onurdongel

Midstream partnerships have long been one of the most popular investments for those that seek income. This makes a lot of sense, as these companies typically enjoy incredibly stable cash flow and boast high dividend yields. They are far from perfect, however. For starters, it can be very difficult to include partnerships into a tax-advantaged account like an IRA or 401k. In addition, it can be difficult to put together a diversified portfolio of these companies without having access to a considerable amount of capital.

One solution to both of these problems is to invest in a closed-end fund (“CEF”) that specializes in investing in these partnerships. These funds offer investors easy access to a professionally-managed portfolio that can in most cases deliver a higher yield than any of the underlying stocks possess.

In this article, we will discuss one of these funds, the First Trust Energy Income & Growth Fund (NYSE:FEN). The fund boasts an 8.07% yield at the current price, which is a little above the index. I have discussed this fund before but more than a year has passed since that time so obviously, a great many things have changed. This article will therefore focus specifically on these changes and provide an updated analysis of the fund’s finances in an attempt to determine if a purchase today might make sense.

About The Fund

According to the fund’s webpage, the First Trust Energy Income and Growth Fund has the stated objective of providing investors with a high level of after-tax total return. This is hardly surprising for an equity fund since equities are at their core a total return instrument. After all, when we buy equity, we are usually looking for both dividend income and capital gains. The fund does specifically state that it intends to deliver much of its total return in the form of current income, though. This is likewise not particularly surprising since master limited partnerships also deliver the majority of their investment return in the form of direct payments to investors.

Curiously, the fund does not specifically state whether it invests solely in common equities or can also include preferred stocks or other fixed-income securities. Instead, it states that it will purchase cash-generating securities of energy companies, which in theory could include both common equity and fixed-income assets as long as they are issued by an energy company. This could be nice since fixed-income securities tend to be somewhat safer than common equity as they are much less affected by the actual performance of the underlying company. In many cases, preferred equity can also deliver higher yields than common equity but this is not always true with master limited partnerships. The inclusion of these securities could still help the fund reduce its overall volatility without hurting its income too much though, so this provided description is somewhat appealing.

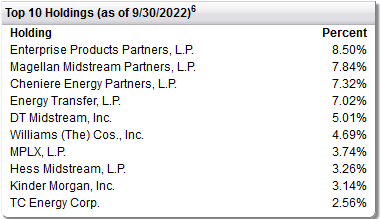

As my long-time readers likely know, I have devoted a considerable amount of time and effort over the years to discussing midstream companies here at Seeking Alpha. As such, the majority of the fund’s largest holdings will likely be familiar. Here they are:

First Trust

I have published articles about all of these companies except for Cheniere Energy Partners (CQP) and Hess Midstream (HESM) over the past few years. In most cases, I have discussed the companies very extensively through a series of articles. Cheniere Energy Partners is very similar to Cheniere Energy (LNG), which I have discussed, however. The only difference is that Cheniere Energy Partners owns the Sabine Pass liquefaction plant while the parent owns a substantial stake in Cheniere Energy Partners and the remainder of the company’s plants and other operations. Thus, it is basically just a subset of Cheniere Energy with essentially the same fundamentals. Hess Midstream is a drop-down partnership that was started by Hess Corporation (HES) as a way to get back the money that it spends constructing midstream infrastructure while still retaining a significant amount of the cash flow generated by it. This is a very common strategy for energy companies.

There have been a number of changes since the last time that we looked at the fund. Aside from some changes in the weightings, Sempra (SRE), AltaGas (OTCPK:ATGFF), Public Service Enterprise Group (PEG), ONEOK (OKE), and Enbridge (ENB) have been replaced by Energy Transfer (ET), DT Midstream (DTM), MPLX (MPLX), Hess Midstream, and Kinder Morgan (KMI). I cannot say that all of these are bad changes. In particular, pretty much any of the new additions have somewhat greater growth prospects than Public Service Enterprise Group. MPLX has been one of the best companies in the entire midstream sector for a number of years and I still have a hard time believing that it was not assigned a high weighting in the fund a year ago.

The fact that so many of the fund’s positions have changed over the past year may lead one to believe that it has a very high turnover rate. This is not inaccurate, although the fund’s 81.00% annual turnover is the middle of the road for an equity fund. The reason why a high turnover can be a concern is that it costs money to trade stocks or other assets, which is billed to the investors in the fund. This creates a drag on performance that management must work to overcome and still deliver a return that investors find acceptable. Most managers cannot do this, which is one reason why index funds have become so popular. Their lack of much in the way of trading and minimal expenses tend to result in higher returns for investors all else being equal. This does not necessarily mean that a fund with a high turnover with underperform of course, but it does make things more difficult for management.

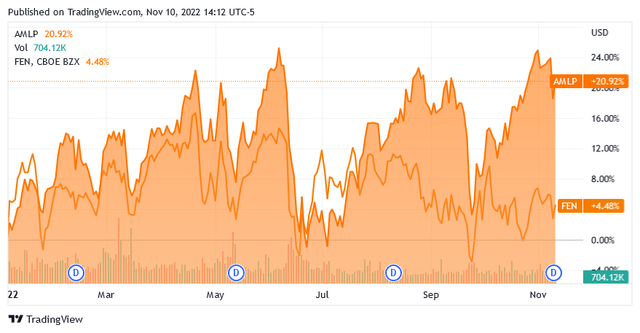

Unfortunately, this fund has failed to outperform the index. As of the time of writing, the First Trust Energy Income & Growth Fund is up 4.48% year-to-date, which is substantially less than the 20.92% gain of the ALPS MLP Index (AMLP):

With that said, both of these investments have greatly outperformed the S&P 500 index (SPY), which is down by quite a bit year-to-date. This further proves my point that this underappreciated sector has been one of the few bright spots in the market this year. The First Trust does have a higher yield by the index, but this is not nearly enough to close the difference between the two assets.

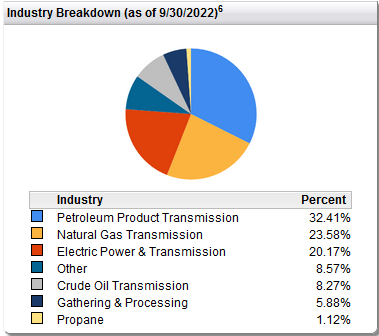

The First Trust does invest in a vastly larger pool of assets than the index, however, which could account for some of the difference. In fact, about 20.17% of the fund’s assets are invested in electric utilities:

First Trust

There are many market participants that believe that electrification will cause electric utilities to greatly outperform traditional energy companies going forward. This belief is based on the idea that electricity will soon render fossil fuels obsolete. While I have disproven this thesis numerous times in the past, there are still some reasons to like the exposure to electric utilities. These companies tend to enjoy very stable cash flows and pay out increasing dividends every year. Midstream companies typically have much higher yields but they do not increase their distributions nearly as frequently. Thus, electric utilities can offer a certain amount of inflation protection that midstream firms lack. This is something that could be useful in today’s economic environment.

Distribution Analysis

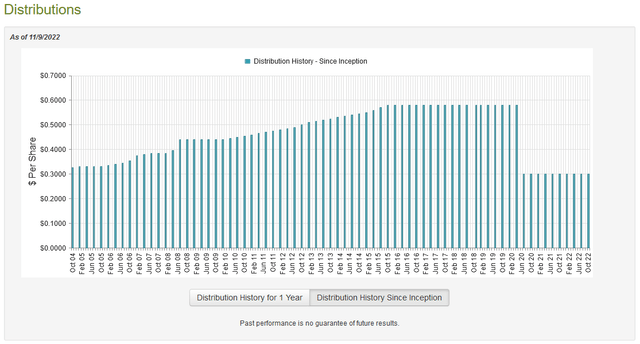

As stated earlier in this article, the First Trust Energy Income & Growth Fund has the stated objective of providing investors with a high level of after-tax total return. However, it aims to deliver most of its returns in the form of distributions paid directly to the investors. In addition, master limited partnerships, which compromise most of the portfolio, tend to have very high distribution yields. As such, we can assume that the fund likely boasts a very high yield itself. This is indeed the case as the First Trust Energy Income & Growth Fund pays out a quarterly distribution of $0.30 per share ($1.20 per share annually), which gives it an 8.07% yield at the current price. Unfortunately, the fund has not been particularly reliable in its distribution in the past:

As we can see, the fund generally grew its distribution over time until it slashed it severely when the pandemic broke out. The distribution has remained at comparatively low levels since then. It is not really surprising that the fund had to cut back in 2020 as most midstream funds also were forced to cut their distributions. This is because the unit prices of many of these firms fell severely along with energy prices and several partnerships cut their payouts in order to conserve capital in that uncertain environment. While there have been a few companies that have begun to increase their distributions again now that energy prices are stronger, the majority of them have not so it makes sense that the fund has still not boosted its distribution. With that said, anyone buying today will receive the current distribution and current yield so the fund’s somewhat disappointing past is not something that most of us need to worry about. The important thing is how well the fund can maintain its current distribution. After all, we do not want to be the victims of another cut since that would certainly cause the share price to decline and result in a reduction in our incomes.

Unfortunately, we do not have an especially recent report to consult for the purpose of analyzing the fund’s finances. The most recent financial report corresponds to the six-month period ending May 31, 2022. As such, it will include no information about how well the fund performed over the past few months, which generally saw energy prices declining from their previous peak in June. However, the first few months of the year were incredibly strong for energy companies, and this report should give us some insight into how well the fund was able to take advantage of that environment.

During the six-month period, the First Trust Energy Income & Growth Fund received a total of $3,316,211 in dividends and $61 in interest from the assets in its portfolio. This gives the fund a total income of $3,316,272 during the period but it is important to remember that distributions from partnerships are not considered income for this purpose. As this accounts for a huge part of the money that comes into the fund, we will need to add that back in when determining the sustainability of the distribution. As this fund’s financial report does not state exactly how much it received from these sources, we will look at the fund’s total change in assets under management in a bit. The fund’s reported income was not enough to cover its investments and it actually reported a net investment loss of $1,848,297 during the period. Although that does not exactly bode well for the fund’s ability to sustain its distribution, it is far from its only source of income, as just stated.

As the first few months of the year were a period of incredible strength for the energy industry, we might expect that the fund would deliver substantial capital gains. That is in fact the case as it had net realized gains of $18,708,384 and another $48,296,913 net unrealized gains. That was more than enough to cover the $11,670,883 that the fund paid out in distributions. In some cases, distributions received from partnerships are not considered capital gains, either. Overall, the fund’s net assets increased by $53,594,762 after accounting for all money coming in and all money going out. That should provide a lot of comforts that the fund can easily afford the distribution that it is actually paying. Everything seems to be perfectly fine here.

Valuation

It is always critical that we do not overpay for any asset in our portfolios. This is because overpaying for any asset is a surefire way to generate a suboptimal return on that asset. In the case of a closed-end fund like the First Trust Energy Income & Growth Fund, the usual way to value it is by looking at the fund’s net asset value. The net asset value is the total current market value of all the fund’s assets minus any outstanding debt. It is therefore the amount that the investors would receive if the fund were immediately shut down and liquidated.

Ideally, we want to buy shares of a fund when we can acquire them at a price that is less than the net asset value. This is because such a scenario implies that we are acquiring the fund’s assets for less than they are actually worth. That is not the case with this fund right now. As of November 9, 2022 (the most recent date for which data is currently available), the fund had a net asset value of $14.96 per share but traded for $15.08 per share. That gives the fund a 0.80% premium to net asset value, which is in line with the 0.78% premium that the shares have averaged over the past year. However, it is still a premium and there are plenty of other midstream funds on the market trading at deep discounts. This price is overall too high and it needs to come down a bit to be interesting.

Conclusion

In conclusion, the midstream sector is a great place for investors to look for income vehicles and the First Trust Energy Income & Growth Fund provides a fairly good way to access a portfolio of these companies all at once. Unfortunately, FEN has underperformed the index by a lot year-to-date and is too expensive at the current price. I might be interested if it started selling for a deep discount though as many of the other things about it look great. The price is too high to recommend FEN today, though.

Be the first to comment