luza studios

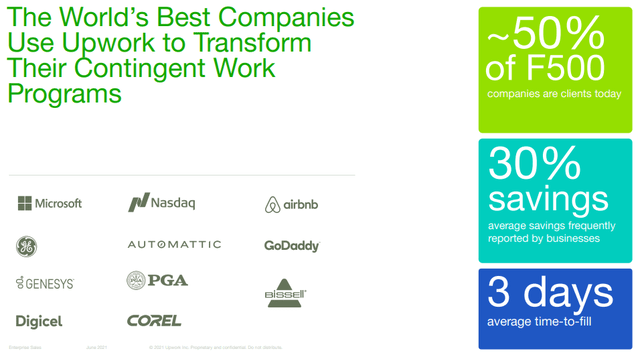

With hybrid work becoming more and more common we thought it would be interesting to analyze one of the leading freelancing platforms in the world, Upwork (NASDAQ:UPWK). Upwork has roughly 50% of the Fortune 500 corporations as customers, and businesses report ~30% savings when hiring freelancers versus developing the projects internally. As seen below, even some of the best known companies in the world make use of freelance talent to fill gaps or complement their internal resources.

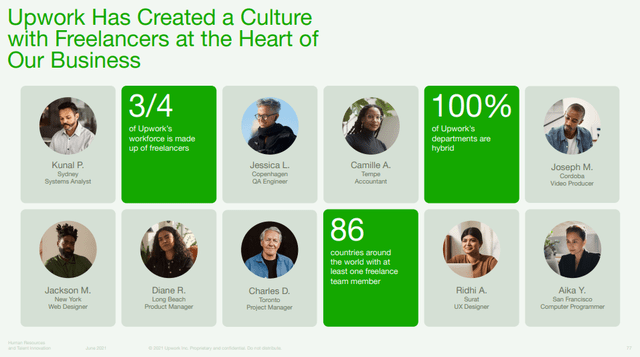

Upwork itself makes significant use of freelancers in its operations, with three quarters of its workforce made up of freelancers, and all the departments being hybrid, meaning they have some permanent employees and get some help from freelancers. This has resulted in a large number of nationalities contributing to Upwork’s development and functioning.

Competitive Advantages

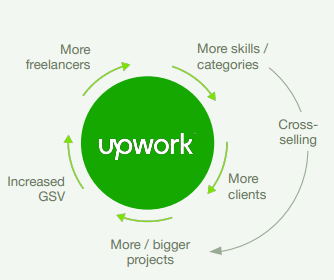

Besides being a hybrid company made up of freelancers and permanent employees, Upwork is also a special company in that it is a two-sided platform, with companies on one side of the marketplace and freelancers on the other. This creates a strong competitive advantage in the form of network effects, given that more companies will tend to use the platform with the most freelancers, and more freelancers will want to participate in the platform with the most companies and projects. Upwork is aware of this competitive advantage and they see it as a self-reinforcing flywheel.

Upwork Investor Presentation

Financials

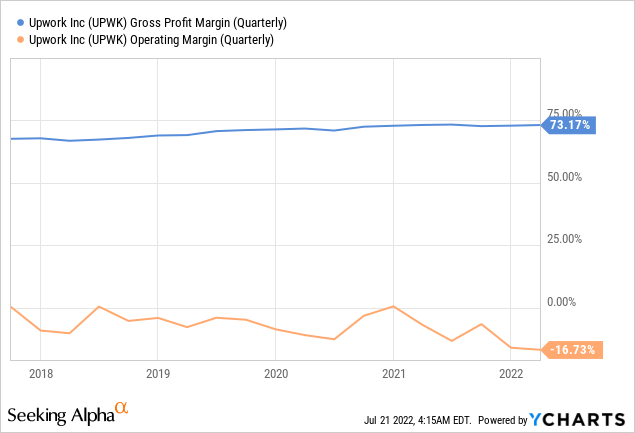

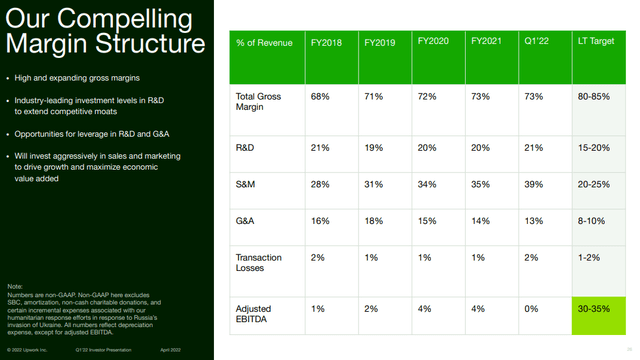

Upwork has high and rising gross profit margins, a sign of its strong competitive advantages. However the operating margin remains negative and is not showing clear signs of operating leverage, what leads us to believe that the company has to be more disciplined with spending in order to create a path to profitability.

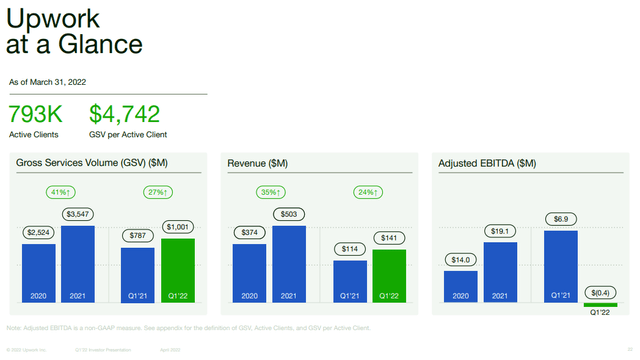

One of its key indicators is Gross Services Volume, which is a fancy way of saying the size of the “economy” taking place on their platform. GSV reached a little over a billion dollars in Q1 2022, and annualized it is more than $4 billion. The more activity takes places on its platform, normally the more Upwork can change in commissions and fees, and that is reflected in the growing revenues. In Q1 2022 revenue for the company was $141 million, and if we annualize it, it is getting close to $600 million a year. For comparison Upwork is currently trading with a market cap of ~$2.76 billion.

Growth

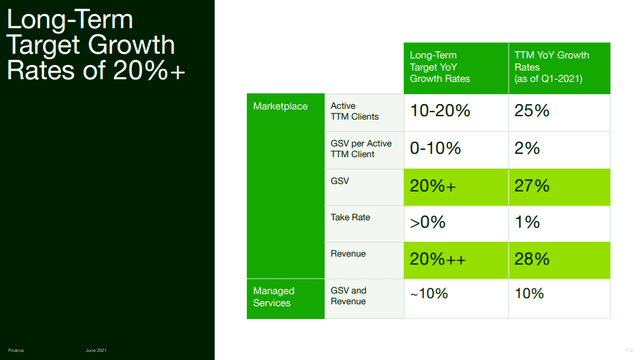

One of the biggest attractions to a company like Upwork is the long runway of growth they have. The company’s long term targets for GSV and revenue are 20%+, and for the last year they have comfortably exceeded these targets.

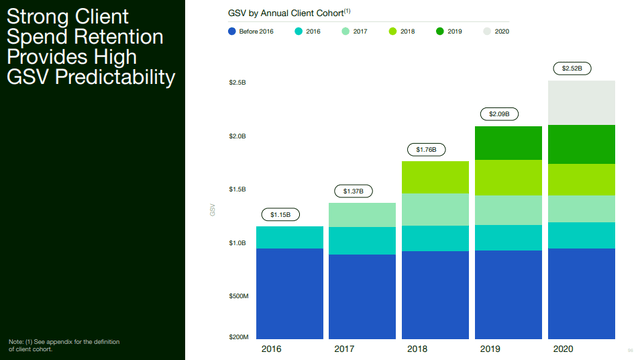

Something that certainly helps growth is having good customer retention. Looking at Upwork’s cohorts it is clear that they manage to retain a good portion of the spend by older cohorts, in some cases even growing their spend.

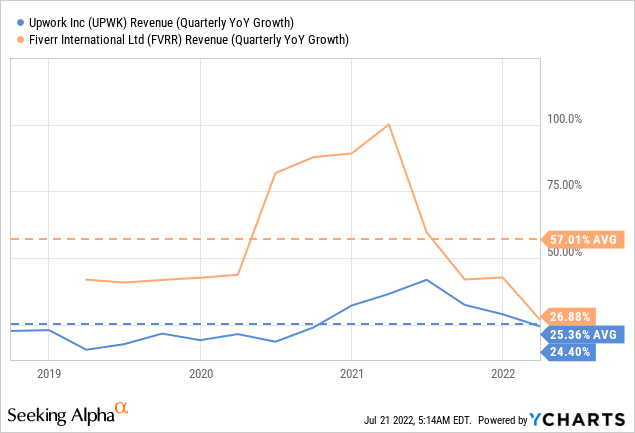

Compared to some smaller competitors, such as Fiverr International (FVRR), Upwork has historically grown at a much lower rate. Surprisingly, however, their growth rates have been converging recently. It will be interesting to see if this convergence continues, or if one of the companies shows much stronger growth compared to the other in the future.

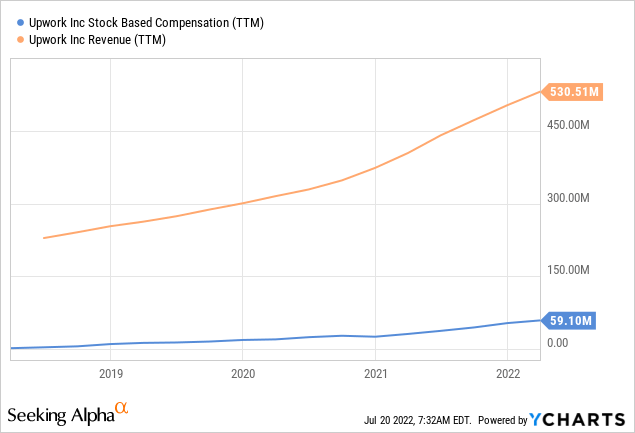

Stock-based compensation

We consider Upwork’s stock-based compensation elevated, even if it is far from the worst offender we have seen. At ~11% of revenue it is far from the extremes we have seen elsewhere of >20% of revenue, but it is still above the ~5% maximum that we like to see.

Valuation

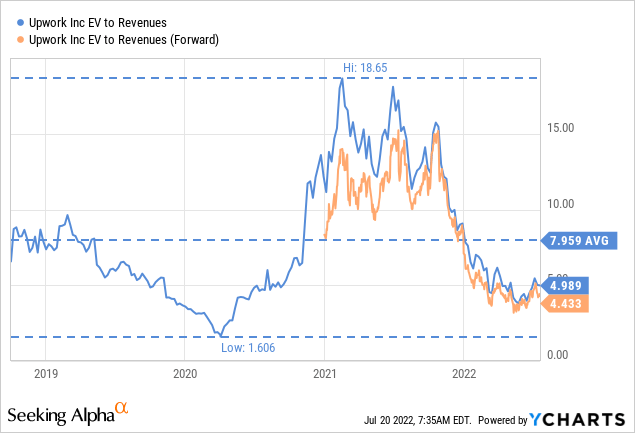

Given that Upwork is not yet profitable it is harder to value it. Using EV/Revenues we can see that it is trading below its historical average, but this in itself doesn’t really tell us if the company is undervalued or not, or what type of returns it could potentially deliver.

We can do a very rough approximation of a fair value by looking at the company’s long-term financial target model where they guide to an adjusted EBITDA of between 30% and 35%. We would subtract around 11% for stock-based compensation to the midpoint, to get an estimated EBITDA of ~21%.

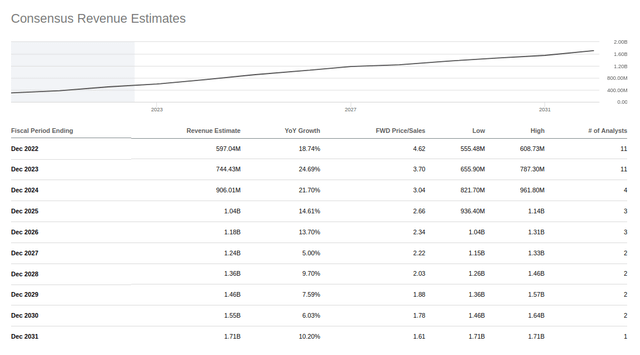

Then we look at consensus revenue estimates and see that in ten years the estimate is $1.71 billion. Multiplying by the estimated EBITDA margin of 21% we get $359 million of EBITDA. Applying a 20x multiple would get us a FY2031 market cap of $7.1 billion. The net present value of that $7.1 billion using a 10% discount rate is ~$2.7 billion. This is very close to the current market cap, what leads us to believe that investors are probably looking at ~10% returns from current prices if the company can deliver on its target model, and on analyst’s revenue estimates.

Risks

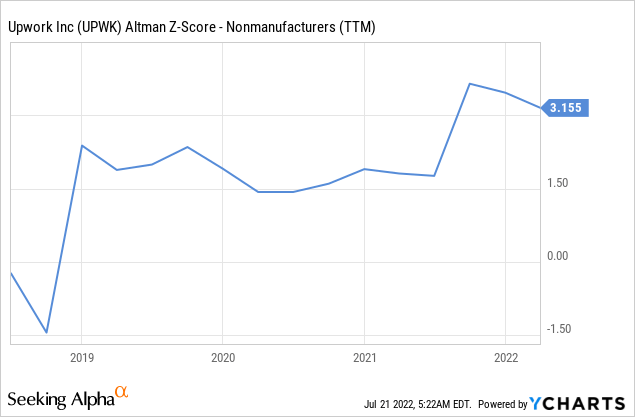

Upwork has a strong balance sheet with more cash & short term investments that long-term debt, so we are not too worried about the company as a going concern in the short to medium term. Longer term the company has to be more disciplined with spending to be able to reach sustained profitability. Currently its Altman Z-score is above the 3.0 threshold, which is also reassuring. The biggest risk we see with Upwork is that of a valuation readjustment should the company disappoint on growth going forward.

Conclusion

Upwork is an interesting investment option that benefits from the strong growth of the freelancing market. The company has been able to deliver 20%+ growth, and it looks like it has a long runway to continue to do so. However the company is not yet profitable, and the valuation does not seem to offer much margin of safety to investors. Overall we have mixed feelings about an investment in the company, and in our case we would rather wait for a more attractive price before considering the shares. That said, an investment in the company at current prices can certainly work out well for investors if the company delivers on its promises.

Be the first to comment