IvelinRadkov/iStock via Getty Images

As I recently covered Carvana Co. (NYSE:CVNA), see (Cracking The Code (Part 1) and (Cracking The Code (Part 2 – The Contrarian Bull Case), unless there is some material news, between now and when Carvana Co. reports its Q2 FY 2022 results, this will be my last note until then.

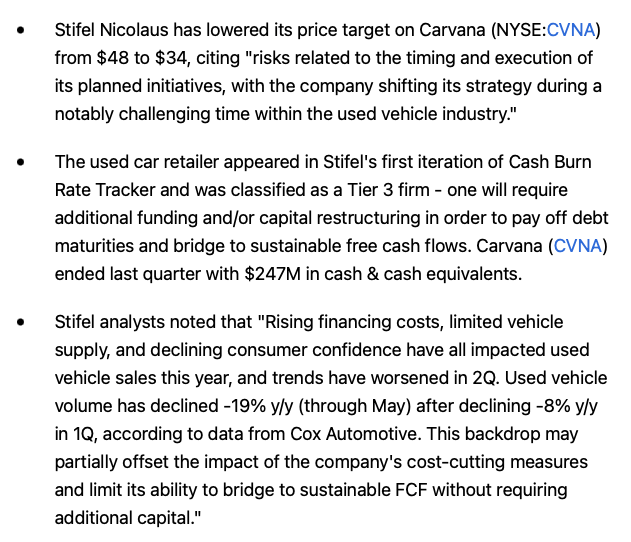

The reason for today’s short note is to question the timing and rationale for Stifel Nicolaus’ June 28, 2922 research note and firm’s lowered priced target (from $48 to $34) on Carvana. Per Seeking Alpha’s excellent news coverage, they shared direct quoted material from Stifel’s Carvana update.

In today’s piece, I want to address the rationale and odd timing.

On May 13, 2022, Carvana issued a detailed new investor deck, entitled Update On Carvana, Operating Plan May 2022. This deck is 50 pages and very granular. Then on June 7, 2022, Carvana presented at William Blair’s Growth Stock Conference. This thirty minute presentation, consisting of 22 minutes of Ernie Garcia III discussing the business and 8 minutes of Q&A between Sharon Zackria and Garcia. Outside of these two communications from Carvana, there haven’t been any other material updates by the company.

However, since then, arguably the most important and current piece of high frequency data, for the sell side and entire investment world to synthesize, occurred last Friday, June 24th, when CarMax, Inc. (KMX) reported its Q1 FY 2023 earnings results and hosted its conference call. Moreover, I want to make clear that the selective data points cited in yesterday’s note from Stifel, notably the monthly Cox Automotive article and data, was published on June 14, 2022. So it seems a little curious, at least to me, that Stifel decided to put a negative note out, on June 28, 2022, two weeks after Cox Automotive’s monthly update was published, and after Carvana shares trade north of $30 and on big volume, last week.

Enclosed below is an update from Seeking Alpha’s breaking news coverage.

Seeking Alpha

The Cash Burn Fears

The primary argument is cash burn and liquidity fears.

On April 26, 2022, Carvana successfully completed a $1.25 billion secondary equity offering, by issuing 15.625 million shares at $80 per share. So net of banking fees, let’s call it roughly $1.2 billion of new equity capital. A few days later, Carvana successfully raised $3.275 billion, albeit more expensively than hoped for, in the form of 10.25% 2030 Senior Unsecured notes. So again, net of banking fees, let’s call it $3.2 billion. So that is $4.4 billion of new capital, which is in addition to the $247 million of cash on its balance sheet, as of March 31, 2022. The ADESA merger was $2.2 billion and completed on May 10, 2022. So, pro-forma cash is $4.65 billion – $2.2 billion (ADESA) or $2.45 billion as of mid May 2022.

No question, Carvana’s management team was caught off guard and the company posted a really bad Q1 FY 2022 earnings report. As management explained on its April 20, 2022 Q1 FY 2022 conference call, within its May 13, 2022 updated investor deck, and again, on June 7, 2022, at the William Blair Growth conference, February tends to be a pivotal point associated with tax refund season and they were planning for much higher retail units. Moreover, a confluence of negative events/shocks impacted the quarter. These series of events dramatically slowed network velocity in CVNA’s IRCs and logistics networks, ultimately resulting in the company carrying much higher SG&A capacity, which drove the really poor Q1 FY 2022 quarter.

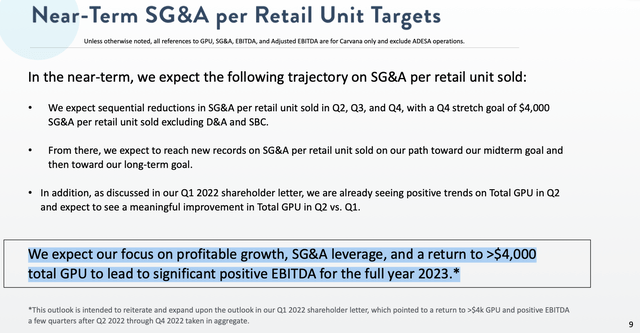

However, as of June 7, 2022, at the William Blair conference, Carvana’s management said the following:

We expect to focus on profitable growth, SG&A leverage, and a return to >$4,000 total GPU to lead to significant positive EBITDA for year 2023*.

Per the fine point of the asterisk:

This outlook is intended to reiterate and expand upon the outlook in our Q1 2022 shareholder letter, which pointed to a return to >$4k GPU and positive EBITDA a few quarters after Q2 through Q4 2022 taken in aggregate.

William Blair June 7, 2022 Growth Conference

So given management’s update from June 7, 2022, and pro-forma cash of $2.45 billion it seems a little odd to be raising the cash burn/liquidity fears before Carvana has reported it Q2 FY 2022 results and provided an update on its outlook for the remainder of FY 2022.

Next, let’s address Stifel’s other bearish arguments.

“Rising financing costs, limited vehicle supply, and declining consumer confidence have all impacted used vehicle sales this year, and trends have worsened in 2Q.” – Stifel Nicolaus (June 28, 2022)

No question interest rates have gone up a lot, and we all know the majority of used vehicle buyers need some form of financing to be able to purchase a used vehicle. And we all know that rising prices, driven by very low OEM production from semi-conductor shortages is the biggest factor in the sharply higher used car prices and this in turn lowers affordability for consumers. So, of course, when the interest rates rise then used vehicle financing is more expensive, which translates into higher monthly payments, which in turn reduces the pool of potential buyers. This is well known and widely understood. I’m not sure this is any new incremental information, on this front, as of June 28, 2022. That said, I will concede this point.

Next, let’s address ‘limited vehicle supply, and ‘declining consumer confidence’ arguments. The best way to address these bearish arguments is synthesize CarMax’s June 24, 2022 Q1 FY 2023 conference call. As I’m sure readers are well aware, as of calendar year 2021, CarMax is the nation’s largest retail used vehicle seller and Carvana is second. So although it is fine to look at the broad and aggregated, the Cox Automotive data, again, CarMax is the largest player in the space, and yet only has 4% market share.

Enclosed below is quoted material, and my brief explanation of what it means, from CarMax’s June 24, 2022 Q1 FY 2023 conference call.

Exhibit A – March 2022 was tough as lapping the stimulus was tricky, but by May 2022, as comps were only down low single-digits.

Note the sequential improvement in comps from March (down double digits) to May 2022 (down low single digits). This is a very positive and real time data point.

Our performance was driven by the same macro factors that led to a market-wide decline in used auto sales during the quarter, including lapping material stimulus benefits paid in the prior year, widespread inflationary pressures including challenges to vehicle affordability and lower consumer confidence. We began the first quarter with a double-digit decline in comp sales during March, continuing the fourth quarter performance we discussed on our last earnings call. Comps then improved sequentially with May ending in a low single-digit decline.

Exhibit B – GPU was solid and CarMax bought more cars directly from consumers in Q1 FY 2023 compared to Q1 FY 2022.

Also, please note, CarMax retains its loans on its balance sheet, so its GPU metrics exclude the financing piece whereas Carvana (CVNA) securitizes and sells its loans to third parties.

We reported first quarter retail gross profit per used unit of $2,339, up $134 per unit versus the prior year period. We continue to focus on striking the right balance between covering cost increases, maintaining margin and passing along efficiencies to consumers to support vehicle affordability. Wholesale units were up 2.7% versus the first quarter last year, despite a calendar shift, which negatively impacted auction volume compared with the prior year. Wholesale volume was also pressured by our decision to reallocate some older vehicles from wholesale to retail to meet consumer demand for lower price vehicles. We estimate that without these two factors, our wholesale unit growth would have been above 10%.

Wholesale gross profit per unit was $1,029 in line with $1,025 a year ago. We are pleased that we continue to drive wholesale unit growth, even as we lapped last year’s nationwide launch of our instant online appraisal offering on carmax.com and in the face of the industry-wide decline in used sales. We believe our wholesale business provides an incremental growth lever and is a valuable component of our diversified business model.

Exhibit C – CarMax bought 345,000 vehicles directly from consumers (up 3% versus last year’s record).

I find it curious that one of Stifel’s core bearish arguments is lack of vehicle supply, yet when CarMax, the nation’s largest retail used vehicle operator, just told the market they bought 3% more vehicles during Q1 FY 2023 compared to Q1 FY 2022 and Q1 FY 2022 was a record.

We bought approximately 362,000 vehicles from consumers and dealers during the first quarter, up 6% versus last year’s period. We continue to be the nation’s largest buyer of vehicles from consumers purchasing approximately 345,000 cars in the quarter, up 3% versus last year’s record results. This enabled our self-sufficiency to remain above 70% during the quarter. We also sourced approximately 17,000 vehicles through our Max offer, our digital appraisal product for dealers that we mentioned during our last call. This is up 183% versus last year’s period. As a reminder, buying directly from consumers and dealers lowers our acquisition cost, enhances our inventory selection and provides profitable incremental wholesale volume.

Exhibit D – Consumer Demand Is Still There Despite the Scary Macro Headlines

Per the CEO of CarMax, Bill Nash, consumer demand is still out there.

Yes, Brian, look, I think overall the consumers absolutely a little softer, just because of all the things I’ve talked about it. I think it’s hard to quantify if you think about lapping over stimulus, vehicle affordability, the general inflationary pressures, rising interest rates. If you think about those, it’s hard to quantify the impact of each one. Now, I would tell you the further we’ve gotten from lapping the stimulus, obviously, the better we performed as I noted in my opening remarks, we got sequentially better on comps throughout the quarter, which is encouraging, but that being said, I think the consumer softer, but there is still some demand out there and I think that’s what we’re trying to really maximize on and we’re taking several steps to take advantage of that. It’s one of the reasons why we’re — we continue to take efficiencies and pass what we can along to consumers to make the vehicle a bit more affordable.

Exhibit E – Per the WSJ, as of mid-June 2022, used car inventories are now down just 11% compared to 2019.

Incidentally, speaking of citing Cox Automotive data, there was a WSJ article: Used-Car Sellers Not Running Out of Gas Just Yet, written by Jinjoo Lee and published on June 24, 2022 at 3:55pm.

Within this WSJ piece, note the sentence that ‘used-vehicle inventory has recovered and is only down 11% compared to 2019, as of mid-June 2022. So the WSJ is analyzing the same Cox Automotive data and suggesting that there isn’t a ‘limited supply of vehicles’.

Certain trends that kept used-car retail business on full throttle are now slowly reversing. New-vehicle inventory remains tight, which is helping keep prices high on both new and used cars. But used-vehicle supply is starting to return to 2019 levels. As of mid-June, new-vehicle inventory was down 70% compared with the same period in 2019, according to Cox Automotive. Used-vehicle inventory has recovered and is down just 11% over the same period. Meanwhile, consumer sentiment about buying conditions for vehicles had plunged to the lowest reading in the history of University of Michigan’s survey in June—even worse than perceptions of the housing market.

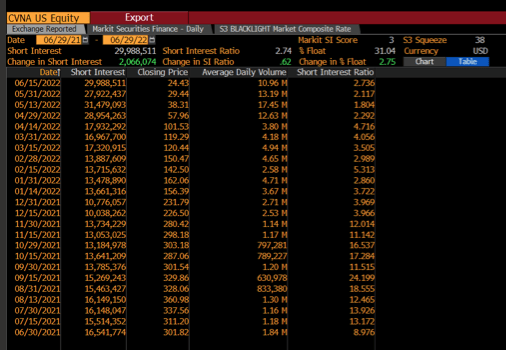

Lastly, as of Monday night, June 27, 2022, the bi-monthly short interest data was reported for the period ending June 15, 2022. As you can see, an incremental 2 million CVNA shares were shorted, over the last two week reported stretch. And I as noted in my first article, Cracking The Code (Part 1), the shorts have been aggressively shorting Carvana, so 13 million net shares shorted during Q2 through June 15, 2022.

Bloomberg

One other important piece of information to consider. Per Bloomberg, when Carvana agreed, in late April 2022, to sell 15.625 million shares, 10.23 million shares, net of the Garcia’s stake, as part of the sale, there was a lock-up on those shares through July 6, 2022. Given the nearly three month lock-up, as often happens, there is a high likelihood that those shares were arbitraged and hedged, as market participants could have shorted the same amount of shares they bought, in the deal, and simply captured the underwriters’ then discount to the then market trading price, as there was plenty of liquidity to lock in the arbitrage profit. Therefore, if you are a really savvy market participant, and in the weeds here, there is a good chance that this hedge, tied to arbitraging this second offering, unwinds soon and the secondary arbitrage players will simply take off this trade and move onto greener pastures and new secondary arbitrage opportunities.

Putting It All Together

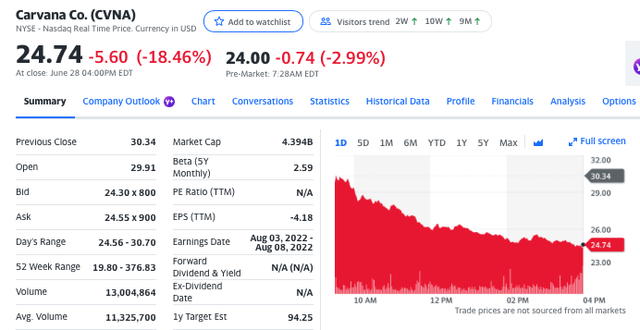

Yesterday, shares of Carvana Co. were down 18.5%. As luck would have it, at least for the shorts, the negative Stifel note was issued on a day where the Nasdaq plunged 3%.

Yahoo Finance

However, as I share in my piece today, there was nothing new in yesterday’s Stifel note. And as I argued, the best and more relevant piece of high frequency data, outside of an update from Carvana, and I don’t think we will get one until the company reports its Q2 FY 2022 results, is the CarMax’s June 24, 2022 earnings results and conference call.

As I discussed and cited, CarMax said comps got sequentially better throughout the quarter (from down double digits in March 2022 to down low single digits by May 2022), they bought 3% more cars directly from consumers despite lapping a record in the Q1 FY 2022 quarter, and said consumer demand is still there despite all of the macro headwinds and scary headlines rattling about in the financial press.

Lastly, Carvana is a battleground stock. The public is out for blood as I read the most hyperbolic comments within the commentary streams of any Carvana articles or news releases. Unfortunately, groupthink becomes too intoxicating for far too many people and that drives sentiment, both bullish or in this case bearishly. Therefore, as I see real value in the business and a strong contrarian bullish case, notably at $25 per share (or better), I am happy to play the highly unpopular role of barrister, like when John Adams defended British soldiers in 1770. A person’s mind has to be sound, and a fierce ability to think independently and clearly is required when you are arguing in front of a mob, in this case the Carvana shorts.

Be the first to comment