ArLawKa AungTun/iStock via Getty Images

A Quick Take On Usio

Usio (NASDAQ:USIO) reported its Q3 2022 financial results on November 9, 2022, beating expected revenue while missing EPS estimates.

The company provides a range of electronic payment and related data solutions for businesses worldwide.

Given future macroeconomic uncertainties, unproven new customer relationships such as MoviePass, flat revenue trajectory and worsening losses, my outlook on USIO is on Hold.

Usio Overview

San Antonio, Texas-based Usio was founded in 1998 to provide merchants and financial institutions with integrated payment processing and complementary products and services.

The firm is headed by co-founder, President and CEO Louis Hoch, who was previously founder, President and CEO at Billserv and an executive manager at Anderson Consulting.

The company’s primary offerings include:

-

Credit card processing

-

Debit/Prepaid processing

-

ACH processing

-

PayFac API

-

Output Solutions

The firm acquires customers through resellers and via direct sales efforts to prepaid card customers in government and corporations.

Usio’s Market & Competition

According to a 2019 market research report, the global market for payment processing services is expected to reach $62.3 billion by 2024.

This represents a forecast CAGR of 9.9% from 2019 to 2024.

The main drivers for this expected growth are a continued growth in the number of merchants seeking integrated payment processing solutions and the entrance of new market participants with new technology offerings.

Major competitive vendors include:

-

PayPal

-

Global Payments

-

Square

-

Jack Henry & Associates

-

Paysafe Group

-

Naspers Limited

-

Shift4 Payments

-

Others

Usio’s Recent Financial Performance

-

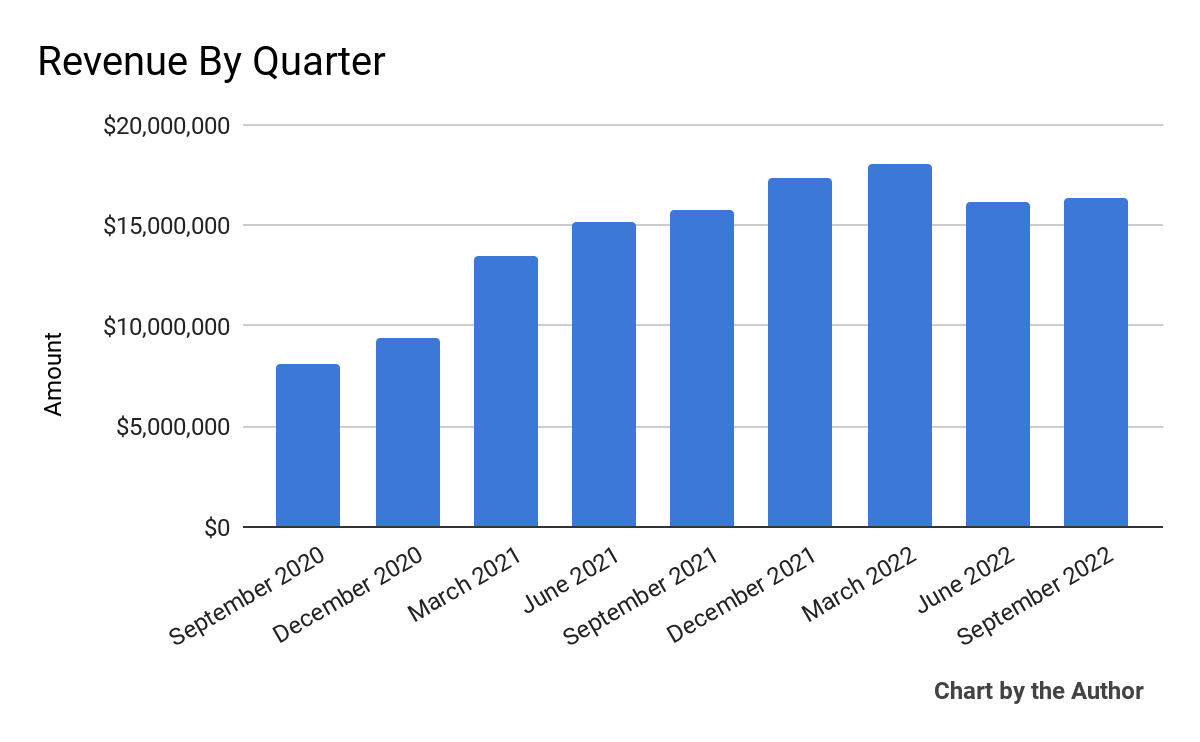

Total revenue by quarter has risen in recent quarters:

9 Quarter Total Revenue (Seeking Alpha)

-

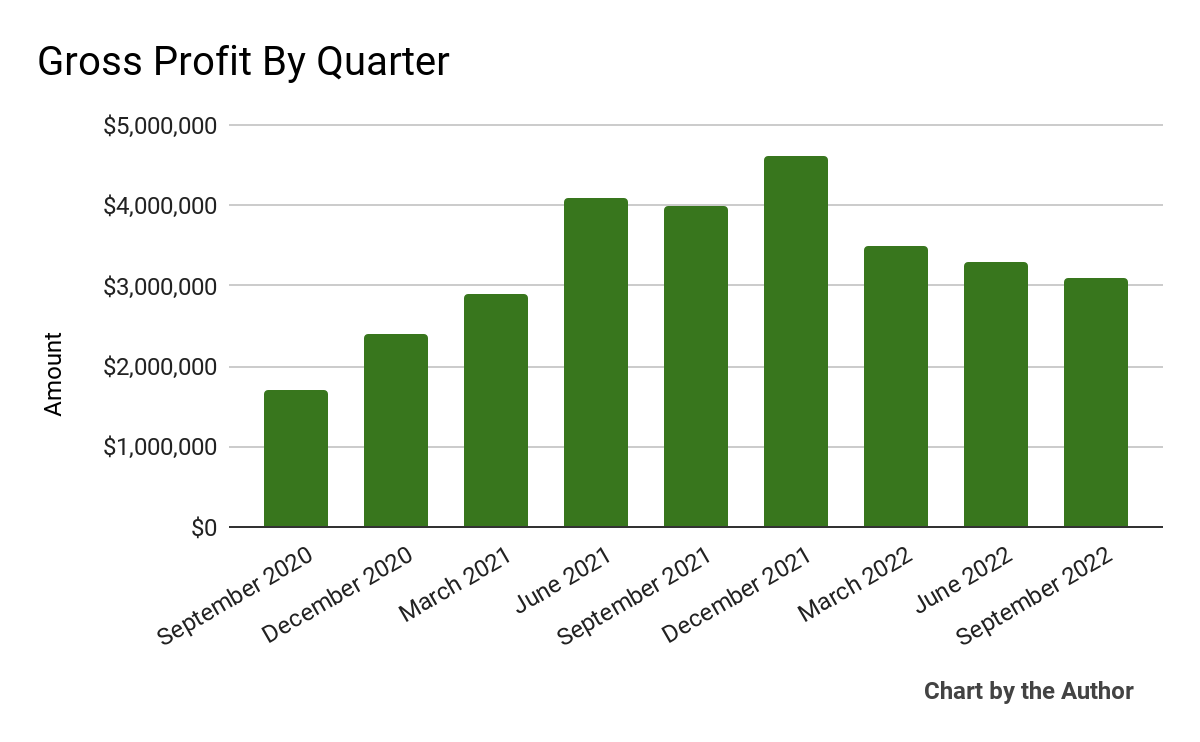

Gross profit by quarter has also grown markedly:

9 Quarter Gross Profit (Seeking Alpha)

-

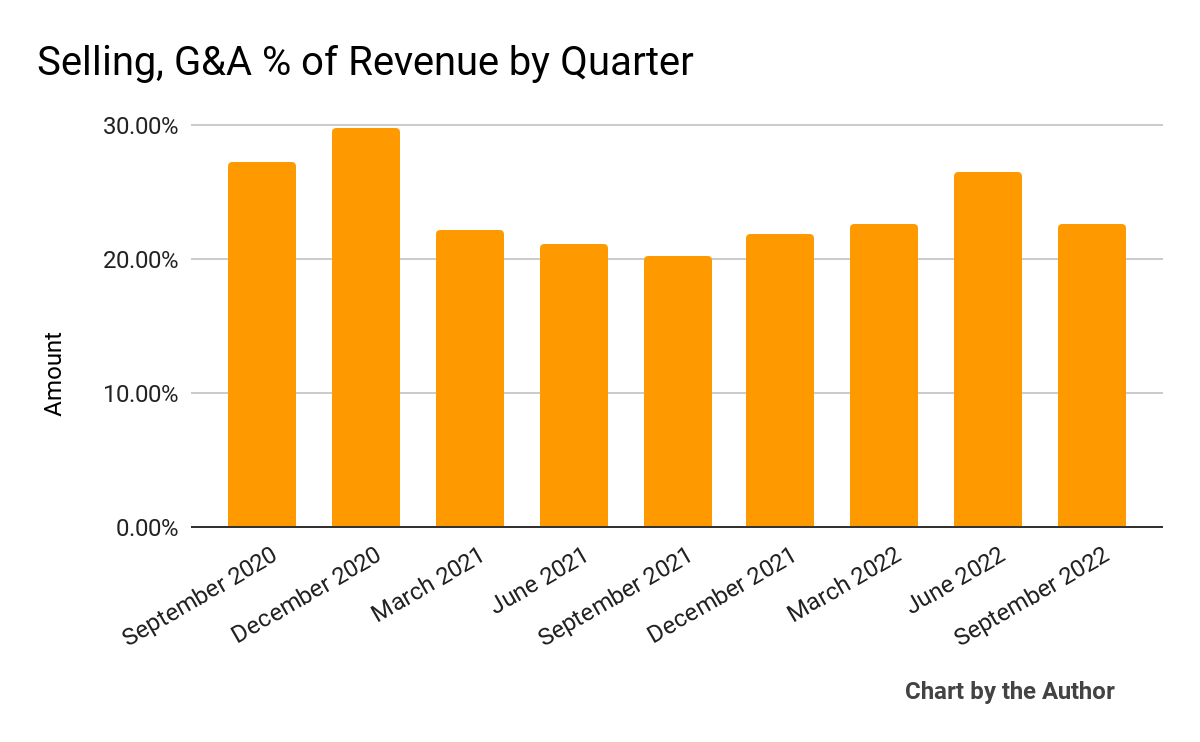

Selling, G&A expenses as a percentage of total revenue by quarter have increased according to the following chart:

9 Quarter Selling, G&A % Of Revenue (Seeking Alpha)

-

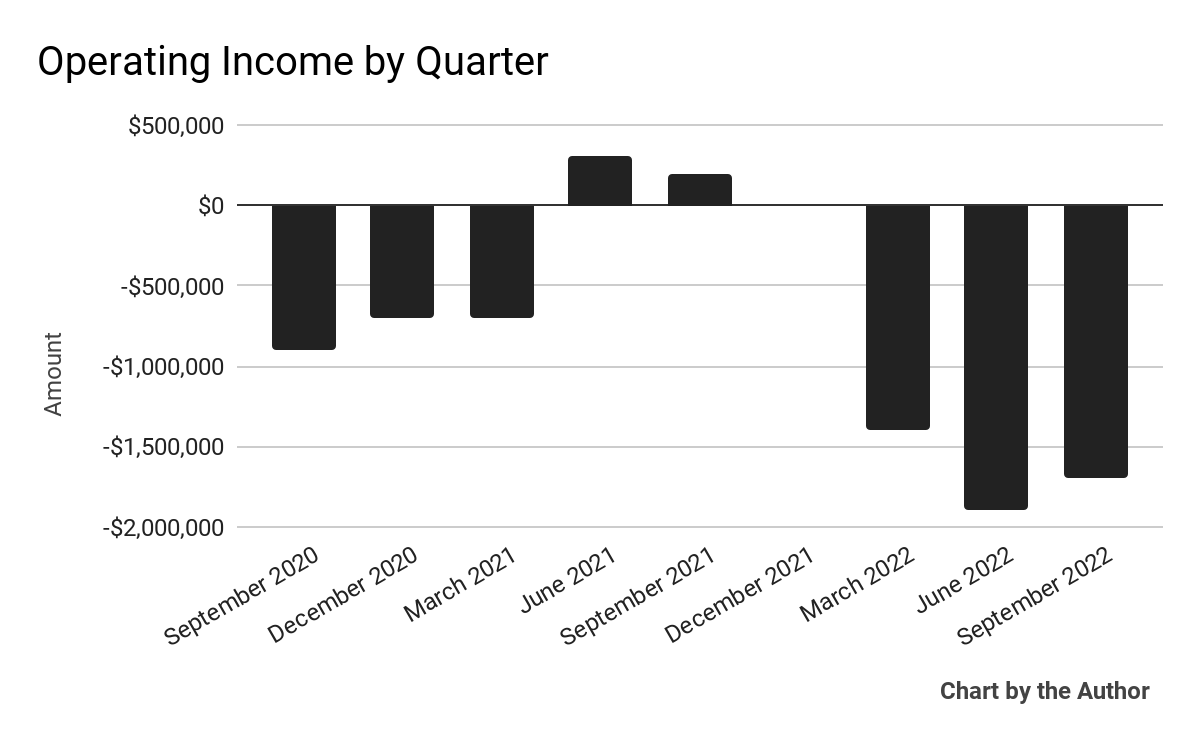

Operating income by quarter has turned well into negative territory in recent quarters:

9 Quarter Operating Income (Seeking Alpha)

-

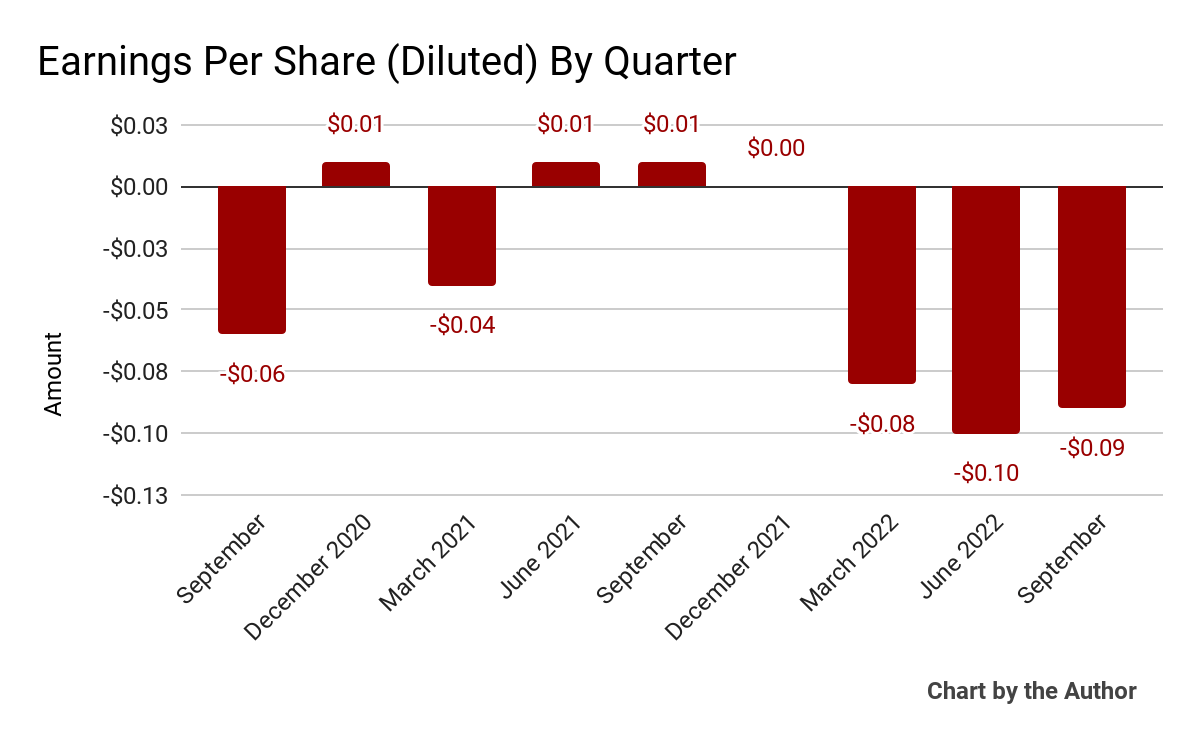

Earnings per share (Diluted) have turned negative in the last two quarters, as the chart shows below:

9 Quarter Earnings Per Share (Seeking Alpha)

(All data in above charts is GAAP)

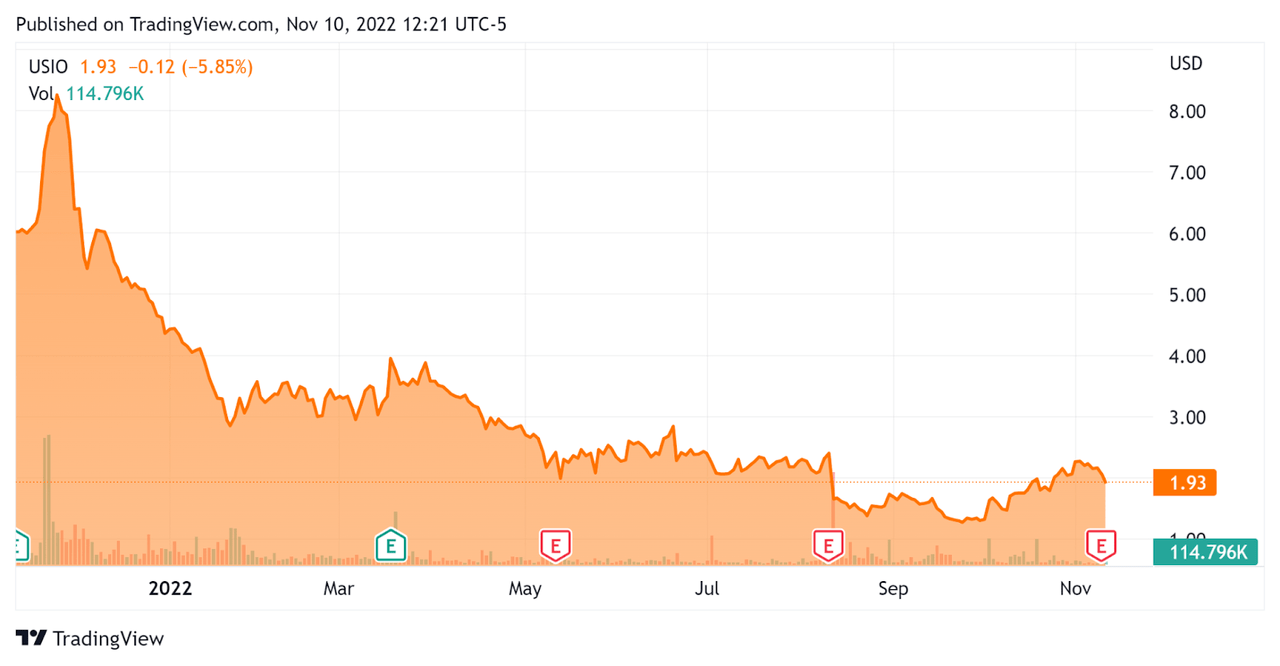

In the past 12 months, USIO’s stock price has fallen 67.6% vs. the U.S. S&P 500 index’ drop of around 15%, as the chart below indicates:

52 Week Stock Price (Seeking Alpha)

Valuation And Other Metrics For Usio

Below is a table of relevant capitalization and valuation figures for the company:

|

Measure [TTM] |

Amount |

|

Enterprise Value/Sales |

0.78 |

|

Revenue Growth Rate |

46.2% |

|

Net Income Margin |

-5.0% |

|

GAAP EBITDA % |

-0.4% |

|

Market Capitalization |

$54,410,000 |

|

Enterprise Value |

$52,610,000 |

|

Operating Cash Flow |

$5,120,000 |

|

Earnings Per Share (Fully Diluted) |

-$0.27 |

(Source – Seeking Alpha)

As a reference, a relevant partial public comparable would be Shift4 Payments (FOUR); shown below is a comparison of their primary valuation metrics:

|

Metric [TTM] |

Shift4 Payments |

Usio |

Variance |

|

Enterprise Value/Sales |

1.87 |

0.78 |

-58.3% |

|

Revenue Growth Rate |

57.4% |

46.2% |

-19.4% |

|

Net Income Margin |

2.0% |

-5.0% |

-354.3% |

|

Operating Cash Flow |

$158,800,000 |

$5,120,000 |

-96.8% |

(Source – Seeking Alpha)

A full comparison of the two companies’ performance metrics may be viewed here.

Commentary On Usio

In its last earnings call (Source – Seeking Alpha), covering Q3 2022’s results, management noted that transaction volumes were ‘down due to the exit from the cryptocurrency market.’

The company’s previous relationship with crypto exchange Voyager ended after the exchange entered bankruptcy proceedings in July 2022.

However, management believes its ACH business, which was most heavily impacted by the exit from the cryptocurrency market, is ‘on the rebound…[as] growth in our high price and high margin return checks remained on a steep trajectory.’

As to its financial results, revenue for the quarter rose only 4% year-over-year, with the firm’s Output Solutions segment growing the fastest at 32% over the prior year due to cross-selling success.

Management did not disclose any retention rate metrics.

Gross profit was lower year-over-year, as was gross margin, due to a shift in product mix away from its high-margin ACH business.

Selling, G&A expenses increased by 30% year-over-year, while operating losses and loss per share worsened substantially over the same quarter in 2021.

For the balance sheet, the company finished the quarter with cash and equivalents of $5.1 million and debt of $0.1 million.

Over the trailing twelve months, free cash flow was $3.9 million, of which capital expenditures accounted for $1.2 million.

Looking ahead, management sees growth potential in its relationship with a relaunched MoviePass, the subscription movie attendance company.

However, recently two former executives, including the CEO, of the previous iteration of MoviePass were indicted by the US Department of Justice for fraud in relation to statements made to previous investors of the predecessor company.

Regarding valuation, the market is currently valuing at an Enterprise Value/Revenue multiple of 0.78x, less than half that of larger competitor Shift4 Payments.

The primary risk to the company’s outlook is slowing macroeconomic conditions leading to reduced payment activity, with many economists predicting a full recession in the U.S. in 2023.

Given future macroeconomic uncertainties, unproven new customer relationships such as MoviePass, flat revenue trajectory and worsening losses, my outlook on USIO is on Hold.

Be the first to comment