everythingpossible/iStock via Getty Images

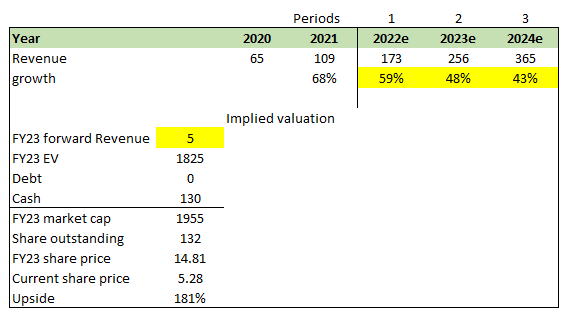

I believe FiscalNote (NYSE:NOTE) is worth $15, representing ~181% upside from the date of writing (Oct 19, 2022). NOTE rides on a strong secular tailwind that provides it with a long runway of growth. My view is that NOTE has been sold off together in a basket of SPACs that are poor businesses, and this gives investors an opportunity to own this asset at a cheap valuation.

Company overview

NOTE is a technology and data company that provides critical legal data and insights in a rapidly evolving economic, political, and regulatory world. NOTE is committed to reinventing how organizations can mitigate the risks and capitalize on the opportunities presented by ever-changing legal and policy environments. To achieve this, the company combines artificial intelligence, machine learning, analytics, workflow tools, and expert research technology. NOTE helps businesses make critical operational and strategic decisions by:

- Ingesting unstructured legislative and regulatory data and

- Utilizing AI and data science to deliver structured, relevant, and actionable information through a variety of its products.

Over half of the Fortune 100, businesses, government agencies, law firms, professional services organizations, trade groups, and NGOs are among NOTE’s worldwide customers in over 45 countries.

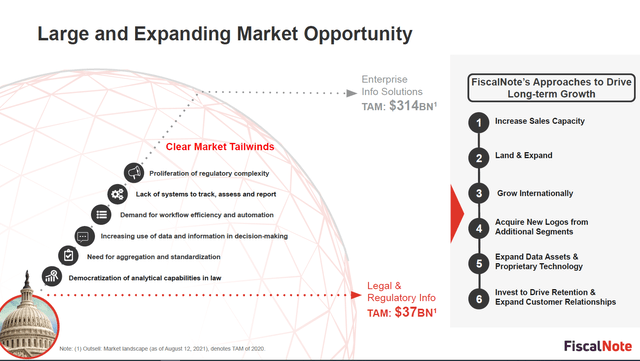

Strong secular trends underpin NOTE revenue growth

As the provider of global policy and market knowledge serving local and multinational customers, NOTE complies with respective laws in different states or localities and keeps track of policymaking that could lead to new regulations. Expansion operations of businesses and organizations may be subject to different, more complex laws and regulations depending on their target market territories. For example, a manufacturing company that works in both the U.S. and Europe must follow different labor laws in each place.

In PwC’s 23rd Annual Global CEO Survey, “Navigating the Rising Tide of Uncertainty,” more than a third of CEOs claimed that regulatory and policy concerns are the most significant threats to their companies. Businesses and organizations could lose their brand, reputation, or money if they don’t have a reliable platform for managing and keeping track of laws and rules.

NOTE also highlights that existing platforms have failed to upgrade their solutions to modern problems of organizations and sectors in general about legal and policy concerns. it also argues that today’s information and software providers cannot support complex procedures across many countries. Current legacy solutions provide poor service to structured variable data and diverse inputs on legal and policy matters, making it challenging to search for information, recognize trends, or gain insights from vast amounts of information. Overall, these service providers lack competent global technology and functionality to handle foreign laws and regulations.

Complex rules, regulations, and policies could be a strength or weakness for companies as global data volumes make it challenging for businesses to discover and monitor crucial policy and regulatory information that would have a direct or indirect, opportune or risky impact on their business. They could only monitor, collaborate, evaluate, and report the data through expert research and analytics. And without an integrated platform, they have to use different point solutions, which adds costs and hurts productivity and efficiency.

Hence, I believe that businesses today need efficient and highly automated solutions that gather, organize, and deliver meaningful insights from the activities of legislative, regulatory, and geopolitical stakeholders, together with workflow tools that enhance efficiency and automation in these sectors. This demand is good for NOTE because I think it is the market leader when it comes to giving data-driven and actionable insights on a wide range of legal, political, regulatory, and policy issues.

NOTE’s technologies and solutions give clients structured, relevant, actionable information targeting mission-critical outcomes. Therefore, strategic efforts should fuel the NOTE’s development.

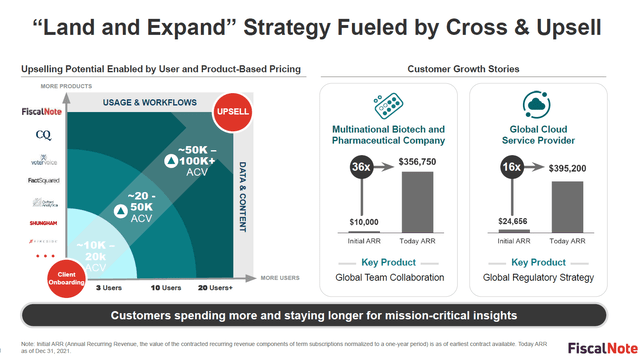

Strategic sales approach – Land and expand

I am confident that NOTE’s optimizing its sales organization and strategy through “Land and Expand” will continue to boost its revenue growth. The key plan is to continue targeting the corporate and government accounts, of which NOTE’s “blue chip” clients already include nearly half of the Fortune 100, aside from the federal, local, and foreign government accounts. Given the large base of customers, I am positive there is still room for growth (upselling more modules) in its base of major corporate and government clients.

In addition, NOTE has increased the number and length of client engagements following the initial sale with the new ones through cross-selling, upselling, and improving product pricing and packaging to suit clients’ demands. As NOTE has proven its value and gained clients’ trust and loyalty, more and more should be ready to sign multi-year contracts with it, boosting yearly recurring revenue.

NOTE leverages its core technologies and scalable platform to grow. As mentioned above, NOTE is capable of ingesting and analyzing extensive data sets on any scale to provide clients with more advanced functionality, from local to global. Insights generated by its technology can be packaged for segmented client use cases, including government affairs and advocacy, geopolitical risk analysis, and corporate compliance with ESG ratings and reporting regimes. NOTE thinks it can use its strengths in data structure, actionable insights, and workflow tools to offer vertically integrated solutions for future regulated industries like driverless cars, cybersecurity, online sports betting, and the cannabis business.

NOTE continues to research potential avenues for expanding its operations internationally, with the dual goals of broadening its product offerings and increasing the size of its client base to give insights on regulatory activity in more countries. Overall, through “Land and Expand,” NOTE should be able to continue to increase average account values over the years.

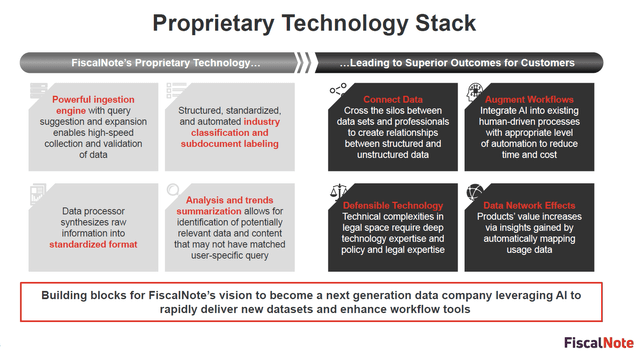

The proprietary technology stack is the backbone of NOTE

The foundation of NOTE’s core technology is its exclusive data gathering, ingesting, processing, monitoring, and refining capabilities. These capabilities enable the company’s product and service offerings to perform more exceptional service than other platforms. Its system gathers and interprets structured and unstructured data from different sources, including news, social, and international events. NOTE combines AI-powered automated processes with human-in-the-loop augmentation throughout the pipelines to give structured metadata and information that can be used.

NOTE’s emphasis on flexible and maintainable ingestion and refinement technology can expand with new data sets and solutions, minimizing the cost and time to market, enabling it to distinguish itself from competitors and expand its reach and client verticals. Ultimately, the value of NOTE’s technology is highlighted in its automated machine learning system to analyze and apply extractions, classifications, recommendations, and links across diverse data sources. As more data is ingested, customer value per dataset and data-driven insights increase.

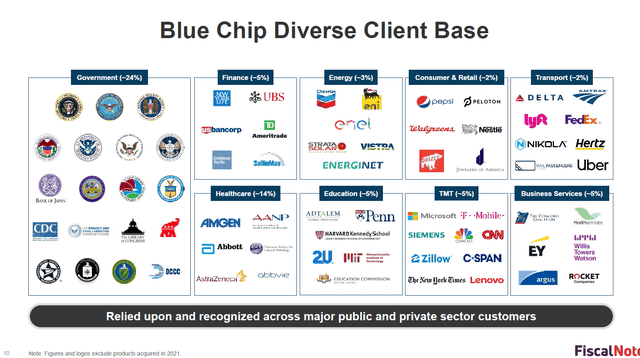

Blue chip customer base mitigates business risk

NOTE has a diverse customer base ranging from startups to multinational corporations and other enterprises. The company also supports all three branches of the United States federal government and other national, state, and local government entities. Its technology solutions may also help non-government organizations, nonprofits, and advocacy groups.

Thousands of firms and agents depend on NOTE to enhance their relationships and compliance with all levels of government, maximizing their influence on legislation and regulation. NOTE benefits from having a wide range of customers in terms of business stability and reducing risk. This is in addition to the fact that having a wide range of customers makes it easier to engage more clients.

Valuation

I believe NOTE is worth USD14.81 representing a 181% upside from the date of writing. I would like to point out that the upside seems significant from today’s price, but NOTE was trading at $14 just 2 months ago after the SPAC got merged.

This value is derived from my model based on the following assumptions:

- Revenue growth will follow management guidance until fiscal year 24 and will be supported by organic growth and M&A.

- I differ from the market and believe that NOTE deserves to trade at a much higher multiple than today when we compare it to other info-services companies such as S&P Global (SPGI), MSCI (MSCI), and Tyler (TYL).

GS Investing estimates

Key Risks

M&A risk

A key focus of NOTE’s business strategy is to develop and expand through the acquisition of technologies, data sets, and product and service offerings. There is always a chance that synergies will be overestimated, which could lead to a bad deal. This is especially true when a business depends more on mergers and acquisitions to grow, which can cloud management’s judgment.

Alternative products that are free

Free or low-cost public information sources have been made available online in recent years. This trend is projected to continue as Congress, state legislatures, the European Union, and other national, state, municipal, and international government and regulatory bodies have increased free public information. NOTE’s key products and services may lose demand if public sources of free or cheap information become more searchable, accessible, and actionable without structuring technology like the company’s system. NOTE’s businesses would suffer if customers substituted public sources for goods or services.

Competition

Other larger companies (such as Bloomberg) may compete with NOTE and have better brand recognition and resources. If one or more of these large and well-funded rivals were to enter the market, the company would be unable to speculate on how quickly a potential rival may develop goods or services that would steal a significant share of the company’s market share or even be superior to the quality of the company’s products or services. This could result in a decrease in demand for NOTE’s products and services, a reduction in the price that the company can demand from new customers as well as for subscription renewals and upgrades from existing customers.

Summary

NOTE is undervalued at its current share price as of the date of this writing. NOTE is a technology provider of artificial intelligence, data analytics, and government information, which rides on the secular tailwind of businesses’ need for efficient and highly automated solutions that gather, organize, and deliver actionable insights about legislative, regulatory, and geopolitical events, along with workflow tools that promote efficiency and automation in specific work areas. So, all NOTE needs to do is keep growing the way management tells it to, and the share price should go up a lot from where it is now.

Be the first to comment