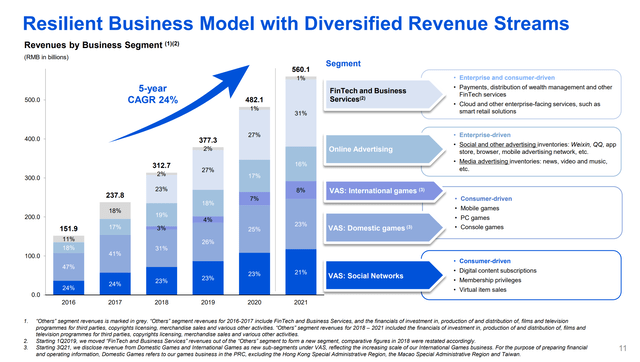

Tencent’s has enjoyed amazing growth in the past few years, with revenues growing from $47.3 billion in 2018 to $86.8 billion in 2021 implying a CAGR of more than 20%. In 2021, the company generated net-income of $13.7 billion, or $1.41 per TCEHY share. Investors should note that Tencent’s decreasing net-income margin from 21.5% in 2018 to 14.3% in 2021 was mainly due to a one-time abnormal loss of $18.3 billion in 2021, which includes regulatory fines and non-realized losses from the company’s fast investment portfolio. According to the company’s financial statements, value-added services including games and social networks accounted for 52% of Tencent’s total revenue, followed by online advertising, which generated 16% of sales, followed by fintech and business services accounting for 31%.

Tencent Investor Presentation, 2022

The company ended FY 2021 with $41.4 billion in cash and investments and $50.9 billion in total debt. Cash provided from operation was $27.16 billion. Going forward, analyst consensus expects Tencent to increase revenues to $104.5 billion in 2023 and write a net-income of $24.3 billion, or $2.4 share. For 2024 and 2025 EPS are expected $2.88 and $3.38 respectively.

Valuation

To value TCEHY, I use the Residual Earnings Framework. I believe the Residual Earnings framework is the best tool to value Tencent, because: firstly, free cash flows are distorted due to growth-investments; secondly, multiples do not reflect business value; thirdly, the company is paying no dividends. My key assumptions are as follows:

- I base my EPS estimates on the analyst consensus until 2025.

- I apply the CAPM model to derive the cost of equity and as a second step calculate the WACC according to the business leverage. My calculations return a fair WACC of 8.3%, which is very much in line with my intuitively estimated required return.

- For the terminal growth rate, I apply expected nominal GDP growth at 3.5%. Although I think that growth equal to the estimated nominal long-term GDP growth is understating Tencent’s potential, I want to be conservative in my valuation.

Based on the above assumptions, my calculation returns a base-case target price for Tencent of $58.51/share, implying that TCEHY appears undervalued by approximately 25%.

Analyst Consensus; Author’s Calculations

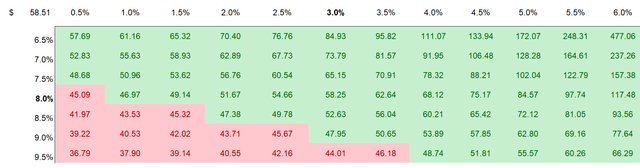

Investors might have different assumptions with regards to TCEHY’ required return and terminal business growth. Thus, I also enclose a sensitivity table to test varying assumptions. For reference, red-cells imply an overvaluation as compared to the current market price, and green-cells imply an undervaluation.

Analyst Consensus; Author’s Calculations

Risks

Investors should be aware of the following downside risks that might cause TCEHY stock to materially deviate from my base-case target price of $58.51/share: 1) the Chinese economy is currently tackling multiple transitory headwinds including inflation, the real estate crisis, Covid-19 lockdowns in Shanghai and Beijing and the potential of a global recession. While most of the challenges are arguably priced in, if the slowdown in China’s economy turns out to be more severe than expected, Tencent’s business outlook must be revised accordingly. 2) In the past 12 – 15 month the CCP has shaped a stricter regulatory environment for China’s leading technology companies. While the CCP has recently said that the party will support platform companies such as Tencent, uncertainty remains and regulatory pressure persists. 3) Investor sentiment towards risk assets in general, and China equities in specific, is very negative as of June 2022. As long as low investor confidence and risk appetite persist, TCEHY will have limited upside potential.

Conclusion

Although Tencent will likely continue to face low investor confidence until major macro-economic and regulatory challenges are solved, the company’s size and fundamentals are too attractive to ignore. Comparing Tencent’s discounted earnings valuation with the company’s market valuation makes me confident to believe that most of the headwinds are fully in, and investing in TCEHY at current price levels is significantly de-risked. That said, long-term investors might want to see the depressed share-price as a buying opportunity. I assign a Buy recommendation and a fair base-case target price of $58.51/share.

Be the first to comment