Mario Tama/Getty Images News

In the transportation and logistics market for the delivery of freight, high volume and low weight business to consumer packages, and other related goods, one of the two big players in the market is FedEx (NYSE:FDX). On June 14th, shares of this $59.6 billion behemoth skyrocketed 14.4%, marking the largest single daily increase the company experienced in its share price in 11 years. This move was in response to a single press release that carried with it a number of developments that are important for shareholders to understand. Between these catalysts and how cheap shares are right now, shares of the company do look to be quite attractive on both an absolute basis and relative to its largest competitor. Because of this, I have decided to designate the company a ‘buy’ prospect.

FedEx – Important changes are occurring

Odds are you already know a great deal about the operations that comprise FedEx. In short, the company operates in four key segments. The first of these, FedEx Express, offers time-definite delivery to customers in over 220 countries and territories across the globe through various means. Under the FedEx Ground segment, the company provides small package ground delivery services at a relatively low cost to customers in North America. The FedEx Freight segment specializes in less-than-truckload freight services to businesses and residences alike to customers throughout the contiguous US, Puerto Rico, and the US Virgin Islands. And finally, FedEx Services provides sales, marketing, information technology, communications, customer service, and other services to various customers who need them. The business also provides various other services like printing, customs brokerage and global ocean and air freight forwarding, and more.

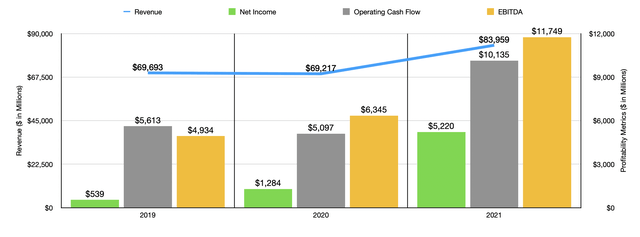

The operating history of the business has been rather appealing. Despite seeing revenue dip in 2020 because of the COVID-19 pandemic, the overall trend for the company has been higher, with revenue climbing from $60.3 billion in 2017 to $84 billion in 2021. Profitability for the enterprise has also risen. Net income has been rather volatile, ranging from a low point of $539 million in 2019 to a high point of $5.2 billion last year. However, other profitability metrics have been more consistent. Operating cash flow, while being a bit volatile, has risen from $4.9 billion in 2017 to $10.1 billion last year. Meanwhile, EBITDA, while also fluctuating from year to year, has increased from $8.1 billion to $11.7 billion over the same window of time.

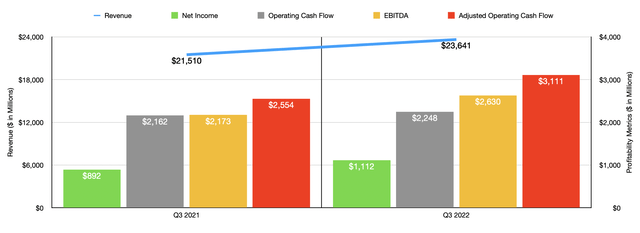

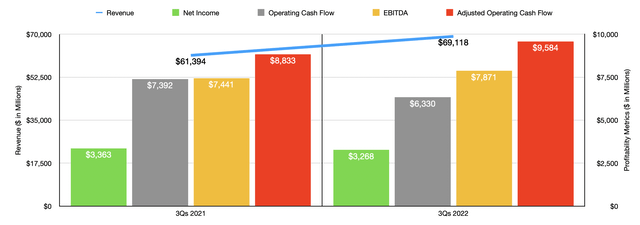

Strong performance for the company has continued into the current fiscal year. Revenue of $69.1 billion in the first three quarters of 2022 translated to a year-over-year increase of 12.6% compared to the $61.4 billion generated the same time last year. This attractive growth continued in the latest quarter alone, with revenue rising year over year by 9.9% from $21.5 billion to $23.6 billion. This rise was driven by a couple of factors. For starters, the company experienced an increase in volume for some of its services. Under the FedEx Ground segment, for instance, home delivery volumes were up by 4.6% year over year in the latest quarter while ground commercial volume was up 4.1%. International export volume under the FedEx Express segment, meanwhile, grew by 2.1%, while priority shipments under the FedEx Freight Unit for the company expanded by 3.3%. Of course, not everything was positive. Some volumes did decline year-over-year. However, the company did benefit from strong pricing. Revenue per package under the FedEx Express rose by 15.2% for its US domestic operations, while for international operations the export composite prices increased by 11.3%. In most other categories, revenue per package increased, including for both economy and priority shipments associated with FedEx Freight, as well as for deliveries under FedEx Ground and FedEx Express.

On the bottom line, financial performance for the company continues to be somewhat mixed. But the overall picture looks robust nonetheless. Net income in the first three quarters of 2022 dropped, falling from $3.36 billion to $3.27 billion. Operating cash flow also contracted, declining from $7.39 billion to $6.33 billion. But if we adjust for changes in working capital, it would have risen from $8.83 billion to $9.58 billion, while EBITDA experienced an increase from $7.44 billion to $7.87 billion.

Even with some of the weakness the company has experienced in the form of reduced volume across some service offerings, the fundamentals of the company look sound. However, the business has just announced some developments that could help to create additional value for the company’s investors. Most significantly, the company agreed to add two independent directors that were brought on as part of a cooperation agreement the business signed with activist fund D. E. Shaw. On top of this, the company agreed that a third independent director, mutually agreed upon by both FedEx and D. E. Shaw will be added to the board of directors at a later date.

Though this maneuver may not seem like much at first glance, it’s important because it means the company is open-minded to strategies suggested by an activist fund that could ultimately lead to a significant amount of value creation for the firm’s shareholders. To build off of this, the company also announced that it was augmenting the board’s Audit Committee, renaming it the Audit and Finance Committee, and tasking it with reviewing the company’s financial affairs. Examples provided by management include examining the company’s capital structure, capital allocation, and returns generated by the business. To me, this is incredibly important because it increases the probability of some value creation strategy aimed at extracting value from the business and transferring that value, ultimately, to shareholders. This could be a spinoff, a merger, some form of recapitalization, a move aimed at boosting distributions, or many other things. As part of the arrangement, the company also agreed to increase its quarterly dividend by $0.40 per share, or 53%, taking it from $0.75 to $1.15. Though on a percentage basis this is significant, I really see it as a nothingburger. It will lead to the pay out of an additional $414.7 million to shareholders each year. But on the other hand, after seeing the company’s share price rise, it translates into a yield, moving forward, of just 2%.

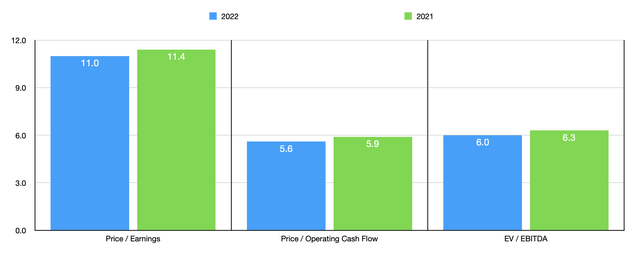

Some sort of catalyst could help to propel shares higher. But even if this does not come to pass, it’s difficult imagining the company not generating attractive upside for shareholders. At present, management expects adjusted earnings per share this year to be between $20.50 and $21.50. At the midpoint, that translates to net income of $5.44 billion. If we assume that this improvement over last year’s income is any indication of the company’s cash flow generation, then operating cash flow for 2022 should be around $10.57 billion, while EBITDA should be around $12.25 billion.

Using this data, we can easily value the business. On a price-to-earnings basis, the company is trading at a forward multiple of 11. This is down slightly from the 11.4 I calculated for the 2021 fiscal year. From last year to this year, the price to operating cash flow multiple should drop from 5.9 to 5.6, while the EV to EBITDA multiple should decline from 6.3 to 6. To put the pricing of the company into perspective, I decided to compare it to the only other industry giant out there. And that is United Parcel Service (UPS). Using 2021 results, it is trading at a price to earnings multiple of 14.1. The price to operating cash flow multiple is 10.1, while the EV to EBITDA multiple comes in at 10. Even ignoring the likely improvement the company should see this year and, instead, focusing on 2021 results, seeing FedEx move up to the multiples that UPS is going for would imply significant upside. Using the price-to-earnings approach, it would translate to upside potential of 23.7%. If we use the price to operating cash flow approach, upside would be as high as 71.2%, while the EV to EBITDA approach would result in upside of 73%.

| Company | Price / Earnings | Price / Operating Cash Flow | EV / EBITDA |

| FedEx | 11.4 | 5.9 | 6.3 |

| United Parcel Service (UPS) | 14.1 | 10.1 | 10.0 |

Takeaway

Based on the data provided, I will say that I am surprised by the recent development regarding FedEx. It’s not every day that a significant activist investor takes aim at a massive, multi-billion-dollar corporation. Depending on how things go, the company might take advantage of some catalyst that could create significant upside for shareholders. Of course, it’s also possible that things could move in the opposite direction. But when you consider just how cheap shares of FedEx are today, it doesn’t seem to need any changes in order to already offer nice upside. Because of this, I have decided to rate the enterprise a ‘buy’ for now.

Be the first to comment