JHVEPhoto

As our followers and readers know, we have been following the proposed buyout of TEGNA Inc. (NYSE:TGNA) by hedge fund Standard General since it was announced. The buyer had stalked this deal for years and we thought that this might be the first of a few acquisitions for Standard General to gain direct exposure to strong, predictable cash flows at attractive multiples. This first acquisition has proven to be quite elusive as regulators have scrutinized the deal far closer than most figured they would.

Up until Friday, the two key hold-ups were the potential for Standard General to raise prices on retransmission fees charged to cable and satellite providers (which would be their right due to assets swaps which would see them take ownership of a Boston station that has higher rates) and the fact that a portion of their financing was coming from Apollo Global Management which owns competitor Cox (and is also a party to the asset swap which has them receiving Texas stations and giving up the Boston station we previously mentioned). Apparently there are worries about collusion with a competitor owning non-voting shares and being a creditor as well as push back over higher prices via retransmission fees being revised higher.

In our article from November 25, 2022 we argued that Standard General should make some concessions and clarify their stance on certain points of contention. We stated:

“While we believe that Standard General can agree to avoid job cuts and not mess with the editors (and by extension the journalism quality), they have failed to dispel the arguments that the Boston transaction is all about forcing higher retransmission rates on to other cable companies. Agreeing to price caps for a few years and to keep headcount stable in the journalism ranks for a few years should solve a number of the deal’s issues, but it appears that Standard General is being coy and trying to avoid tipping its hand with its plans for the impact on the entire business as it relates to the Boston transaction. It seems like a very easy agreement to make, but we do understand the company not wanting to give up the one play it had to increase revenues to help cover additional interest payments.”

So What Happened Friday?

After the close on Friday, 25 minutes to be exact, Standard General issued a press release discussing how they had, “committed to waive certain contractual rights” in order to alleviate inflation concerns for the government. The contractual rights they are alluding to are the retransmission fee increases that they would have been entitled to by swapping assets and taking ownership of the Boston station. We thought that Standard General would agree to this as it is a standard practice and has been utilized as a selling point to regulators in previous media M&A; specifically Comcast’s (CMCSA) acquisition of NBCUniversal.

So What Does This Accomplish?

This is arguably the key question for TEGNA investors. The base price for the takeover is already locked in, and right now the ticking fee is accumulating so investors know what they will get if the transaction closes. The key is getting the transaction closed, and that falls on Standard General’s shoulders as the acquirer. Each concession that Standard General makes is good for shareholders as it increases the likelihood that they receive approval to move forward and the deal closes, and the fact that this is a cash bid (which will result in a private entity) protects shareholders from having to deal with the effects of the concessions later on.

While this concession will hit Standard General in the wallet by limiting their ability to increase revenues and cash flows on day one via price hikes, it does, in our opinion, increase the likelihood of the deal closing, while also putting the ball back into the regulators’ court to either allow the transaction to move forward or come up with another reason that it cannot proceed. Complaining about TEGNA eliminating some jobs upon closing of the deal is not reason enough to block the deal, so the unions can make noise but really cannot extract much.

The risk to the deal as we see it is that the government may pursue blocking the deal on the financing which is coming from a private equity firm – which also happens to own a competitor. That could very well be a deal breaker for the government, which then brings up the question of whether that financing can be replaced by more traditional lenders or restructured where the financing portion is kept in place but TEGNA does not enter into an agreement to swap assets.

How We See It

This transaction is still a high-risk, high-reward transaction but we do think that this latest move forces the government’s hand. With all of the FCC rules already in place to protect the market and consumers, the government might need to let this one go through now (especially since they have already forced some pretty big changes to the transaction and protected both consumers and cable/satellite companies) as they will be focusing a lot of key resources to the Microsoft (MSFT) acquisition of Activision-Blizzard (ATVI).

With Friday’s news, we think that the case for Standard General gaining approval went up. This M&A transaction does not build up a dominate market position, will no longer move prices higher and should see minimal layoffs in the years ahead (compared to M&A between two operating companies merging). While the debt deal does utilize equity, those shares have no voting rights and Apollo will not be able to actively interfere with the ongoing business. If the government kills that portion of the deal, it will force TEGNA and Standard General to revisit the financing to line up new credit lines and figure out what they are going to do about the Texas stations that they previously announced they would be divesting.

Our Final Take

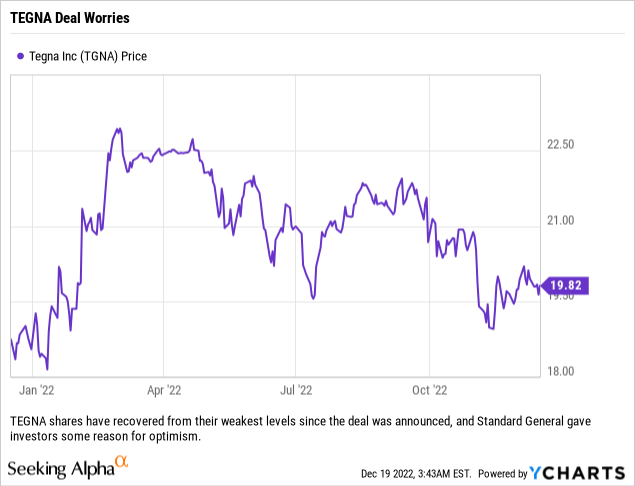

With the deal already richer than $24/share due to the ticking fee, the shareholders have a keen interest in having this deal close, especially with the difference in the current share price to the closing deal price having reached near their largest spread recently. This move by Standard General increases our confidence that a deal does get done, although we must highlight that there are still substantial risks to the deal closing as the government has taken a keen interest due to the parties involved (media assets, private equity fund, hedge fund and unionized employees).

We have increased our odds of this deal closing back up to 70-75% on this news. While good money can be made on this deal if it closes, if it does not then investors need to be happy owning a local news company that trades at a low multiple and will only get cheaper should the deal not close. The trade still works to give investors a little more upside than downside, but with a little over $24/share potentially being received, it leaves little room for error as we think that this name could fall by as much as 20% if the government moves to block the deal. This is why we think TEGNA shares are still a ‘Hold’ although we could not argue with someone interested in establishing a small position at $20/share or below, knowing the risks, and wanting to play the M&A news.

Be the first to comment