valiantsin suprunovich

Introduction

When last discussing Crestwood Equity Partners (NYSE:CEQP) earlier in the year, my previous article saw a new era of distribution growth possibly beginning following their acquisition of Oasis Midstream. Only days later, they lifted their distributions by nearly 5% as expected and following the recent market sell-off, it now sees their yield exactly at a very high 10%. Despite higher distributions being a positive start, following their subsequently announced upcoming acquisitions and divestitures, it seems that the numbers are not stacking up with these likely to hinder their distribution growth.

Executive Summary & Ratings

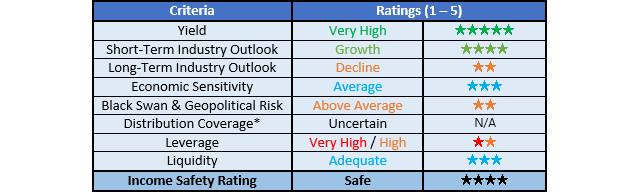

Since many readers are likely short on time, the table below provides a very brief executive summary and ratings for the primary criteria that were assessed. This Google Document provides a list of all my equivalent ratings as well as more information regarding my rating system. The following section provides a detailed analysis for those readers who are wishing to dig deeper into their situation.

Author

*Instead of simply assessing distribution coverage through distributable cash flow, I prefer to utilize free cash flow since it provides the toughest criteria and also best captures the true impact upon their financial position.

Detailed Analysis

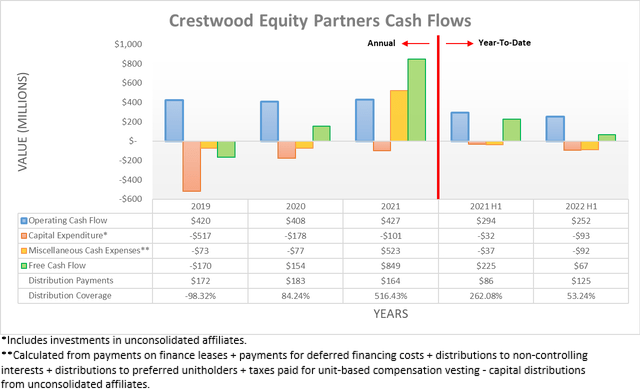

Following the completion of their Oasis Midstream acquisition in February 2022, it was obviously expected to see their cash flow performance surge ahead. Although on the surface, their operating cash flow of $252m during the first half is well below their previous result of $294m during the first half of 2021. Thankfully, their latest result only saw an immaterial draw of $6m, whereas their previous results saw an abnormally large working capital draw of $90m, thereby skewing their surface-level comparison. If comparing their underlying result of $246m for the first half of 2022 against their equivalent result of $204m during the first half of 2021, it sees a very impressive increase of 20.59% year-on-year and thus moving forwards, the benefits of their large acquisition should begin flowing through to their cash flow performance.

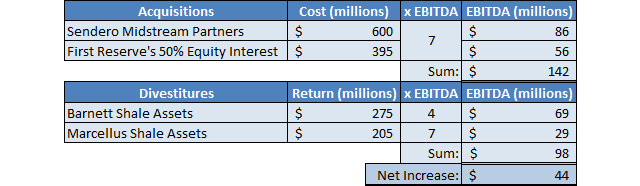

Despite still integrating their Oasis Midstream acquisition, they are not foregoing any time with another two upcoming acquisitions already announced simultaneously for the unlisted Sendero Midstream Partners and a further 50% equity interest in their Crestwood Permian Joint Venture, which is presently held by First Reserve. In the same announcement, they also announced the divestiture of their Barnett Shale assets, before later also announcing the divestiture of their Marcellus Shale that makes for a total of four transactions. Interestingly, the only transaction where they did not disclose its EBITDA multiple was their Barnett Shale assets but upon reading the associated announcement from EnLink Midstream (ENLC) who is the acquirer, they state the price was 4 times EBITDA. Whilst not to say the management of Crestwood Equity Partners did anything wrong, it nevertheless is easy to see why this was glossed over considering their sale price is far cheaper than the 7 times EBITDA seen for their other three transactions, as the table included below displays.

Author

Once aggregated, the net cost of acquisitions is $515m and stands to provide a net increase of $44m to their EBITDA, as per the numbers disclosed within the previously linked announcements. If they see the same cash conversion rate of circa 70% as during 2021 between their adjusted EBITDA and operating cash flow, this translates into a circa $31m net increase to their operating cash flow, given its result of $427m during 2021 and accompanying adjusted EBITDA result of $600.1m, as per their fourth quarter of 2021 results announcement. In theory, this cash conversion rate should broadly continue going forwards in regards to these transactions because their operating cash flow during 2021 was not materially impacted by temporary working capital movements.

Whilst a circa $31m boost to their operating cash flow would be nice, realistically it does not change the dynamic much given they already generated $252m during the first half of 2022, which annualizes to circa $500m. Furthermore, they are funding $320m of their First Reserve acquisition via issuing new units and given their current unit price that carries a very high 10% distribution yield, this would boost their distribution payments by $32m per annum. Disappointingly, this would roughly consume the entirety of their additional estimated operating cash flow, even before considering any associated capital expenditure. In my eyes, the numbers are not stacking up for these transactions as a whole and actually appear likely to hinder their distribution coverage and thus growth outlook, as additional capital expenditure is virtually assured with their new assets.

Since their distribution payments were only approximately half of their operating cash flow during the first half of 2022, as a basic rule of thumb they do not appear to be at significant risk of being cut because they are not too burdensome. The bigger question is the extent that these acquisitions and divestitures will influence their ability to grow their distributions, although this remains a wait-and-see aspect, as it also depends upon their yet-to-be-known cash conversion rate and synergies of the assets in question.

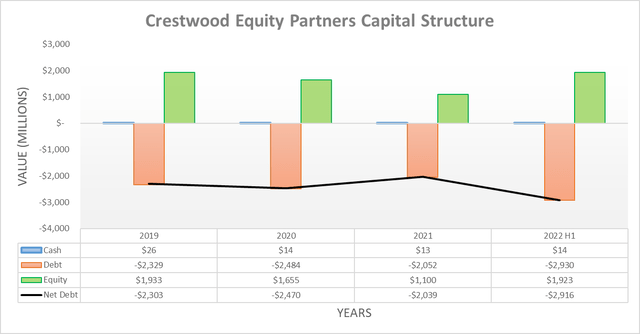

The first half of 2022 saw their net debt surge to $2.916b from its previous level of $2.039b at the end of 2021, as was expected when conducting the previous analysis given their acquisition of Oasis Midstream. When looking ahead, their net debt will see further increases as they complete their upcoming acquisitions but thankfully, this should not be too significant given their accompanying upcoming divestitures. Whilst they see a net cost of $515m, as previously mentioned, $320m of this is funded via issuing new units and thus only leaves a relatively modest $195m to be funded via cash or in effect, debt, given their virtually non-existent cash balance. Similar to their distribution growth outlook, the extent they can deleverage in the coming years remains uncertain for the moment.

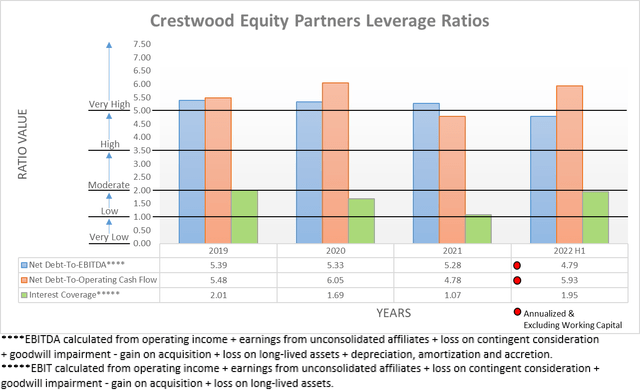

When conducting the previous analysis, it was expected that their leverage would increase following their acquisition of Oasis Midstream, which certainly appears to have come to fruition with the first half of 2022 seeing their net debt-to-operating cash flow increasing to 5.93 from its previous result of 4.78 at the end of 2021. This now sees their result above the threshold of 5.01 for the very high territory, whilst their net debt-to-EBITDA of 4.79 is only slightly below this point. On the surface, it appears the latter actually decreased from its previous result of 5.28 at the end of 2021, although this merely stemmed from their previous results seeing an abnormal $120.4m of losses arising from their unconsolidated affiliates. If not for these, their previous result at the end of 2021 was 4.03 and thus their result of 4.78 following the first half of 2022 marks a sizeable underlying increase. Even though this does not necessarily endanger their distributions, it reduces their scope for growth, unless their upcoming acquisitions have a far greater than expected benefit.

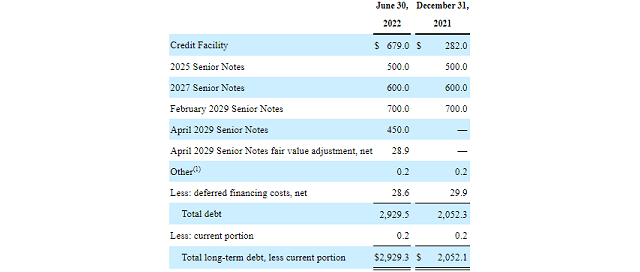

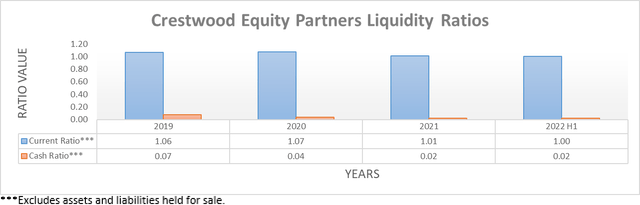

Despite negatively impacting their leverage, thankfully their acquisition of Oasis Midstream did not materially impact their liquidity with their current ratio barely changing to 1.00 following the first half of 2022 from its previous result of 1.01 at the end of 2021. Meanwhile, their cash ratio was unchanged at only a barely visible 0.02 but thankfully, they retain $812.2m of availability under their credit facility that does not mature until December 2026 and thus helps ensure they have adequate liquidity. Whilst seeing their leverage increase was not ideal, at least the additional debt they issued does not mature until April 2029 and thus provides ample breathing room together with the remainder of their debt structure that sees no other maturities until April 2025, as the table included below displays.

Crestwood Equity Partners Q2 2022 10-Q

Conclusion

There is only a minimal short-term threat to their distributions but until these various acquisitions and divestitures are absorbed, their scope for distribution growth remains uncertain. Even though I would like to see a rosy outlook, disappointingly, the numbers are not stacking up for their transactions thus far with the cost of funding their new distribution payments roughly equal to the additional estimated operating cash flow, which is likely to hinder their distribution growth. As a result, I now believe that downgrading to a hold rating is appropriate until more certainty is provided or it not, their unit price drops even lower.

Notes: Unless specified otherwise, all figures in this article were taken from Crestwood Equity Partners’ SEC filings, all calculated figures were performed by the author.

Be the first to comment