Steve Jennings

It takes a very brave investor to look out at the current turbulence in the market and see buying opportunities. It takes special bravery to lean in on tech/growth stocks, which have reversed basically the entirety of the gains they made during the pandemic and are now arguably trading at value levels.

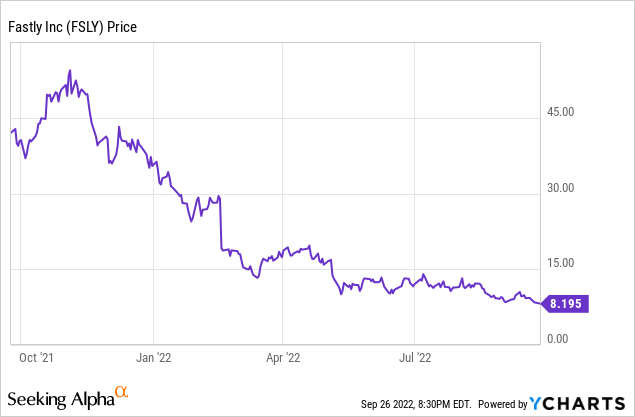

Though the macro outlook is murky and a rebound will take patience and a strong stomach, it’s a fantastic time to be “dumpster diving” for beaten-down stocks – even though that have raised new fundamental risks. In the case of Fastly (NYSE:FSLY), a CDN (content delivery network) company that has lost nearly 80% of its value this year, I believe there’s a great opportunity for investors to dive in for a bargain buy.

I remain bullish on Fastly. Yes, the company has gone through quite a bit of turbulence lately. As a shortlist of issues for investors who are newer to this name, the company dealt with a widespread service outage late last year; growth is decelerating (in line with other tech stocks), and gross margins are also under pressure. Note that to address all of these issues and to hopefully spur a turnaround in the stock price, Fastly has named a new CEO who began in his seat on September 1, Todd Nightingale – a former Cisco (CSCO) executive. Joshua Bixby, the current CEO, will move into an advisory capacity.

Despite many moving pieces here that understandably make investors nervous, I think A) Fastly’s product platform remains mission-critical and quite sticky for its customers, and B) its cheap stock price more than makes up for the risks.

Here’s a rundown of my long-term bull case on Fastly:

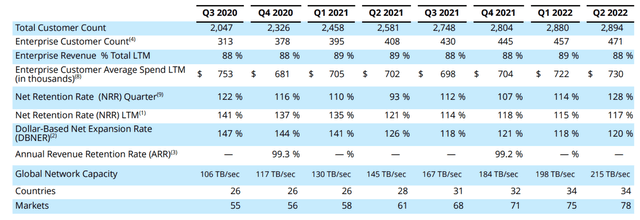

- Fastly’s usage-based business model opens the door to tremendous growth. Fastly, alongside other software/technology peers like Twilio (TWLO), were among the companies that could fully take advantage of the pandemic and the increase in internet traffic that came with it. Because Fastly’s pricing is based on volumes of content delivered, as the underlying customers continue to grow their websites and traffic, Fastly’s revenue will also grow proportionally. Fastly’s net revenue retention rates recently clocked in at 120%, indicating that the average Fastly customer increases their usage by 20% in the following year.

- Greater customer diversification. Fastly continued to add customers at a fast pace throughout 2020, and though investors were disappointed by TikTok’s gradual pull away from Fastly, the company’s continued ~40% revenue growth (pre-outage impacts) shows that Fastly can grow without depending too much on a single large client.

- Best of breed. Though CDN is not a new technology category, with companies like Cloudflare (NET) and Akamai (AKAM) preceding Fastly by several years (and in Akamai’s case, decades), Fastly is one of the most highly regarded CDN vendors. Fastly’s addition of Signal Sciences and its web application firewall (WAF) tools also flesh out Fastly’s offering.

Now let’s discuss the anchor point: cheapness. At current share prices near $8, Fastly trades at a market cap of just $1.00 billion. After we net off the $767.4 million of cash and $703.4 million of debt on Fastly’s most recent balance sheet, the company’s resulting enterprise value is $937 million.

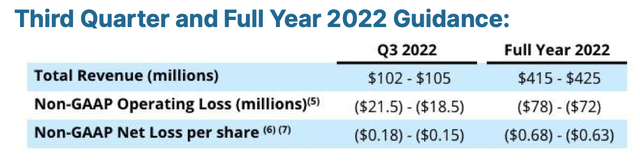

For the current fiscal year, Fastly has guided to $415-$425 million in revenue, representing 17-19% y/y growth. Note that this is actually a slight increase from the company’s Q1 guidance of $405-$415 million, one of the few instances in the tech sector this earnings quarter in which guidance has gone up and not down.

Fastly outlook (Fastly Q2 earnings release)

If we look ahead next year to FY23, Wall Street consensus puts Fastly’s revenue at $481.6 million, representing 15% y/y growth (data from Yahoo Finance). This puts Fastly’s valuation multiples at:

- 2.2x EV/FY22 revenue

- 1.9x EV/FY23 revenue

While it’s true that Fastly is working on margin builds and reinvigorating its growth, this ~2x multiple is a sharp fall from grace for a company that once traded at double-digit revenue multiples. I continue to believe in this company for the long run: use this dip as a buying opportunity.

Q2 download

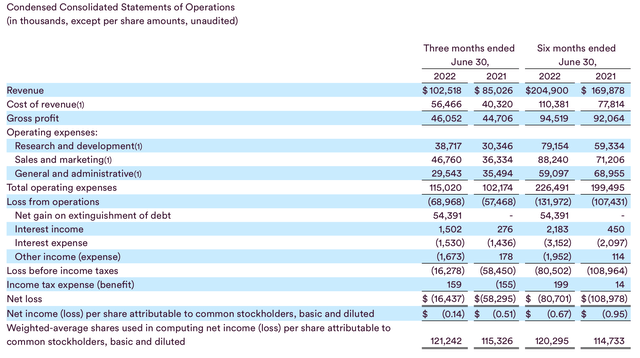

Let’s now go through Fastly’s latest Q2 results in greater detail. The Q2 earnings summary is shown below:

Fastly Q2 results (Fastly Q2 earnings release)

Fastly’s revenue grew 20% y/y to $102.5 million in the quarter, beating Wall Street’s expectations of $101.6 million by roughly one point. Revenue growth also largely kept pace with Q1’s 21% y/y growth pace.

One black eye raised in the quarter was lower net customer adds. As shown in the chart below, the company ended Q2 with 2,894 total customers – up only 14 customers sequentially, versus 76 adds in Q1.

Fastly customer trends (Fastly Q2 earnings release)

The company noted here that it experienced higher than expected churn from the lower end of the company’s customer base. However, we note on the bright side that dollar-based net retention rates are up to 120%, a two-point sequential improvement from 118% in Q1 – indicating that large customers continue to increase their usage and dependency on the Fastly platform.

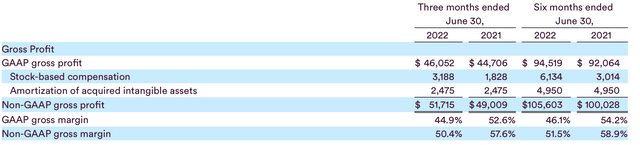

The other potential black eye was on gross margins. The company recorded a seven-point in its pro forma gross margin profile to 50.4%, as shown in the chart below:

Fastly margins (Fastly Q2 earnings release)

The company noted, however, that there were many non-recurring and one-time items in the decline (without which the y/y drop would have only been 50bps), and that it directionally expects its capacity-planning decisions to result in improved margins going forward. Per CFO Ron Kinsling’s prepared remarks on the Q2 earnings call:

Our gross margin was 50.4% for the second quarter compared to 52.6% in the first quarter of 2022. This gross margin is below the flattish sequential level we anticipated during our last quarterly earnings call. This is primarily due to a onetime true-up to our cost of revenue I discussed above as well as other smaller one-time items that, had they not occurred, would have led to an approximate decline of only 50 basis points sequentially. We realized the optics of this gross margin trend are unfavorable and I want to confirm that we did not see any meaningful decrease in our pricing in Q2 compared to the first quarter. And our prior discussion on our network investments in the next-generation architecture remains intact, and we expect gross margin improvement in the second half. We continue to expect gross margin to increase meaningfully for the remainder of 2022 towards the low to mid-50s.”

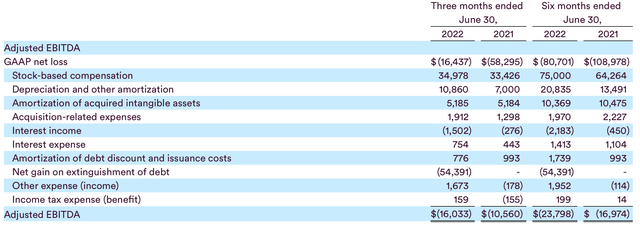

Fastly’s adjusted EBITDA loss also widened to -$16.0 million, representing a -15.6% adjusted EBITDA margin: a 320bps reduction from a -12.4% margin in the year-ago Q2.

Fastly adjusted EBITDA (Fastly Q2 earnings release)

As noted, however, gross margin drops are the key driver here and the company is on a path to recovering on this front.

Key takeaways

There is undoubtedly a lot of uncertainty swirling around Fastly at the moment, but I think the company’s ~2x revenue multiple plus its sticky product platform makes it a worthwhile buy while the market continues to correct. Have patience and build a low-cost position here.

Be the first to comment