Images By Tang Ming Tung/DigitalVision via Getty Images

You can either have individual liberty, or dependence on the government. One is designed to undo the other.”― A.E. Samaan

Today, we post a deep dive on a diagnostic firm that is delivering consistent growth. The stock, like most small healthcare concerns, have been shellacked so far in 2022. However, the shares have made a nice comeback over the past month. Still more upside for this recent rally? An analysis follows below.

Company Overview:

Veracyte, Inc. (NASDAQ:VCYT) is a South San Francisco based genomics diagnostic testing concern with commercial or clinical-stage assays for eight of the top ten most prevalent cancers, as well as interstitial lung disease. The company’s bailiwick is developing (and acquiring) tests that clear up uncertainty about a nodule’s malignancy, in many instances, saving patients from unnecessary surgery or enabling faster treatment. Veracyte was formed as incubator Calderome in 2006, changed to its current moniker and raison d’etre in 2008, eventually going public in 2013, raising net proceeds of $59.2 million at $13 per share. After briefly achieving an all-time high above $86 in February 2021, shares of VCYT have fallen over 80%. They currently trade just over $26.00 a share, equating to a market cap of just over $1.8 billion.

May Company Presentation

Testing Portfolio

The company’s does not break out its sales by product, but the majority of its revenue is derived from sales of its Afirma thyroid cancer and Decipher prostate cancer tests.

Afirma. Veracyte’s first-approved and best-selling diagnostic is Afirma, a thyroid cancer test platform that was developed in 2008. The necessity for this test was a function of indeterminate (not clearly benign or malignant) outcomes employing traditional cytopathology on ~30% of the ~565,000 fine needle aspiration biopsies performed on thyroid nodules annually. Patients with undefined tests were shuttled into surgery to remove all or a portion of their thyroid, with approximately three-quarters ultimately proving to be benign and thus unnecessary. Afirma has a sensitivity of 91% and specificity of 68%, meaning that in a thyroid patient population with 24% cancer prevalence, it can identify more than two-thirds of benign thyroid nodules with a negative predictive value of 96%. The net real-world result of this assay is ~74% fewer surgeries on benign tumors. The market opportunity for Afirma is ~$800 million worldwide, of which ~$500 million lies in the U.S., where it enjoys nearly 50% penetration

Decipher. In March 2021, Veracyte purchased Decipher Biosciences for a cash consideration of $594.7 million, which provided it with urology tests for prostate and bladder cancers, of which the former generated revenue of ~$40 million in FY20. The latter was launched in November 2021. Including its clinical-stage renal cancer test, the deal expanded the company’s total addressable market by ~$12 billion.

Other Veracyte tests include:

Percepta. Percepta is a lung cancer assay that was first introduced in 2015, with an early detection (Percepta Nasal Swab) test added in 4Q21 that should see a broader commercial launch in 2023 assuming reimbursement approval. The nasal swab should significantly increase the addressable market for this indication, which is currently estimated at $475 million in the U.S. and over $200 million in Europe. A recent study showed that this test is accurate in determining lung cancer risk in patients with lung nodules whose bronchoscopy results are inconclusive.

Envisia. After Percepta, Veracyte launched Envisia to identify idiopathic pulmonary fibrosis in 2016 as an enhancement to the 150,000 patients who receive uncertain diagnoses for interstitial lung disease. Management puts the market opportunity for Envisia at ~$350 million in the U.S. and north of $200 million in Europe.

Prosigna. The company’s early-stage breast cancer assay is Prosigna, which it acquired in 2019 to potentially improve diagnoses for ~110,000 patients in the U.S. and ~250,000 internationally each year.

Immunoscore. While still integrating Decipher, the company purchased French colon cancer screening concern HalioDx for a total consideration of $319.6 million (consisting of $168.3 million in cash, 3.3 million shares of stock, and debt assumption of $4.2 million) in August 2021. Through the acquiree’s Immunoscore colorectal cancer test, Veracyte received an entrée into immuno-oncology diagnostics.

More importantly, the deal provided Veracyte with in vitro diagnostic kit manufacturing capabilities in Europe for its nCounter Analysis System, which it in-licensed from NanoString (NSTG) in 2019. The nCounter platform allows the company to deliver most of its laboratory developed tests as in vitro diagnostics to laboratories and hospitals that can perform the tests locally. Currently, only the Prosigna test is on nCounter, but the plan is to add Envisia in 2023 and other diagnostics over the next two to five years. The company expects to be manufacturing kits in France by YE23.

Veracyte also has a test in development for lymphoma with a $350 million market opportunity.

Stock Price Performance

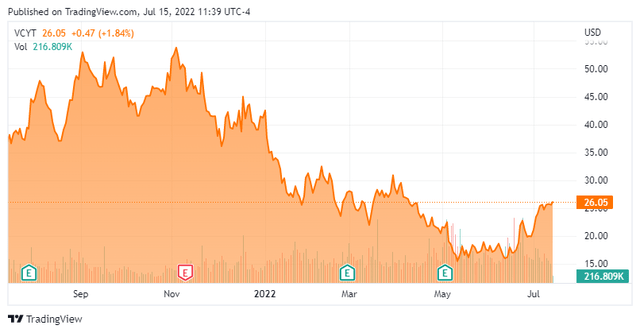

From predominantly Afirma sales, Veracyte grew its top line at a CAGR of 25.8% from FY14 to FY19 to $120.4 million. Most of its growth was funded through shareholder dilution. That said, its stock traded primarily in the high $20 area during 2H19 and early 2020. Then, in the throes of the pandemic-related selloff, shares of VCYT fell to $13.90 as hospitals dedicated the majority of their time to Covid-19, which caused the company’s sales to fall to $117.5 million in FY20. However, with pent-up demand for its tests auguring a rebound in business, the market began bidding its stock higher in 2H20, eventually culminating in a February 2021 blowoff rally to an all-time intraday high of $86.03 a share shortly after announcing its acquisition of Decipher.

The company reacted swiftly, executing a secondary offering that raised $593.8 million at $74 a share to cover the cost of Decipher. That price reflected a stratospheric and unsustainable valuation of 22.6x FY21 sales. Priced for perfection, shares of VCYT had already lost approximately one-third of their value before inflation ushered in the risk-off trade near YE21. At that juncture, the market focused on Veracyte’s unprofitability – losing $0.41 a share (non-GAAP) in FY21 – and the nearly $1 billion spent on Decipher and HalioDx for a combined ~$125 million in FY22E sales. Furthermore, although it has an established foothold in thyroid cancer, that market is already well penetrated, meaning the company will have to rely on its acquisitions and other products to drive future growth that face competition from testing concerns in other oncology indications, such as Myriad Genetics (MYGN) (prostate; breast), Exact Sciences (EXAS) (prostate; breast), and Biodesix (BDSX) [LUNG].

1Q22 Earnings & Outlook

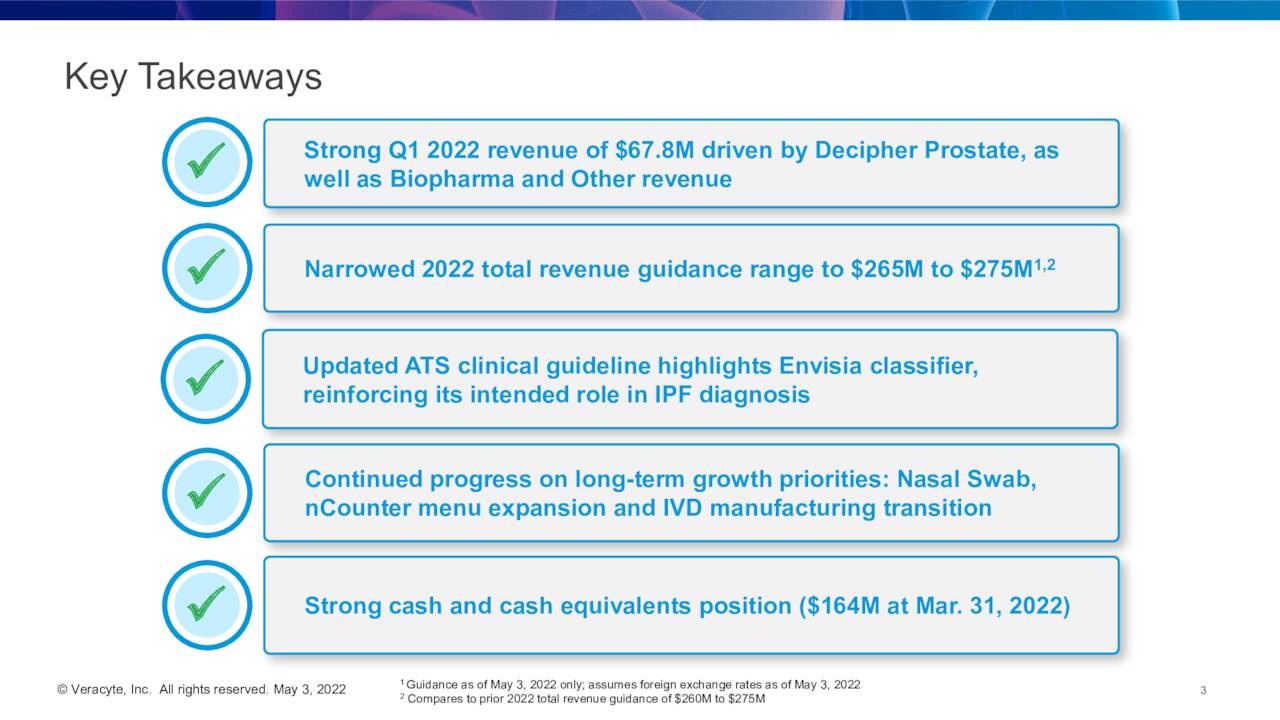

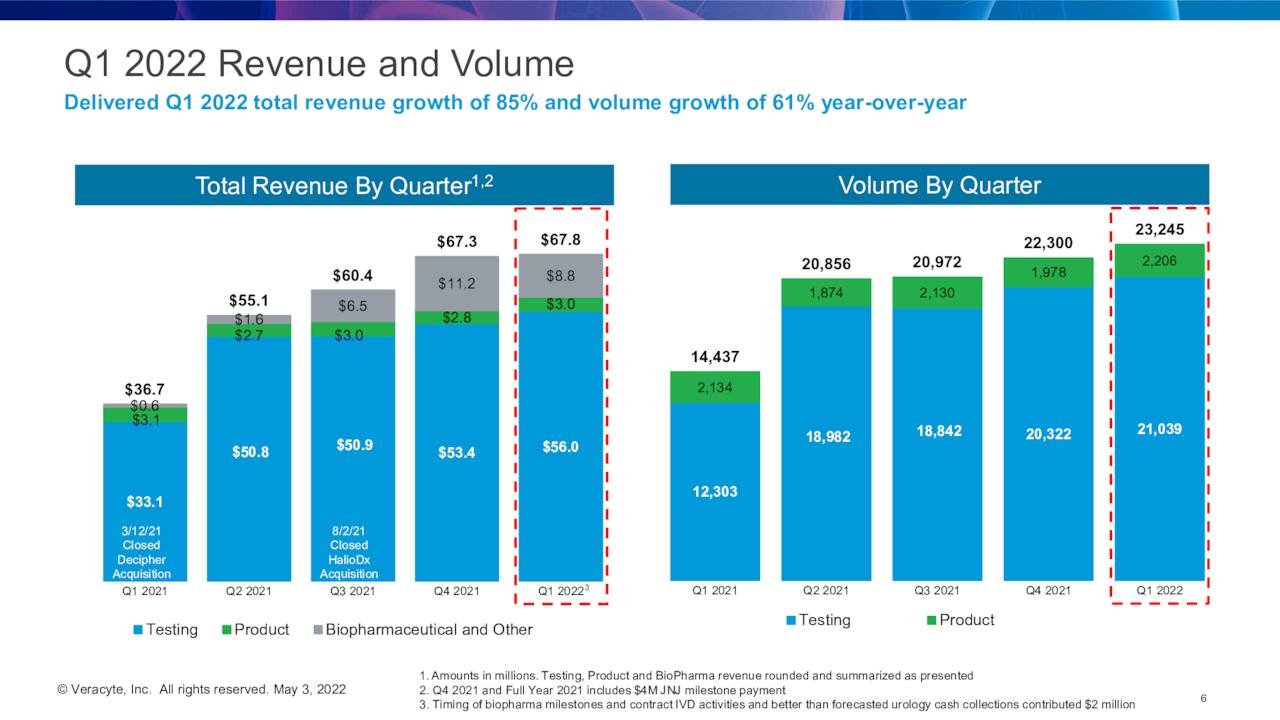

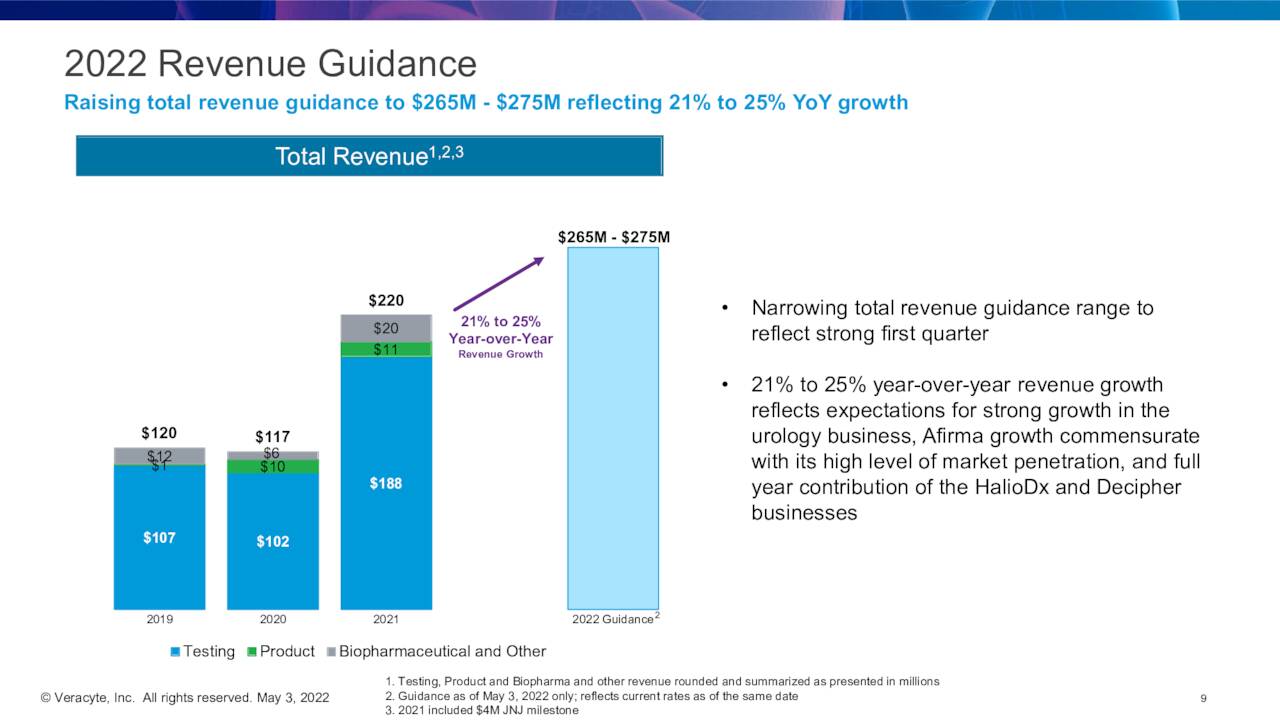

That FY22 estimate was provided as part of Veracyte’s 1Q22 earnings report of May 3, 2022, in which the company lost $0.20 a share (GAAP) on revenue of $67.8 million versus a loss of $0.66 a share on revenue of $36.7 million in 1Q21. The top line reflected an 85% increase over the prior year, but only 9% organically as Decipher and HalioDx contributed about $27.5 million to its top line. That said, revenue did beat Street expectations by $5.9 million. Test volume improved sequentially by 1,145 to 23,245, of which ~11,000 were Afirma – up ~10% year-over-year – and ~8,800 Decipher. Throughout the integration of its two acquisitions, gross margins have remained steady, generally within a point of 65%.

May Company Presentation

Based on range midpoints, management tweaked its FY22 revenue outlook higher, from $267.5 million to $270.0 million, representing 23% growth over FY21.

May Company Presentation

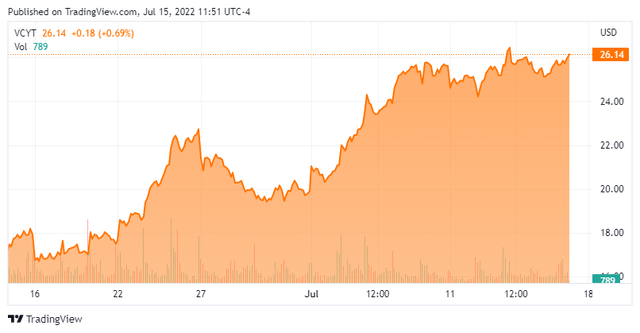

The solid report was liked by the market for exactly one day, rising 5% to $22.45 in the subsequent trading session, thereafter plunging below $20 as Street analysts lowered price targets to reflect “peer multiple compression.” Over the past month as sentiment on healthcare/biotech has improved, the shares have shot up approximately 60%.

Balance Sheet & Analyst Commentary:

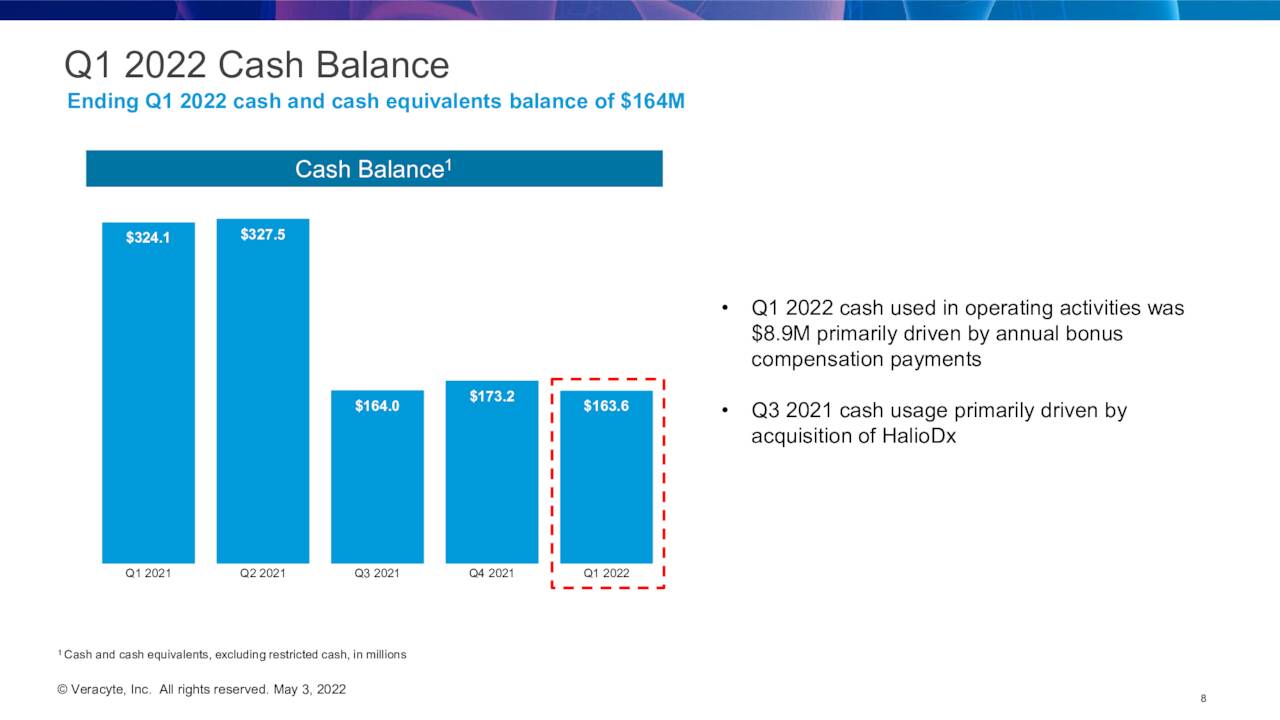

Despite its GAAP losses, Veracyte is in solid financial stead, holding cash and equivalents of $163.6 million on March 31, 2022, while bleeding $8.9 million from operating activities in 1Q22, after losing $31.6 million in FY21. Management expects the company to bounce around cash flow breakeven over the balance of FY22.

May Company Presentation

Street analysts are largely constructive on Veracyte’s future, featuring four buy and four outperform ratings against Morgan Stanley’s lone and (to date) correct underperform rating. Their median twelve-month price target is $40 per share. They anticipate the company losing $0.87 a share (GAAP) on revenue of $272.4 million in FY22, followed by a loss of $0.63 a share (GAAP) on revenue of $324.3 million in FY23, representing a 19% increase at the top line over FY22.

May Company Presentation

CEO Marc Stapley shares the Street’s optimism, purchasing 60,000 shares at $16.33 on June 10, 2022. The $979,800 investment brought his total position to 159,761 shares.

Verdict:

Veracyte’s narrative is enticing: growing its domestic market by increasing the number of cancer tests available while leveraging its HalioDx acquisition to expand its menu of in vitro diagnostics on nCounter to grow globally. nCounter is simple to use, requiring ~80% less hands-on time than sequencing technology, providing Veracyte with a long runway of growth. Furthermore, trends in screening should act as a tailwind for the diagnostic industry as a whole.

However, with gross margins of ~65%, no signs of meaningful profitability, and forecasted 20% longer-term growth, it can be reasoned nearly seven times FY22E sales net of cash for VCYT seems expensive. As such, I would fade the rally of the last month and remain on the sidelines until the company can map out a plan for meaningful profitability.

Welfare’s purpose should be to eliminate, as far as possible, the need for its own existence.”― Ronald Reagan

Be the first to comment