Sundry Photography/iStock Editorial via Getty Images

Price Action Thesis

FedEx Corporation (NYSE:FDX) stock has underperformed the market and its peers over the past five years. However, we think the current pessimism in its stock is overdone. Its valuation has fallen to attractive levels, despite yesterday’s (June 14) 14.4% surge.

Our detailed price action analysis also suggests that FDX stock has a solid near-term bottom, under girded by a validated double bottom bear trap. So even though it’s at a near-term resistance, we think it should overpower it moving forward.

Accordingly, we rate FDX stock as a Buy on attractive valuations, supported by a double bottom bear trap. However, more conservative investors can consider waiting for a retracement before adding exposure, given June 14’s surge.

FedEx Stock – Double Top Bull Trap Looks Fully Digested

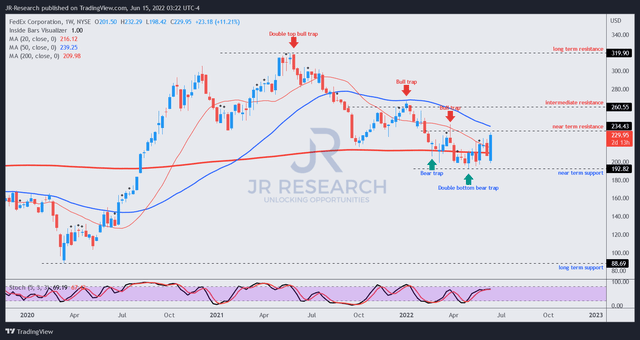

FDX price chart (monthly) (TradingView)

FDX stock has had a secular uptrend over the past ten years. However, its 5Y performance with a CAGR of 2.18% disappointed investors, as it underperformed the market and its Industrials peers.

Nevertheless, the massive surge from 2020’s COVID bottom lifted its fortunes. However, the party ended with a double top bull trap that formed in June 2021, as the market parsed its valuations.

Given the headwinds that FDX and its peers have been facing this year, it has validated the market’s uncanny forward-looking ability. However, we believe that FDX stock is at a robust near-term support, having fallen 28% from its 2021 highs.

FDX price chart (weekly) (TradingView)

Going into its weekly chart, we can observe that the double top bull trap sent FDX stock into negative flow (decisive bearish momentum) since August 2021, and it has not recovered from it.

Therefore, we have often urged investors to pay particular attention to the menace of double top price action. We believe double tops are often early warning signals of the market’s intention to reverse its prior uptrend. Investors could then use these opportunities to layer out of the stock and hedge their remaining exposure with bear put options spreads or covered calls.

Notwithstanding, FDX stock formed a validated double bottom bear trap in May, after its March 2022 bull trap. Therefore, we believe the market is ready to overturn its bearish momentum and subsequently resume FDX stock’s long-term uptrend bias.

Nevertheless, investors should accord some caution to its near-term resistance, as FDX stock has failed to overcome so far. Moreover, June 14’s momentum spike has brought the stock to its near-term resistance again. Therefore, some caution is warranted.

However, we think the attractive valuation of FDX stock has convinced us that it’s a reasonable price to enter, even at the current level.

FDX Stock Valuation Is Undemanding

| Stock | FDX |

| Current market cap | $59.6B |

| Hurdle rate (CAGR) | 10% |

| Projection through | CQ2’26 |

| Required FCF yield in CQ2’26 | 3.5% |

| Assumed FCF margin in CQ2’26 | 3% |

| Implied TTM revenue by CQ2’26 | $101.8B |

FDX stock reverse cash flow valuation model. Data source: S&P Cap IQ, author

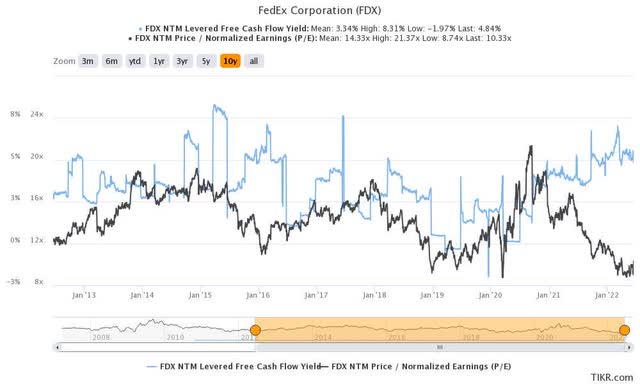

FDX valuation metrics (TIKR)

We used reasonable parameters in our valuation model. Notably, we applied a hurdle rate that expects FDX stock to outperform its 5Y performance. We also used an FCF yield in line with its 10Y mean, which is lower than its current yield of 4.84%.

Accordingly, our model suggests that FedEx needs to deliver a TTM revenue of $101.8B by CQ2’26. The consensus estimates indicate that it could post revenue of $101.16B in FY24. Therefore, we believe the valuation asked by the market now is attractive and undemanding. As a result, we are confident that FedEx can meet our revenue requirements by CQ2’26.

Is FDX Stock A Buy, Sell, Or Hold?

Given its 14% surge yesterday, investors can wait for a retracement first before adding. Otherwise, more conservative investors can wait for a pullback nearer to its near-term support, which is supported by its double bottom bear trap.

However, we believe the double bottom bear trap, coupled with an attractive valuation, supports a bullish thesis on FDX stock.

As such, we rate FDX stock as a Buy.

Be the first to comment