hapabapa

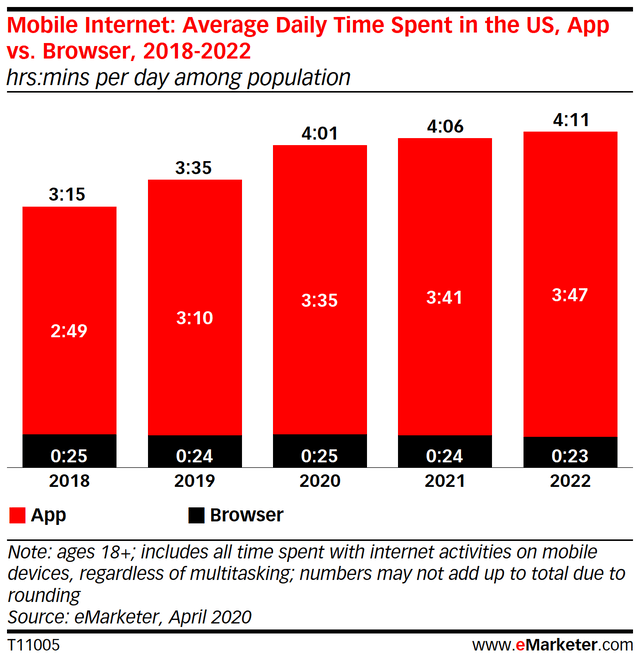

When was the last time you checked your phone? Most likely a few minutes ago (if you are not already on it). In fact, the average American checks their phone 96 times per day, that’s once every 10 minutes. Customer attention is where the dollars can be found, and in today’s modern world users spend an average of 4 hours on mobile with the majority of that time spent inside apps. Therefore, it is no surprise that the App industry was worth $187 billion in 2021 and is forecasted to grow at a 13.4% compounded annual growth rate up until 2030.

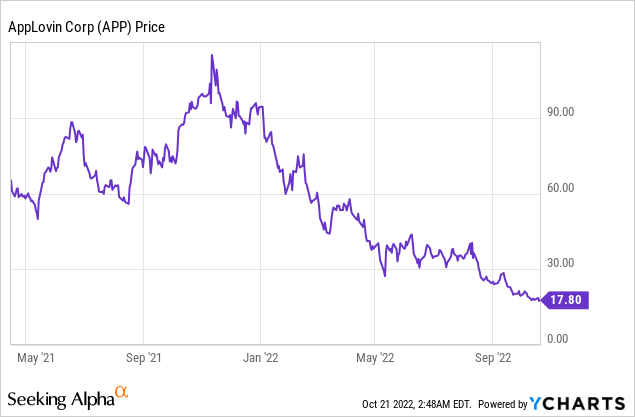

AppLovin Corporation (NASDAQ:APP) is poised to benefit from the aforementioned trends, as a tech platform provider with the mission to grow the app ecosystem. The company beat its earnings consensus estimates for the second quarter of 2022, but despite this, its stock price has slid down by 84% from its highs in November 2021. Thus in this post, I’m going to break down the business model, financials, and valuation. Let’s dive in.

App-Centric Business Model

Applovin was founded in 2012, in Palo Alto, California, and acquired reputable customers such as Spotify (SPOT) and Opentable in the early days. Today, the company has six main products. These include: App Discovery, Adjust, Sparklabs, MAX, Exchange, and Array. I will now dive into each of these products in turn.

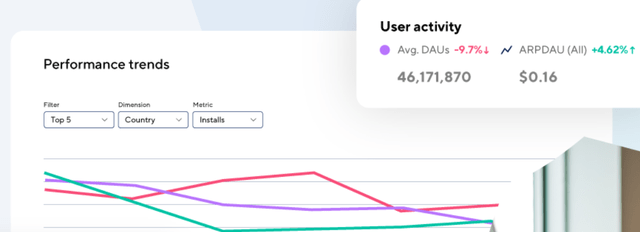

App Discovery is an Ad campaign management platform that is used to acquire users and track advertising spending with metrics such as Return on Advertizing spend [ROAS]. The platform uses AI technology to optimize and recommend the users most likely to download and engage with the app.

In order to measure the effectiveness of various Ad campaigns, you can then use Applovin’s second product called “Adjust” (acquired in 2021). This is a mobile attribution platform that allows you to track the customer journey across an App. This is essential for global brands running localization marketing campaigns, in which they must tailor their user acquisition in each region. The platform is used by fintech giant Monzo, owned by PayPal (PYPL), carpooling app “Bla, Bla car,” and mobile gaming leader Zynga (TTWO). An alternative/competitor to this platform includes “Appsflyer” which integrates with “App Discovery” by Applovin also.

On the ad creative side, which is the part you see as a user the company’s “Sparklab” service and platform is extremely popular with businesses, especially those in the gaming industry. This platform allows “playable” adverts to be created which encourages users to “play” part of the game inside the advert. These ads are often colorful and extremely enticing, with often a storyline and music. Now, although many mobile users (such as myself) will find these adverts annoying, there is no doubt that they increase conversions. In fact, according to a study by the company, these playable adverts increase Installs per millie [IPM], [Installs per thousand impressions] by over 200%. Although the ad rates for these usually cost the business more, so the benefit must be calculated.

The company’s fourth product is “MAX,” which is a mobile monetization solution which uses programmatic auctions to drive the highest price for your app “real estate.” This solution is ideal for “freemium” adverts which don’t plan to make a lot of money from in-app purchases. With the platform, you can test different monetization solutions from video to native ads. This works with the Applovin Ad Exchange, which connects buyers with over 60,000 mobile apps across 1.5 billion mobile devices.

MAX programmatic ads (Applovin)

Applovin’s “Array” product is used with mobile carriers and OEM (Original Equipment Manufacturers) to recommend the best apps for users.

Applovin has also expanded its business through a variety of mergers, acquisitions and investments. For example, in 2020 the business invested into the mobile game studios Geewa and acquired Machine Zone. The company also acquired the mobile monetization company MoPub from Twitter (TWTR) for $1.1 billion in early 2022. The company even tried to acquire 3D gaming creator Unity for a staggering $17.54 billion in stock, although the board rejected this offer in the end.

Applovin’s Solid Financials

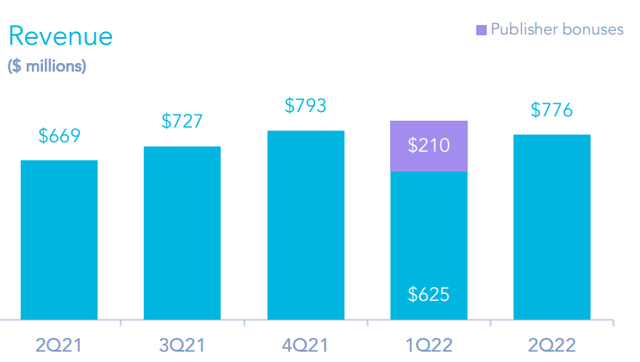

Applovin generated solid financial results for the second quarter of 2022. Revenue was $776 million, which increased by 16% year-over-year. This was driven by software platform revenue which increased by a blistering 118% YOY, to $318 million.

Revenue Applovin (Q2 Earnings Report)

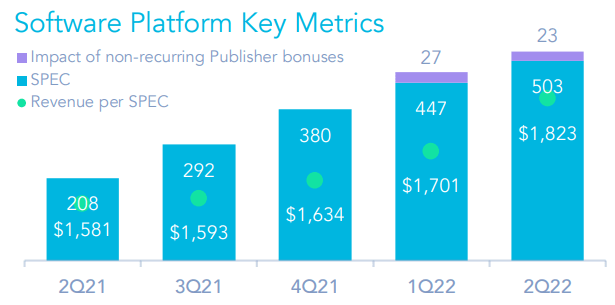

The revenue growth was further driven by a greater number of Software platform Enterprise clients [SPEC], which increased by a rapid 141% year over year to 503. Enterprise clients tend to produce greater revenue and have higher retention than most businesses, thus it was great to see a boost in this segment. The company has also boosted its revenue per enterprise client from $1.58 million in Q2,21 to $1.8 million by Q2,22.

software (Q2 Earnings Report)

App segment revenue was $459 million in the second quarter of 2022, which declined by ~12% year over year. This was mainly driven by a user decline in its Project Makeover App, which hit the top of the app charts within just four days of publishing, before declining due to the fad nature of gaming applications.

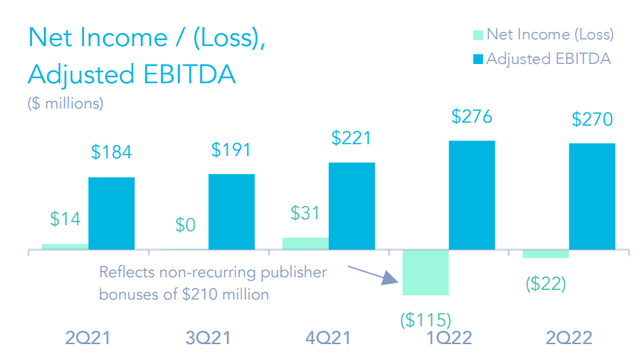

Overall, the business generated a net loss of $22 million in the second quarter of 2022. This was driven by a net margin of minus 3%, which was down from net income of $14 million or a net margin of 2%. Management announced bolds plans to optimize their cost structure to boost long-term profitability. The company announced a 12% reduction in its workforce and scaling of its investment to suit the tepid market conditions.

The good news is that, on an Adjusted EPS basis, the company generated $0.53 in Q2,22, which beat analyst estimates by $0.03. Its Adjusted EBITDA also increased by a rapid 47% year over year to $270 million. Its Adjusted EBITDA margin improved from 27% to 35% which was great to see.

Management showed confidence in the quarter and bought back $339 million worth of stock, as part of its $750 million share buyback program. The company has a solid balance sheet, with $951.6 million in cash and short-term investments and just $33.3 million in current debt. However, long-term debt is approximately $3.19 billion, which should be noted.

Advanced Valuation Model

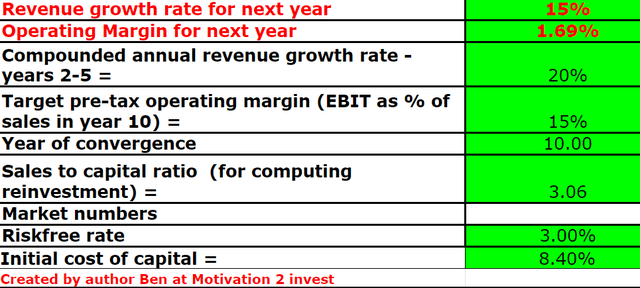

In order to value Applovin, I have plugged the latest financials into my advanced valuation model, which uses the discounted cash flow (“DCF”) method of valuation. I have forecasted a conservative 15% revenue growth rate for next year and 20% per year over the next 2 to 5 years. This is aligned with the low end of management and analyst forecasts.

Applovin stock valuation (created by author Ben at Motivation 2 Invest)

I have forecasted Applovin to grow its operating margin to 15% over the next 10 years. I forecast this to be driven by the increasing adoption of its software platforms. In addition, the average operating margin for a software company is 23%, thus this figure is fairly conservative.

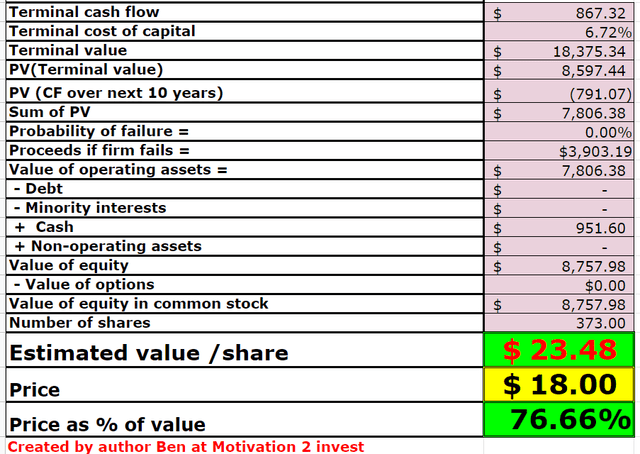

Applovin stock valuation 2 (created by author Ben at Motivation 2 Invest)

Given these factors, I get a fair value of $23 per share. The stock is trading at ~$18 per share at the time of writing and thus is ~23% undervalued.

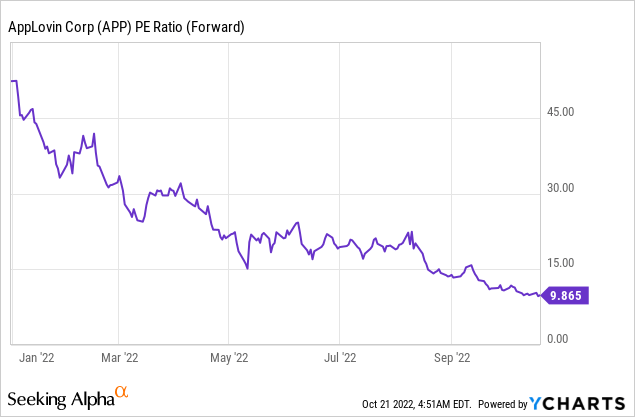

As an extra datapoint, Applovin is trading at a Non-GAAP P/E ratio = 9, which is cheaper than the industry and its history.

Risks

Recession/Lower Demand

The high inflation and rising interest rate environment have caused many analysts to forecast a recession. Therefore management is predicting lower consumer demand, and I forecast longer sales cycles.

Final Thoughts

Applovin is a fantastic software provider which provides essential services to many businesses. The company has a super high net dollar retention rate of 204%, which means its customers are highly “sticky” and spending more. Therefore, despite the lower economic demand forecasted within the next year, I expect the company to benefit from the long-term secular tailwinds.

Be the first to comment