Petmal

FREYR Battery (NYSE:FREY) stock is trading near its post-SPAC highs and is seeing good momentum despite the significant correction in the broader markets. The company recently got a price target boost from the prior $18 to $26 by Morgan Stanley (MS) analyst Adam Jones. The analyst also hiked his bull case price target for the company to $60 from the prior $34. Adam Jones highlighted on-shoring and the Inflation reduction Act which will incentivize EV and battery production domestically. He also cited a recent binding off-take agreement as a reason for turning more optimistic about the stock.

Late last month, FREYR Battery signed a broad partnership with Japanese electric motor manufacturer Nidec (OTCPK:NJDCY). In it, FREYR and Nidec have agreed to convert and expand the previously announced 31 GWh conditional offtake agreement between them to a binding sales agreement under which FREYR will supply 38GWh of cells (with an estimated gross value of $3 billion +) from 2025 to 2030 with an option to upsize volumes to 50 GWh in that period. A binding sales agreement is usually helpful in securing project financing at favorable terms. FREYR and Nidec also agreed to form a joint venture to combine FREYR’s clean, next-generation battery cells with modules and packs into integrated downstream ESS solutions for industrial and utility-grade customers.

With the transition to Electric Vehicles picking up, several players have emerged in the cell and battery manufacturing space. FREYR battery differentiates itself as being cleaner (less CO2 emission during its manufacturing) and an onshore manufacturer in the U.S. and Europe. Onshore or near-shore manufacturing has gained some traction in recent years given significant supply chain issues post-Covid which have impacted production. Having an on-shore or near-shore parts manufacturer lessens the risk of supply chain disruption.

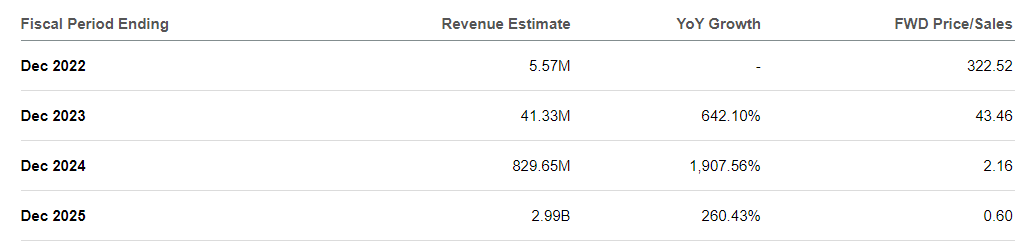

The company currently doesn’t have any significant revenues (for the current year it is expected to generate just $5.57 million in revenues according to consensus estimates) but over the next 3-4 years, as its battery manufacturing facilities go online, analysts are expecting significant ramp-up in revenues given its off-take agreements and the strong momentum in EV industry.

While I don’t have a problem investing in the companies in pre-revenues or initial stages, I look for some kind of a moat whether it is technology, early mover advantage or industry structure to give me some sort of confidence in the company’s longer-term prospects. For example, I covered Li-Cycle (LICY) a few days back. It is also a play on the transition to EVs as it addresses the issue of Li shortage by recycling Lithium from used batteries. LICI is expected to see a significant ramp-up in revenues over the next couple of years. The one thing which I liked about Li-Cycle was its unique technology which increases the recovery rate of used Lithium and other rare metals from used batteries and leaves little wastage.

FREYR, on the other hand, doesn’t own significantly differentiated technology. It has licensed 24M technology but there are other competitors and end-customers including Kyocera, GPSC, ITOCHU, Lucas TVS and Volkswagen (OTCPK:VWAGY) which license and use the same technology. So, there is little technology moat for the company.

There is also no early mover advantage and the industry is fragmented with several bigger manufacturers like CATL, LG Chem, Panasonic, BYD (OTCPK:BYDDY), and Samsung SDI already in the market. Even in Europe, there are competitors like Northvolt. Further, the major prospective buyers are big automobile companies which have higher bargaining power and many of them are having the option to manufacture their own batteries in-house. So, this is a tough industry to be in.

Also, while there is a lot of buzz around on-shoring or near-shoring parts suppliers, with covid-related disruptions waning and supply chain conditions improving, I don’t think this will be a top priority for long. In the longer term cost economics will prevail and since labor cost is much cheaper in Asia, manufacturers there might have an edge. Further, while the company is doing a good job in terms of lower CO2 emissions, it is not something that its competitors can’t achieve.

If we think a few years ahead and assume the company is able to execute well and reach the target production capacity, its sales will ramp up significantly.

FREY revenue estimates (Consensus Estimates, Seeking Alpha)

However, there is a lot of uncertainty between now and a few years down the line. There is a good likelihood of several new projects by existing competitors and new players, especially given the kind of valuations the companies like FREYR are getting. The technology may also improve which is a big risk as the company currently licenses technology and may not be able to keep up the pace. Valuation might compress as investors realize it is a commodity business with the severe competition and little moat. Also, what the Federal Reserve is doing in terms of increasing interest rates and quantitative tightening might have a negative impact on the valuations of loss-making story stocks which have much to prove in terms of execution.

That said, the momentum can continue in the near term with the sell-side analysts cheerleading the stock and assigning a much higher target price than where the stock currently is trading at. Other than Morgan Stanley, Goldman Sachs (GS) analysts also upgraded the stock last month as they focused on benefits from the Inflation Reduction Act. However, I believe while the inflation reduction act might incentivize these manufacturers to set up their facilities in the U.S., it cannot ensure their long-term profitability and cost competitiveness. Hence, despite strong near-term momentum, I prefer to be on the sidelines and have a neutral rating on the stock.

Be the first to comment