Sundry Photography/iStock Editorial via Getty Images

Introduction

I have always wanted Adobe Inc. (NASDAQ:ADBE), the well-known company behind creative software like Photoshop, InDesign, Illustrator, et cetera, and the widely used Document and Experience Cloud services, in my own portfolio because of its wide moat and my own positive experiences with the products.

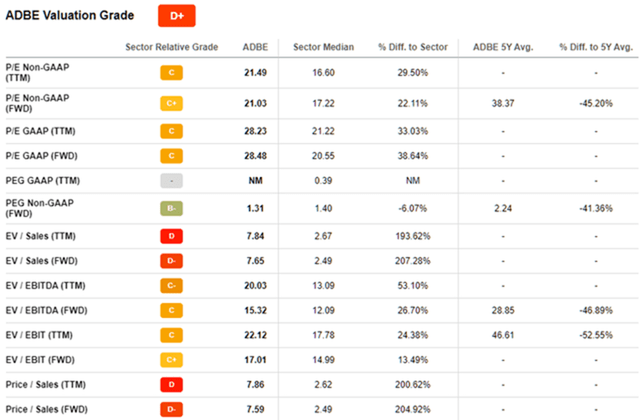

However, the stock’s extremely high valuation and high duration (owners are paying for cash flows far into the future, meaning there is a lot of hope for future growth priced into the stock) kept me from opening a long position. Now that the share price has fallen considerably (nearly 60% from the double top formed in late 2021) and valuation metrics have reached quite meaningful levels, I figured it was time to reconsider – maybe it is finally time to buy the stock?

In this article, I will give my take on Adobe’s moat in the context of its acquisition of Figma (the incumbent UI/UX company) and discuss the stock’s current valuation from a duration perspective.

Adobe’s Wide Moat – Photoshop As An Example

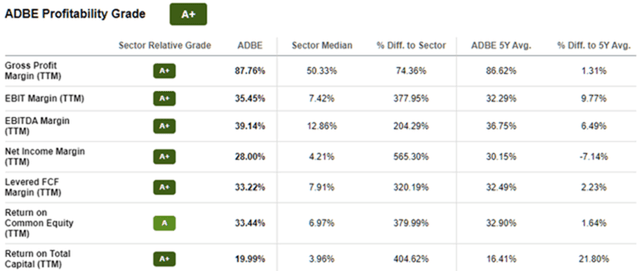

Adobe boasts a five-year average gross margin of 86.6% (Table 1), and its longer-term gross profitability is also extremely high. Adobe’s cash return on invested capital (CROIC) is also juicy – in the low 30% range.

Table 1: Selected profitability metrics for Adobe Inc. (taken from the ADBE stock page on Seeking Alpha)

The stellar profitability is a strong indication that the company is indeed running a business with a very wide moat that benefits greatly from scale. As a very satisfied user of their products, I have a good understanding of the ecosystem they have created around Photoshop in particular. The 100% shift to a subscription-based cloud service (Adobe Creative Cloud) was announced in 2013, and while I was not a particular fan of that decision from the perspective of a consumer – who now faces recurring payments – it signaled that Adobe was operating in a quasi-monopoly position. At some point, the compatibility of certain filters, file types, et cetera, practically forced commercial users of Adobe software to migrate to the cloud. Functioning eye-to-eye competition using Adobe Photoshop as an example is lacking, especially when working in a collaborative environment – another sign that Adobe’s moat is very wide. GNU Image Manipulation Program (free, open source), PaintShop Pro (Corel), and Clip Studio/Manga Studio (Smith Micro, SMSI) are helpful and solid software, but they cannot replace Photoshop by any means.

Adobe’s UI/UX Portfolio – Or, Why The Company’s Moat Could Be Showing Signs Of Weakness

For UI/UX designers, Adobe currently offers Adobe XD, but the company’s flagship products, Photoshop and Illustrator, are also widely used. However, Figma has gained popularity among UI/UX designers in recent years and can be considered the top software for collaborative user interface and experience design tasks.

On September 15, Adobe announced its intention to acquire Figma for $20 billion in a 50/50 cash/stock deal. The price is double Figma’s June 2021 valuation – or 10 times its 2020 valuation. Adobe’s CEO went at great length – in my opinion – to make the deal palatable to shareholders during the company’s third quarter 2022 earnings conference call. A net dollar retention rate of more than 150%, a growth rate of more than 100% (against a backdrop of expected annual recurring revenue of $400 million in 2022), and a total addressable market of $16.5 billion USD (by 2025, representing 8% of Adobe’s total addressable market at the end of 2021) suggest that a lot of hope for future growth is baked into the $20 billion price tag, which equates to a forward price-to-sales ratio of 50 – more than six times Adobe’s current price-to-sales multiple (Table 2).

As a value investor, I am obviously not a big fan of acquisitions at lofty multiples that are mostly justified on the basis of future potential. Just imagine what will happen if it turns out that Figma’s total addressable market is smaller than expected. In addition to the negative impact on earnings, goodwill will have to be written down – and Adobe’s balance sheet already contains a significant amount of goodwill (48.6% of total assets at the end of Q2, p. 3, 2022 10-Q2). The acquisition of Figma will again significantly increase this percentage.

Table 2: Selected valuation metrics for Adobe Inc. (taken from the ADBE stock page on Seeking Alpha)

In addition to the high expectations associated with the transaction, another aspect is worth mentioning: the fact that Figma is expected to grow so strongly suggests that the position of Adobe XD, Photoshop and Illustrator in UI/UX design has become weak. Perhaps Adobe’s moat is not that wide after all? Keep in mind that Figma only launched in September of 2016 and has been able to evolve and claim market share for itself in the UI/UX segment pretty quickly. I sense from this desperation on the part of Adobe management, especially given the high price paid.

Of course, Adobe is in a good position to acquire other companies (at the end of Q2 it had a net cash position of nearly $1.2 billion), so I would not question management’s decision to grow inorganically. However, the strong balance sheet should not be taken as a call to acquire potential threats to the company’s wide moat at any cost. At some point, debt will have to be considered. After all, management has fiduciary duties to fulfill and must be good stewards of the company’s resources in all respects.

Since the transaction is structured on a 50/50 cash/share basis, current investors will have to accept a slight dilution of their stakes, while the company will have to take on a few billion in debt. The capital raise at current levels is disappointing from a shareholder perspective – the stock has traded more than 70% higher for most of 2021 (even excluding the exuberant surge into the $600+ range), especially given the nearly $4 billion spent on share repurchases in 2021 at an average price of $536 per share (p. 87, 2021 10-K).

Discounted Cash Flow Valuation – And The Duration Component In Growth Stocks

Companies like Amazon (AMZN), Alphabet (GOOG, GOOGL) , Meta Platforms (META), Netflix (NFLX), PayPal (PYPL), et cetera, have performed miserably in 2022. Stock prices in the most basic sense are (or should be) a reflection of discounted future cash flows. If interest rates rise, the cash flow discount rates are adjusted upwards accordingly. Stocks of companies with high current cash flows (i.e., value stocks) are less vulnerable to changes in risk-free interest rates than stocks of companies with better growth prospects but lower current cash flows (i.e., growth stocks like ADBE). The following thought experiment should be taken as an easy-to-understand example:

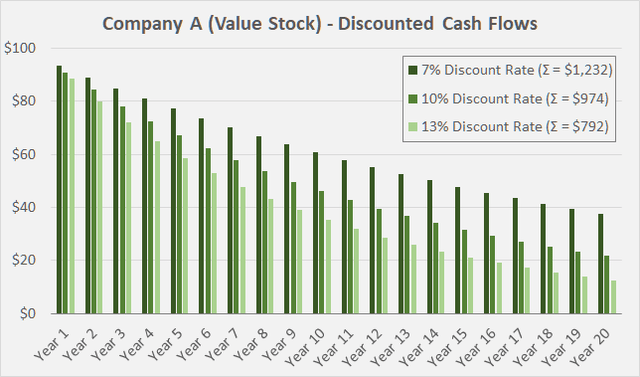

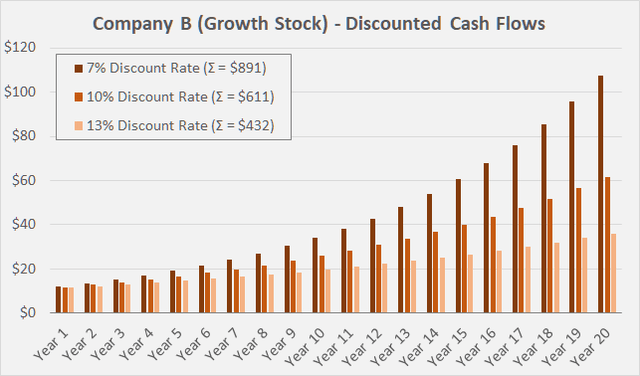

Assume that in year 1, Company A generates $100 in free cash flow and is able to grow at a compound annual growth rate (CAGR) of only 2%. After 20 years, the company has generated approximately $2,430. Company B generates only $13 in year 1, but grows much faster – at a CAGR of 20%. After 20 years, it has also generated $2,430 in free cash flow. Since a dollar generated today is worth more than one generated in the future, in part due to inflation, we must discount future cash flows accordingly. Assuming a discount rate of 7% per year, the sum of Company A’s cash flows is worth $1,232 to an investor, while Company B is worth only $891 because of its right-skewed cash flows. The market adjusts to this and values the shares of the two companies accordingly.

But what happens when interest rates rise by, say, 300 basis points? Suddenly, Company A’s cash flows are worth 21% less than they were before the rate increase (all else being equal), but the present value of Company B’s cash flows has fallen by 31%. The interest rate sensitivity of the cash flows of the two companies is shown in Figure 1 and Figure 2. It is important to note that cash flows far out in the future are worth increasingly less, especially as higher discount rates are applied. As a result, growth stocks with high terminal growth rate expectations are particularly sensitive to interest rate hikes – and the effect is amplified if terminal growth rates do not materialize as expected.

Figure 1: Interest rate sensitivity of the cash flows of a weakly growing company with strong present cash flows (own work) Figure 2: Interest rate sensitivity of the cash flows of a strongly growing company (own work)

Returning to Adobe, the company generated $7.2 billion in free cash flow in 2021, normalized for working capital movements. Note that this excludes significant stock-based compensation, which typically accounts for 15% of operating cash flow at Adobe (see my article on this topic).

The company had a weighted average of 473 million diluted shares outstanding in the second quarter of 2022. With $6.0 billion in baseline free cash flow (taking into account stock-based compensation), the market currently expects Adobe to grow its free cash flow at a CAGR of 5.6% in perpetuity, assuming a 10% cost of equity. Such a growth rate sounds quite feasible, especially since the company is able to continuously increase the prices of its subscriptions due to strong customer retention and monopolistic tendencies. However, if it proves correct that Adobe must continue to make mergers and acquisitions to defend its moat, the associated capital expenditures are understandably much higher, as is the implied required free cash flow growth rate.

Conclusion

Even though I am skeptical about the $20 billion acquisition of Figma and suspect that the moat around Adobe’s creative software products is narrower than initially thought, I am still considering the stock for my portfolio. Adobe is a highly profitable company with a very strong business model and a particularly solid balance sheet – no question.

However, as Adobe seems increasingly forced to make mergers and acquisitions to defend its moat and sustain growth, I am hesitant to invest in the stock today, even though the implied terminal growth rate is less than 6% at the current share price and a 10% cost of equity. Buying up other companies at extremely high multiples is a major threat to shareholder value, and that is one reason why I am mainly invested in well-established companies with limited growth prospects that pay out a large part of their free cash flow in dividends.

The fact that Adobe is, by its nature, very dependent on the advertising market makes it very likely that the stock will suffer more in the event of a recession. Of course, the market is always forward looking and has likely begun to price a recession into the stock – as is the case with Alphabet and Meta Platforms. However, there is a possibility that the decline to date is merely to be associated with the deflation of the mindless buying frenzy in 2021. Recency bias is a powerful pitfall that every investor should keep in mind.

I continue to watch ADBE and consider the stock for my portfolio, but I suspect things could get worse before they get better, so I rate the stock a “hold” at a price of $286. The current valuation makes sense from a long-term discounted cash flow perspective, but for my tastes and given the uncertainties surrounding Adobe’s moat, the stock price does not reflect a reasonable margin of safety.

Thank you very much for taking the time to read my article. In case of any questions or comments, I am very happy to hear from you in the comments section below.

Be the first to comment