Leon Neal

This article is contributed by Jun Hao from our Superstocks Seekers team.

Overview

We have been following Fastly (NYSE:FSLY) for a long time, and least to say, the company has found itself in a wrecked ship with rapidly declining sales, deteriorating profitability, and an almost complete revamp in its management team. And it’s even unfathomable to think that at one point in time, the stock is trading at a high of over $100 per share, to $11 a share today. To put things into context, that’s 90% of the valuation being wiped out.

Is all hope lost? What’s next for Fastly?

What we are going to be covering in this article is the series of problems in the company, as we share our thoughts on Fastly’s situation. Let’s get right into it.

Sales Issues Have Yet To Be Resolved

The Slowdown In Fastly’s Core Business

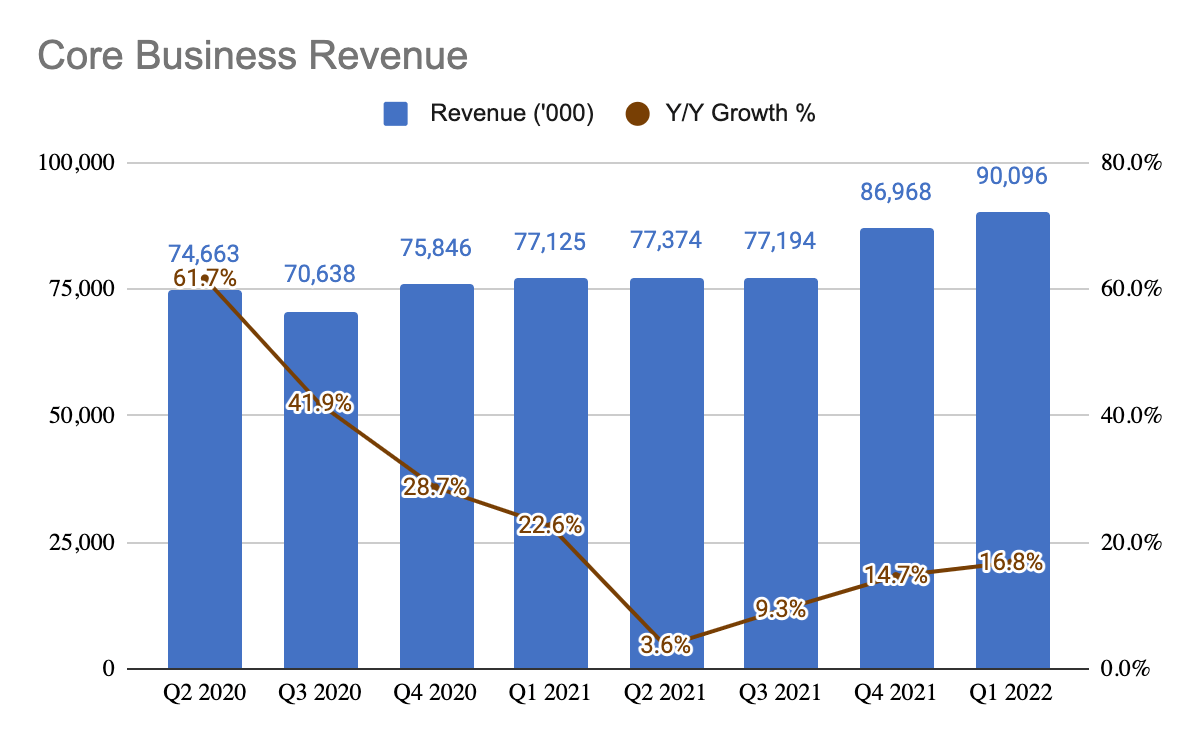

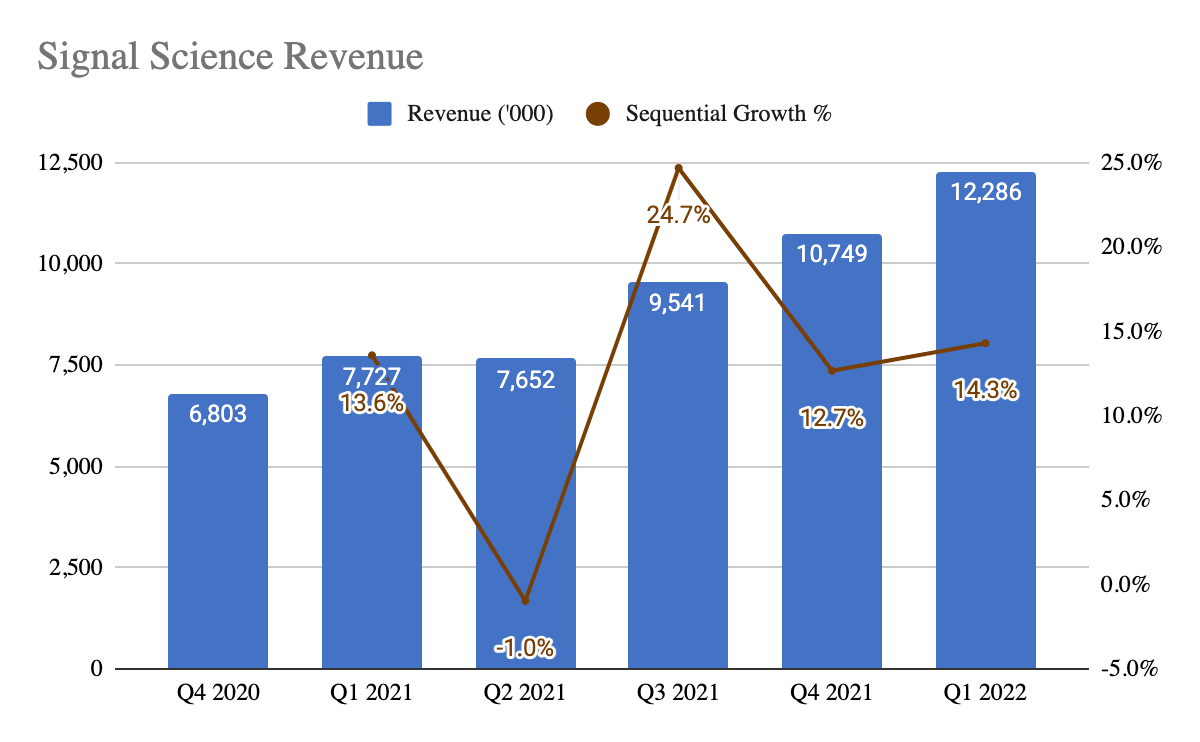

In this portion, instead of looking at Fastly’s total revenue, we are going to break it down into 2 components – core business and Signal Sciences (“SS”), which was acquired back in 4Q20. This is so that we see how its core business is performing without including the revenue added from SS.

(Source: FSLY IR) (Source: FSLY IR)

From 2Q20, we can see that its core business revenue growth rate has been decelerating from the peak of 61.8% in 2Q20 to 16.8% in 1Q22.

For revenue to decline so rapidly, something worrying must be going on.

Fastly operates a usage-based model and during the pandemic in FY20, it experienced a surge in traffic as most people are staying at home. The management attributed the slowdown to the tough comps in FY20. While that was partially true, this was not the only reason. It was also its lackluster sales execution and one-time outage that occurred in 2Q21 that caused many customers to pause their spending and revenue to fall drastically during that quarter. On top of that, Compute@Edge, an edge development platform that allows developers to build applications, is expected to have a material contribution to its FY22 revenue. However, there are still no clear indicators of how it will play out until 2H22.

To turn around the company and transition into the next phase of growth, it has had several leadership changes.

They brought in a new CRO Brett Shirk in 1Q21, CFO Ron Kisling in 2Q21, CMO Margaret Arakawa, and CPO Lakshmi Sharma in 4Q21. And most recently, CEO Joshua Bixby resigned from his position as a CEO. With so many leadership changes in a short span of time, it does seem like it’s time for changes to be implemented and rectify its poor sales execution.

Let us take a closer look into customer growth.

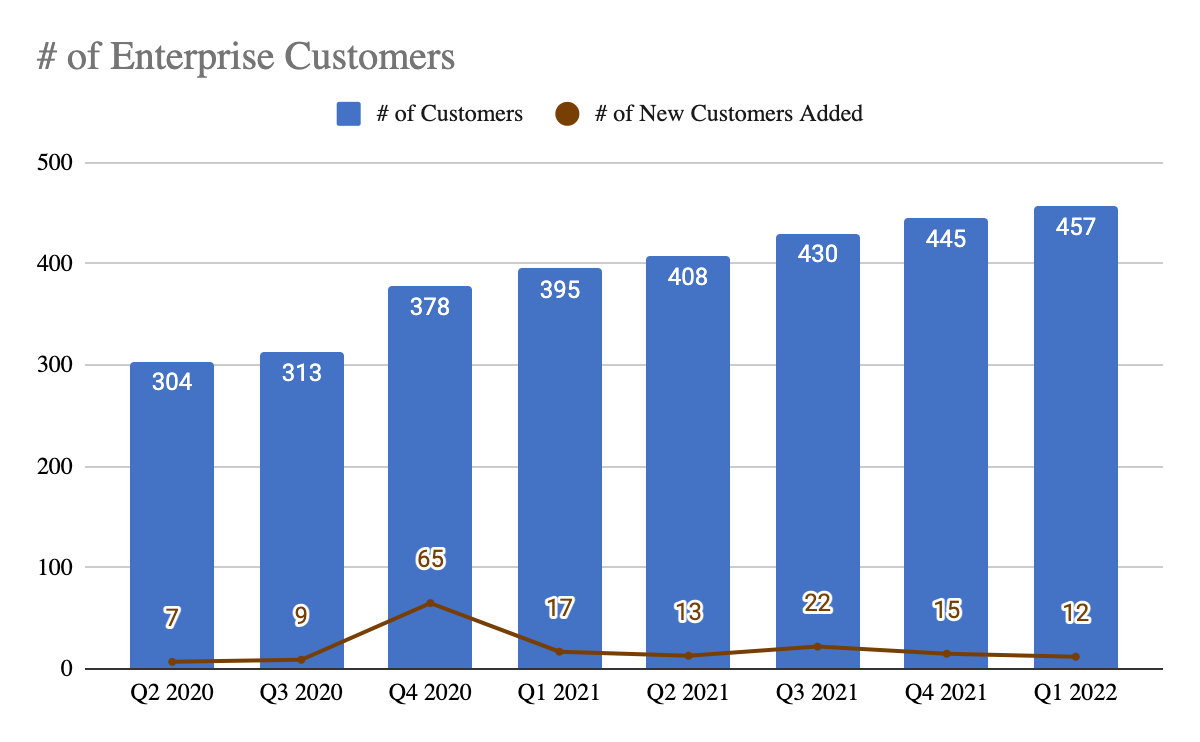

Slowdown In Customer Growth

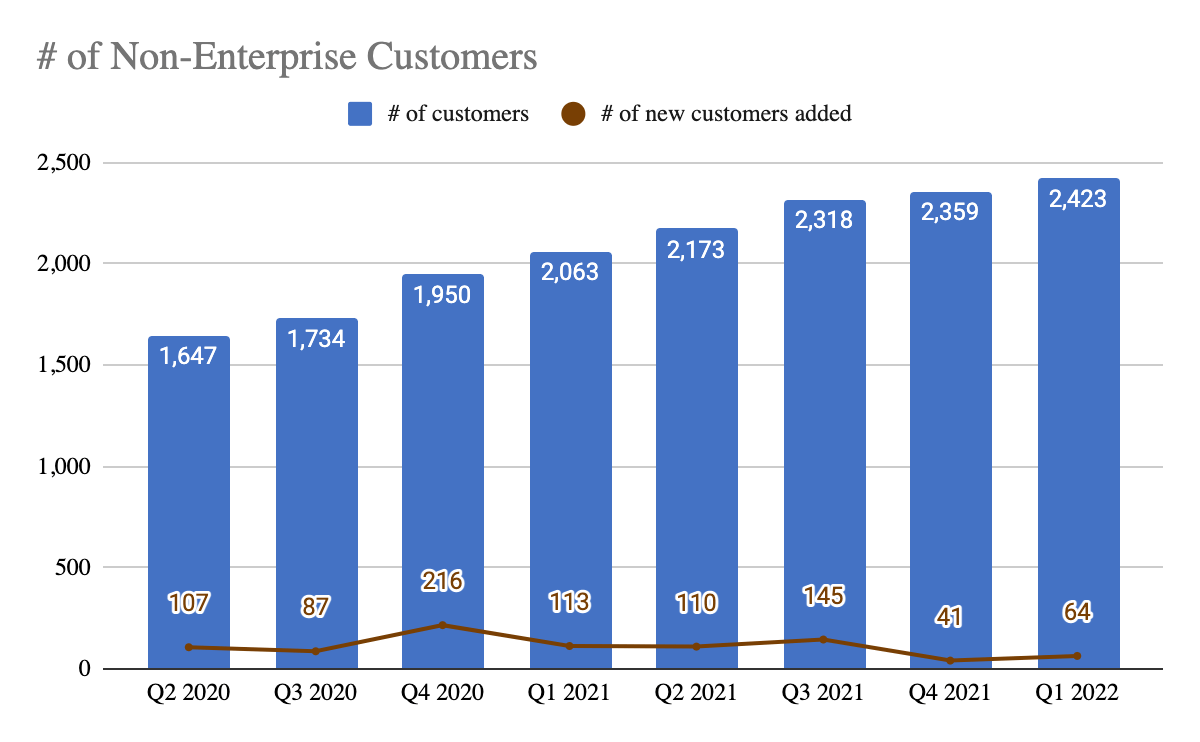

CRO Shirk was appointed in 1Q21, so we will look at how they are growing its customer base from 2Q21. In this portion, we will be breaking its customers into 2 segments, enterprise, and non-enterprise customers.

(Source: FSLY IR) (Source: FSLY IR)

For its enterprise customers, the pace that they are adding new customers seems to be at a similar pace before the onboarding of the new CRO. Whereas, the number of new non-enterprise customers added has also been slowing down over time, as seen from 4Q21 and 1Q22. While 4Q is a seasonally weaker quarter, it still doesn’t justify the slowdown in customer acquisition considering that a new CRO was appointed a year ago and this is also post-SS acquisition.

Let’s dive in a little bit more on this to find out if this is a seasonality issue or its lackluster sales execution.

(Source: FSLY IR)

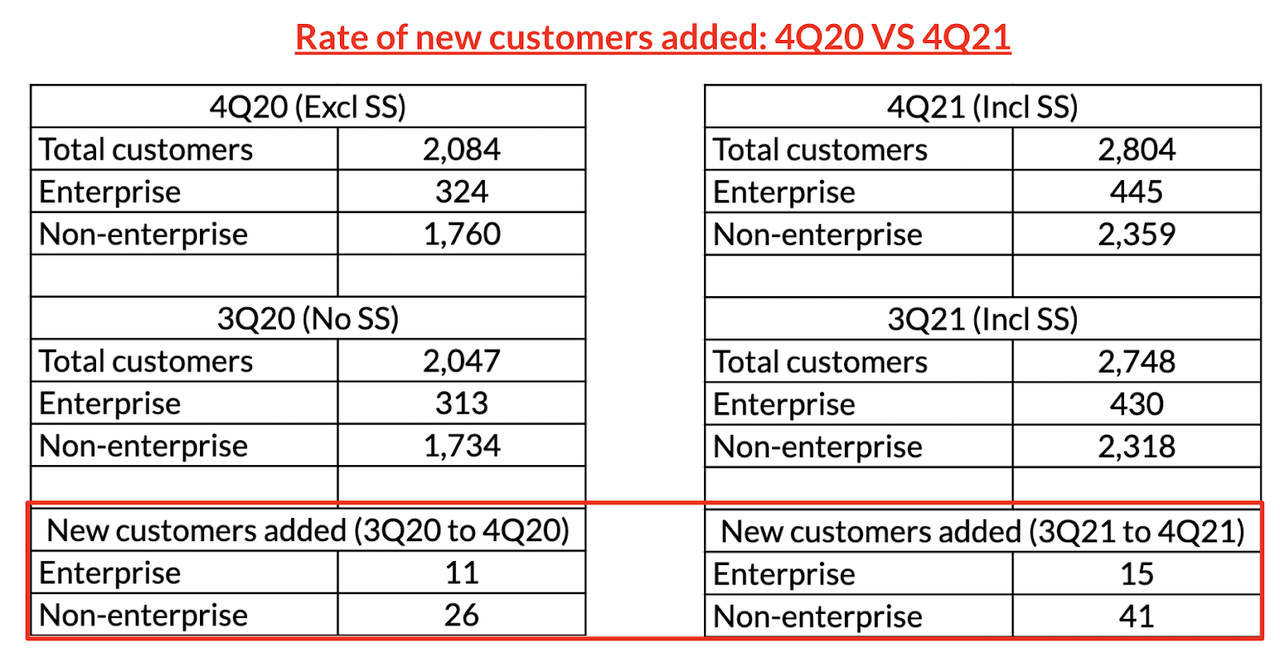

Over here, what we’re doing is simply finding out what’s the rate of new customers they are adding in 4Q20 so that we can understand if this is a seasonality issue. This is because, in 4Q20, the number of Fastly’s customers was distorted due to the acquisition of Signal Sciences (“SS”), hence, there was a spike in net new customer addition.

If we exclude SS numbers from 4Q20, they added only 11 enterprise and 26 non-enterprise customers sequentially. This is in comparison with 15 enterprise and 41 non-enterprise customers added in 4Q21, which includes SS’s customers. This was in line with the management saying that 4Q is a seasonally weaker quarter.

However, this also means that since 4Q21 includes SS’s customers, there are barely any improvements in customer acquisition for its core business.

(Source: FSLY IR)

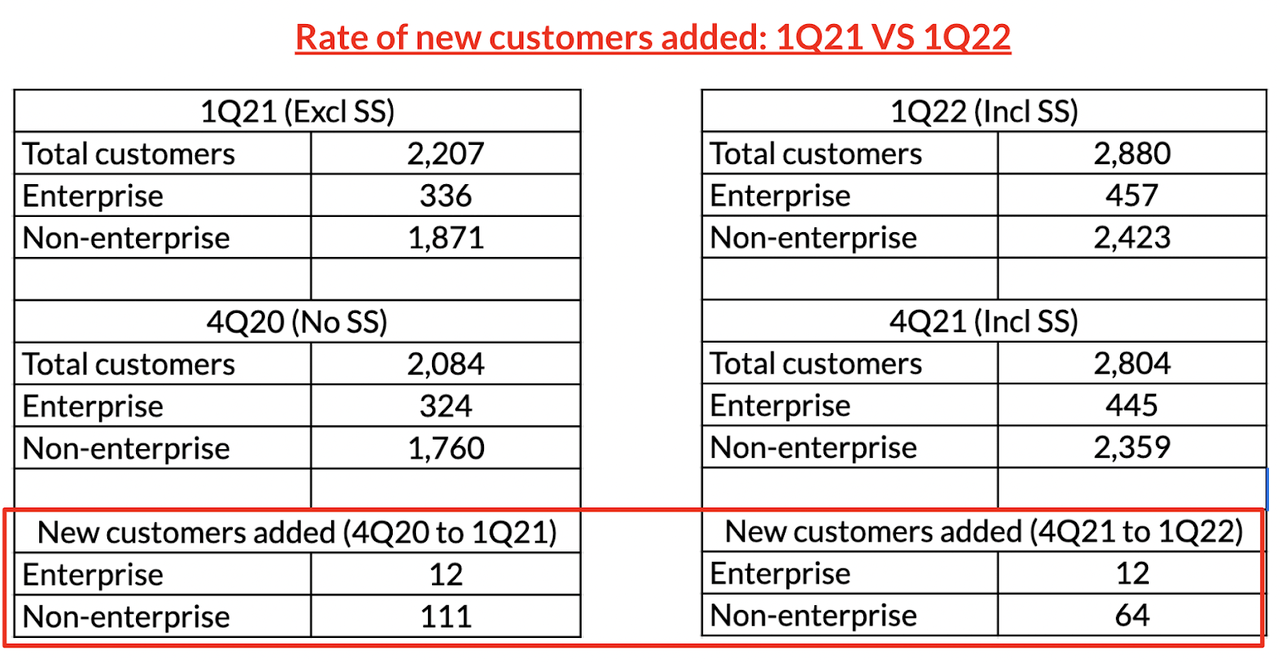

Similarly for 1Q22, we are doing a comparison with 1Q21.

Excluding SS, Fastly added 12 enterprises and 111 non-enterprise customers. Compared to 1Q22, which includes SS’s customers, they added 12 enterprise and 64 non-enterprise customers. The new addition in 1Q22 is lower than 1Q21.

Whether this continues to be a recurring issue, the slowdown in customer acquisition is a concern as this tells us about its lackluster acquisition. Moreover, the revenue growth has not been improving as well. This is why we believe that CMO Arakawa was brought in 4Q21 and they are to step up on its sales and marketing (“S&M”) expenses to accelerate customer acquisitions. According to CFO Kisling, they expect an acceleration in new customers this year, likely in 2H22, and for them to contribute revenue in FY23.

Since they are in re-investing mode, let’s look at Fastly’s S&M efficiency to date.

Poor Sales & Marketing Efficiency

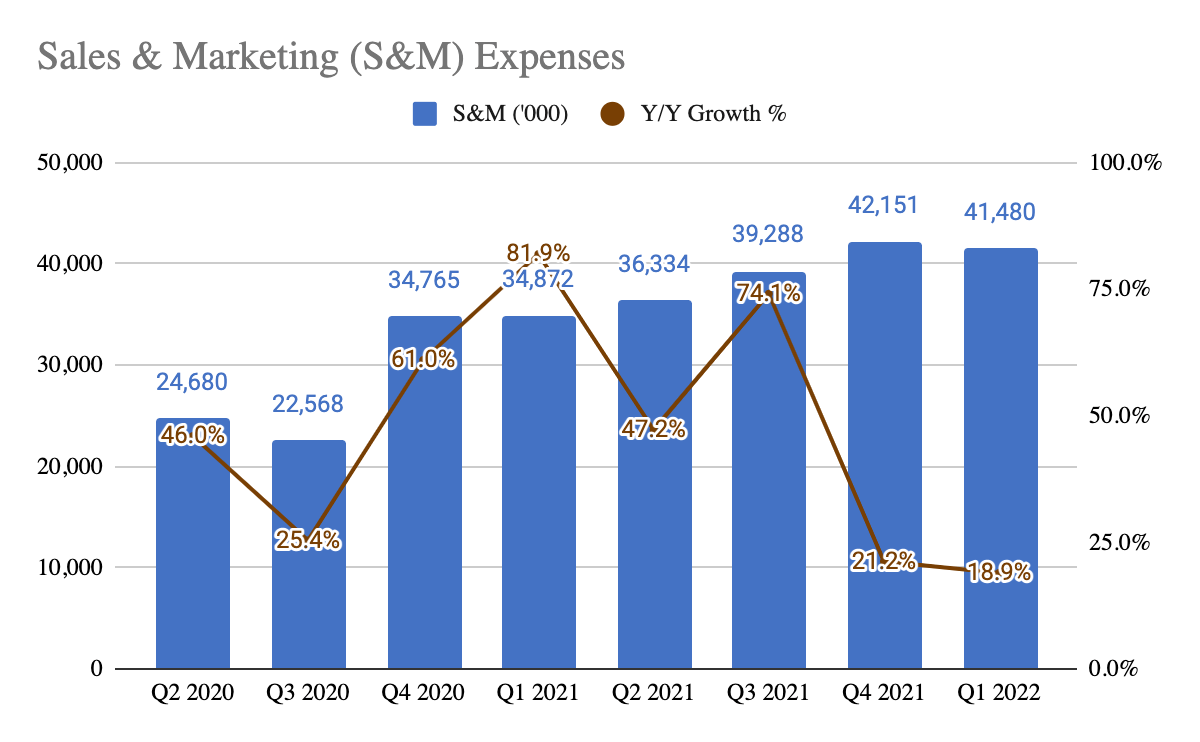

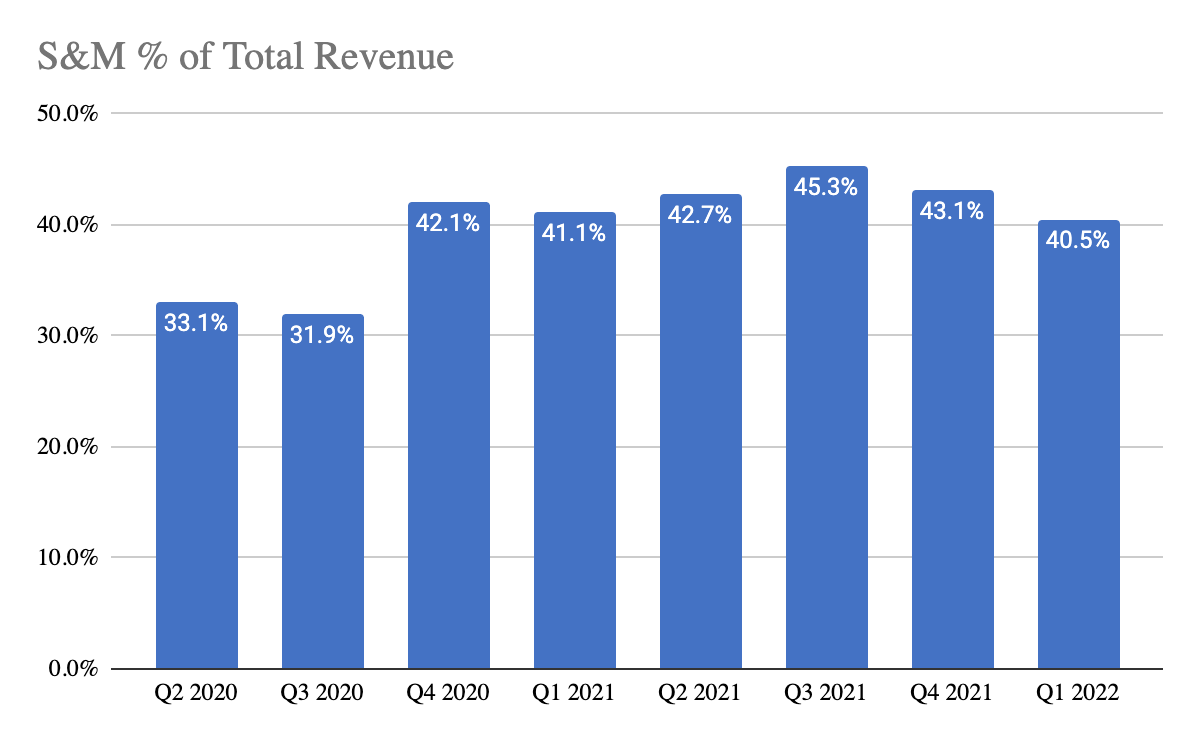

(Source: FSLY IR) (Source: FSLY IR)

Here, you can see that despite increasing its S&M expenses every quarter, S&M consistently makes up a big portion of its total revenue, with no improvements. What this means is that its S&M investments are not translating into revenue growth. And this is likely to impact the bottom line of the business as well.

This is something to monitor in the upcoming quarters and ideally, we like to see S&M % of revenue decreasing. Otherwise, growing at this rate will continue to eat into its cash pile, which is a recipe for disaster. In a worst-case scenario, Fastly has to cut costs and aim for profitability.

This brings us to the next portion, Fastly’s lack of profitability.

No Clear Path To Profitability

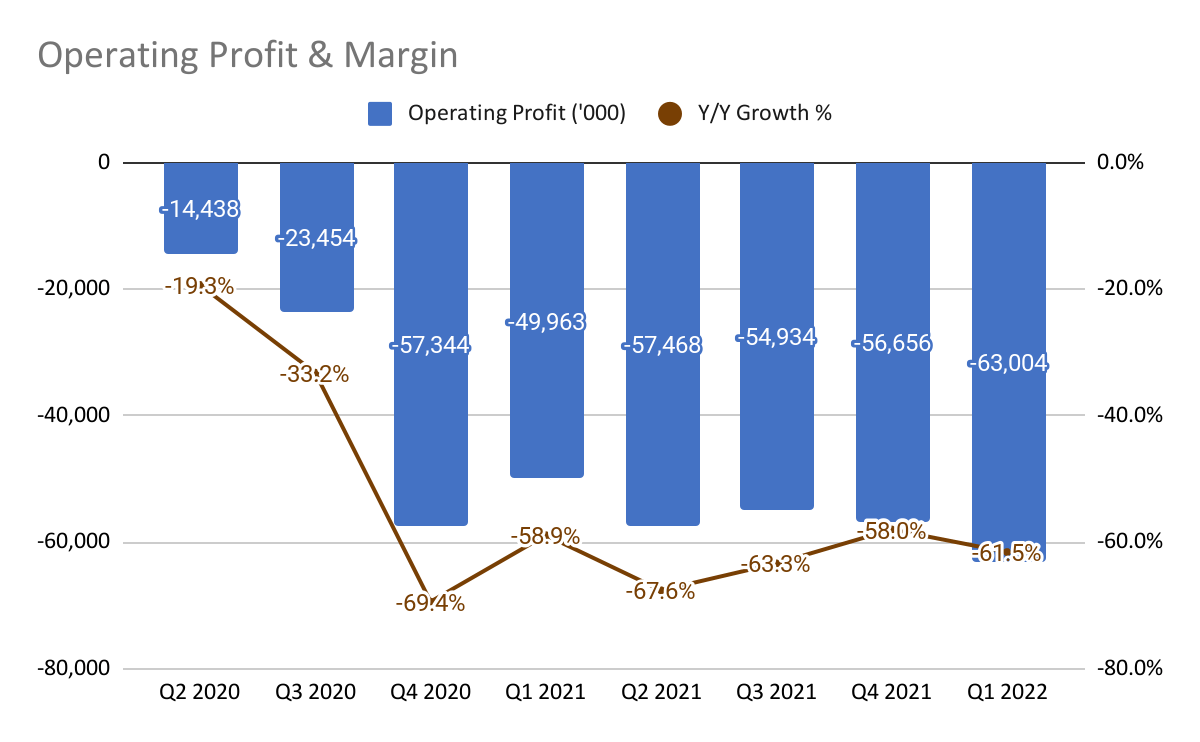

(Source: FSLY IR)

Fastly’s operating margin has been deteriorating, with a negative operating margin of 61.5% in 1Q22. If we take a closer look at its 1Q22 10-Q, we can see that its stock-based compensation (“SBC”) makes up 39% of its total revenue, and this is the result of hiring more headcounts.

While SBC is used to establish loyalty, we are uncomfortable that Fastly is incurring so much SBC expense, and yet, results are not improving at all. With declining revenue and high re-investments in S&M, it seems that there is no clear path to profitability unless the sales problem is resolved.

Strong Balance Sheet

(Source: FSLY IR)

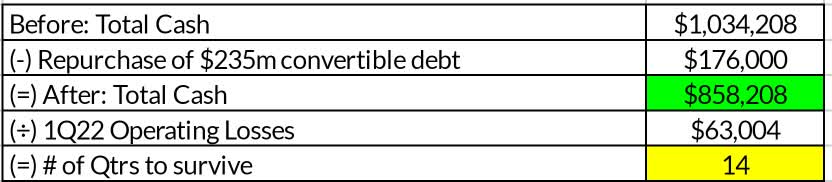

Now that Fastly is incurring huge operating losses every quarter, we want to find out if they have sufficient cash in hand.

As of 1Q22, Fastly has total cash of $1.03 billion. Weeks later, they announced the repurchase of $236 million of 2026 convertible debt for $176.1 million, at a 25% discount. This brings down their cash level to $858 million, and $713.8 million of convertible debts. At this stage, we decided not to include the convertible debts as actual debt as it’s only expiring in 2026. But do also notice how this also resulted in positive net cash of $17.8 million.

Assuming that Fastly continues burning cash at this rate, taking the $858 million of cash and $60m of operating losses in 1Q22, we see that they have approximately 14 quarters (~3.5 years) worth of cash to survive.

At this moment, Fastly does have a strong balance sheet to navigate the turnaround. However, if sales execution does not improve and they continue to be unprofitable, paying off the 2026 convertible debt may be an issue.

$1 billion Revenue Guidance: Hit or Miss?

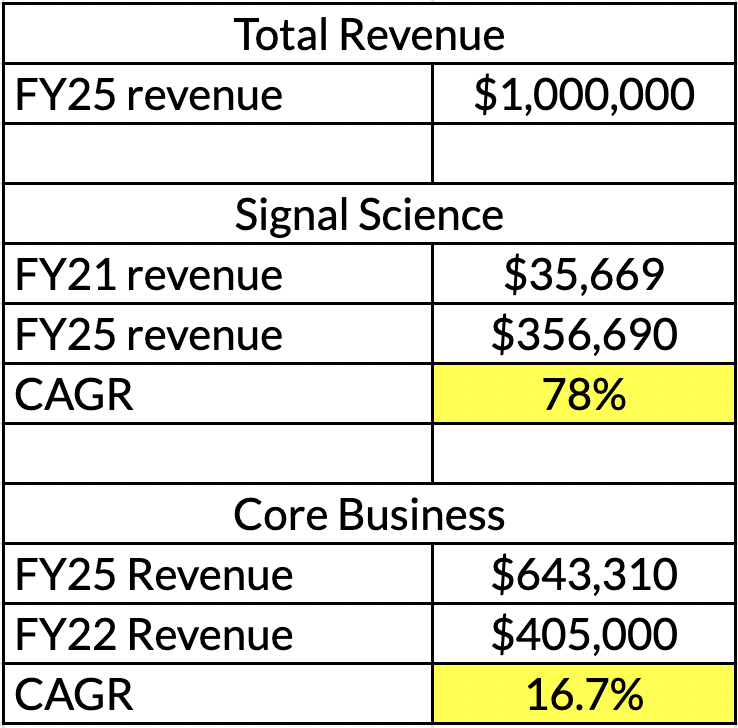

(Source: FSLY IR)

The management laid out a goal to hit $1 billion in revenue by 2025. Since they are already guided revenue of $405m by the end of FY22, this represents a 35% CAGR to $1 billion by FY25.

A lot of investors right now must be wondering, is this goal achievable?

Let’s break down the $1 billion revenue into 2 segments – Signal Science (“SS”) and Fastly’s core business.

In 3Q21, ex-CEO Bixby mentioned that they are looking to grow SS revenue by 10x by FY25. Given that SS’s FY21 revenue was $35.6 million, growing its revenue by 10x will give us $356 million by FY25. This represents 78% CAGR. However, SS’s latest 1Q22 revenue only grew by 59% Y/Y. Whereas, Fastly’s core business requires a 16.7% CAGR to reach $405 million of revenue by FY25. Its latest quarter growth was 16.8%.

With how Fastly has been performing the past few quarters, it’s perfectly understandable for investors to be concerned, we are as well. Is it even reasonable to expect the revenue growth to accelerate with the current issues at hand? Will the newly revamped management team really make a difference? Ex-CEO Bixby was confident in hitting that goal and states that they are going to grow in a non-linear fashion. Will this guidance still stand with him not being at the helm?

Until the sales problem is resolved, there is still little visibility on when they are going to turn this around, hence, it is prudent that we wait until there are any material improvements in customer acquisitions and revenue growth.

Customers Reviews

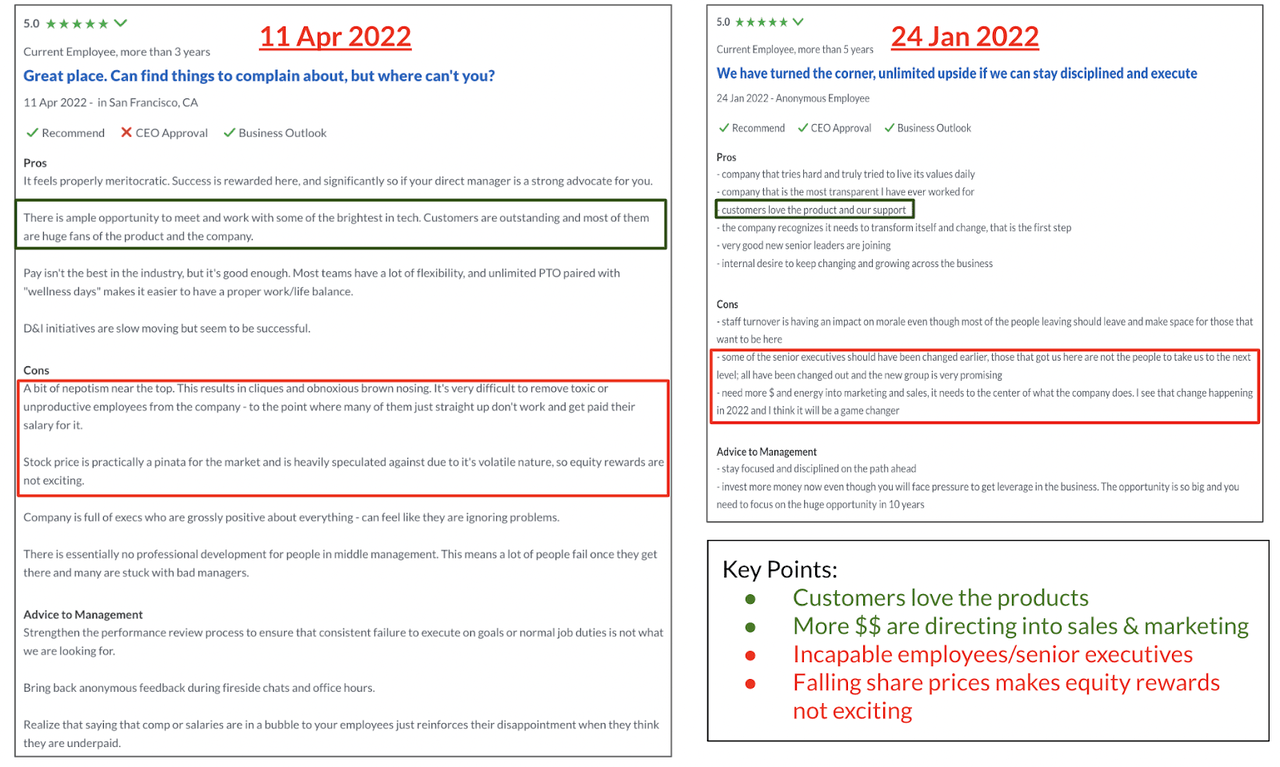

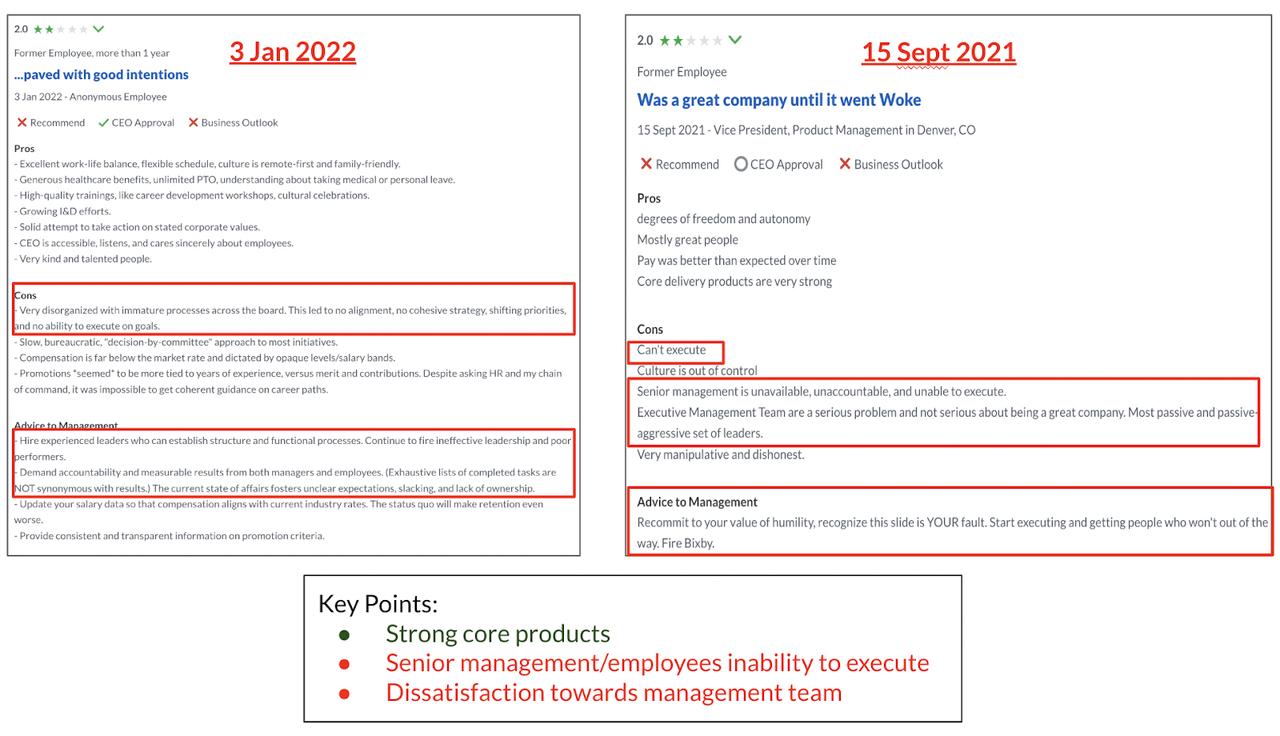

(Source: Glassdoor) (Source: Glassdoor)

We went to Glassdoor reviews to get a sense of employees’ morale, and a few reviews have stood out for us.

It is a strong validation of Fastly’s products as employees are stating that customers love its products. This corresponds to the 1% churn Fastly has, demonstrating that they have a great product. One of the reviews has also stated that there seem to be more investments into marketing, which is crucial as they resolved their sales execution. However, multiple reviews were on the senior management’s inability to execute and some of them have expressed their dissatisfaction with the management team. Falling share prices may also make equity awards less attractive especially when there is no visibility on when they are going to turn the corner.

We have to be wary of the employees’ ability to execute as they play an instrumental role in Fastly’s turnaround. With a near-complete revamp of its leadership, we suspect that it’s going to take a longer time to resolve the sales issue. This is something to monitor moving forward.

Concluding Thoughts

Fastly is currently going through a turnaround under a new management team, and until there are any material improvements in its sales execution and clear visibility into the success of Compute@Edge, we will stay prudent and monitor its progress. Furthermore, its huge operating losses and the lack of profitability are also a huge concern to us, although they have a robust balance sheet.

To add to that, it has been over a year since Fastly embarked on the journey to resolve its sales issue, and under the new management, we highly suspect that it may take a longer-than-anticipated time to successfully execute it.

What are your thoughts on Fastly’s current situation, and do you agree with our assessments? Let us know in the comments section below.

Be the first to comment