Thurtell

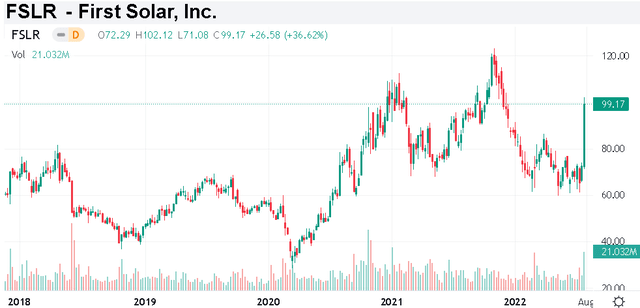

First Solar, Inc. (NASDAQ:FSLR) is coming off a massive week with shares rallying over 35% to currently trade at an eight-month high. From a solid Q2 earnings report with a bump to full-year sales guidance, the bigger development was reports of a new clean energy/climate bill gaining traction in congress. The “Inflation Reduction Act of 2022” includes upwards of $369 billion over the next decade between tax credits and direct investments toward renewable energy technology like solar. Indeed, while the bill still needs to get passed into law, the setup here is a potential windfall for First Solar as the largest solar panel manufacturer in the U.S. gaining a boost to its growth outlook.

We are bullish on the stock and expect more upside targeting a new all-time high over the next year. In our view, FSLR is a high-quality category leader supported by overall solid fundamentals that now benefits from a new tailwind of operating and financial momentum.

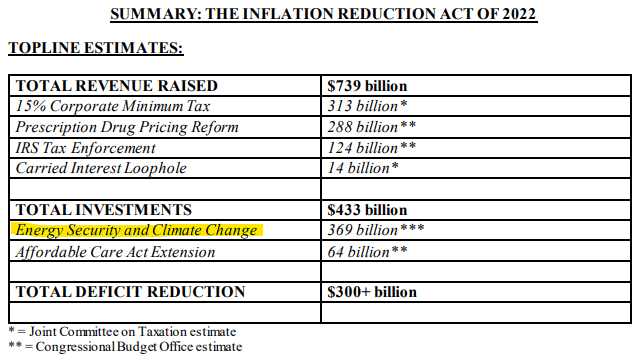

What’s In the New Climate Bill?

There were high expectations in 2021 for the Build Back Better Act which was touted as a wide-reaching “human infrastructure” package covering everything from education, healthcare, and climate change. Despite the Democrats controlling the Senate, the $2 trillion spending deal ultimately fell apart on concerns regarding its inflationary impact, particularly from Senator Joe Manchin. In many ways, the persistently hot inflation trends this year reaching a 40-year high ended up vindicating some of that opposition.

Fast forward, the Democrats have come up with a slimmed-down version that excludes most of the education and social spending aspects of (BBB) while focusing on clean energy initiatives to fight climate change, funded through new taxes. The support by Joe Manchin gives some confidence that the deal will move forward.

The expectation that the package reduces the Federal deficit by more than $300 billion over the next decade is intended to help limit inflation by supporting the adoption of renewable energy along with some healthcare reforms. On the other hand, there is still some criticism that the tax hikes including a new 15% minimum corporate tax would hit corporate innovation and be bad for the business environment in the U.S.

US Senate

As it relates to First Solar, several provisions stand out. Specifically, First Solar would likely be a recipient in part of the upwards of $40 billion targeted towards tax credits for manufacturing facilities and through production tax credits of clean energy products that include solar panels along with wind turbines, batteries, and electric vehicles. First Solar CEO commented on this development noting they would consider shifting more of its capacity to the United States to take advantage of the legislation. From the latest Q2 earnings conference call:

While we are still reviewing the full legislative tax release last night, we are hopeful that the advanced manufacturing production credit, if passed, helps deliver the incentives required to boost domestic solar manufacturing and secure our nation’s energy independence…

In light of these latest developments and should the Inflation Reduction Act get passed with consistent language on solar-related tax credits, we plan to pivot quickly to reevaluate U.S. manufacturing expansion.

On the demand side, the climate deal also includes consumer tax credits to make homes energy efficient with technologies like rooftop solar. There are also billions in potential grants going to states in an effort to accelerate broader decarbonization of the economy towards a goal of the U.S. cutting emission by 40% through 2030. While it’s still early to know all the details, the takeaway here is a major tailwind of operating momentum for First Solar and the broader solar industry fueled by new subsidies.

FSLR Key Metrics

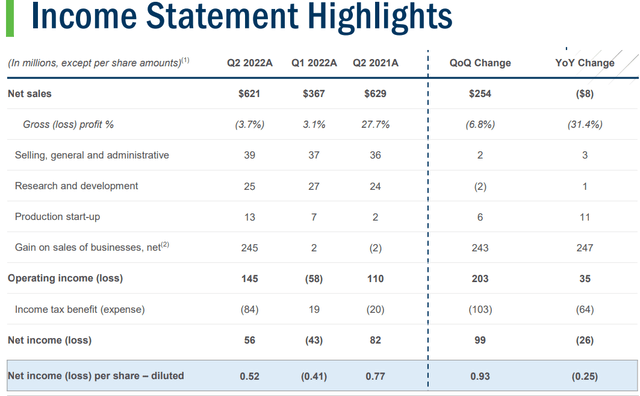

Coincidently, the climate deal breakthrough in Congress came the day before First Solar’s Q2 earnings release on July 28th. The financials this quarter were overall messy considering several one-time charges.

The company reported a GAAP EPS of $0.52 which includes a large post-tax gain of $232 million from the sale of the company’s Japan business. On an adjusted basis excluding the sale gain, a non-GAAP EPS loss of -$0.40 captures significant expenses related to the manufacturing site construction and production start-up costs. There was also a $58 million impairment to its Luz Del Norte power plant operation in Chile which flowed into a negative gross profit for the quarter.

The story here was ongoing efforts to divest from its legacy power plant platform business and focus just on solar manufacturing. With two new facilities under construction between a site in Ohio and one in India, the expectation is for a significant ramp-up in capacity over the next several years. Q2 net sales of $621 million declined by 2% year over year but were also up 69% from Q1. Again, there are several moving parts reflecting what is currently a transition period as First Solar gears up for its next stage of growth.

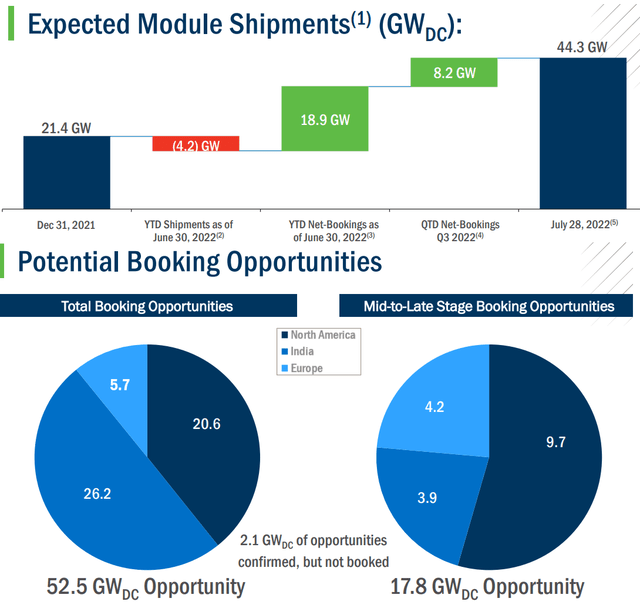

More favorably have been the trends in the bookings and expected module shipments. From 21.4 GW reported at the end of 2021, 18.9 GW of net new bookings year to date has driven total expected shipments to more than double to 44.3 GW. The company has also identified 52.5 GW of total potential booking opportunities worldwide noting India as a high growth opportunity particularly as its local manufacturing comes online.

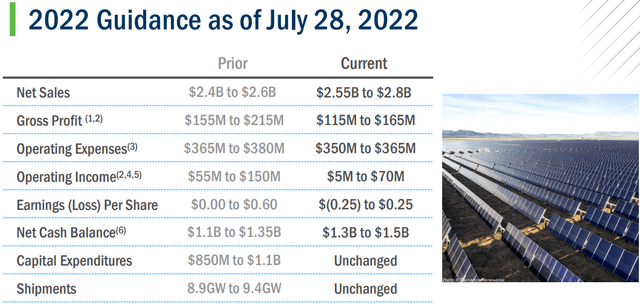

In terms of guidance, First Solar is hiking its full-year sales target to a range between $2.55 billion and $2.8 billion, compared to a previous midpoint target of $2.5 billion. That said, some of the other figures were revised lower including its EPS target to between -$0.25 to $0.25, from $0.00 to $0.60 cited back in Q1. The volatility of guidance this quarter is in large part based on the uncertainty of how a potential sale of the Chile Luz Del Norte facility evolves.

What’s Next For First Solar

The way we’re looking at FSLR is that its operating and financial backdrop gets a lot more interesting into 2023 and 2024. Management expects the completion of its Ohio and India factories to incrementally add around 6 GW of annual manufacturing capacity. For context, the Q2 production level implied a current capacity of 8.8 GW. By this measure, there is a roadmap here for sales to nearly double over the next few years. The additional volume should be materially positive to margins and as the company scales.

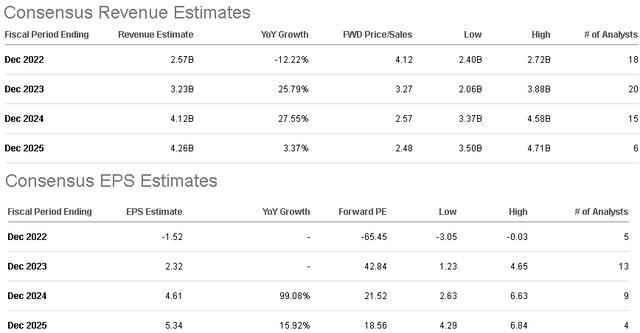

Compared to the forecast for 2022 full-year revenue of $2.6 billion in line with company guidance, the market sees a 26% increase in 2023 and again 28% higher in 2024 towards $4.1 billion. On the earnings side, from an estimated EPS loss of -$1.52 this year, First Solar is expected to swing into profitability by 2023 with an EPS forecast of $2.32, which has room to double to $4.61 in 2024. The trends with booking provide some visibility that these estimates are within reach.

Going back to the new clean energy bill, the kicker is that the strong demand from the U.S. could be supportive of higher average sales prices. Depending on how fast the legislation goes into effect and the grants get distributed, the bullish case for the stock now is that there is room for these estimates to get revised higher. We can also consider that if market conditions for solar in the U.S. evolve fast enough, First Solar could shift some of its shipments from overseas into the U.S. to meet demand and capture share.

It’s clear that the incentives are positive for the entire solar industry. What we like about First Solar is its profile as a pure play on modules/panels supplies which is in contrast to other names that focus more on power systems, inverters, energy storage, or power management systems. Specifically, First Solar is likely best positioned to take advantage of the tax credits proposed by the latest legislation. For context, its current U.S. facilities have a combined capacity of approximately 2.7GW which compares to just 0.4GW from China-based JinkoSolar Holding (JKS) which operates a single facility in Jacksonville, Florida.

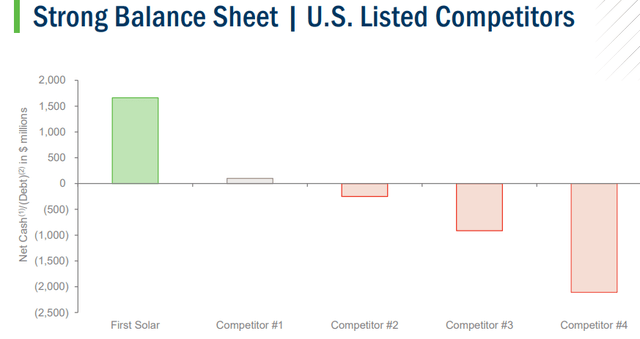

The other strong point of First Solar is its rock-solid balance sheet which ended the quarter at $1.8 billion in cash and equivalents against just $135 million in long-term debt. A weakness in several other solar stocks like Canadian Solar Inc. (CSIQ), Sunrun Inc. (RUN), or SunPower Corp. (SPWR), for example, is their high net debt positions.

Putting it all together, we believe FSLR’s current valuation with a 1-year forward P/E of 43x or 2-year forward P.E of 22x based on the consensus 2024 is justified given the growth outlook. While FSLR is not the “cheapest” solar stock or the most profitable, its combination of segment leadership and earnings momentum warrants a premium to the sector in our opinion.

FSLR Stock Price Forecast

For all the challenges the market is facing dealing with macro growth uncertainties, record inflation, and rising interest rates; the solar industry is a bright spot. The resurrection of the climate deal represents a game changer in terms of turbocharging growth on the demand side while producing subsidies for suppliers like First Solar. We expect solar stocks to outperform while FSLR leads higher.

We rate FSLR as a buy with a price target of $125 for the year ahead which would mark a new all-time high representing a 55x multiple on the current consensus 2023 EPS. The thesis here is that the company’s outlook is stronger than ever and over the next few months, we can expect revisions higher to consensus estimates as more details of the climate bill get ironed out. The stock should reprice higher as the earnings trajectory gets pulled forward.

The caution is that shares have already exhibited an impressive run, over 66% from their low of the year. A consolidation of these recent gains around $100 as a psychologically important technical level with renewed volatility over the near term should be expected. That being said, any weakness would be an opportunity to average down and add to a position.

The main risk to consider would be an unexpected setback in the clean-energy bill that would undermine the positive impact on First Solar’s growth outlook. Provisions within the legislation making tax incentives fully refundable are important to maximize their impact and value to the company. A significant deterioration of the economic environment beyond the current baseline would also open the door for another leg lower in the stock. For the rest of the year, we want to hear updates from management regarding its view on the impact of the deal on bookings while cash flow trends and margin levels will be key monitoring points over the next few quarters.

Be the first to comment