adaask

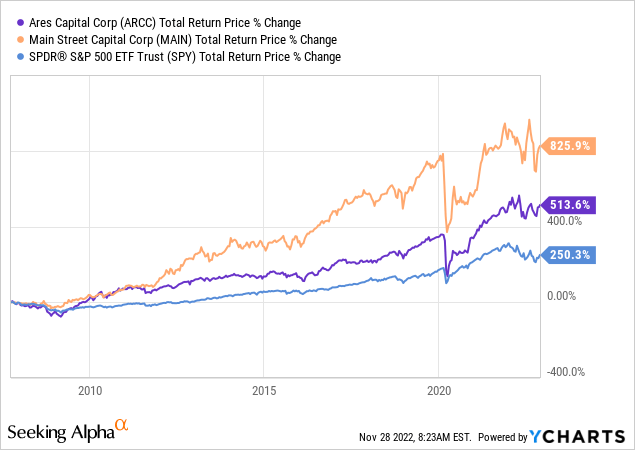

Both Main Street Capital (NYSE:MAIN) and Ares Capital Corporation (NASDAQ:ARCC) are high yield business development companies (i.e., BDCs) with investment grade balance sheets. Both are also considered among the very best of breed BDCs with impressive long-term track records of generating considerable shareholder value that has crushed the S&P 500 (SPY):

In this article, we will compare them side by side and offer our take on which one is a better buy at the moment.

Ares Capital Vs. Main Street – Quarterly Results

Both ARCC and MAIN generated excellent Q3 results, as they benefited significantly from rising interest rates alongside stable underwriting performance.

ARCC reported a 6.4% year-over-year increase in core earnings per share while net investment income per share shot up by 42.5% year-over-year from $0.40 to $0.57. This prompted the board of directors to announce the largest quarterly dividend increase in the company’s history: an 11.6% sequential and 17% year-over-year increase to $0.48 per share per quarter alongside its already announced $0.03 fourth quarter special dividend.

MAIN, meanwhile, reported a 15.8% year-over-year increase in distributable net investment income per share to $0.88, while net asset value per share increased 2.6% year-to-date and 2.2% sequentially. The strong growth in earnings per share enabled the board of directors to announce a 2.3% sequential (4.7% year-over-year) increase to the monthly dividend to begin in 2023 with a December supplemental dividend of $0.10 per share.

Ares Capital Vs. Main Street – Balance Sheet

Both ARCC and MAIN have some of the stronger balance sheets in the BDC sector, enjoying investment grade credit ratings and plenty of access to capital at reasonable cost.

ARCC’s debt-to-equity ratio is a bit higher than MAIN’s at 1.27x vs. 1.0x. That said, given that ARCC has greater exposure to debt investments than MAIN – which places a greater emphasis on equity investing than ARCC does – its asset base can support a higher leverage ratio.

Both balance sheets have plenty of liquidity – particularly ARCC’s – with $4.5 billion of total available liquidity for ARCC (20.5% of its enterprise value) and $420 million for MAIN (8.5% of its enterprise value).

Overall, we rate the balance sheet strength of both businesses to be roughly equal at the moment as we favor MAIN’s lower leverage ratio, but also like ARCC’s vastly superior liquidity, which positions it to respond more opportunistically to market dislocations as well as support underlying holdings that may struggle in the expected upcoming recession.

Ares Capital Vs. Main Street – Business Models

The two main differences between MAIN’s and ARCC’s business models are:

- MAIN is internally managed, whereas ARCC is externally managed. As a result, MAIN has a lower expense ratio for shareholders than ARCC does, resulting in more efficient operations.

- ARCC invests a greater percentage of its assets into senior secured debt than MAIN does, whereas MAIN invests a greater percentage of its assets into equity than ARCC does.

While both employ somewhat similar business models and tend to benefit from rising interest rates and strong economic conditions, MAIN is a bit more sensitive to economic conditions than ARCC is given its greater exposure to equity investments and weaker exposure to senior secured debt investments. This is a big reason why – along with its lower management cost – MAIN has outperformed ARCC since the last major economic downturn (2008-2010), as its equity investments have outperformed debt investments on average, driving stronger total return performance for MAIN shareholders.

However, as we appear headed into the next major economic downturn in 2023-2024, ARCC is better positioned to withstand economic pressures and therefore will likely see less earnings and NAV erosion.

Given the current macroeconomic conditions and outlook, the risk-reward seems to favor ARCC’s approach at the moment.

Ares Capital Vs. Main Street – Dividend Outlook

Both businesses are booming at the moment and providing growing earnings per share that not only easy cover their previous quarterly dividend levels, but prompted both management teams to announce meaningful dividend increases along with special dividends.

Looking out through 2024, ARCC is expected to continue growing its dividend per share at a 4% CAGR supported by a 5.8% CAGR in earnings per share over that span.

Meanwhile, MAIN is expected to sustain its monthly dividend but see a decline in special dividends, leading to a -0.7% CAGR in total dividends paid out in 2024 relative to 2022. That said, earnings per share are expected to continue growing at a 4.5% CAGR over that time span.

Overall, we think both business’ dividends have solid outlooks as both management teams have strong underwriting track records and solid balance sheets. Barring a deep recession and/or interest rates shooting through the roof and prompting mass defaults in their underlying holdings, both companies should be able to support their dividends through the coming economic downturn.

As ARCC’s management stated on its latest earnings call:

We elected to raise the regular quarterly dividend from $0.43 to $0.48 per share because the company is now experiencing a higher level of core earnings, primarily due to the substantial increase in base rates. This increase, the largest quarterly increase in our company’s history, is our third increase this year and results in a regular dividend that is 17% higher than our regular quarterly dividend level at the end of 2021.

The higher base dividend that we are paying also reflects our positive outlook on our ability to generate this level of core earnings under a variety of interest rate and economic scenarios for the foreseeable future.

MAIN’s management sounded a similarly bullish tune on its latest earnings call as well:

We are pleased to be able to deliver this significant additional value to our shareholders. We currently expect to recommend that our Board declare future supplemental dividends to the extent DNII significantly exceeds monthly dividends paid in future quarters and we maintain a stable to positive net asset value. Based upon our current expectations for continued favorable performance in the fourth quarter, we currently anticipate proposing an additional supplemental dividend in the first quarter of 2023.

Ares Capital Vs. Main Street – Valuation

ARCC’s valuation is considerably cheaper than MAIN’s across a variety of metrics:

| Valuation Metric | MAIN | ARCC |

| Price to NTM Normalized Earnings | 10.77x | 8.95x |

| NTM Dividend Yield | 7.2% | 10.0% |

| P/NAV | 1.49x | 1.06x |

Investor Takeaway

Overall, we favor ARCC at the moment given its more conservative investment portfolio in the face of an all-but certain recession as well as its more favorable exposure to rising interest rates (due to have a greater percentage of its portfolio in floating rate loans). On top of that, its valuation is significantly cheaper than MAIN’s, which more than compensates for its greater management expense due to it being externally managed by Ares Management Corporation (ARES).

That said, both management teams are battle tested and have delivered phenomenal total returns for shareholders, so it is hard to pick against either option. At the end of the day, given ARCC’s meaningfully more attractive and – in our view safer – dividend, we have elected to hold it along with four other BDCs and BDC-related holdings at High Yield Investor. You can read our full investment thesis here.

Be the first to comment