hapabapa

Amgen Inc. (NASDAQ:AMGN) is one of the largest pharmaceutical companies in the world, with an almost $150 billion market capitalization. Recently, the company announced that it would acquire Horizon Therapeutics Public Limited Company (HZNP) for almost $28 billion, a large acquisition that will transform its portfolio and potentially help support future returns.

Amgen Horizon Therapeutics Transaction

The company is making a substantial acquisition of Horizon Therapeutics at a cost of almost $28 billion.

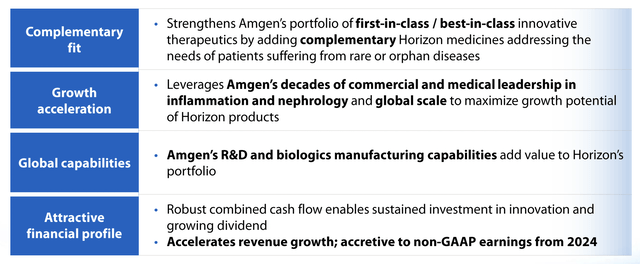

Horizon Therapeutics has a unique portfolio of assets that complements well with Amgen’s assets. The assets are already earning substantial revenue and leveraging well with the company’s existing assets. The company expects its R&D and biologics capabilities will add to its portfolio.

Going forward, the company expects the acquisition to be accretive to non-GAAP earnings from 2024 onwards. That’s impressive for a young pharmaceutical acquisition that is being purchased at a relatively high price. The transaction will still have strong synergies and support future shareholder returns.

Horizon Therapeutics Financial Growth

Horizon Therapeutics itself has an impressive portfolio that will support continued shareholder returns.

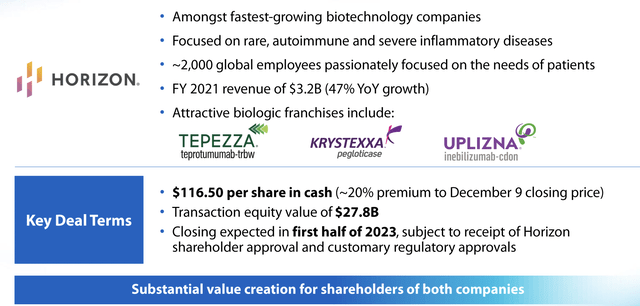

The 20% premium to the closing price of the acquisition comes in at $116.5 per share in cash at a $27.8 billion transaction equity value. The transaction is expected to close in the next 6 months, and Amgen expects that it will result in substantial value creation for shareholders of the two companies. That potential is worth paying close attention to.

Horizon Therapeutics has 2000 global employees with $3.2 billion in revenue. That’s 47% YoY growth in revenue, showing the strength of the portfolio. The acquisition price has been more expensive, however, it’s beneficial to acquire a company with long-term potential. The company has several expanding drugs such as Tepezza, Krystexxa, Uplizna.

Tepezza is expected to see peak sales of more than $4 billion. Krystexxa is expected to hit more than $1.5 billion and Uplizna can be expected to pass $1 billion. The peak sales estimate from these 3 drugs alone is expected to be double the company’s revenue in 2022. That highlights the impressive strength of the portfolio.

Amgen Transaction Financials

Amgen has an impressive portfolio of financials that will support continued shareholder returns.

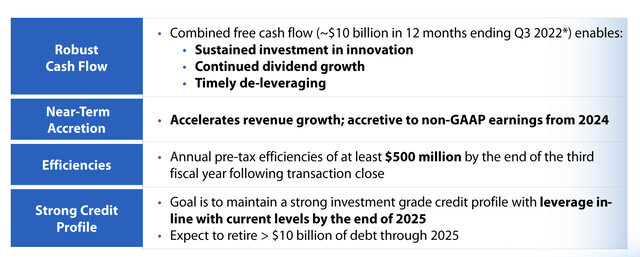

The combined business had $10 billion in trailing 12-month free cash flow (“FCF”), which means a roughly 7% FCF yield. With a more than 3% dividend yield, the company can easily afford continued dividend growth and timely de-leveraging. The company expects to retire >$10 billion in debt through 2025, paying off most of the acquisition by YE 2025.

These financials show the businesses’ strength.

Amgen Biosimilar Growth

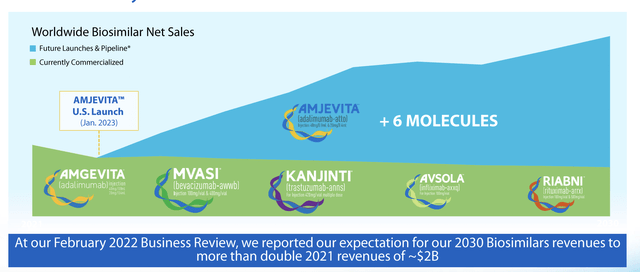

Another exciting part of Amgen’s portfolio, especially with pricing pressures, is the growth of biosimilar.

The company expects, based on its business review, that its 2030 biosimilar revenue will be more than double 2021 revenues. That’s almost 10% of the company’s current revenues, and it can be expected to grow substantially. We expect that this will be a substantial part of the company’s portfolio growth, and without a lot of the same risks as patented molecules.

Amgen Diversification

Amgen is working to aggressively diversify its portfolio, which is incredibly important given the company’s current U.S. concentration.

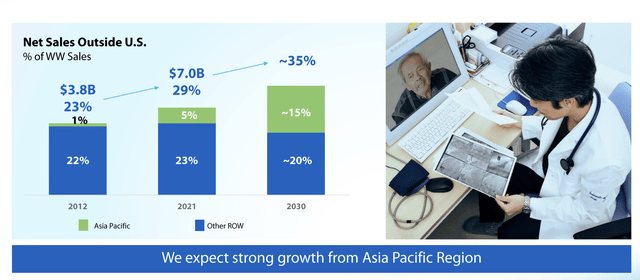

The U.S. is an incredibly concentrated market, and there’s a lot of pressure about, for example, enabling Medicare drug negotiations. We expect, as a result, the U.S. market will provide less revenue. As a result, growing biosimilar drugs and sales outside of the U.S. will become important. Hitting 35% of sales outside of the U.S. by 2030 from 29% currently is important.

Much of this growth will come from Asia Pacific. The company hasn’t yet guided for what the revenue numbers will be by 2030, but its continued diversification here is essential.

Thesis Risk

The largest risk to our thesis is that the biopharmaceutical industry is incredibly expensive. And it’s incredibly high risk. Companies spend billions of dollars on drugs that might not pan out, as evidenced through Amgen spending almost $28 billion on an acquisition that might not pan out. Plenty of other large pharmaceutical acquisitions haven’t panned out.

That’s worth paying close attention to.

Our View

Amgen has a unique portfolio of assets that the company will be able to use with its growing revenue and FCF to generate strong returns. The company’s combined business with Horizon Therapeutics has $10 billion in TTM FCF and that can be expected to continue growing substantially with synergies from the acquisition and revenue growth.

Additionally, Amgen has numerous avenues of its business that can provide substantial returns. That includes the company’s growing biosimilar pipeline along with the company’s international drug business growth. This combination of factors we expect will continue to support the company’s dividend of more than 3% and continued shareholder returns.

Editor’s Note: This article was submitted as part of Seeking Alpha’s Top 2023 Pick competition, which runs through December 25. This competition is open to all users and contributors; click here to find out more and submit your article today!

Be the first to comment