jetcityimage/iStock Editorial via Getty Images

Although there are concerns today about a recession, some companies are doing better now than ever. One great example can be seen when looking at Fastenal (NASDAQ:FAST). This provider of fasteners, other industrial products, and creative on-premise solutions continues to grow at a rapid pace. Even so, shares of the company have fallen slightly more than what the broader market has in recent months. Given how shares are priced today, and the increased risk associated with the broader economy, I do still think that the company is more appropriately rated a ‘hold’ prospect. But if financial performance continues to improve as it has so far this year, this picture could change before too long.

Remarkable strength

Back in early April of this year, I wrote an article discussing whether or not Fastenal made for an attractive prospect. In that article, I acknowledged that the company was continuing to see attractive revenue, earnings, and cash flow growth. I called it a high-quality company that would likely do well for itself and its shareholders in the long run. At the same time, however, I could not deny that shares of the business were looking rather pricey. This came even after the company’s stock had declined in value in the months leading up to that. As a result of this, I ultimately rated the business a ‘hold’, which reflected my belief that its performance would more or less match the broader market for the foreseeable future. Since then, this call has not been too far off. While the S&P 500 is down by 14.5%, investors in Fastenal have seen a decline in price of 16%.

When the market experiences a significant downturn, you can see high-quality companies that are growing rapidly decrease in price. Sometimes, this decline is warranted because of how cheap shares are. In other instances, however, the decline is justified because the company in question is a high-priced enterprise anyways. And when the market is concerned about real risks, the premium investors are willing to pay for a business will decrease. Based on my assessment, Fastenal fits into this latter category.

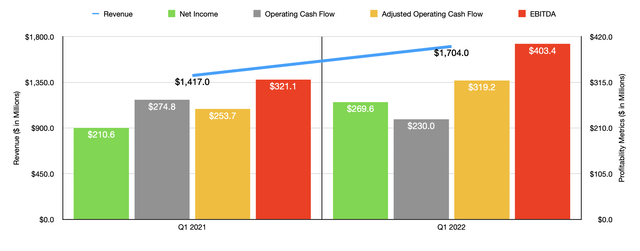

None of this is to say that the fundamental performance of the company is anything other than great. Because the fact of the matter is that management has done a fantastic job recently. During the first quarter of the company’s 2022 fiscal year, sales came in at $1.70 billion. That’s 20.3% higher than the $1.42 billion generated the same quarter one year earlier. This growth came as a result of strong demand for the company’s products, combined with increased pricing. And for those worried about a potential recession, data experienced so far in the second quarter has been quite robust. Management is not due to report financial results for the second quarter of this year until July 13th. Fortunately for investors, management does release monthly data regarding sales. We don’t have any data as of this writing for the month of June. But we do have data covering April and May. In April, sales for the company were up 14.8% year over year while sales in May jumped by 23.5%. In both months, the greatest strength came from the US market. Growth here was 21.1% in April, followed by 19.1% in May.

As revenue has risen, so too has profitability. Net income in the latest quarter came in at $269.6 million. That’s 28% higher than the $210.6 million generated just one year earlier. Operating cash flow did worsen, dropping from $274.8 million to $230 million. But if we adjust for changes in working capital, it would have risen from $253.7 million to $319.2 million. Another profitability metric to consider is EBITDA. According to my calculations, this came in at $403.4 million during the latest quarter. That’s up nicely from the $321.1 million reported the same quarter last year. Unfortunately, management has not really provided any guidance for the current fiscal year. But if we annualize results seen so far this year, we should anticipate net income of $1.18 billion. Using that same approach, operating cash flow should be around $1.37 billion if we adjust for changes in working capital. And EBITDA should total around $1.75 billion.

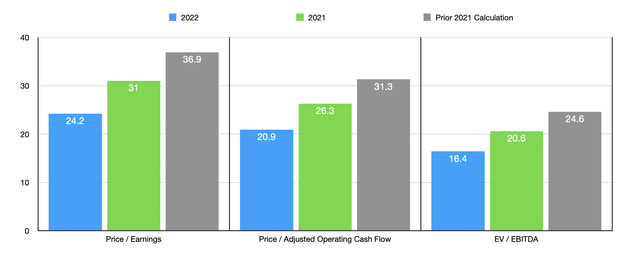

Using this data, we can easily price the company. On a price-to-earnings basis, using our 2022 estimates, the company is trading at a multiple of 24.2. This compares to the 31 reading that we get using 2021 results. For context, when I last wrote about the firm, these multiples were 36.9 and 37.4, respectively. Using the price to operating cash flow approach, the 2022 estimate would give us a reading of 20.9, while the 2021 results would give us a reading of 26.3. These compare favorably to the 31.3 and the 29.3, respectively, that we got in our last article. And finally, when it comes to the EV to EBITDA approach, the multiple would be 16.4 on a forward basis and 20.6 if we use the 2021 figures. In the last article that I wrote, these multiples were 24.6 and 24.9, respectively.

To put the pricing of the company into perspective, I decided to compare it to five similar firms. On a price-to-earnings basis, these companies ranged from a low of 1.9 to a high of 11.2. Using the EV to EBITDA approach, the range was from 1.6 to 6.4. In both cases, Fastenal was the most expensive of the group. Using the price to operating cash flow approach, the range for these companies was from 3.7 to 39.4. In this case, four of the five companies were cheaper than our prospect.

| Company | Price / Earnings | Price / Operating Cash Flow | EV / EBITDA |

| Fastenal | 31.0 | 26.3 | 20.6 |

| Veritiv (VRTV) | 8.3 | 12.4 | 6.4 |

| BlueLinx Holdings (BXC) | 1.9 | 4.1 | 1.6 |

| Hudson Technologies (HDSN) | 5.5 | 39.4 | 4.8 |

| Herc Holdings (HRI) | 11.2 | 3.7 | 5.3 |

| GMS (GMS) | 7.3 | 11.1 | 5.6 |

Takeaway

Relative to similar firms, Fastenal may look incredibly expensive. But this is an industry leader with a unique business model and a quality operation under its belt. I believe that it warrants a premium compared to other firms. If we had seen the kind of decline that we saw over the past few months and given the improved fundamental condition of the company, but not had the fear of a downturn, I would certainly have decided to change my rating on the company from ‘hold’ to ‘buy’. But because of the heightened uncertainty, I have decided to retain my ‘hold’ rating for now, with the idea being that shares might make for a good ‘buy’ prospect if current projections for the 2022 fiscal year play out.

Be the first to comment