Joe Raedle/Getty Images News

FedEx (NYSE:FDX) delivered a quarter with disappointing results that were already pre-announced a week earlier. That preannouncement led the stock to plummet over 20% in a single session. While management blamed the miss primarily due to macroeconomic issues, investors and analysts alike appear to believe that this is a company-specific issue. The analyst call showed a high level of skepticism, and one wonders if the company can achieve its 2025 financial targets set just a few months prior. Still, the stock is trading cheaply at just 10x earnings, offering immense upside if management can right the ship.

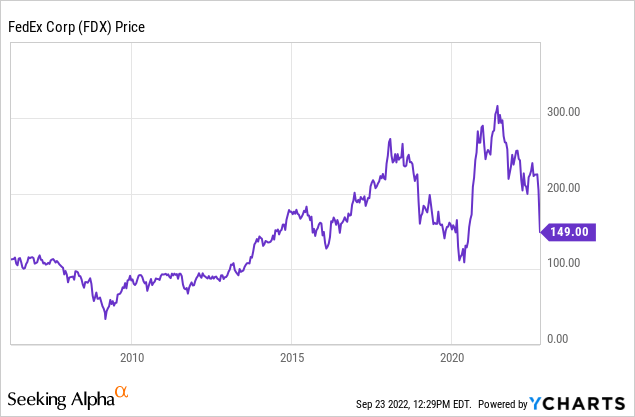

FedEx Stock Price

FDX had previously soared 20% after unveiling ambitious medium-term guidance, highlighted by an outlook for higher free cash flow and a greater commitment to returning capital to shareholders. The stock has since given up all those gains, and more. The stock has now delivered minimal returns (excluding dividends) since 2006.

I last covered FDX in June, where I changed my rating from “avoid” to “buy” on account of the aforementioned optimistic outlook. Was I too early to make that judgment call?

FedEx Key Metrics

This latest quarter saw revenues come in at $23.2 billion, representing 5.5% growth YOY, but operating income declined by 15%. Non-GAAP earnings declined 21.3% to $3.44 per share. The company retracted full-year earnings guidance and guided for the following quarter to see revenues stagnate and for earnings to decline by 47.5% year over year.

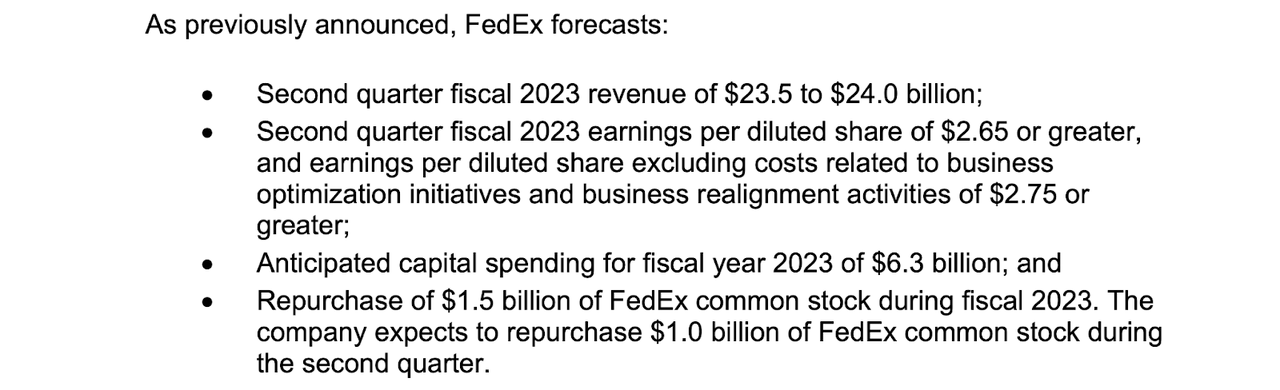

FY23 Q1 Release

Perhaps the only positive was that the company stated its intentions to repurchase $1 billion of stock this quarter, enabling it to take advantage of the depressed stock price. That was unfortunately the only positive.

On the conference call, management chalked up the issues as being mainly due to macro-related weaknesses in volume.

We saw a decline in our volumes during the first quarter, which accelerated in the final weeks. Our softening volumes in Asia and the U.S. were predominantly due to the economy while the shortfall in Europe was both economic and service related. Therefore, we had costs in the system for volumes that didn’t materialize. While we immediately took action, savings from these cost efforts lagged the volume decline due to the scale of our operations. As a result, while revenue was up 6% year-over-year, these dynamics translated to volumes being down year-over-year at all our transportation segments. The volume decline directly impacted our bottom line driving total company adjusted operating income down roughly 18% year-over-year. (highlights from author)

Management stated that in response to the macro-headwinds, the company aims to reduce costs this year by up to $2.7 billion, with about $1 billion of those reductions to be permanent.

Among the planned cost savings initiatives include consolidating sorting facilities in response to the lower volumes. Management reiterated its guidance to reduce costs by $5 billion through 2025, implying another $4 billion of cost savings expected on top of the $1 billion this year.

Is FDX Stock A Buy, Sell, Or Hold?

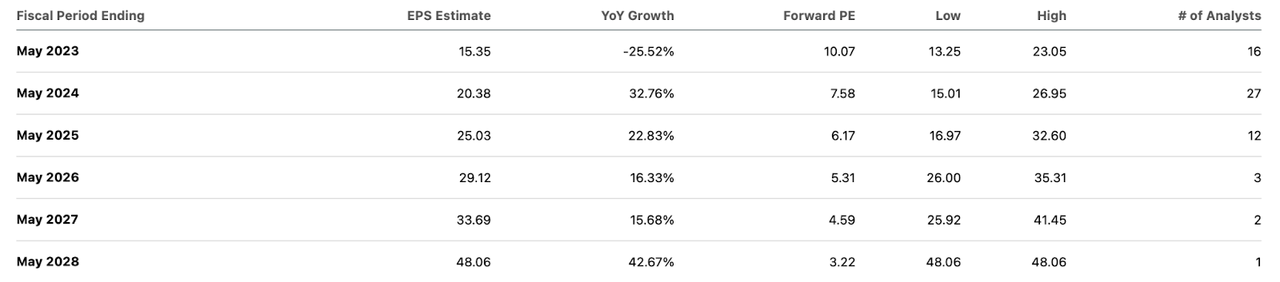

The stock is cheap here at only 10x earnings, and the multiple gets even more crazy when looking several years out.

Seeking Alpha

Unfortunately, valuation is not the main issue as management execution has been called into question.

Analysts were very critical on the call, even suggesting that a new executive team may be in order. I highly recommend prospective investors to look through the latest earnings call, as it was more candid from both ends than typically seen.

Management was asked on the conference call why their peers have not yet called out similar weakness but their response was to reiterate the macro-headwinds and imply that others may eventually see the same weaknesses.

Analysts weren’t convinced and began to more directly imply company-specific issues. Take for instance the following exchange between Brandon Oglenski of Barclays and CEO Subramaniam:

Hey, Raj and team. Thanks for taking my questions. And definitely appreciate the new cost plans, but maybe we are going about this all the wrong way, because there has been plenty of cost improvement plans in the past at this company that just haven’t delivered. So, can I ask a pointed question? Have you done a product review, like what is not working in the last 20 years that’s driving lower profitability in your network relative to your competitor? Is there a certain product or customer or a region that just isn’t working? And I can tell you from the outside looking in, TNT seems to have been an unmitigated disaster here that just has been delivering, because you guys are calling out European losses again. And then from our perspective as well dual Express and Ground pickup and delivery networks, I get it. I know that Express and Ground have different dynamics. However, your asset efficiency is literally half that of your nearest competitor, which is unionized, if I might add. So I guess, why not use this downturn to put more concrete plans in place to exit markets or regions that aren’t working and the $1 billion in permanent costs out, obviously a step in the right direction. But I guess how can you address the deficiencies in the network as you see them? (highlights from author)

CEO Raj Subramaniam replied as follows:

Well, thank you, Brandon. I think we are absolutely fully committed to taking cost levers out. We have talked about that in three buckets: fiscal year ’23, the $2.2 billion to $2.7 billion with – for cost take-out here. We are talking about $4 billion between ’23 and ’25 and then in the Network 2.0 of $2 billion after that. So those are significant numbers. We are confident in these numbers. We have identified domains with targets. We have people who are focusing on run the business and people focused on transform the business. And we are using cutting-edge technology and some of it is already coming on live here. And all of this is in motion as we speak to deliver value as quickly as possible. So we are confident, we are committed, and this is definitely the focus of the entire team.

As far as TNT is concerned, since you asked that question, you got to go back and look at the – a little bit of history here. There is a portfolio gap that we had in Europe that our competition has – has been in Europe since 1974 and it took – it’s a very important business and profitable business for them. We had to fill that portfolio gap. Now has the integration gone exactly the way we thought it would? No, because we had the cyber-attack, we had COVID, we had all kinds of things in the middle. But the integration is now complete, and the – that part of it is done. We had – the service issues are getting better. And we have in our portfolio to sell in Europe that’s unmatched and sales is getting on the front foot. So this is a starting point, if you would call, and that’s why we are confident of the improvements that Europe is going to deliver for us over the next 2 or 3 years. And again, on the issue of Network 2.0, it’s very easy to say yes, put it together and look at the numbers, yes, that’s great. But the complexity of – from a technology perspective, from a facilities perspective, other issues is far greater. And most importantly, we have $4 billion of in-network efficiencies we can get relatively easier than that. And by the way, we’re building technology that will enable us to get the Network 2.0. So we think it’s a right sequence.

From the outside looking in, the response looked like a lot of excuses and little accountability. Other analysts tried to press further to get some sort of ownership of the underlying issues from management but to no avail.

What should investors do at this point? The stock is still cheap here, but it is clear that my prior rating must be adjusted. I previously rated FDX a buy as a secular growth story. The crucial element of the thesis there was management’s apparent commitment to improving free cash flow generation and utilizing excess cash flows to return cash to shareholders. But at this point, I must elevate the risk profile as management execution is once again called into question. Perhaps emotions are coming into play here, perhaps the issues really are just macro-related. But with so many other beaten-down growth stocks available at compelling valuations, there is no reason to continue pounding the table here. The clear risk here is if management’s planned cost reductions prove unable to stabilize margins, which would further hurt credibility and would likely negatively impact valuation multiples in the near and medium term. It is possible that FDX is not a secular growth story but instead is losing market share to competitors, though management stated that it was winning market share in key markets. On the flipside, the valuation is compelling enough that a small position still makes sense here. Perhaps my 15x earnings multiple target was too aggressive – but even at 10x to 12x earnings, the stock is still presenting as much as 160% potential upside over the next five years. I rate FDX a buy, but investors should pay close attention to management execution over the coming quarters.

Be the first to comment