jetcityimage

Why I took profits on my Exxon Mobil position

I recently sold out for a 30% profit on my Exxon Mobil (NYSE:XOM) position held in my Winter Warrior Investor Seeking Alpha Marketplace Service income portfolio.

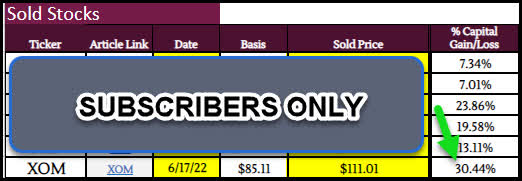

WWI Sold Stocks (WWI Income Portfolio)

Exxon Mobil was the anchor position for my service when I started it back in June. It was the first buy for the portfolio on June 17, 2022. Based on the 30% gain over the past four months, I’d say it was a fairly prescient move. Nonetheless, over the past four months and even prior to that, the unending throng of “irrationally exuberant” buyers entering the energy sector has become obvious. Young and old investors alike have piled into energy stocks with “visions of sugar plums dancing in their heads.” I must say I was one of them myself. There was good reason to be bullish. The ever-present unending supply/demand imbalance, the Ukrainian war, etc. etc. Even so, the drumbeat of bullish rhetoric has just gotten out of control. Investors are more focused on the often used but seldom seen “generational buying opportunity” in energy stocks rather than the risk of a steep decline, hence the employment of Buffett’s adroit adage “Be fearful when others are greedy.” Let me explain.

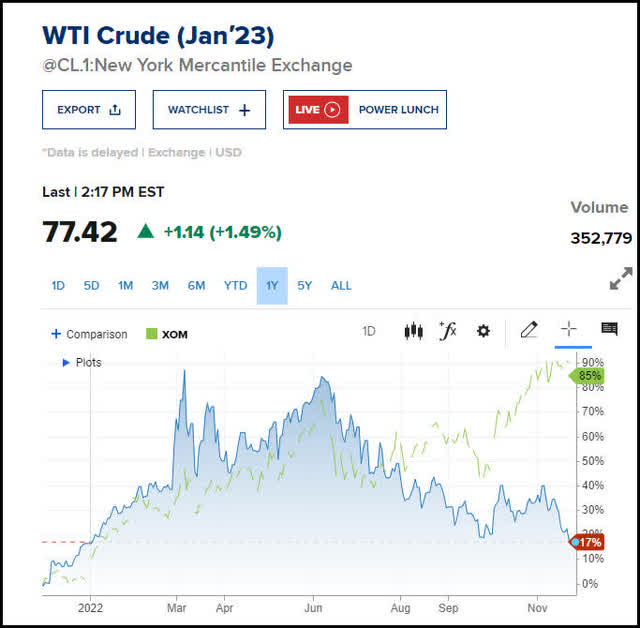

Oil stocks and Oil price correlation out of whack

Oil stocks like Exxon Mobil and the price of oil are historically highly correlated. Nevertheless, over the last quarter that correlation has failed.

Exxon Mobil vs. WTI Crude

XOM vs, WTI Comparison (CNBC)

As you can see by the chart Exxon Mobil’s stock and the price of oil was highly correlated. Yet, over the last four months, Exxon’s stock has continued higher and oil’s price has plummeted. This gap must be resolved in one way or another. Either Exxon Mobil’s stock price is too high, oil’s price is too low, or it’s a bit of both.

Exxon Mobil’s stock trading at all-time highs

The issue is Exxon Mobil is trading near its historical all-time highs and had been on a tremendous run since hitting a historic low in 2020.

Exxon Mobil Current Chart (Finviz)

Year-to-date the stock is up 85%. This is indicative of the stock being the “belle of the ball” for investors at present. Yet, looking at the chart you can see it’s having trouble breaking through the $110 level. The fact of the matter is Exxon Mobil’s stock has gotten ahead of itself pushed to heights not seen in years by overly aggressive investors who have been lulled into energy by all the positive articles and analysts upgrades.

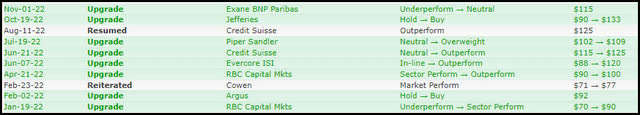

2022 Analyst Activity

Analysts Upgrades 2022 (Finviz)

For the entirety of 2022 the only things analysts have done is upgrade the stock. Yet, if you look closely, you will see that the stock has pretty much reached the top end of their estimates. So, either they will soon have to either raise their price targets and reaffirm their outperform ratings or downgrade the stock and lower their targets. The bottom line over my 30-year investing career, I’ve learned that analyst upgrades are usually a lagging indicator and when energy stock spike higher in the face of falling oil prices, it more often than not resolves itself by the stock prices dropping precipitously to come back into alignment with oil’s price. I see Exxon Mobil’s stock falling approximately 20% in the near term.

Exxon Mobil Price Drop (Finviz)

The stock is currently trading about 20% above its 200 Day SMA. I believe a recession of some magnitude lies ahead for the US economy. It will most likely rear its ugly head sometime in the first half of 2023. This is when I see the stock dropping back into the $90 range where I may buy it back for the income portfolio. When the dividend yield reaches approximately 5% I will get interested again. The fact of the matter the Exxon Mobil position was bought for the dividend income. The reason I sold out of the stock was with a 30% capital gain in the stock over a four-month period we effectively earned six years’ worth of dividend income in short order. Here’s why.

Income is Income

I’m running a retirement income portfolio. The main differentiator between my methodology “The Diversified Cash Flow Method” and others is the fact that taking profits on winners is part of the strategy not just collecting dividend income.

30% gain equates to 6 years of dividends @ 5%

As I stated earlier, by taking profits on a 30% gain in the stocks we effectively booked six years’ worth of 5% dividends 30% dividend by 6 years equals 5% dividend yield per year. So we basically have a six-year cushion to buy back into the stock when the yield becomes attractive again. Now let’s bottom line this piece.

The Bottom Line

I sold Exxon Mobil for the Winter Warrior retirement income service for the following primary reasons. Firstly, the bullish euphoria of the crowd has just gotten out of hand as evidenced by the dispersion between the high price of Exxon Mobil’s stock and the falling price of oil. Secondly, as Warren Buffett says, the time to sell is when you see others becoming overzealously greedy, which they certainty are at present. Finally, heading into next year, I see a recession on the horizon which will more likely than not give us a chance to buy back into Exxon Mobil for the dividend income at a much lower price and substantially higher yield. Now, as far as those reading this article, I’m not telling you to buy or sell Exxon Mobil based on what I have done. Everyone has their own circumstances and methodologies. What I’m saying is I believe Exxon Mobil’s stock has topped out and will soon drift back down to the $80-$90 range coming back into correlation with oil’s price. What you do with that information is for you to decide.

What do you think?

part of my process is to gain insights from prescient Seeking Alpha members. I’m interested to know what your thoughts are on the subject matter presented. What do you think is going to happen? Is oil going higher or lower? Has Exxon Mobil’s stock price topped out or not? Do you think the euphoria regarding the energy sector has gotten out of hand? Thanks for your feedback. Please use this information as a starting point for your own due diligence.

Be the first to comment