sefa ozel

Introduction

I like to write about companies that lack coverage on SA and today I’m taking a look at Presto Automation (NASDAQ:PRST). It’s a restaurant tech provider whose market valuation has declined by almost 80% over the past three months and I think that significant stock dilution might be on the horizon. Revenue growth has slowed down and just three customers account for over 90% of sales. All of their contracts are up for renewal in 2023. Overall, I think that Presto’s future looks grim and that opening a small short position seems viable. Let’s review.

Overview of the business and financials

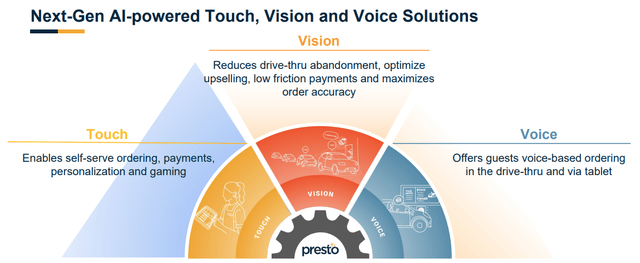

Presto was founded in 2008 as E la Carte and it has developed a suite of technology offerings that aim to help restaurants automate services as well as improve the dining experience through kiosks and tablets that enable guests to pay and order at their tables. This sounded like a good value proposition during the COVID-19 lockdowns as it helped restaurants minimize their face time and interactions with people. It had the added benefit of enabling clients to overcome labor shortages.

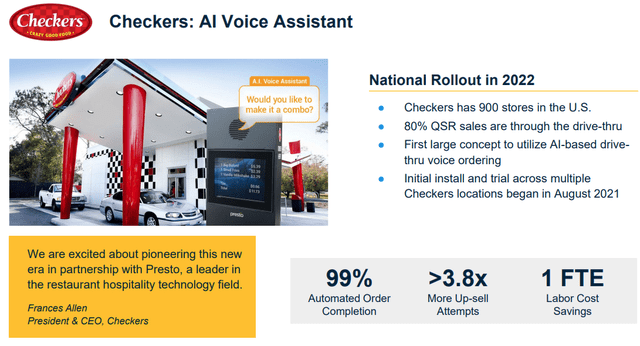

The system also uses computer vision and analytics to help eateries optimize operations and guests can also make orders by talking to a device at drive-throughs. Speaking of which, Checkers is implementing the drive-through product in 2022.

Presto Automation Presto Automation

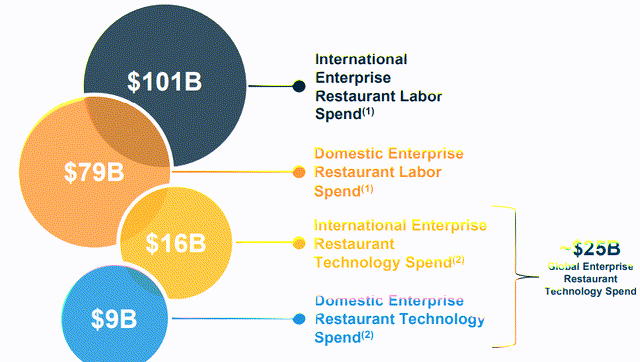

Presto has shipped close to 280,000 systems and has several high-profile clients such as McDonald’s (MCD), Applebee’s and Chili’s. Presto claims that the addressable market opportunity is worth over $200 billion and what sets it apart from its competitors is that its restaurant technology platform was made by founders and operators for founders and operators.

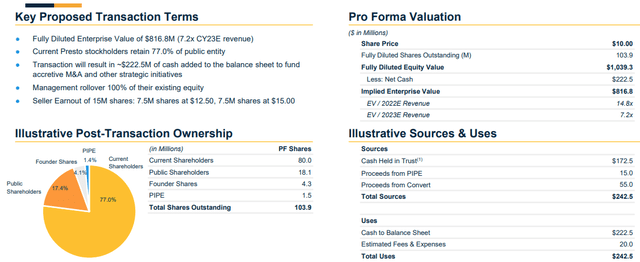

In October 2021, it was announced that Presto is going public through a merger with a special purpose acquisition company (SPAC) named Ventoux CCM Acquisition Corp a valuation of about $1 billion. Under the terms of the deal, the resulting company would have about $222.5 million in cash to fund its growth.

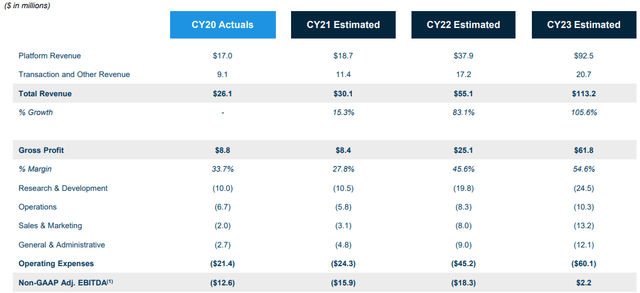

In my view, the goals were ambitious as Presto aimed to grow revenues to $113.2 million by 2023 and finish that year with positive EBITDA.

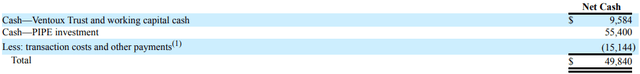

Unfortunately, SPAC deals have been losing steam this year and Presto ended up receiving just under $50 million in cash after transaction costs and other payments after the merger was completed in September 2022.

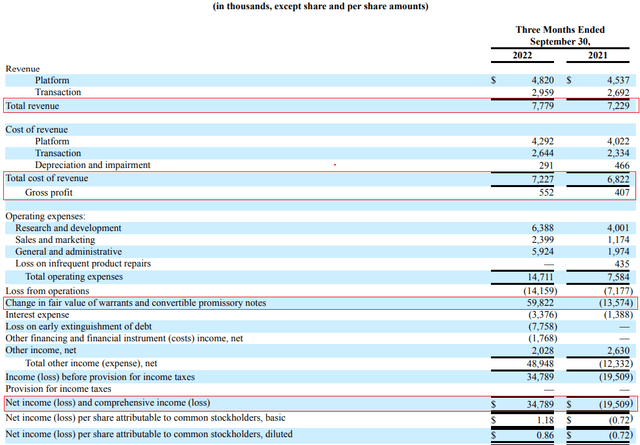

In my view, this outcome of the listing significantly limits the company’s growth prospects and the path to profitability is unclear now. Presto is barely growing at the moment as revenues rose by just 7.6% year on year in Q3 2022. The gross profit margin is just 5.6%, which is several times lower than interest expenses alone. The company booked a net income of $34.8 million for Q3 2022 but this was thanks to the decline of its share price as it led to a significant change in the fair value of warrants and convertible promissory notes.

It seems that clients are satisfied with Presto’s products as the net revenue retention rate for Q3 2022 stood at 105%. However, the loss of any major client will affect results in a major way as the top 3 customers accounted for a total of 92% of revenues during the quarter. I find it concerning that Presto hasn’t been able to increase its revenues coming from new clients or its smaller existing customers considering the 3 largest clients accounted for 91% of revenues a year earlier.

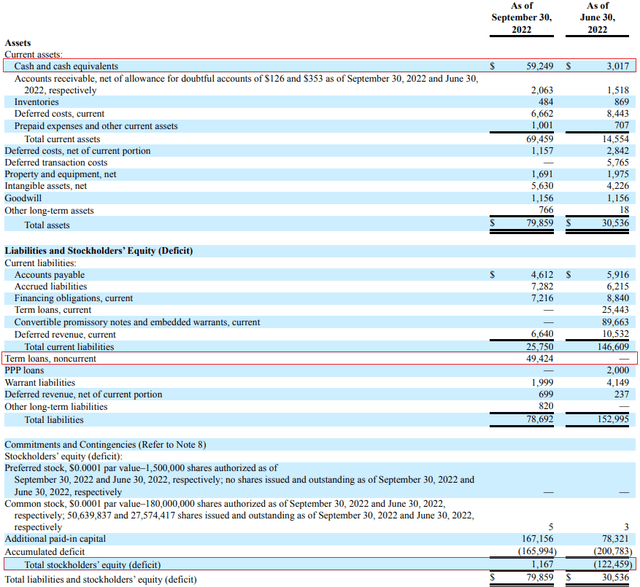

Turning our attention to the balance sheet, I think the situation looks challenging as stockholders’ equity was barely positive as of September and net cash stood at just $9.8 million. Considering net cash used in operating activities was $11.2 million in Q3 2022 alone, it seems that Presto could need to carry out a capital increase around the end of 2023 as it starts running out of cash. The company has an asset-light business model, so there aren’t any notable non-core assets that could be sold to fund operations.

Overall, I think that Presto’s growth plans were too ambitious, but we will never know for sure as the company doesn’t have the funds to try to complete them. The amount raised in the SPAC deal was underwhelming and I doubt that the company will be able to become profitable before it runs out of cash. Growth is low for a start-up and just 3 clients still account for over 90% of revenues. So, how do you play this? Well, short selling seems like a viable idea as data from Fintel shows that the short borrow fee rate is 10.87% as of the time of writing. However, there are still no call options available.

Looking at the risks for the bear case, I think that the major one is that Presto could be bought by a competitor or by a large restaurant operator. This could provide a boost for the share price. It’s also possible that Presto will find a way to grow its revenues with a limited budget and get into the black, but I view this as highly unlikely.

Investor takeaway

Presto’s business gained traction through the COVID-19 lockdowns and a SPAC deal was supposed to provide the company with enough funds to become an industry leader as more and more restaurants reopened. Unfortunately for investors, the company has been unable to attract any major clients in 2022 and the cash raised in the SPAC merger was much lower than initially expected.

In my view, it’s too late to turn the ship around and significant dilution is coming as Presto runs out of cash over the coming year. The short borrow fee rate is just over 10% which isn’t great but short selling still looks like a good idea. However, there are no call options to hedge the risk so it’s best for risk-averse investors to avoid this stock.

Be the first to comment