GoodLifeStudio

Interest-rate drama mostly has investors racing to the sidelines on tech stocks. And while we agree that the near-term outlook for the economy is likely going to continue pressuring fundamentals, we also shouldn’t ignore the fact that many tech stocks have wiped off a good chunk of their former valuations and are now sitting at juicy bargain multiples.

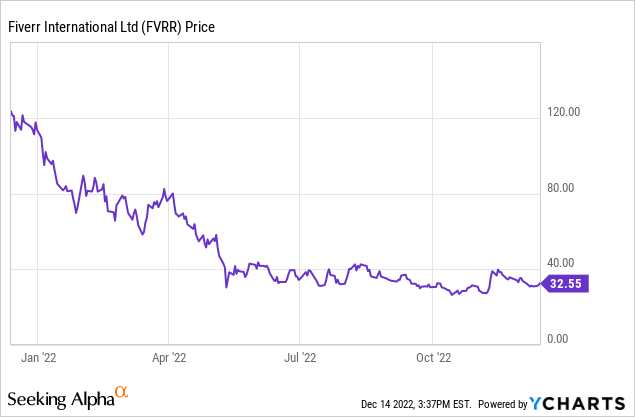

Fiverr (NYSE:FVRR), in particular, is worth a hard second look. This freelance-work platform shot up during the pandemic as the remote-work trend kicked off. Now facing a double-whammy from return-to-office trends plus recessionary fears that are causing many companies to re-evaluate headcount/spending and delay non mission-critical projects, Fiverr has been experiencing serious growth deceleration and the market is punishing the company for it. Year to date, the stock is down more than 70%:

The question we have to ask ourselves, however, is this: at what point is enough enough? Because when we take a step back, we still have to acknowledge that Fiverr is an attractive platform with a large established customer base (including among enterprise customers), which also brings in revenue at a sky-high gross margin. Furthermore, today’s macro environment may not necessarily be net-unfavorable for Fiverr in the long run. Companies are cutting spending and permanent headcount now – and in the future to lower overall costs, they could staff more projects on an as-needed basis by turning to the freelancer market.

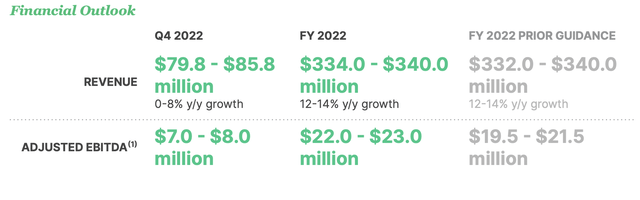

Optically, too, it feels like Fiverr has found its fundamental bottom. After cutting its outlook twice this year, in its most recent earnings release the company finally slightly adjusted its full-year 2022 outlook:

Fiverr outlook (Fiverr Q3 shareholder letter)

As a refresher, here is my long-term bull case on Fiverr:

- The gig economy is growing; Fiverr is expanding the types of gigs available on its marketplace. Americans are quitting their jobs at a greater rate than ever, and more people are supporting themselves through means of gig-based or freelance jobs. In addition, Fiverr itself is acknowledging the wider diversity of skills and gigs and is adding/featuring more services on its site (in its most recent quarter, one of the biggest growth areas was 3D animation).

- Employers are taking note of the shifts. Widespread labor shortages have been well-documented across industries. While some employers are sweetening their employees’ packages to reduce churn, many employers are also shifting their hiring mindset and filing many positions with contract-based or gig-based roles.

- Fiverr’s clout is growing. The company is expanding upmarket into more business-oriented service buyers, growing its take rates, and expanding its geographical presence.

- Subscriptions. Though the majority of Fiverr’s gigs are done on a one-time contract basis, for its larger buyers, the company has introduced the concept of subscriptions, or being able to order the same recurring service on a set schedule.

- Profitability expansion made possible by huge growth margins. Fiverr generates positive and growing adjusted EBITDA, which is a relative rarity for a stock of Fiverr’s scale. Fiverr also carries a very high mid-80s pro forma gross margin. When a company is still growing revenue at a mid-teens to low 20s pace, at that gross margin profile, the opportunities for operating leverage are dramatic.

Fiverr also remains very cheaply valued. At current share prices near $33, Fiverr trades at a market cap of just $1.22 billion. After we net off the $470.5 million of cash and $452.1 million of debt on Fiverr’s most recent balance sheet, the company’s resulting enterprise value is $1.20 billion. Meanwhile, Wall Street analysts are expecting revenue of $368.0 million next year, representing 9% y/y growth (data from Yahoo Finance). This puts Fiverr’s valuation at just 3.3x EV/FY23 revenue – a steal for a company that has such a rich-margin revenue profile, and is already at a high single-digit adjusted EBITDA margin with plans to expand into the double digits.

All in all, I remain bullish on this name and while it won’t be a home run in the short-term window, I view it to be quite a solid hold for the longer term.

Q3 download

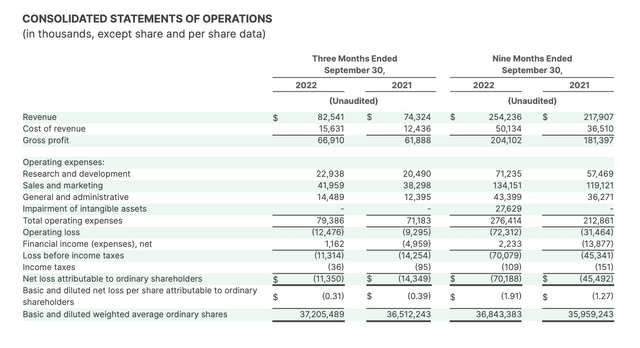

Let’s now go through the highlights of Fiverr’s most recent quarterly results. The Q3 earnings summary is shown below:

Fiverr Q3 results (Fiverr Q3 shareholder letter)

Fiverr’s revenue grew 11% y/y to $82.5 million, beating Wall Street’s expectations of $81.1 million (+9% y/y) by a two-point margin.

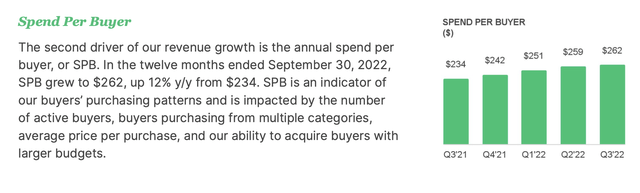

A couple of drivers contributed to the better-than-expected results. First, Fiverr grew active buyers by 3% y/y – instead of seeing net churn. Recall as well that the company’s heavier focus on enterprise clients means that its customer base is also skewing toward heavier spenders. Average annual spend per buyer, as shown in the chart below, grew 12% y/y to $262:

Fiverr spend per buyer (Fiverr Q3 shareholder letter)

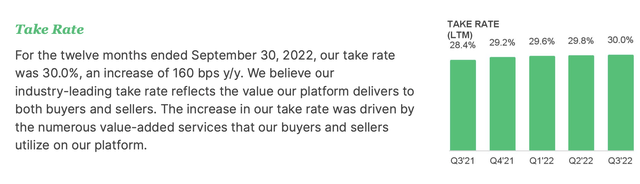

Fiverr has also done a good job of upselling its customers into value-added services, which has helped drive up the company’s take rate to 30.0% – an all-time high take rate that is up 160bps y/y and 20bps sequentially versus Q2.

Fiverr take rate (Fiverr Q3 shareholder letter)

Management notes that while discretionary freelance workers were the first to get impacted by the current recession, historical data shows that freelancers also enjoy an early and sharp rebound. Per CEO Micha Kaufman’s remarks on the Q3 earnings call:

Talents are increasingly demanding freedom, flexibility, and control over their own work-life balance. Furthermore, macro volatility is also driving talent to embrace freelancing more. We saw this during COVID pandemic and in fact, in recent months, with inflation driving up the cost of living and a flurry of companies conducting lay-off, we saw a record level of sellers coming to our market space.

Now, many of you have asked me why we haven’t seen the market base benefit from those trends yet. The answer is twofold: one, we looked into the industry hiring trends around the last economic cycle and noticed that during the economic downturn, freelance demand gets hit first before full-time hiring and oftentimes, leads broader GDP trends.

That said, freelance demand is also expected to be the first to recover as we climb out of the downturn and the rebound is typically of a bigger magnitude compared to full-time employment and the GDP growth itself. So, the first part of the answer is a matter of timing, and we believe Fiverr will be the first to benefit from the upswing down the road.”

The company also noted that its new brand campaign, “Team Up,” produced noticeable lifts in web traffic.

And in spite of the opex inflation that most companies are facing, Fiverr still managed to eke out $6.6 million of adjusted EBITDA, representing a 7.9% margin – down 190bps y/y. Pro forma EPS of $0.21, however, came in well ahead of Wall Street’s $0.05 consensus.

Key takeaways

Stay long on Fiverr and build up a position here while the stock is still underwater. In my view, structural shifts in favor of remote work and freelancers are here to stay and will see a strong post-recession rebound; in addition, Fiverr’s existing high margin profile and commitment to profitability gives it ample room to scale.

Be the first to comment