Ratchat/iStock via Getty Images

Dear readers/followers,

Let’s take another look at Carlisle Companies (NYSE:CSL). I’ve reviewed the company a few times in the past. There’s much to like about this former tire/rubber business, and the recent set of results gives us at least some confirmation that the strategy which has worked historically for Carlisle is still working well, at this point.

Let’s look at recent results and let me show you why I’m positive about the company here.

Carlisle – An update on the company

If you recall my former article on the company, it’s a global manufacturer of very highly-specialized materials. The company creates building materials of the future, both in terms of fairly fundamental products, but also value-added products for various end users, including clients in aerospace, pharma/Medtech, defense, industrials, liquids, sealants, adhesive finishing equipment, and other products.

On a high level, the company organizes into Construction Materials, Interconnect Technologies (cables, wiring, etc.), and Fluid Technologies. The company is among the world-leading businesses in these segments. The company is a world-class dividend payer with a superb, 10-11 year history averaging an 11.6% dividend CAGR, and also repurchases shares when possible – hundreds of millions of dollars’ worth over the past few years alone.

The company’s track record is one thing we can really point to as something amazing.

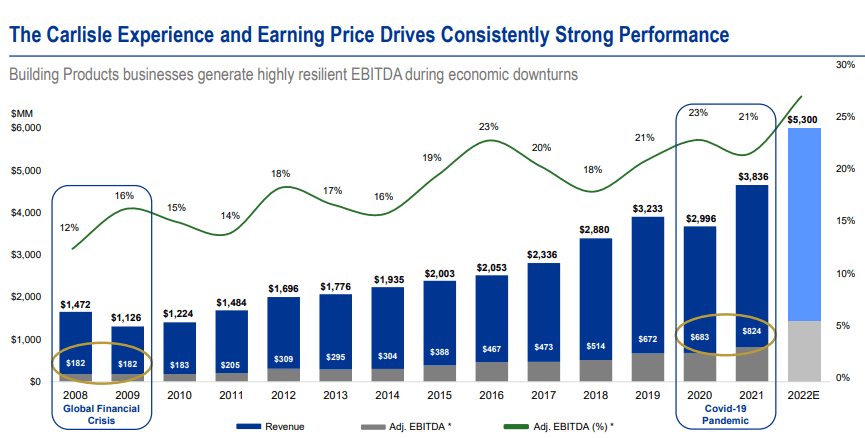

Carlisle IR (Carlisle IR)

The company has a very strong history of delivering strong numbers, based on superb execution and management ability. While part of the company’s products has a high correlation with the building/renovation market, much of what the company sells is through-cyclic in terms of recession/downturn sensitivities, and this is also something we see confirmed in terms of overall results. The company’s business is based on global mega-trends, which the company follows closely. Currently, this trend is highly correlated to/with ESG.

The most recent trend, 3Q22, confirms the continued upside here. We have strong non-US resi construction material demand, pricing adjustments that the company uses to manage inflation impacts, improved availability of materials and better supply chains, record backlogs in key segments, and new product introductions.

The company is busily integrating Henry, with results here exceeding expectations as well.

Revenue for 3Q is up 36%, and adjusted EPS is up almost 90%, meaning both top-line and bottom-line results are improved, due to better volumes, pricing, accretive EPS additions from Henry, savings, share buybacks, and general M&A growth. All of these positive trends managed to offset the headwind of raw material, wage headwinds, logistics inflation, and other well-known headwinds we’ve been battling for the past few quarters.

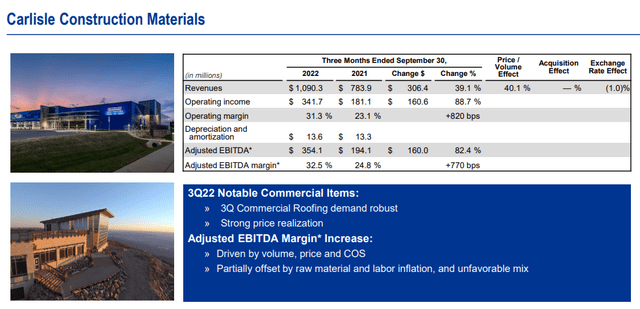

CSL IR (CSL IR)

All of the individual segments had good development during this latest quarter. Most of the upside here or the difference in terms of revenue growth – which is close to half a billion dollars, is organic, around $120M worth of M&A-based (Henry) sort of growth. Same with the YoY EPS growth – most of the massive upside is volume/price/mix – only around a quarter dollar from M&A here, with an around $1.66 input inflation impact, which still leads to the company to closely to doubling its adjusted bottom line.

The company’s fundamentals remain solid – a few maturities in the next couple of years, but nothing major.

Remember, Carlisle is an extremely future-proof company. Why?

Because virtually everything that Carlisle makes or develops, including but not limited to Polyiso wall/roofing insulations, Single-ply EPDM, Assemblies, metal roofing, coatings, air barriers, foundational weatherproofing, spray foams, etc. are directed towards efficiency. This company is a direct beneficiary of these trends as businesses and customers are seeking to become more efficient and more in line with current ESG policies.

Even if you don’t personally are in line with this, I can assure you that most of the current industry is, and you shouldn’t be allowing your personal bias to impact your ability to make money.

The company offers an industry-leading platform for building products – billions of dollars in revenue, with dominant or close to leading market positions across insulations and architectural metals. It’s beyond solid – and that’s even before we go into the fact that it’s the market-leader in single-ply premium roofing systems.

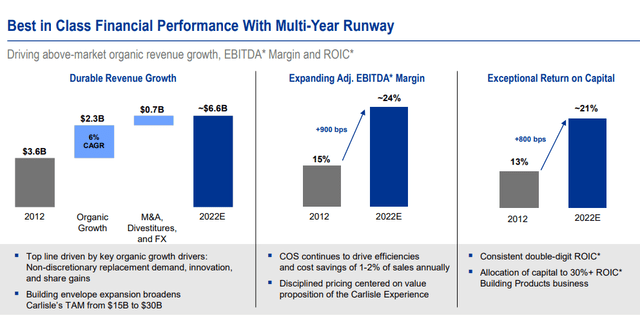

The company has a success story of improving its return metrics – so when looking at historicals, remember that the company has done better, not worse, than historical results.

CSL IR (CSL IR)

The portfolio transformation continues, with the company really shifting towards a construction-materials heavy revenue split, with a 60%+ forward weighting towards the segment, making both of the other segments relatively far back in comparison. 83% of the company’s current revenue is derived from one building product business or another.

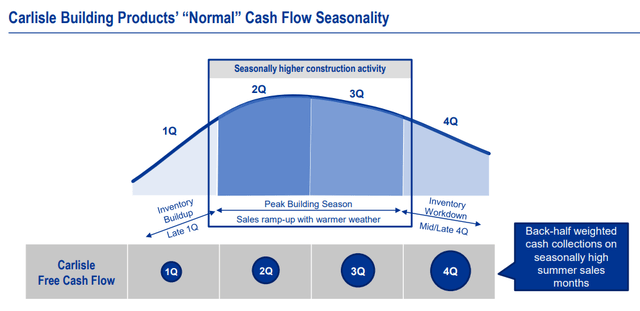

Here is what to expect from CSL for the next few quarters – with 4Q and 1Q being relatively weak quarters with sales inventory work downs and buildup.

CSL IR (CSL IR)

Why is the company going to continue to perform well? Well, I believe the following drivers are going to be central here. First off, non-discretionary roofing demand persists, especially for re-roofing. The company is also going to be recording gains from its manufacturing and organizational efficiencies they’ve been pushing, including a relatively good pricing for what value the company offers.

Fundamentally, the company remains very strong, with plenty of cash on hand and liquidity available, and a net debt lower than 2.6X to EBITDA. Even the CIT segment still has strong aerospace and medical backlog. This strong forecast is backed by very strong TSR traditions, where CSL has outperformed the S&P 500 significantly on a 10-year return basis.

CSL remains very attractively priced.

Here is why.

CSL Companies – Valuation

Remember, this company typically warrants a bit of a premium – closer to 17-20x P/E or so, and we continue to expect a very solid amount of EPS and revenue growth over the next few years. Both the bottom and top line is expected to grow here.

This company is investment-grade rated. Its dividend is very modest – less than 1% at this price – but it’s expected to slowly grow. The majority here though is potential capital appreciation, and there’s a decent amount of that to be had here.

If you recall my previous article, the company hasn’t yet normalized to where the company is expected to generate earnings for the next few years – at least that is what I said, and this is still what’s happening here.

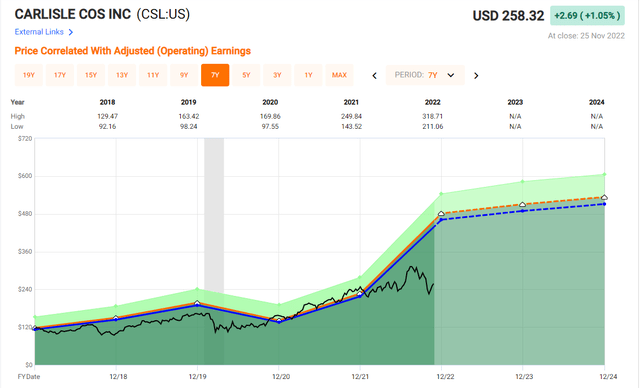

CSL upside (F.A.S.T Graphs)

If we assume an 18-20X P/E premium multiple, which I wouldn’t consider outlandish for a world-leading manufacturer in this segment, we can estimate returns to close to 20-30% annually or 73% in less than 3 years. That’s a very decent RoR given the risk you’re taking and what you’re investing in.

Remember, CSL is IG-rated with BBB. Even if the company doesn’t have the best yield, and indeed it doesn’t, you should be looking for safe plays that hold up in any environment. CSL Companies could be such a portfolio position for you.

The company remains extremely undervalued for the cash flows, earnings, and revenues that it’s actually expected to deliver here. We can even go far more conservative than this, and still get some excellent RoR.

Even if, for the sake of argument, the company was to deliver returns or valuations below this, even at a 13-15X P/E, your returns would still be inflation and market-beating, at around 7-8% annually, or 20% in 4 years.

Remember the position the market is in and remember the way things are looking here.

While we can hardly call CSL the most undervalued opportunity out there – but CSL is a rare company that works almost exclusively on mission/application-critical products, and has an expertise that makes it hard for customers to simply “switch” to another supplier, as the quality of the products might not be on par.

Because of this, it’s fair to say that despite tightening in the home markets across the world, and the uncertainty we’re currently facing, CSL is actually appealing here. It’s not the best investment you can possibly make – but it’s, in my view, a very good one here.

Analysts’ estimates remain positive here – and even improved since my last article. The average comes in between $330 on the low side and $360 on the high, with a current PT average of $350/share, implying an upside of at least 35% here based on these targets.

The latest couple of months has seen analysts really raise their estimates for this company, confirming in their mind the upside we can see above in the F.A.S.T Graphs estimates.

I continue to view the bullish perspective on this business as the main, relevant one. This one is as follows. I expect the company to continue its outperformance that it’s seen historically, and deliver superior growth based on good execution and an excellent mix of sales.

I don’t see CSL as tied to the builder market as some investors, given its high correlation not to new construction, but to Renos and commercial. This combined with its engineering segment makes it an appealing investment with a double-digit upside despite the low yield.

I’m an advocate of the Bullish thesis for CSL. I’m a “BUY” with a PT of no less than $300/share – meaning I stay unchanged, which gives the company a significant upside.

Thesis

- Carlisle Companies is an attractive play in the building materials and engineering sector. It has a proven ability to generate alpha from attractive investments and operations, and I consider it likely that it will continue to generate attractive alpha for years.

- The company has gone to an underappreciation here, and analysts view it as an upside of no less than 20-30% on a premium upside.

- Based on current estimates and company historical performance, I view CSL as a “BUY” to a PT of $300.

Remember, I’m all about:

1. Buying undervalued – even if that undervaluation is slight, and not mind-numbingly massive – companies at a discount, allowing them to normalize over time and harvesting capital gains and dividends in the meantime.

2. If the company goes well beyond normalization and goes into overvaluation, I harvest gains and rotate my position into other undervalued stocks, repeating #1.

3. If the company doesn’t go into overvaluation, but hovers within a fair value, or goes back down to undervaluation, I buy more as time allows.

4. I reinvest proceeds from dividends, savings from work, or other cash inflows as specified in #1.

Here are my criteria and how the company fulfills them.

- This company is overall qualitative.

- This company is fundamentally safe/conservative & well-run.

- This company pays a well-covered dividend.

- This company is currently cheap.

- This company has a realistic upside based on earnings growth or multiple expansion/reversion.

This means that the company is fulfilling every single of my investment criteria – hopefully clarifying why I consider it a “BUY” here.

Be the first to comment