Daniel Grizelj

It pays to have sleep well at night holdings in one’s portfolio, especially when they can be had at bargain prices. In other words, buying above average companies at below average prices is generally a winning strategy. This brings me to Alexandria Real Estate (NYSE:ARE), which remains undervalued, especially considering its recent strong Q3 results. In this article, I highlight why dividend growth investors ought to give ARE a hard look.

Why ARE?

Alexandria Real Estate Equities is an S&P 500 company and a REIT with a long operating history since 1984. ARE is focused on owning urban office real estate leased to leading life science and agtech tenants. At present, its asset base includes 41 million rentable square feet of properties rented to over 1,000 tenants that are located in major metropolitan areas such as New York City, SF Bay Area, San Diego, Greater Boston Area, and Research Triangle in North Carolina.

ARE’s properties can be considered to be near irreplaceable, considering that they are located in densely populated areas that have little to no extra space to expand. Plus, they are located in close proximity to major research institutions in the United States, giving its tenants a virtuous cycle of being able to attract and retain highly-educated talent, which in return makes the properties valuable.

Nearly half (49%) of ARE’s annual rent comes from either investment grade-rated and/or large cap publicly traded companies, including large pharmaceutical companies such as Merck (MRK), Pfizer (PFE), Eli Lilly (LLY), and Bristol-Myers Squibb (BMY).

Meanwhile, ARE just reported impressive Q3 results, with revenue growing by 20.5% YoY, and FFO per share grew by a respectable 9.2%. This was driven in part by very strong lease spreads on 1.7 million square feet of space, with a 27.1% increase on a GAAP straight-line and 22.6% on a cash basis, signaling high demand for its well-located properties.

Moreover, it appears ARE has a strong reputation with its existing tenant base, as 87% of its Q3 leasing activity was generated from its existing roster of over 1,000 tenants. Occupancy also remains strong at 94.3%, and management has guided for 95.3% at the midpoint by year end. Looking forward, these trends seem set to continue, as healthcare relatively less sensitive to macroeconomic volatility. Management also sees plenty of greenfield long-term for this industry and its tenants, as highlighted during the recent earnings call:

I think the overriding macro observation would be the long-term healthcare needs of this country certainly aren’t going away. Innovation in medicine is really a national imperative and just look at the mental health problem across this country as one simple example.

And as I’ve said many times before, there are about 10,000 known diseases to human kind and really that we’ve only addressed as a society about 10% with addressable therapies and very few real cures. Biotech, I think, remains resilient. Clinical data, regulatory updates and M&A can be idiosyncratic events that really are unaffected by economic trends. I think demand continues very solidly for our high-quality and well-located assets, which are really powered by asset level operational excellence, second to none.

Meanwhile, ARE carries a strong BBB+ rated balance sheet with a net debt and preferred stock to adjusted EBITDA of 5.4x and a fixed charge coverage ratio of 4.9x. ARE is less sensitive to the recent uptick in interest rates, as 96% of its debt is fixed rate at a weighted average interest rate of just 3.5%. It also has no maturities prior to 2025 and a long weighted average remaining term of 13.2 years, one of the longest among REITs.

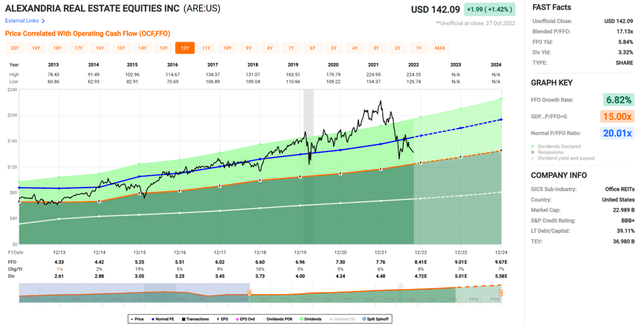

ARE currently yields a healthy 3.3% that’s well-covered by a 55% payout ratio (based on Q3 FFO per share of $2.13). While its 5-year dividend CAGR is “only” 6.6%, I see potential for acceleration down the road, as ARE’s pipeline is brought online and stabilized. Given the quality and growing nature of ARE’s income stream, I find the shares to be attractively valued at $142 with a forward P/FFO of 16.9, sitting well below its normal P/FFO of 20 over the past decade.

This sets up the stock for potential double-digit total returns through just a reversion to mean valuation, while business growth provides an added kicker. Analysts have a strong buy rating and S&P Capital IQ has an average price target of $177.

Investor Takeaway

In summary, ARE is well-positioned to benefit from the growing healthcare industry. It has a strong balance sheet and impressive portfolio of properties leased to some of the largest and best-rated companies in the world. The shares are attractively valued at well below historical valuation, all while paying a healthy and growing dividend. ARE is an attractive buy at present for dividend growth investors.

Be the first to comment