master1305/iStock via Getty Images

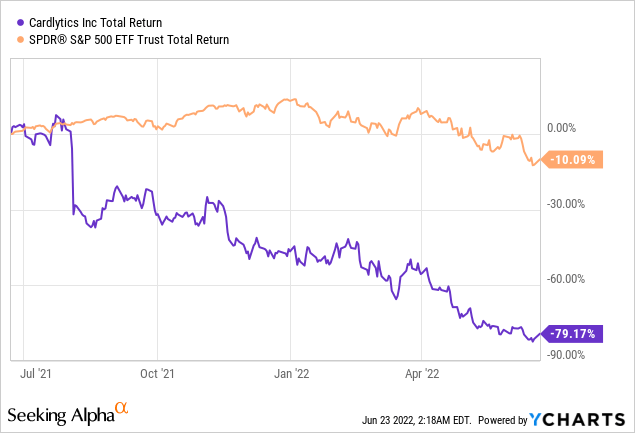

Cardlytics, Inc. (NASDAQ:CDLX), founded in 2008, very quickly becomes one of the largest digital ad platforms. Recently, the stock has been crushed by the pessimistic sentiment of unprofitable and high-growth tech businesses. Although the stock is not well known, it already acquired the scale and the business relationships that are needed for future growth. I think the company can only be better from here. Many qualities and opportunities are not represented in the stock price.

Product scale and business update

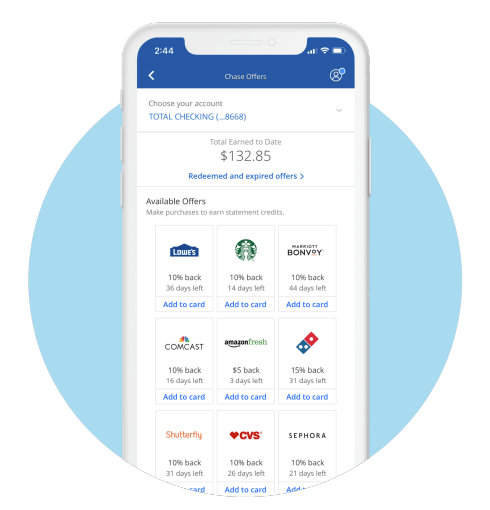

CDLX partners with financial institutions (e.g. banks) who provide access to the purchase data and digital banking customers’ profiles (anonymized). Merchants (through the Bridg platform) also provide CDLX point-of-sale (“POS”) data including product-level purchase data. Powered by these high-quality data, CDLX helps marketers identify, reach and influence consumers with actionable advertising campaigns. You can find those ads from many leading bank apps such as bank of America, Chase, and Wells Fargo.

CDLX app example (CDLX presentation)

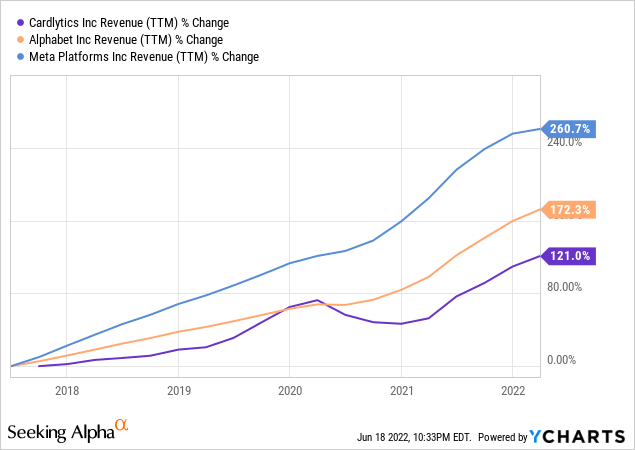

According to recent filings, CDLX has 178M monthly active users (MAU) and access to data of 1 in 2 US purchase transactions. Currently, CDLX is just behind Facebook (META), Google (GOOG) (GOOGL), and Amazon (AMZN) on MAU numbers. This is a huge scale! However, CDLX’s revenue is extremely smaller at only 281M. The company expects 30% growth for the full year of 2022. Q2 2022 guidance is 30% YOY growth of billings between 106M and 116M and revenue between 73M and 80M. Please note that Billings = consumer incentives + revenue where consumer incentives are funds distributed directly to consumers as cash rewards. CDLX has been affected during COVID (-11%) and grew slower than GOOG and META (as the chart below). But the 30% YOY growth guidance is the biggest moving forward.

A true ecosystem

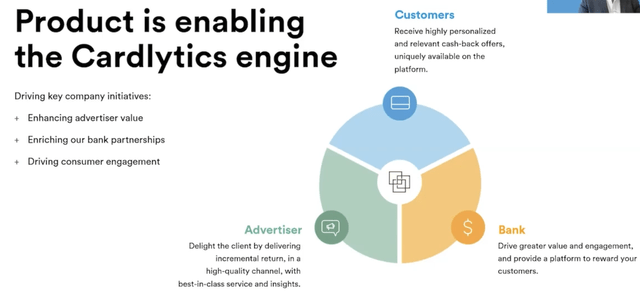

CDLX is building a true ecosystem for advertising and consumer research. It benefits every participant on the platform! Customers receive cash-back offers at no cost; advertisers can reach customers, gain insights and drive sales; banks get more customer engagement and spending, they also get 35% of the advertiser spends for basically doing nothing. Nobody wants CDLX to fail. As CDLX grows bigger, it becomes more important for consumers, banks, and advertisers which drives more businesses and profits in return for CDLX. I think this business concept is very durable and well-positioned for the long-term as a true win-win-win platform.

CDLX ecosystem (CDLX presentation)

Advertising effectiveness

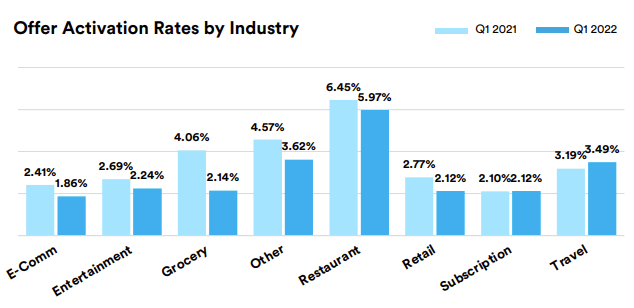

What is special about CDLX is its quality of reach and behavior data that is highly differentiated from GOOG, AMZN, META, PINS, etc. Most advertisers have access to the purchase behavior of their own customers in their stores, websites, apps, etc. However, it is impossible to gain insights who are not their customers yet. CDLX has developed a data structure called Purchase Graph that identifies the importance of each individual, geography, and the merchant for all of their MAUs. As a result, CDLX could do large-scale ad campaigns similar to random control trials (the most effective way) to match consumer participants to gain insights into brands, customers, and markets. Unlike other traditional media-based platforms (e.g. Facebook, Twitter, Pinterest), CDLX will have fewer issues with fake accounts, scam ads, etc. CDLX ads are also not hated or annoying as other platforms (e.g. I hate YouTube ads in the middle of a video and I skip as fast as I can). Arguably, CDLX may have the most effective and efficient approach for targeted advertising in the industry. As the chart below, CDLX offers activation rates (the total number of offers activated divided by the total number of offers served to MAUs in the applicable period) are at a very high range between 2-6% while Facebook’s highest Click Through Rate is only 1.6%.

CDLX engagement metric (CDLX presentation)

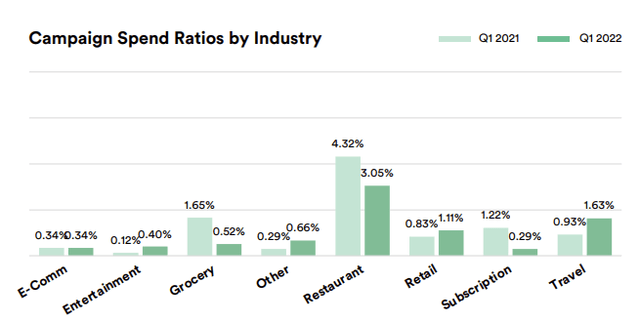

Another valuable metric is the campaign spend ratio as shown in the chart below. The official definition is:

The amount of spend from MAUs that is associated with the campaigns in which they were targeted with offers divided by the total amount of spend from MAUs in the industries in which MAUs were targeted with offers during the applicable period.

CDLX engagement metrics (CDLX presentation)

This is very unique for CDLX since I don’t think other ad platforms can track the participants’ spending as efficiently as CDLX.

Growth opportunities and the constant improvement

With 178M MAU already, CDLX’s growth space for more MAU onboarding is somewhat limited. However, there are still tremendous opportunities in its existing MAU by raising the average revenue per user (ARPU) metric.

- CDLX can offer more content to customers by bringing on agencies, advertisers, providers, etc. In the recent quarter, the total advertiser count increased to over 600. 1000 advertisers are expected for 2022. More advertisers will bring more deal options for consumers and more revenue for CDLX. This also indicated the attractiveness of the CDLX platform.

- Better quality and features. CDLX’s current toolset can be improved and very updates should bring new businesses to the platform. For example, the new CDLX platform adopted by US bank has shown a 49% increase in offer activation, a 50% increase in visits, 5x visits to the website through premium imagery, etc.

- Dosh brings partnerships with neo-banks and fintech players (e.g. Venmo, Betterment, and Ellevest) which brings more MAUs. CDLX currently has 18 publishers live and 15 are scheduled to launch later this year.

- Bridg offers access to SKU and UPC data and creates a whole larger world for advertising and gaining insights. Higher ARR renewals and a large multi-year contract are expected to be signed. Significant growth for Bridg is expected according to recent calls.

- International expansion is also gaining momentum with 50% YOY growth (although not much info provided yet). This indicates that CDLX’s model and technology work for all financial systems.

Evaluation

I think the ARPU is a function of the breadth of offers and average time spent per day. Bank users only have 11 online banking logins per month. Assuming 5 minutes per login, we estimate about 1.8 minutes per day which is only 5% of Facebook (33minutes a day). FB has 10M advertisers on the supply side while CDLX only has 600. CDLX customers are currently spending less time with very limited offers. I believe the number of offers will significantly improve. As CDLX’s ad click-through rate is about 2x of Facebook, I believe CDLX has the capability to generate 2x of sales per interaction minute in the future.

Currently, CDLX ARPU is just around $0.36 while Facebook could achieve as high as $40.96. If CDLX has 5% of interaction time as Facebook with 2x monetization capabilities, a 10% ARPU ($4.1) could be achievable. This is about 11.3x of current levels (3B revenue considering no MAU growth).

Regarding earnings power, gross profit is about 110M and keeps growing its margin. Sells (114M) and RD expenses (44M) are about 158M operating expenses in total. Assuming half of the operating cost is for maintenance and half for growth (considering the stability of the CDLX platform), I estimate an earnings power of 31M (15% profit margin). If CDLX could grow sales to 3B, that is around 450M earnings which could lead to a 9B market cap for 20x PE and a 6.7B market cap for 15x PE. Considering the current 790M market cap, the opportunity is tremendous.

Simply looking at the price-to-sale ratio, CDLX is 2.9x (TTM) at a 30% growth rate which is also very cheap when compared to other advertising-based companies (PINS, SNAP).

Risks

Regarding risks, I am worried about Banks. CDLX really has to rely on big Banks which affects their pricing power on them. For new features and platform offerings, CDLX needs the bank’s commitment to connecting MAU data to their server which often is not as quick as CDLX expects. CDLX is the only company that leverages bank purchasing data, but future uncertainties may exist if banks decide to try other start-ups. The good news is BOA’s new contract will be likely to be signed. One large bank is planning to double its 2021 investment spend on CDLX’s program. These are all indications of how banks prefer CDLX’s system instead of creating it in-house.

Conclusion

Overall, I think CDLX is a high-quality company with lots of long-term opportunities. I think people are tired of the typical digital ads Facebook and Google have. Getting a deal from CDLX clearly offers more convenience, more value, and more selection. CDLX is unique in a lot of ways and it is worth a serious look by investors.

Be the first to comment