SimonSkafar

Investment Thesis

Microvast (NASDAQ:MVST) is a solid company within the electric battery industry. Even when considering its vertically-integrated product line with opportunities to expand downwards on the supply chain, the stock still fell off a cliff, returning -56% (YTD). Let’s see what are the reasons and if the stock might be attractive at all.

Financials

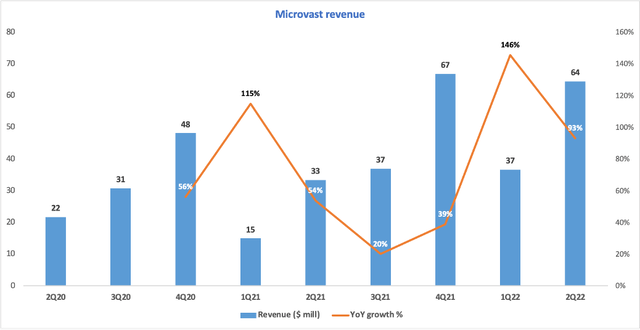

Let’s start our analysis with most important aspect, the revenue growth:

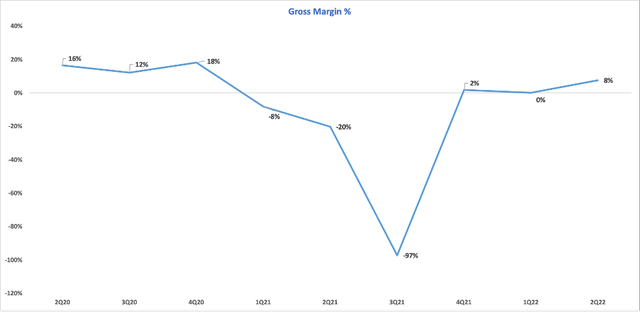

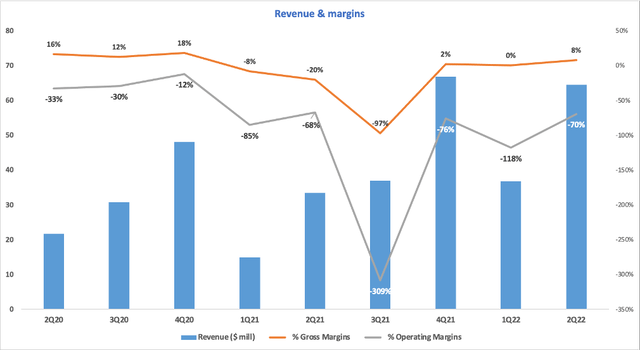

Revenue grew 93% YoY, which is a great sign considering the difficulties that Microvast encountered in recent quarters. Moreover, Microvast reiterated its 2022 guidance of 35% to 45% revenue growth (YoY). Honestly, revenue growth is the best thing about Microvast’s quarter because if we’re looking at the margins, they are really really bad. Gross margin sits around 8%, and although improving, it’s still lower than its trend from 2020:

The reason for this severe drop in the gross margin is explained by the management:

“Raw material prices remained at elevated levels as a result of supply chain disruptions as well as worldwide inflation. Our unit costs across the board are tracking significantly higher than we anticipated at the beginning of the year.” – Microvast President

This shows that because of its relationship with its clients Microvast can’t pass some of the increased costs onto their customers as quickly as it incurs them. This confirms that Microvast doesn’t really have pricing power because of its long sales cycle, which is a risk for investors, especially on the short term.

Looking at the (GAAP) operating margin, this was really bad, sitting around -70%. To understand it better, let’s look at the operating expenses:

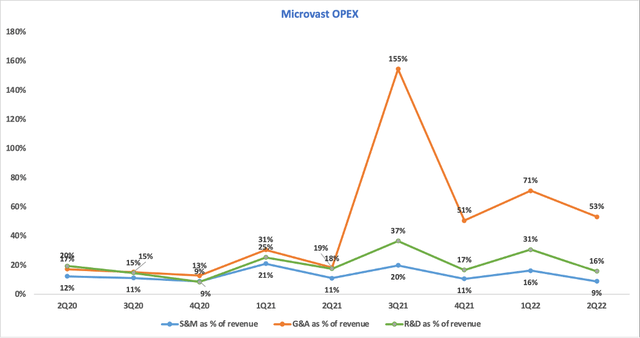

There are 2 important things that we can see here: Firstly, the sales & marketing expenses are below 10%, which is encouraging. On the flip side the general & administrative costs are huge, around 53% of revenues, which happened mainly as a result of a $25 million expense with share-based compensation.

Stock Based compensation (SBC) – a real risk

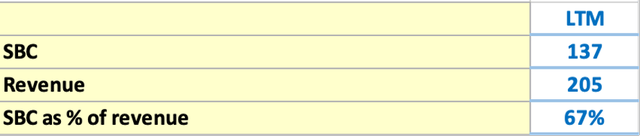

When considering the SBC for the last 12 months, this is another downside for Microvast as it represented around 67% of the company’s revenue, which is a very elevated percentage. Remember that SBC is a real cost for the shareholders as it dilutes them (you own now less of the company although you have the exact same number of shares).

Free Cash Flow

Lastly, perhaps the most important aspect about a company is its ability to consistently generate cash.

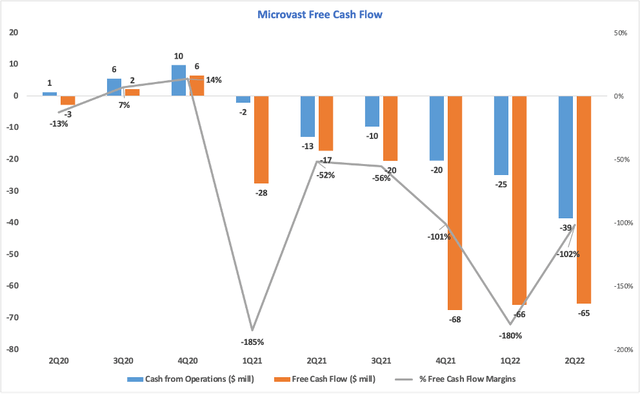

Unfortunately for Microvast, the trend is really bad as the company only generated free cash flow sporadically during 2020, and moreover in the last 18 months it couldn’t even attain operational free cash flow, which is obviously another downside.

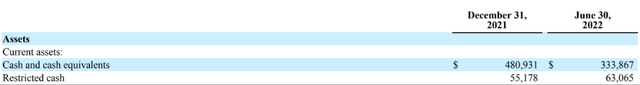

Capital Investments

Regarding capital investments, Microvast completed its capacity expansion in Germany, while the China and Tennessee projects are expected to be completed in 2023. The company expects to spend another $200 million in 2022 for capital investments on top of the $68 million that it already invested. This intense spending in an inflationary period might put pressure on Microvast’s liquidities, but luckily the company still has around $400 million in cash and has opportunities to attract more debt if needed.

Valuation

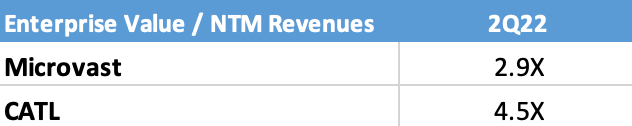

Even if the stock is now much cheaper than its mean in terms of Enterprise Value / (NTM) Revenues, given the recent headwinds that affect the company, the risk is now much more elevated.

Moreover, even if the multiple seems low, it’s better to give some perspective by comparing it with the biggest player in the world, Contemporary Amperex Technology Co. Limited (CATL), who has a 33% market share of the global lithium-ion battery market in 2021:

TIKR.com

Moreover, CATL has just posted a 160% revenue growth for 2021 and a 154% revenue growth for 1Q22. So, considering that the bigger player is outgrowing Microvast by a mile, this tells me that Microvast still has a lot of work to do in order to become an attractive investment.

Technical analysis – Where to buy?

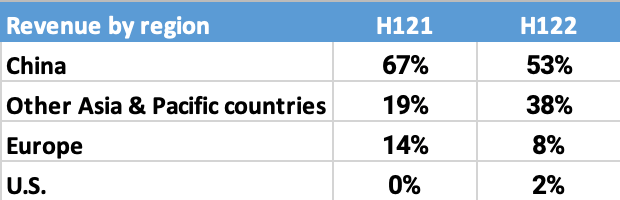

Regarding the stock, I am not buying it as I believe it will be dead money until the company can significantly improve its margins and its execution. The trend is obviously bearish as the stock has been selling a lot lately. As the short float is only around 9%, I believe this has to do with the company’s slow execution and high multiples. Another possible reason is that Microvast is heavily exposed to China, which might spook investors. Besides the fact that more than 50% of their revenue still comes from there, the company continues to be subsidized by China, as in 2022 it received around $2 million:

Microvast 10-Q Q2 2022

Final thoughts

To conclude, Microvast is feeling a significant impact from the supply chain disruptions and from the high inflation in the commodities space. Even considering that Microvast has plenty of potential for future growth, the execution isn’t great as of now. Microvast doesn’t have operational free cash flow, its products are really expensive to manufacture, which leads to low margins. On top of that, the company is capital-intensive, which requires to invest a lot of money upfront, which aren’t great, especially in an inflationary period. As a result, I believe that Microvast stock is not investable for now.

Be the first to comment