rlesyk/iStock Editorial via Getty Images

Investment thesis: The market is still operating based on the same playbook that was used over and over again in the last few decades when it comes to the relationship between gold and interest rates. It is thought that when interest rates go up, gold tends to move down, for valid fundamental reasons. This is why Barrick Gold (NYSE:GOLD) stock is now trading at half the price it traded at during its high point of this decade. It is assumed that higher interest rates tend to make gold less attractive to own compared with other assets. Paper assets such as bonds for instance start yielding more, while gold yields nothing. US dollar tends to outperform other fiat currencies in these times, which is considered to be negative for gold. This assumption is fundamentally flawed because what makes this current economic turbulence different from what we saw in previous decades is the fact that we are headed for a stagflationary environment that is likely to last a very long time. A rise in interest rates will probably lead to a growing trend toward debt defaults, which could potentially weaken the global fiat-based financial system. Despite higher interest rates, this situation will become a net positive for gold prices as investors will seek safety. Barrick Gold is set to benefit, as it is already a profitable gold producer with ample reserves that can sustain production at current levels for the foreseeable future.

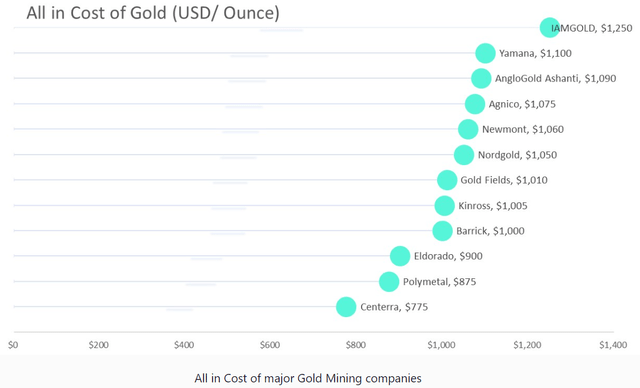

Barrick is among the more profitable gold producers.

All-in costs of gold mining by various producers (Money graph it)

As we can see, Barrick is on the lower end of the cost chart when it comes to all in costs. At a production cost of $1,000/ounce, we can assume that it is safe from any short-term declines in the price of gold from current levels. In other words, its production price is more competitive than that of many industry peers, therefore it is not likely to be among the first to curtail mining activities if it comes to it in a worst-case scenario.

For the first quarter of the year, Barrick had a decline in revenue of almost 4% compared with the same quarter a year earlier. Revenue came in at $2.85 billion, and net earnings came in at $438 million. The profit margin was therefore just over 15%, which is rather healthy. The drop in revenue was in part due to a decline in gold production of about 10% compared with the same period last year.

Whatever happens to gold prices is what will happen to Barrick stock going forward.

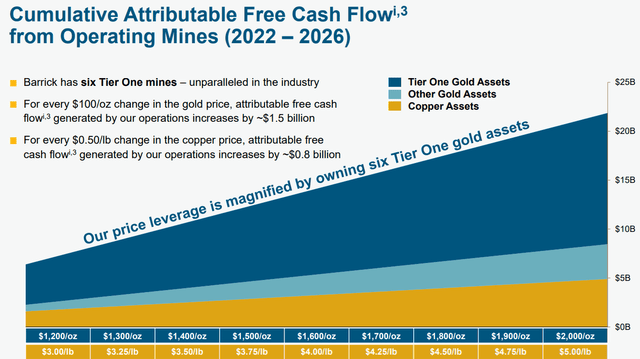

As far as future financial prospects, Barrick’s outlook is deeply tied to the outlook for the price of gold, and to a much lesser extent to the price of copper.

As we can see, Barrick’s free cash flow expectations are positive with gold prices as low as $1,200/ounce, and it doubles if prices will go to $2,000/ounce. Personally, I think that gold prices will start to move up significantly sometime next year, and the average price between now and 2026 will be much higher than $2,000/ounce. Barrick stock should move up accordingly as higher gold prices will have an exponential impact on profitability, free cash flow, debt reduction, dividends, and other aspects of Barrick’s financial particulars.

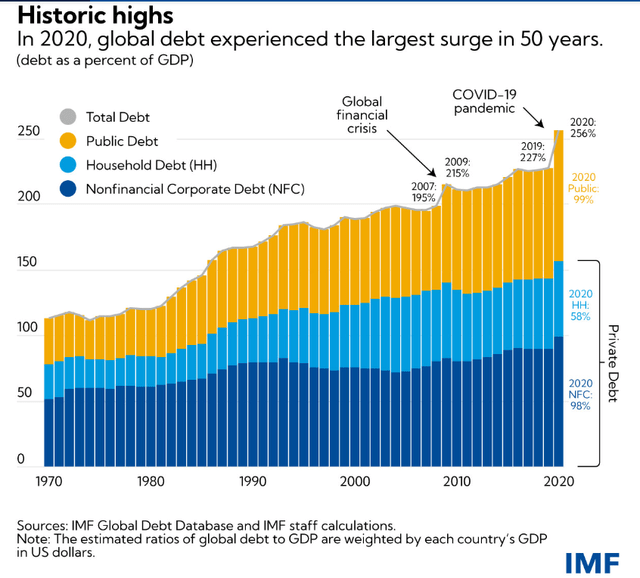

Rising interest rates can be detrimental to the global fiat financial system, as well as negatively impacting the financial performance of most companies, leading to investors flocking to gold as a safe haven. As I pointed out in a recent article, the current trend in interest rates rising higher has the potential, in conjunction with persistently high inflation rates to derail the global fiat financial system. Long story short, the world’s total debt/GDP is about two and a half times higher than it was in the early 1980s.

We managed to increase our debt-carrying capacity as a percentage of GDP through steadily declining interest rates in the last four decades. As interest rates are now headed higher, our debt-carrying capacity is set to shrink. As a side-note, given the recent Q2 GDP numbers, showing an official recession, there are investors assuming that interest rates will stop rising. I am personally skeptical of the viability of this argument, even though it tends to be what happens when there is an economic slowdown.

The reason why interest rates are not about to return to a long-term declining trend is that inflation is not likely to do so either. Some temporary relief from inflation growth may occur, when oil & gas prices retreat, along with other commodities prices. An economic slowdown, in part triggered by rising interest rates, may help in that regard. On the other side of the equation, we have a serious case of commodities scarcity, which even if there will be some demand destruction going forward, it will not be enough to provide long-term relief from the scarcity issue. In addition, we have the rising tide of global geopolitical friction which is causing more and more disruptions to the global supply chains. All of this spells global scarcity, therefore inflation, combined with low economic growth rates. These factors put together amount to stagflation for the foreseeable future.

Governments will be tempted to fight low economic growth with more spending. So even as interest rates may rise, central banks around the world will continue to keep an expanded balance sheet policy. The ECB policy of continued support for heavily indebted sovereigns such as Italy, even as it timidly started raising rates, pretty much sums up the overall fiscal and monetary trajectory of much of the developed world. Another developing trend is a renewed round of bailouts. EU energy companies are being nationalized, with petrochemical, steel, and other industries probably set to follow perhaps as soon as the coming winter. All this means higher deficits as the EU economy in particular will have to nationalize growing private sector losses in order to keep them from collapsing altogether. Of course, this is just a temporary fix, meant to shift debts and ongoing losses onto the entity that has the most capacity to carry growing loads of debt. At some point, that too will cease to work, which is when we will probably start to see serious cracks in the global fiat financial system emerging.

It may take a while before the damage to the system will become more obvious, at which point investors will likely find renewed interest in increasing their gold asset holdings as a hedge against fiat calamity, even as interest rates will continue to linger at higher levels. Until then it will be rough going for gold prices perhaps for a little while longer. We may even see it break below $1,700/ounce very briefly, perhaps this year or next.

Investment implications.

While the market is driving down gold prices, based on the execution of the same playbooks we have been used to over past economic cycles, I dare say that this time it is really different. It is very obviously different when the US Federal Reserve is raising interest rates into a recession when at this stage, where an official recession has been confirmed, it tends to shift into monetary easing mode. The global supply side situation is such that a stagnated economy, as well as higher interest rates, will have a rather limited effect on inflation. Central banks are stuck in an impossible situation, where any monetary easing will lead to inflation as more money will chase scarce products while raising interest rates will likely cause the global fiat system significant difficulties. Either way, it is a positive situation for gold.

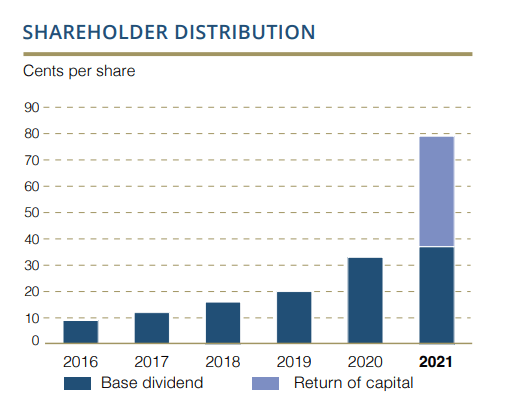

Barrick is a profitable producer of gold. While gold does not pay dividends, Barrick as a miner of gold does, which makes it a nice bonus, in addition to what I perceive as a mostly positive outlook for its stock price.

Barrick Gold

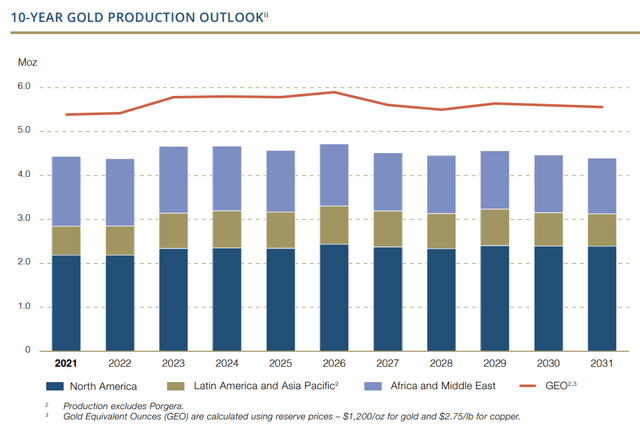

Gold production is set to be more or less steady, even within assumed gold and copper prices that are far below current levels, based on Barrick’s own forecast.

Given the long-term production outlook, which looks to be stable, the main question in regards to where Barrick stock is headed is mostly connected to the long-term outlook for gold prices. In this regard, as I pointed out in a recent article, the way I see it, the long-term support level is based on the price needs of miners to produce those marginal ounces. I see that price level as being somewhere in the $1,500/ounce range, which is a price floor that can be breached by the market but only for a limited period of time.

The upside potential for gold prices is practically limitless. Within this context, Barrick stock at current levels presents an investment opportunity with somewhat limited downside risk, while there is no telling how high it can go, in correlation with gold prices. If I am correct about the dismal outlook for the global fiat-based financial system, which will be reflected accordingly in a flight to the safety that gold offers, Barrick stock is currently a bargain that should not be missed as a long-term investment opportunity in my view. I recently bought some more shares. If the price of gold goes below $1,700 taking Barrick stock further down with it, I am prepared to add more to my already existing position.

Be the first to comment