anatoliy_gleb/iStock via Getty Images

If you’re an iREIT on Alpha member, you get a whole lot of bonuses. I’m talking about access to my specialized portfolios… proprietary investment tools my team and I have worked very hard on… and instant access to my published articles instead of having to wait 24 hours, two whole days, or longer.

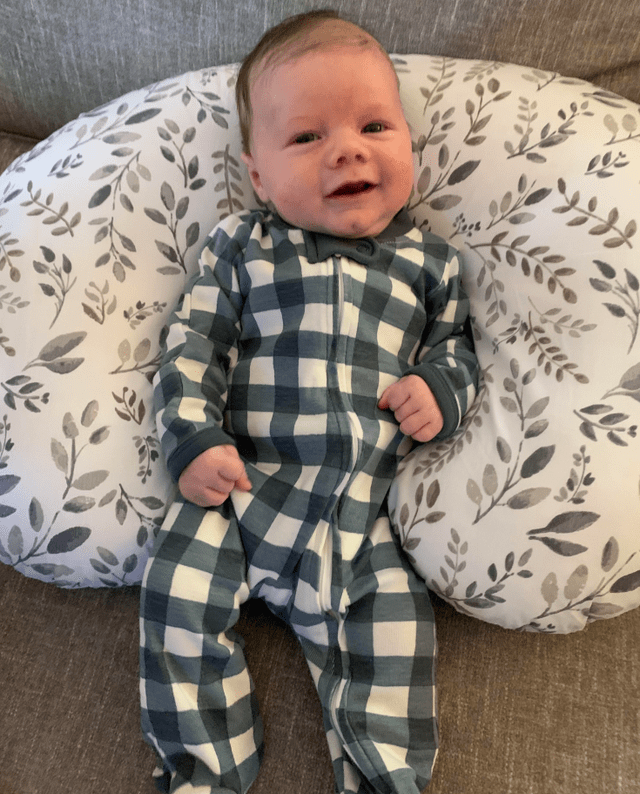

But right now, my favorite offering to iREIT members is pictures of my grandson, Asher. I share those every week in my Monday-Morning REIT Quarterback pieces, which I publish exclusively on that service.

For the record, that’s not an intentional gimmick. If I had my way, I’d share pictures of Asher here too. But my daughter would have my head if I did, and I know it.

Considering how she has some significant leverage on me these days (i.e., my grandson), I don’t want to risk angering her too much.

Oh, how we grandparents suffer.

Admittedly, I wasn’t suffering one bit this past weekend. As I wrote on Monday, I got to see the little guy. And “Boy, oh boy, life has changed” with him in it.

“… this little boy has brought so much joy into the life of our family.

“And just think, I have four daughters and a son. So now I’m wondering how many grandkids I will be holding over the next 10 years?”

It’s tough to think of my youngest as a mom since she’s still in school. But in 10 years, I could very well be holding her firstborn.

You just never know.

The Good Things in Life

That’s the thing. You really just never know what’s around the corner. That’s why you have to properly prepare for the “whatevers” in life.

Some of those possibilities are going to be amazing, like Asher. But even then, they come with responsibilities.

That’s why my Monday-Morning REIT Quarterback piece kept going:

“As I reflected on my being a dad and now a granddad, I began to ponder the next decade and what it will mean to me as an investor, an analyst, and the leader of iREIT on Alpha.

“In many ways, you are part of my family, or perhaps extended family. And it means a lot to me to have you commenting on articles or on the chart board [for iREIT members].

“I know that you came here to get research or investing advice, but I must tell you that being a father – and now a grandfather – makes me highly qualified to share lessons learned, with the sole purpose of being the voice of reason in a world of chaos.”

As I’ve mentioned before, I’ll definitely be sharing as many of those lessons with Asher as I can – around watching him learn how to walk… helping him sing his ABCs… and maybe even showing him how to shoot a three-pointer someday.

I want to give him the good things in life whenever and however I can. And I’m sure that you want to do the same for your closest loved ones, whether a spouse, children, or grandchildren.

In which case, obviously, you’ll want to tell them about real estate investment trusts. Or flat-out buy up some for them.

At least I think this is obvious. You’re more than welcome to form your own opinions though.

Asher Will Now Own an Industrial REIT

I’ve written about building a starter portfolio for my grandson a few times now. (Clearly, this little guy is taking up a lot of my focus these days.) And now I’ve got another “Asher” pick to share.

This time, it’s in the industrial field of REITs.

Now, you may be thinking that the brink of recession isn’t the right time to invest in anything retail related. We all know by now about big companies like Walmart (WMT) and Target (TGT) – especially the latter.

As I wrote in Wednesday’s blog:

“The retail giant has been grappling with a drop in demand for discretionary items, causing revenue to plummet even though shopping has stayed consistent more or less…

“It’s not the only one dealing with these issues.

“As the pandemic put the retail world in overdrive, consumers rushed to purchase everything from flat-screen televisions to expensive exercise bikes. Retailers everywhere rose to the occasion, ordering a surplus of goods – especially in the face of never-ending supply issues.

“And now those excess orders are piling up and proving useless as our economy contracts.”

Which means nobody is going to need new warehouses any time soon.

But just because they don’t need new warehouses doesn’t mean they don’t need existing ones… especially when existing ones are strategically placed in high-traffic areas. There’s rent money to be made off of companies that still need to store their “stuff” somewhere.

As such, Asher can be practically assured of getting his own “rent money” quarter after quarter as well.

Become a Warehouse Landlord

One day I’ll be able to tell my grandson about Industrial REITs and how my hometown of Greenville-Spartanburg has evolved into a hotbed of industrial activity.

Once considered sleepy industrial city, Greenville-Spartanburg has become a thriving industrial community anchored by two automotive titans, BMW and Michelin.

Years ago, I arranged site selection and development services for one of BMW’s Tier 1 suppliers, Lemforder, and I also used to own over 300,000 square feet of space leased to Goodyear Tire.

These days developers are flocking to the area to participate in one of the most active industrial development cycles that I’ve witnessed in my lifetime.

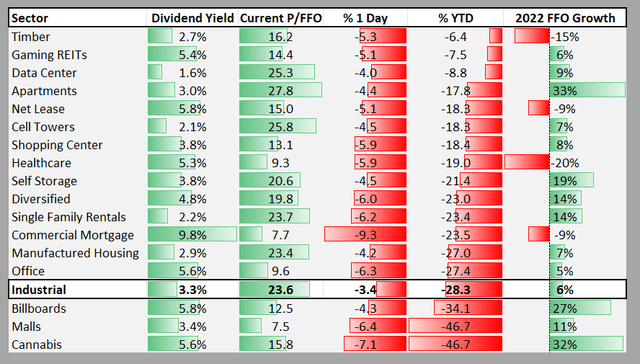

Of course, Asher is too young to wear a hard hat, but he can certainly get started early by assisting his grandad in some stock selection opportunities. As you can see below, the Industrial REITs have become attractively priced after a 28% pullback year-to-date.

iREIT on Alpha

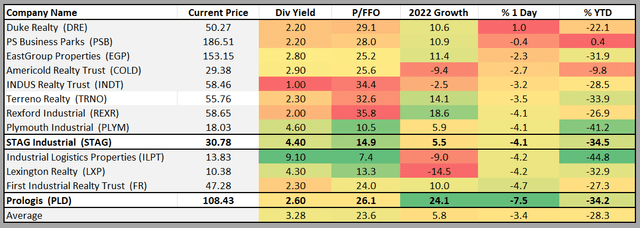

More recently, several very high-quality Industrial REITs have becoming even more compelling, as shown below:

iREIT on Alpha

As you can see (above), Prologis (PLD) fell by around 7.5% after announcing an agreement to merge with Duke Realty (DRE), valuing DRE at $26 billion, in an all-stock transaction.

PLD sweetened its bid to 0.475 exchange ratio from 0.466 previously, implying a value of $55.69 for each DRE share based on PLD’s current price (vs. DRE’s $49.78 price), which we estimate values DRE at a 3.7% implied cap rate.

Post-transaction, PLD shareholders will own 80.5% of the combined company; DRE 19.5%. In the event of a termination, the termination fee is $775 million from DRE; $1.5 billion from PLD.

As we informed members at iREIT on Alpha, we view the deal as complementary based on the fact that PLD said it will hold 94% of DRE’s portfolio and exit only one of its markets; increasing PLD’s US NOI to 84.7% (from 81.3%) and strengthening PLD’s balance sheet to 4.5x Debt/EBITDA (from 4.7x).

PLD has the strongest balance sheet in the sector and given the pullback we consider it an opportunistic time to become a shareholder.

As I explained a few days ago, “during Q1, PLD’s average occupancy came in at 97.4%. 98.1% of the company’s portfolio was leased as of 3/31/2022…and same-store rent was up 8.7% on a YOY basis during Q1, highlighting the strong demand for its blue-chip retail properties. The company noted that same-store-rent in the U.S. was up 9.7% YOY during the quarter.”

The DRE deal will certainly move the needle for PLD as the company said that the majority of Year 1 accretion ($275M at midpoint of range) will be derived from accounting (lease and debt fair value adjustments), and another $65M from G&A savings.

PLD estimated another $387M of future accretion, including $80M from incremental property cash flows and Essentials, and $300M from development value creation.

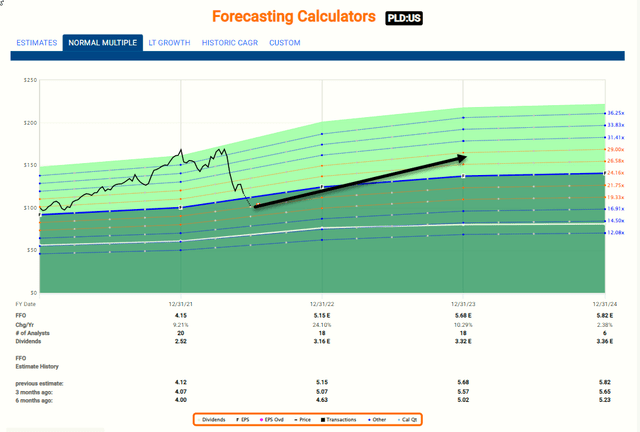

Prior to the merger news analysts were forecasting FFO per share growth of 24% in 2022 and 10% in 2023. We suspect that this $26 billion deal will provide plenty of dividend power for America’s largest industrial landlord.

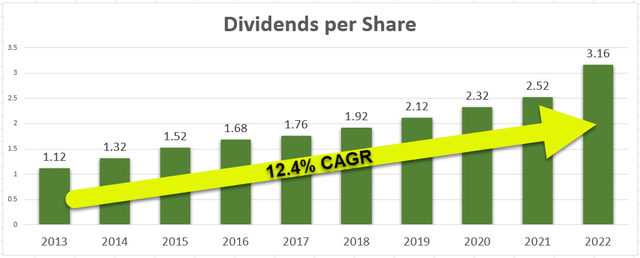

Speaking of dividends, PLD has grown its annual dividend by around 12.4% per year since 2013.

iREIT on Alpha

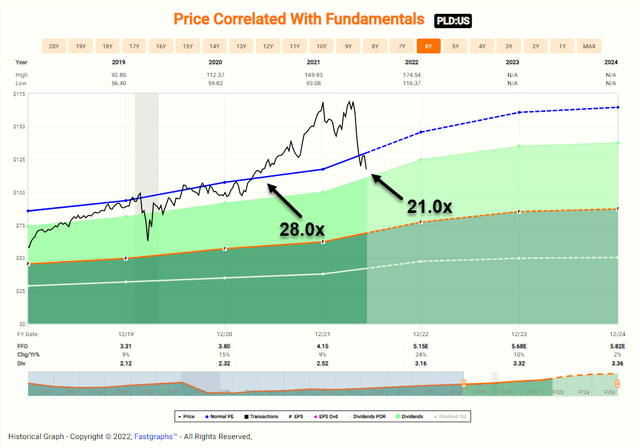

I want to teach Asher how to become a value investor, and this means I must demonstrate that I am purchasing PLD shares with a margin of safety in mind. As you can see below, shares are now trading at 21x compared with the 3-year average of 28x.

FAST Graphs

PLD’s dividend yield is now 2.7% and based on the DRE news we believe that the potential for robust dividend growth is elevated. As show below, we estimate PLD to return 25% over the next 12 months and is now a Strong Buy.

FAST Graphs

STAG Industrial (STAG) is an industrial REIT that owns 551 properties within 40 states all here in the US. Those 551 properties are made up of 110.1 million square feet of industrial space.

The growth we have seen from the company has been staggering.

Since going public back in 2011, the company has gone from 93 properties to 551 properties. At IPO STAG had 21% of its annual base rent attributable to Flex/Office type properties, whereas today that is down to 0.1%, making STAG a pure-play industrial REIT.

In March, STAG Industrial acquired a 156,000 square foot warehouse distribution facility located in my hometown of Greenville, SC for $16.4 million at a 4.6% stabilized cash cap rate. The property is in the Matrix Industrial Park near I-85 and the building is leased for just under three years to an investment-grade tenant.

The tenant has occupied the facility for more than 13 years and has a large capital investment in the facility. Rents are well below market, providing an attractive opportunity to create additional value at lease expiration.

Also in March, STAG acquired a 289,000 square foot warehouse distribution facility located in the Greenville market for $28.3 million at a 5.7% stabilized cash cap rate. It’s located in the Exchange Logistics Park, in the I-85 submarket and was 78% leased upon acquisition to three credit tenants, with the ability to add value through the lease-up of the remaining space.

According to STAG’s latest 10-K, the company had ten buildings located in the Greenville-Spartanburg MSA as of 2021 and that exposure represented around 5.1% of total average base rent (‘ABR’). These new investments should move Greenville to the number two position of STAG’s top ten city list, just under Chicago at 7.9% ABR.

STAG Industrial has an investment grade rated balance sheet and expects net debt to run rate adjusted Ebitda to be between 4.75x-5.5x.

The company has seen a reduction in leverage since 2015 with net debt to run rate adjusted Ebitda reduced from 5.6x in 2015 to 5.1x as of first-quarter 2022 (2021 average leverage lower than normalized expectations due to pandemic). Conservative capitalization supports robust growth.

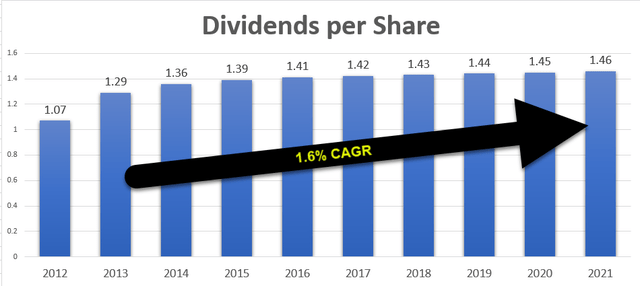

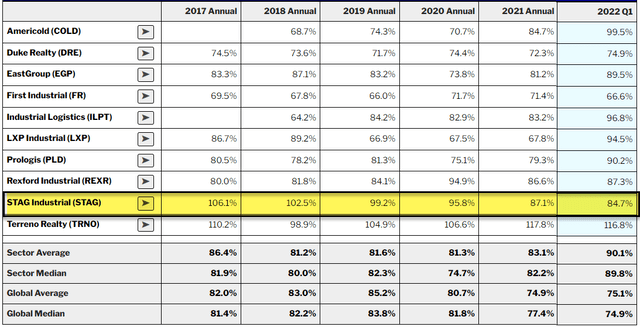

STAG has reduced its payout ratio and while I would like to see more robust dividend increases, the dividend is safer today because of the 82.2% payout ratio (as of first-quarter 2022 and based on CAD).

iREIT on Alpha

As you can see (above) STAG’s dividend growth is extremely more modest that PLD’s, and that’s because STAG has been busy lowering its payout ratio to become more competitive with its peers.

Dividend Payout – AFFO

Source: REIT-Base

This provides confidence that STAG is aligned with investors (growing its dividend) while also practicing responsible risk management (AFFO payout ratio in Q1-22 was 84.7%). In Q1-22 STAG’s acquisition volume was ~$166.4 million across eight buildings with stabilized cash and straight-line cap rates of 5.0% and 5.2%, respectively.

During Q1-22 STAG also sold one building for $35.9 million at a 4.4% stabilized cash cap rate, with the proceeds accretively redeployed into acquisitions. The company said it expects disposition proceeds in the range of $200 million to $300 million in 2022, “higher than the previous years to take advantage of the current pricing environment”.

STAG also guided FFO per share to a range of $2.16 per share to $2.20 per share, an increase to the midpoint of $0.01. And also increased same-store guidance to be between 4% and 4.5% for the year, an increase in the midpoint of 75 basis points.

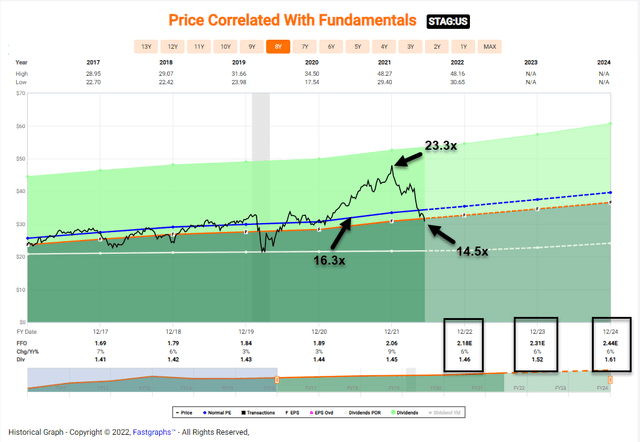

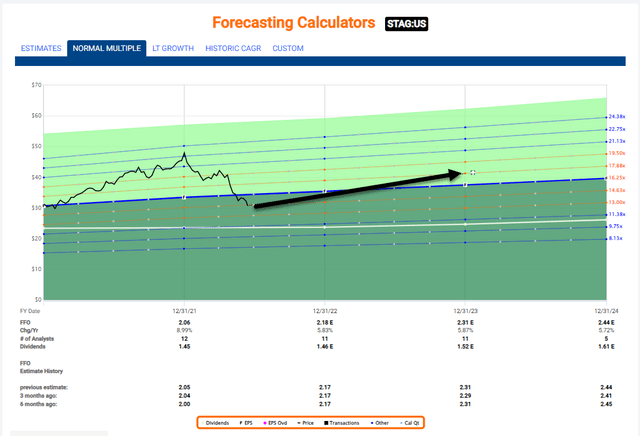

FAST Graphs

As viewed above, analysts are forecasting STAG to grow by 6% in 2022, 2023, and 2024. This means the company should be able to continue reduce the payout ratio AND grow the dividend by more than 1.5% per year.

STAG is now trading at 14.5x P/FFO compared with the normal range of 16.3x (high was 23.3x in December 2021). Also, the dividend yield is 4.7% (once again, well covered by AFFO).

As viewed below, we are targeting STAG to return 20% to ~25% over the next 12 months. That model is based up a 4.7% dividend (paid monthly), 6% growth forecast, and multiple expansion (14.5x to 16.0x).

FAST Graphs

Asher Is A Happy Camper (now Landlord)!

In the Bible, Asher was the patriarch son of Jacob and Zilpah, and it means happy, fortunate, or blessed.

This morning I was on my early walk in South Carolina and my daughter facetimed me so that I could speak with my new grandson, Asher. What perfect timing for a call, because I wanted to tell Asher that I was buying two REITs from him today.

You may recall my first article on Asher (May 20, 2022) in which I picked Simon Property Group (SPG) and Realty Income (O) and now I will be adding Prologis and STAG to his portfolio.

By the time Asher is high school he should have accumulated significant wealth, thanks in large to “big Daddy” (that is what Asher is calling me), price appreciation, and of course the wonderful magic of dividend reinvesting.

Note: We will call Asher’s portfolio “Big Daddy’s REIT Picks”…

Source: Brad Thomas

Be the first to comment