kokkai

Thesis

We presented our thesis in our pre-earnings article on Sea Limited (NYSE:SE), arguing that the market had anticipated an underwhelming Q3 release as it closed in on its November lows.

As such, we aren’t surprised that the market sent SE surging in a momentum spike, hitting our previous price target (PT), as SE rallied nearly 61% from its November bottom.

Management came out with guns blazing against bearish investors after pulling guidance in Q2 previously. Accordingly, CEO Forrest Li’s emphasis in its Q3 commentary on Shopee (Sea Limited’s e-commerce arm) to reach adjusted EBITDA breakeven exiting Q4’23 stunned the bears.

Notwithstanding, SE has pulled back nearly 20% from its recent surge, which should be expected. Moreover, we postulate that the market has likely reflected the optimism in Sea Limited’s more constructive guidance with its recent surge. As such, we believe the market will likely parse Sea Limited’s execution moving forward before a material re-rating is justified.

Hence, we believe the reward/risk in SE looks relatively well-balanced at these levels. Revising from Speculative Buy to Hold for now.

Shopee: How Can It Reach Adjusted EBITDA by FY23?

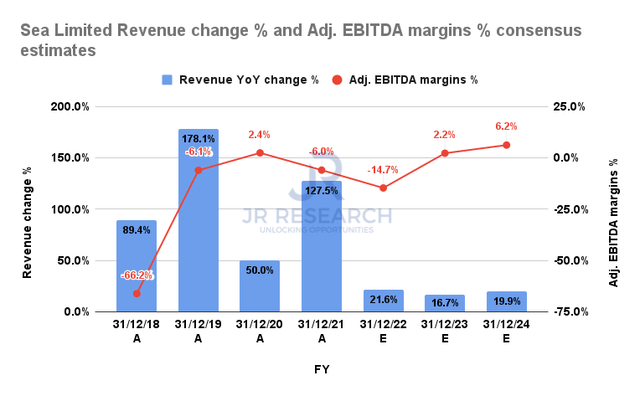

Sea Limited Revenue change % and Adjusted EBITDA margins % consensus estimates (S&P Cap IQ)

The consensus estimates have been revised upward with management’s upgraded guidance for Shopee. As such, Wall Street analysts project Sea Limited to post an adjusted EBITDA margin of 2.2% in FY23.

However, it’s predicated on revenue growth of 16.7% for FY23, below FY22’s 21.6% uptick. Based on management’s commentary, we believe analysts have penciled in a higher bar for SE to cross. Therefore, as we postulated in our previous update, it has likely normalized the Street’s more pessimistic forecasts.

Notably, management highlighted that its focus on its e-commerce profitability drive “may see no growth or even negative growth in certain operating metrics in the near term.”

Hence, the critical profitability driver will be cutting costs expeditiously and improving efficiencies concurrently.

But the crucial question is how far Shopee is from reaching adjusted EBITDA breakeven.

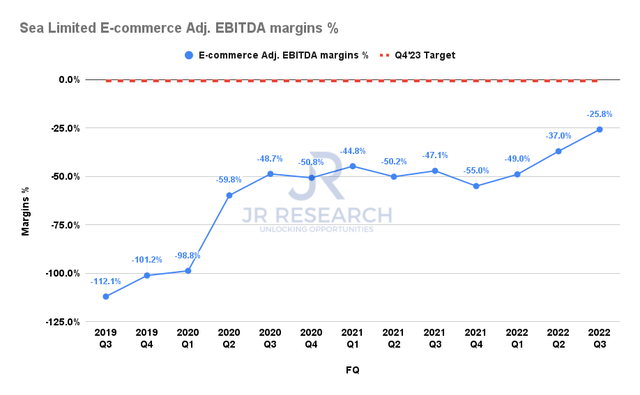

Shopee Adjusted EBITDA margins % (Company filings)

Shopee posted an adjusted EBITDA margin of -26% in FQ3, up from Q2’s -37%. Notably, Shopee has also continued to improve its path toward profitability constructively. Hence, investors could be assured that management’s execution has been relatively consistent despite worsening macros impacting its key markets.

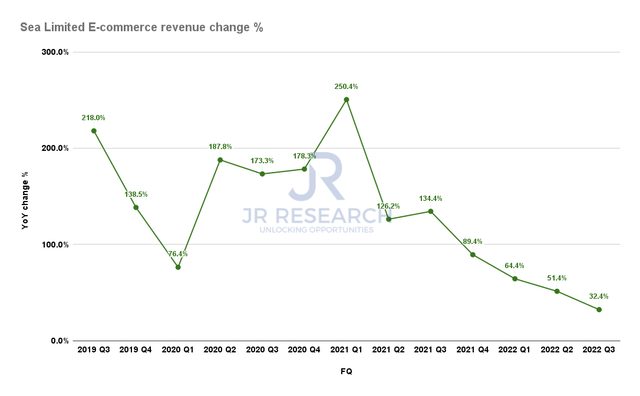

Shopee Revenue change % (Company filings)

Moreover, Shopee has managed to overcome the significant deceleration of revenue growth since Q1’21, corroborating management’s confidence in optimizing efficiencies.

Notwithstanding, Shopee still posted revenue growth of 32.4% in FQ3, down from FQ2’s 51.4%.

However, due to its cost-rationalization exercise, investors should expect its e-commerce segment to head toward an anemic gross merchandise value (GMV) growth phase. Also, we believe Shopee could be looking at lifting its e-commerce take rates in its profitability drive.

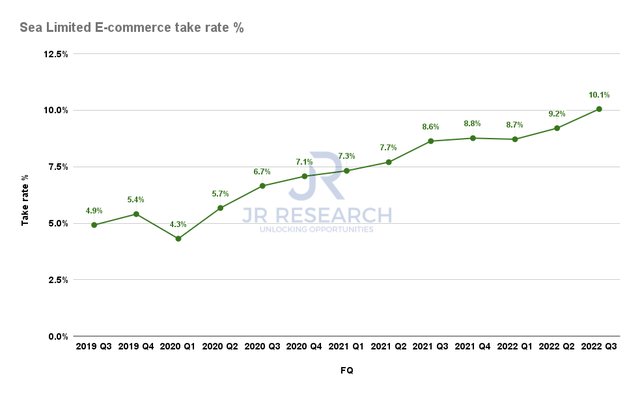

Shopee take rates % (Company filings)

As seen above, Shopee managed to post take rates of 10.1% in FQ3, well above FQ2’s 9.2%. It has also been creeping up over time, which has helped Shopee deliver more robust monetization metrics, despite the slowdown in GMV growth (down to 13.7% in FQ3).

Hence, it’s a lever that Shopee could continue to pull as it pushes toward adjusted EBITDA breakeven. Notably, Shopee posted core marketplace revenue growth of 54% YoY in FQ3, demonstrating its strong execution prowess and value proposition for its merchants.

Notwithstanding, macroeconomic headwinds could hamper its ability to drive further take rates accretion as it pulls back its GMV growth initiatives. An analyst on the earnings call also highlighted her concern, probing management whether it anticipated a marked impact on advertising revenue.

While management telegraphed its confidence in its advertising offerings, it also cautioned investors that worsening macro risks could impair Shopee’s ability to monetize further (i.e., increase take rates), as Chief Corporate Officer Yanjun Wang articulated:

We are mindful of the potential macro headwinds that, over time, [could] more deeply affect our region and the market as a whole. And this might affect, for example, people’s purchase power, discretionary spending and to the point might also have a more pronounced effect on our platform and overall e-commerce in the region. When that happens, that could have a negative impact on our ability to monetize. (Sea Limited FQ3’22 earnings call)

Is SE Stock A Buy, Sell, Or Hold?

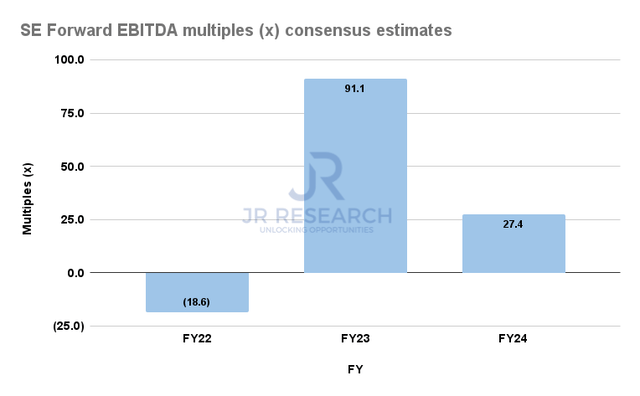

SE Forward EBITDA multiples consensus estimates (S&P Cap IQ)

With the recent surge in SE, we postulate that near-term optimism on its revised guidance has likely been reflected.

Also, SE’s valuation remains highly aggressive, as it last traded at an FY23 EBITDA multiple of 91x and an FY24 EBITDA multiple of 27.4x. Both are much higher than Sea Limited’s e-commerce peers’ median (7.3x NTM EBITDA) and gaming peers’ median (8.6x NTM EBITDA).

We applaud management’s initiative to justify its valuation through its profitability impetus. However, we assess that a further near-term re-rating is unlikely unless the market anticipates better execution from Sea Limited.

We should be able to glean more clues as SE looks to consolidate at its current pullback.

Revising from Speculative Buy to Hold for now.

Be the first to comment