RHJ

Denison Mines Corp. (NYSE:DNN) is a uranium exploration and development company whose primary base of operations is the Canadian Prairie province of Saskatchewan. The company has a broad portfolio of properties, most of which are in the early exploratory stages, but also owns a post-closure mine maintenance service as well as a stake in the McClean Lake Uranium Mill, one of the world’s largest uranium processing facilities.

The bulk of the company’s value, however, comes from only two assets. The first of these is a couple of million pounds of U3O8 that the company bought at prices far lower than what spot uranium trades at today. The other is its Wheeler River Project, a property that Denison is currently developing and on which it plans to use in situ recovery (“ISR”) processes to produce very low-cost uranium.

This article will review Denison’s operations and discuss why this stock should be considered by someone wishing to add uranium exposure to their portfolio.

Company Backgrounder

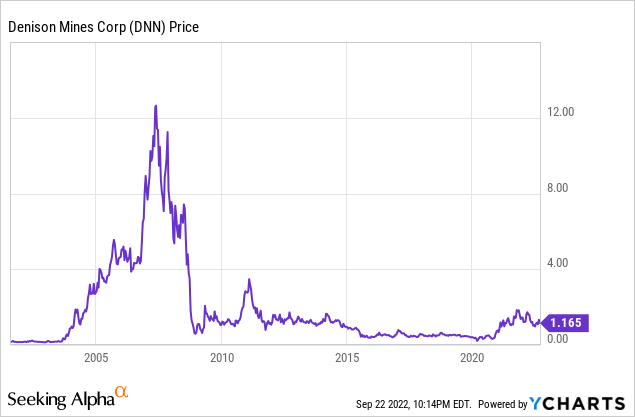

Denison Mines was incorporated in 1954, and over the subsequent decades mined tens of millions of pounds of uranium. The company was involved in the exploration, mining, and processing of the actinide in locations all over North America as well as several properties overseas. But like all mining companies, Denison was subject to the ebbs and flows of commodity prices, and had to deal with the fact that individual mines don’t last forever.

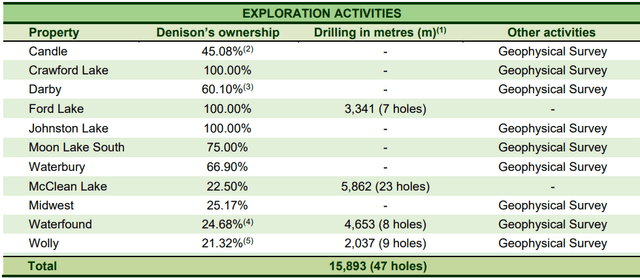

Today, the company still carries out exploration activities on a broad portfolio of properties that it owns either outright or in partnership with other uranium miners. And although some encouraging results have been found, it’s nothing to write home about. Below is a list of the properties that currently make up Denison’s exploration pipeline along with an account of the drill work that was done in the first half of this year.

In addition to that, the company also owns the Closed Mines group, a division focused on post-closure mine care and maintenance services. Revenue from Closed Mines during the year ended December 31, 2021 was $8.8m and operating expenses totaled $7.8m, netting Denison about $1m. So, while this division does generate a bit of money while providing a valuable service, it won’t move the needle.

Next up is the McClean Lake Uranium Mill, a joint venture with Orano Canada in which Denison owns a 22.5% stake. The mill processes ore from Cameco Corporation’s (CCJ) Cigar Lake mine under a tolling arrangement and contributes positively towards Denison’s net income. In fact, the company recognized almost $4m of revenue from the joint venture during the first six months of this fiscal year. The problem, however, is that Denison never received any cash.

That’s because in February 2017, Denison made a deal with Anglo Pacific Group plc (OTCPK:AGPIF) whereby Denison was given $43.5m in exchange for its right to receive all future toll milling cash receipts stemming from the Cigar Lake contract. Denison forwards all cash receipts related to the processing of Cigar Lake ore to APG. And given that Cigar Lake is the mill’s only customer, Denison must forward all the cash it receives from its milling operations to APG. The upfront payment was originally accounted for as deferred revenue, and at the end of every quarter Denison recognizes a portion of it as revenue.

Uranium Holdings

Another noncash charge that finds its way to Denison’s net income every quarter are the gains and losses the company recognizes on its uranium holdings. And the company has been seeing a lot more gains than losses as of late. That’s because, back when uranium was trading at a much lower prices and management saw that spot uranium supply was beginning to tighten, they began buying. They bought 2.5 million pounds of U3O8 at a weighted average price of $29.66 per pound and a total cost of approximately $74.15 million.

With uranium currently trading at around $50/lb, Denison’s holdings are worth about $125m, or about 12.5% of the company’s current billion-dollar valuation. Granted, by choosing to remain in the trade instead of converting the uranium to cash, management is adding an extra dimension of volatility to the stock. But the trade makes sense, as any investor in Denison obviously believes in uranium’s prospects, and if the price of uranium continues to rise the gain on the trade could defray a good portion of Wheeler River’s build out.

Wheeler River

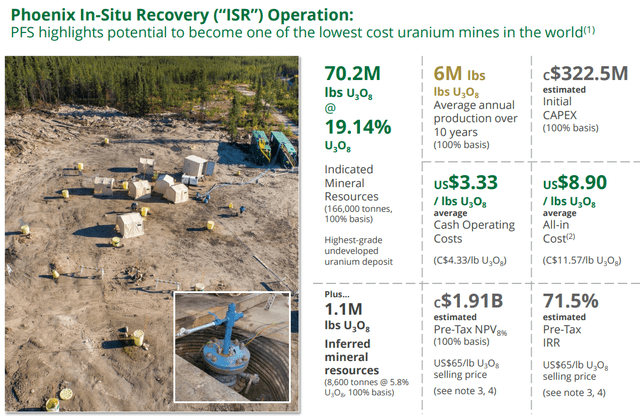

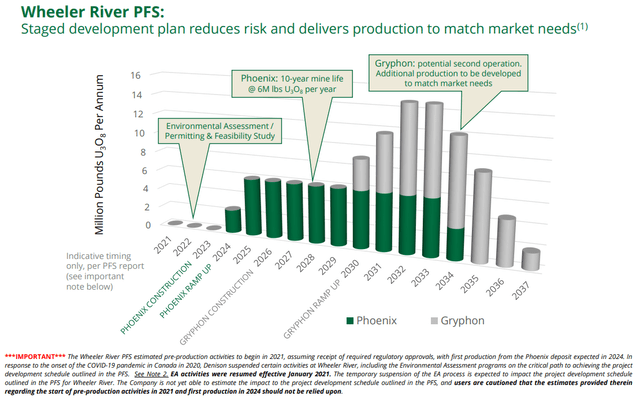

Wheeler River accounts for a big part of the other 87.5% of Denison’s current billion-dollar valuation. Denison, which owns 95% of the project, plans to develop the property in two phases. The first deposit to be developed will be the Phoenix, which is anticipated to produce 6m/lbs of U3O8 per year for 10 years with a resource size of 70.2m lbs (Indicated).

A 2018 PFS listed capex at $250m, a pre-tax IRR at 71.5%, and an NPV of $1.44b. The NPV of C$1.91b on the slide bellow is in Canadian dollars, I converted it using a USDCAD exchange rate of 1.33. Notice that the NPV and IRR also assume a $65/lb price for the U3O8.

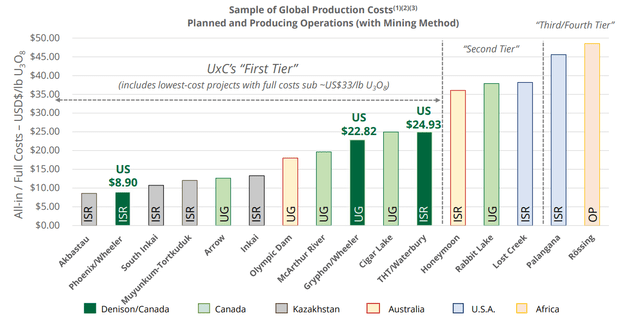

Denison anticipates average total production costs to come in at an extremely low $8.90/lb. To do so, it plans to be the first uranium producer in Canada to use in situ recovery methods. And while ISR is a commonly used method in many countries, it has yet to be proven in the Canadian tundra, although the company did test the process last year and got positive results. They are currently in the midst of another, and this much time larger, test.

The second phase of the project, named Gryphon, will be done through conventional underground mining. It has an estimated resource size of 62m lbs (indicated) to be extracted over 6.5 years at a rate of 7.6m/lbs per year. Initial CAPEX will be $468m and the project will have a pre-tax IRR of 31% and an NPV of $751m. Here the average total operating cost is estimated to be a more expensive $22.82/lb due to the use of conventional mining methods.

The company had initially anticipated production from Phoenix to begin in 2024, but delays caused by COVID-19 will likely push that back as per the message on the bottom of the slide below. It looks likely that Phoenix will only begin production in 2025. Meanwhile, Gryphon is anticipated to come online early next decade.

Takeaway

It’s clear that Denison’s management was rather optimistic when they used a $65/lb price assumption in there 2018 PFS. But the recent rise in uranium prices is beginning to prove them right. And that rise looks set to continue, as analysts at Macquarie this week lifted their uranium price forecast to $55/lb for 2024 and to $60/lb for 2025.

The combined U.S. dollar NPVs for both the Phoenix and Gryphon projects comes to about $2.2b, and adding to that $125m to account for the company’s uranium holdings gives us a total of $2.325 billion. That makes the company’s current billion-dollar valuation very reasonable and gives any potential investor a lot of upside over the coming years as the company approaches production.

Risk

The primary risks to this thesis come from two sources. The first of these, of course, is from the price of uranium. No one can predict with 100% certainty where it will go, a sharp fall in the price of uranium could cause the stock of DNN to plummet.

The other source of risk comes from the use of in situ recovery. ISR is a very commonly used method in the world of uranium extraction but has yet to be used for uranium recovery in Canada. There’s always a risk that the soil of Northern Saskatchewan is inhospitable to the process or even that site specific factors prevent its successful use.

Be the first to comment